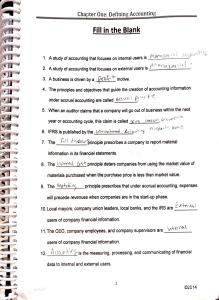

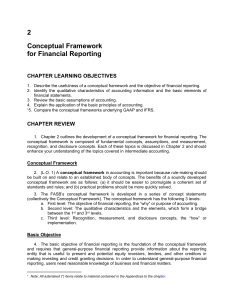

Accounting ◦ Philippine Financial Reporting Standards: “a service activity that provides quantitative financial information about economic entities that is intended to be useful in making economic decisions.” GAAP (Generally Accepted Accounting Principles - collection of commonly used accounting rules and standards for financial reporting. Branches of Accounting ◦ Financial accounting - preparation of FS based on historical data-> internal and external users ◦ Managerial accounting - preparation of FS based on historical and estimated data-> internal users (management) ◦ Cost accounting – tracing, categorizing and summarizing manufacturing costs to be used in planning control. ◦ Tax accounting – tax related matters ◦ Government accounting – allocation administration of government funds. ◦ Auditing – independent review of an entity’s FS. ◦ Accounting education – teaching accounting ◦ Accounting research – careful analysis of economic events to understand impact on decisions and creation of new knowledge. Users of Accounting Information ◦ Owners – whether earned or lost during a particular period of time. ◦ Management – evaluation of financial position and performance of a business for economic decisions purposes. ◦ Investors – whether to increase or decrease investment ◦ Lenders – whether the borrowing entity will be able to pay amount loaned ◦ Suppliers – to know credit worthiness of an entity; whether continue or not in providing goods on credit. ◦ Customers – whether there’s a continuous availability of products.. ◦ Employees – job security ◦ Government – for taxation and regulation purposes Forms of Business ◦ Sole Proprietorship – sole provider of capital, managing the business and bearing risk of enterprise. ◦ Partnership – 2-15 partners ◦ Corporation – has separate legal personality from its owners; board of directors==elected group from stakeholders. Types of Business According to Activity ◦ Service Business – provide service ◦ Merchandising Business – buy and sell ◦ Manufacturing Business – buy, create and sell Steps in the Accounting Cycle *Accounting cycle – steps to be followed sequentially in producing FS. 1. Analyzing transactions (to determine effects to accounts) 2. Journalizing -> Journal “Book of Original Entry” 3. Posting -> Ledger “Book of Final Entry” 4. Unadjusted TB 5. Adjusting Entries 6. Adjusted TB 7. Preparation of FS 8. Closing Journal Entries 9. Post-Closing TB (serves as the base for next year’s accounting cycle Basic Accounting Concepts ◦ Entity Assumption – transaction of business is separate from that of the owner/s ◦ Going Concern Assumption – business will continue for a long time ◦ Monetary unit Assumption – transactions must be measured in money terms ◦ Periodicity Assumption – activity can be divided into artificial period: monthly, quarterly, annually ◦ Materiality concept – inclusions and omission of transaction ◦ Substance over form – economic substance not legal form ◦ Historical Cost Principle – value of A is recorded at its original cost ◦