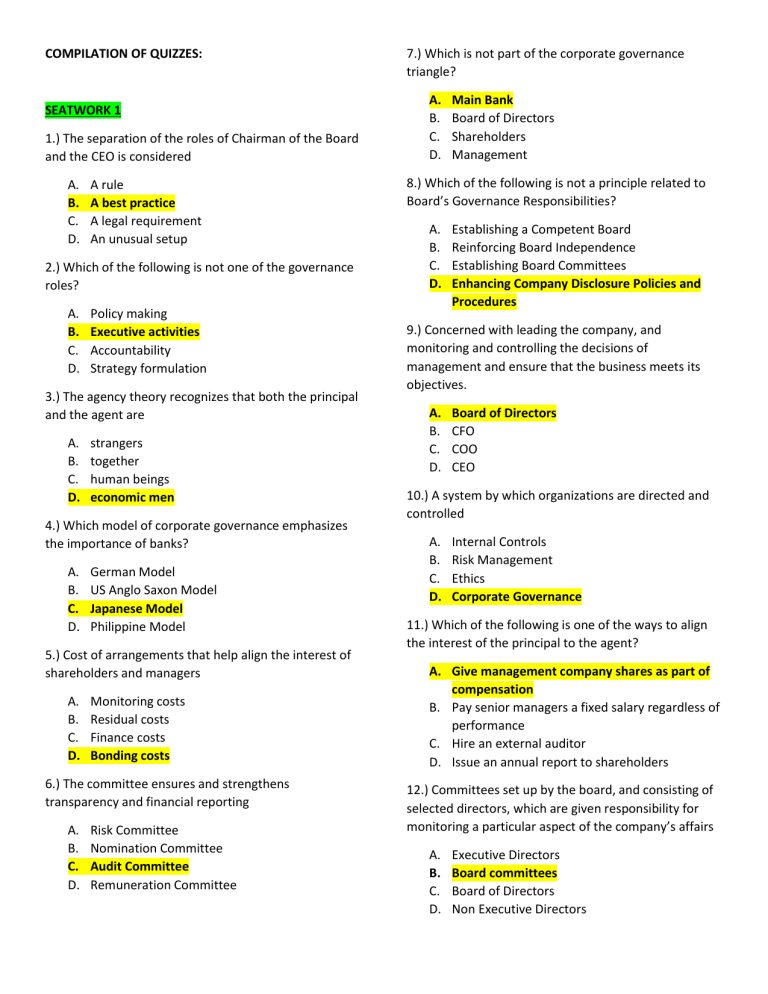

COMPILATION OF QUIZZES: SEATWORK 1 1.) The separation of the roles of Chairman of the Board and the CEO is considered A. B. C. D. A rule A best practice A legal requirement An unusual setup 2.) Which of the following is not one of the governance roles? A. B. C. D. Policy making Executive activities Accountability Strategy formulation 3.) The agency theory recognizes that both the principal and the agent are A. B. C. D. strangers together human beings economic men 4.) Which model of corporate governance emphasizes the importance of banks? A. B. C. D. German Model US Anglo Saxon Model Japanese Model Philippine Model 5.) Cost of arrangements that help align the interest of shareholders and managers A. B. C. D. Monitoring costs Residual costs Finance costs Bonding costs 6.) The committee ensures and strengthens transparency and financial reporting A. B. C. D. Risk Committee Nomination Committee Audit Committee Remuneration Committee 7.) Which is not part of the corporate governance triangle? A. B. C. D. Main Bank Board of Directors Shareholders Management 8.) Which of the following is not a principle related to Board’s Governance Responsibilities? A. B. C. D. Establishing a Competent Board Reinforcing Board Independence Establishing Board Committees Enhancing Company Disclosure Policies and Procedures 9.) Concerned with leading the company, and monitoring and controlling the decisions of management and ensure that the business meets its objectives. A. B. C. D. Board of Directors CFO COO CEO 10.) A system by which organizations are directed and controlled A. B. C. D. Internal Controls Risk Management Ethics Corporate Governance 11.) Which of the following is one of the ways to align the interest of the principal to the agent? A. Give management company shares as part of compensation B. Pay senior managers a fixed salary regardless of performance C. Hire an external auditor D. Issue an annual report to shareholders 12.) Committees set up by the board, and consisting of selected directors, which are given responsibility for monitoring a particular aspect of the company’s affairs A. B. C. D. Executive Directors Board committees Board of Directors Non Executive Directors 13.) Which model of corporate Governance emphasizes worker rights? A. B. C. D. German Model Japanese Model US Anglo Saxon Method Philippine Model 14.) This refers to the comply or explain approach of Corporate Governance A. B. C. D. Rules Based Principles Based All choices refer to comply and explain Sarbanes Oxley 15.) Which of the following is not a type of board structure? A. B. C. D. Multi Tier Unitary Principles Based All choices are board structure Long Quiz 2: Corporate Governance 1.) The board of directors may grant stock options to managers in order to A. B. C. D. Comply with a legal requirement Align the interest with that of shareholders Use as a substitute for bonus Save compensation costs 2.) A board committee is best described as a subset of the board formed to achieve which one of the following outcomes? A. Enhance the effectiveness of the board B. Being independent by having exclusively independent auditors C. Report to the shareholders on specific issues D. Enable directors to reduce their individual liability 3.) Which one of the following is not a function of the board of directors of a large public company? A. Managing the recurring operations of the business B. The oversight of management in the application of policies and guidelines about the principal risks faced by the company C. The selection of auditors D. Monitoring of the CEO’s performance 4.) Which of the following is the best description of Conflict of Interest? A. a situation in which a person is in a position to derive personal benefit from actions or decisions made either in their official or unofficial capacity B. a situation in which a person or organization is involved in singular interests, financial or otherwise and serving one interest could involve working against another C. a situation in which a person’s ability to act with independence and impartiality is hindered by a countervailing interest held in a cause which could be the beneficiary decisions made D. a situation in which the concerns or alms of two different parties are compatible E. 5.) What is meant by the separation of ownership and control? A. That those who control the company should be separate to those who own it B. The owners and controllers of companies should not act in concert to defeat resolution C. That the owners of companies have become separated from those who control companies D. That the law should seek to keep the owners and controllers of company apart in order to avoid an over concentration of power 6.) Which of the following is true? A. Corporate governance addresses the principal agent relationship between management and directors on the one hand and the relationship between the company and suppliers on the other B. It is the responsibility of the internal auditor to set the objectives for the company C. The management board approves the mission, vision, objectives, and strategy of the entity D. Conflicts of interest between management and stakeholders can result in bankruptcies or major fraud 7.) Which of the following is not a benefit of having NEDs? A. NEDs can help increase market confidence in the business especially in the earlier years of the company’s life B. NEDs can advise on specific issues with start-up businesses C. NEDs increase the board’s accountability to the shareholders D. NEDs can better make decision relation to the recurring transactions of the business 8.) The cost of monitoring management is considered to be a/n) A. B. C. D. Agency cost Bankruptcy cost Transaction cost Institutional cost 9.) Which of the following is not a key corporate factor driving the need for better governance? A. Increasing competition making high levels of performance harder to achieve B. Higher levels of individual taxation dissuading potential shareholders C. The growth in shareholder activism D. The requirement to access lower cost debt and equity finance 10.) Why do corporate governance problems arise as per the agency theory? A. Profit maximization is the main objective of organizations B. Stakeholders have differing levels of power C. Managers act in their own self interest D. Ownership and control is separated 11.) Which one of the following statements best describes an independent director of a listed company? A. An executive director who is a CEO but who receives no additional remuneration for being on the board B. A non-executive director who receives a flat fee for being a director and who accepts no additional consulting, advisory or performance related fees C. A full time employee of a bank who is appointed to the board at the request of the bank (a major lender to the corporation) and is instructed by the bank to always vote in the interests of the corporation’s shareholders D. A non executive director who holds 2- per cent of the shares in the corporation 12.) Which one of the following defines non-executive director? A. Do not have much involvement in daily management of the company and do not occupy an executive management position in the company B. Any person, other than professional adviser, with whose instructions appointed directors of the company normally comply C. D. Who by virtue of an agreement with the company or resolution passed by the company in general meeting or by its board of directors of or by virtue of its Memorandum of Agreement, is entrusted with substantial powers of management which would not otherwise exercisable by him Who attend board meetings of a company and participate in matters put before the board 13.) Which one of the following would be the best way for a shareholder to become involved in the corporate governance of a listed corporation in which they own shares? A. By selling their shares on the market because the corporation fails to pay dividends at appropriate level B. By voting through proxy or by attendance at the general meetings of the corporation C. By overruling board decisions, including through votes against the board in relation to nonbinding shareholder votes D. By taking an active interest and an active role in the management of the corporation 14.) A board member is independent when A. She represents the company’s only majority shareholder B. She is a family member of the CEO C. She is a top executive of the company supervised D. She has no relationship of any kind whatsoever with the corporation, its group or the management of either that is such to color her judgement 15.) According to the Cadbury definition, corporate governance is an issue of power and A. B. C. D. Profit Accountability Rights Appropriability 16.) Which of the following can be considered opportunistic residual loss behavior by an agent? A. Investing in technology that will substantially reduce short term profit, but yield returns in the long run B. Suspending negotiations with a potential acquisition target because it would not enhance shareholder wealth C. Purchase of an expensive painting for the managing director’s office D. All of the choices are opportunistic residual loss behavior 17.) Which of the following is not included as one of the main roles of a Chief Executive Director (CEO) of a listed company? A. To analyze the performance of the board of directors B. To propose and develop strategies capable of making an acceptable return to shareholders C. To ensure that appropriate systems are in place for internal controls and the management of risk 18.) Which of the following actions will not help directors to protect themselves from non compliance with their obligations and responsibilities? A. Keeping themselves fully informed about company affairs B. Seeking professional help C. Ensuring that regular management accounts are prepared by the company D. Including a disclaimer clause in their service contracts 19.) Which one of the following statements best describes characteristics likely found in agency relationships? A. Agents who are highly bonded will be expected to try to maximize the returns of their principal and will be expected also to seek returns for themselves B. It is necessary to monitor an agent extensively, even when that agent voluntarily assumes the imposition of higher bonding costs C. Agents will often not provide sufficient signaling to principals. It is principally this factor that results in principals finding it necessary to engage in and pay for monitoring D. An agent will find it relatively easy to achieve the best interest of the principal in an agency relationship 20.) Which one of the following would not be an example of Agency cost? A. B. C. D. Audit fees Delegated authorities Information symmetry Dividends 21.) According to the Agency Theory A. B. C. D. Information asymmetry does not exist The management board is the agent The management board is the principal Self interest plays no role 22.) Directors may not be disqualified for A. Continuing to trade when the company is insolvent B. Paying inadequate attention to the company finances C. Persistent breaches of company legislation D. Being convicted of drunken driving 23.) Directors’ responsibilities are unlikely to include A. A duty to propose high dividends for shareholders B. A duty to ensure proper accounting records are kept C. A fiduciary duty D. A duty of care 24.) Why is it rational to make shareholders weak by giving control to the managers of the firm? A. This may be rational to the extent that managers are answerable to the board of directors B. This may be rational when shareholders may be neither qualified nor interested in making business decisions C. All of the choices D. This may be rational since may shareholders may find it easier to sell their shares in underperforming firms than to monitor the management 25.) Which of the following is not something performed by the company’s board? A. Defines the company’s strategy B. Oversees management and ensures the quality of information provided to shareholders and financial markets through the financial statements C. Day to day supervision of the sales manager D. Appoints the corporate officers responsible for managing the company 26.) According to the Anglo Saxon best practice the board represents A. B. C. D. Shareholders Minority shareholders Employees All constituencies 27.) Which of the following is not a desired quality of someone who wishes to be a Chief Executive Officer? A. Analytical skills in major aspects of the business’ operations and finances B. Micro management skills that allows one to focus solely on detailed work particularly in the company’s products/service C. Persuasiveness, confidence, and communication skills most especially in dealing with colleagues and negotiation with external parties D. Strategic skills that would allow for the conception and implementation of strategic objectives 28.) Which of the following is not valid difference between executive and non executive directors? A. Executive directors work full time, whereas non-executive directors work part time B. Non-executive directors should be independent, whereas the executives will usually not be C. Executive directors are involved in the management of the company, whereas nonexecutive directors are not expected to be involve in day-to-day management D. Executive directors tend to be involved mainly in policy making and planning exercises while non-executive directors are tasked to run the company’s business 29.) What is the meaning of OECD? A. Organization for the Ease of Collaboration and Development B. Organization for Economic Co-operation and Development C. Organization for Economic and Cultural Development D. Organization for Ensuring Collaboration and Development 30.) Which of the following is not a goal of a greater accounting transparency? A. All of the choices are goals of accounting transparency B. To reduce information asymmetry between corporate insiders and the public C. To discourage managerial self dealings D. To impose more rules and harsher penalties for their violation LONG QUIZ 3: INTERNAL CONTROLS 1.) Which of the following is not an example of factors that are reflected in the control environment? A. New business models, products, or activities that are undertaken by the company B. Those charged with governance actively participate in setting the direction of the company C. Management’s philosophy and operating style clearly reinforces its internal control culture D. A company has clear lines of communication and policies that enforce integrity and ethical values 2.) Which of the following is responsible for establishing a private company’s internal control? A. B. C. D. Management and external auditors External auditors COSO Management 3.) Which of the following is a component of internal control? A. B. C. D. Risk awareness Organization structure Legal environment Control environment 4.) Internal controls can never be considered as absolutely effective because A. Internal controls prevent separation of duties B. Their effectiveness is limited by the competency and dependability of employees C. Controls are designed to prevent and detect only material misstatements D. Not all organizations have internal audit performances 5.) These are policies and procedures that help ensure that management directives are carried out A. B. C. D. Control activities Internal Control Internal Control System Monitoring 6.) What does PSA mean? A. B. C. D. Philippine Standards at Auditing Philippine Standards of Auditing Philippine Standards on Auditing Philippine Standards in Auditing 7.) The University of St. Joseph, a premier higher education institution, has identified its main risk categories as marketing especially of its core programs; human sourcing and labor piracy. Which business objective do these represent? A. B. C. D. Compliance objectives Overall objectives Financial reporting objectives Operational objectives 8.) A reason to establish internal control is to A. Ensure the accuracy, reliability, and timeliness of information B. Encourage compliance with organizational objectives C. Have a basis for planning the audit D. Provide reasonable assurance that the objectives of the organization are achieved 9.) Which of the management’s concerns with respect to implement internal control is the auditor primarily concerned? A. B. C. D. Reliability of financial reporting Compliance with laws and regulations Efficiency of operations Effectiveness of operations 10.) The override resulted to process senior citizen discounts is an example of A. Specific authorization B. General authorization C. Special authorization 11.) Which of the following statements related to application controls is correct? A. B. C. D. Application controls relate to various aspects of the IT function including software acquisition and the processing of transactions Application controls relate to all aspects of the IT function Application controls relate to the processing of individual transactions Application controls relate to various aspects of the IT function including physical security and the processing of transaction of various cycles 12.) A company regularly compares information about current performance to forecasts, budgets, and previous results in order to determine company performance. This is an example of A. B. C. D. Preventive controls Corrective controls Detective controls General controls 13.) San Jose Incorporated, a manufacturer of life sized religious statues, observes controls such as the management team regularly checks the organization’s inventory, security systems are in place, and authorization policies for the access of assets and equipment are properly laid out. These are considered A. B. C. D. E. General controls Preventive controls Detective controls Corrective controls Either detective and preventive controls 14.) Which of the following is not a reason why the effectiveness of internal controls cannot be guaranteed? A. The cost of putting up internal controls is relatively expensive B. Human factors can undermine or circumvent the effectiveness of many internal controls C. The occurrence of non-routine events when controls are designed for relatively routine behavior D. The control can be over or under specified. An under specified control is one which is not capable of actually controlling the risk or activity intended. Conversely, an over specified control is one which over controls and may have the effect of losing the confidence of employees and others influenced by the control 15.) The following are examples of separate monitoring, except A. Independent checks performed by outsiders B. Self-assessment performed by mangers over the controls in their areas of responsibility C. Evaluations built into business processes at different levels of the entity D. Periodic checks on operational, legal, and financial performance and reporting 16.) An act of two or more employees to steal assets or misstate records is frequently referred to as A. B. C. D. Control deficiency Collusion Significant deficiency Material weakness 17.) Monitoring involves assessing the A. B. C. D. All of the three other choices Operation of controls Quality of internal control over time Design of controls 18.) Internal control procedures for cash disbursements (other than from petty cash) should not include A. Cash disbursing function should be decentralized as much as possible B. Checks are signed by authorized individuals C. All expenditures are authorized D. All disbursements are made by check, debit card, or credit card 19.) To segregate duties involving cash receipts, specific responsibilities should be assigned to various employees, except when A. A supervisor s responsible for collecting cash at the end of each cashier’s shift B. Members of the accounting department are responsible for ensuring that cash sales are properly recorded C. Cashiers are responsible for collecting cash and issuing a receipt at the point of sale D. An employee who handles credit approval authorizes the de recognition of accounts receivable 20.) Financial controls provide reasonable assurance on the following, except A. Access to assets is allowed in accordance with general or specific authorization B. Transactions are recorded so that assets can be accounted for C. Profits are maximized in the negotiations entered into by management D. Transactions are made only in accordance with general or specific authorization 21.) Which of the following is not one of the primary objectives of effective internal control? A. B. C. D. Compliance with laws and regulations Efficiency and effectiveness of operations Elimination of business risk Reliability of financial reporting 22.) When two or more persons work together to circumvent internal control procedures is called A. B. C. D. Reasonable assurance Collusion Control weakness Management override 23.) Which of the following is not a component of SPAM SOAP? A. B. C. D. Organization controls Personnel controls Authorization and approval controls Performance reviews 24.) Effective internal control over cash requires segregation of duties. Which of the following duties should be segregated? A. Opening the mail and deposit of checks in the bank B. Depositing checks into the banks and recording receipts in the accounting records C. Both depositing checks into the banks and recording receipts in the accounting records or opening the mail and deposit of checks in the bank D. Either depositing checks into the banks and recording receipts in the accounting records or opening the mail and deposit of checks in the bank 25.) One of the components of an internal control system is information and communication systems. Within this component, there should be a system for reporting the following to management A. Information about risks, the effectiveness of controls, failures in control and the success of action to remove weaknesses in controls and reduce risks. B. All of the three other choices C. Information marketing strategies, operational objectives, quotas and budgets, as well as new target markets D. Information about employees, hiring qualifications and disqualifications, sanctions for erring employees, and personal misdemeanor of said employees