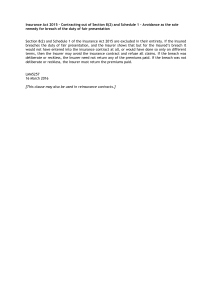

PFRS 17 An entity shall apply IFRS 17 Insurance Contracts to: Insurance and reinsurance contracts that it issues; Reinsurance contracts it holds; and Investment contracts with discretionary participation features (DPF) it issues, provided it also issues insurance contracts. Insurance contracts may be classified as : ◦ Direct insurance contract – insurer directly accepts risk from the insured and assumes the sole obligation to compensate the insured in case of a loss event. ◦ Reinsurance contract – issued by one insurer to compensate another insurer for losses on one or more contracts issued by the cedant. Insurance contract - A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder. Insurer (insurance provider) – the party that has an obligation to compensate a policy holder if an insured event occurs. Policyholder (insured) – a party that has a right to compensation under an Insured event – an uncertain future event that is covered by an insurance Insurance risk – risk other than financial risk, transferred from the holder of a insurance contract if an insured event occurs. contract and creates insurance risk. contract to the issuer. (can be speculative risk or pure risk) PFRS 17 provides a general measurement model and a simplified model called “premium allocation approach” The general model is modified for onerous contracts, reinsurance contracts held and investment contracts with discretionary participation features. Initial measurement at the total of: ◦ The fulfillment cash flows, and ◦ The contractual service margin Subsequent measurement : • the CA of the group of insurance contracts at the end of RP is the sum of : (a) the liability for remaining coverage comprising: (i) the FCF related to future services and; (ii) the CSM of the group at that date; (b) the liability for incurred claims, comprising the FCF related to past service allocated to the group at that date. The following are presentation separately in the statement of financial position: Insurance contracts issued that are assets and liabilities Reinsurance contracts held that are assets and liabilities Recognized in the statement of P/L and OCI are separated into the ff: insurance service result, comprising insurance revenue and insurance service expenses (in P/L) • insurance finance income or expenses (full in P/L or separated into amounts that are recognized in P/L and OCI, as an accounting policy choice. •