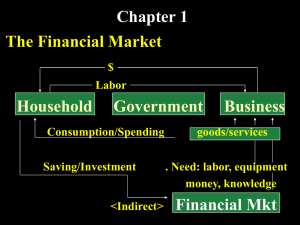

Student name: Carlos Rocher Carbo TRUE/FALSE - Write 'T' if the statement is true and 'F' if the statement is false. 1) The board of directors is ultimately responsible for all large investment decisions. ⊚ ⊚ 2) A corporation has a legal existence of its own and is based on "articles of incorporation." ⊚ ⊚ 3) true false Real assets of a corporation are claims on their financial assets. ⊚ ⊚ 4) true false true false A firm's total asset value belongs entirely to the shareholders. ⊚ ⊚ true false 1 5) Managers, shareholders, and the firm's debtholders have identical information about the value of the firm. ⊚ ⊚ true false MULTIPLE CHOICE - Choose the one alternative that best completes the statement or answers the question. 6) This book is mainly about: A) B) C) D) 7) Shareholders of a corporation may be, among others, A) B) C) D) 8) financial decisions made by corporations. financial decisions made by households. financial decisions made by governments. financial decisions made by employees. individuals. individuals and pension funds. pension funds. individuals, pension funds, and insurance companies. Generally, a corporation is owned by its 2 A) B) C) D) 9) A corporation, potentially, has infinite life because it A) B) C) D) 10) is a legal entity. has the same ownership and management. has limited liability. is closely regulated. Limited liability is an important feature of: A) B) C) D) 11) managers. board of directors and shareholders. shareholders. managers, board of directors, and shareholders. sole proprietorships. partnerships. corporations. both partnerships and corporations. As a legal entity, a corporation can perform the following functions EXCEPT: 3 A) B) C) D) 12) Which of the following assets is tangible? A) B) C) D) 13) ExxonMobil's corporate headquarters building Apple Inc.'s trademark Hewlett-Packard's most recent printer patent Microsoft's technical expertise Which of the following types of assets are intangible? A) B) C) D) 14) borrow money and lend money. borrow money, lend money, and sue and be sued. vote. borrow money, lend money, sue and be sued, and vote. production machinery factories trademarks office equipment A firm's investment decision is also called its A) B) C) D) financing decision. liquidity decision. capital budgeting decision. leasing decision. 4 15) Which of the following is not a financial asset? A) B) C) D) 16) Which of the following is an important function of financial markets? A) B) C) D) 17) providing financing providing financing and liquidity providing financing, providing liquidity, reducing risk, and providing information providing information Disadvantages of the corporate form include: A) B) C) D) 18) common stock bank loans preferred stock buildings agency costs double taxation cost of managing the corporation all of the options In the principal-agent framework: 5 A) B) C) D) shareholders are the principals. managers are the principals. managers are the agents. shareholders are the principals and managers are the agents. 19) Costs associated with the conflicts of interest between the managers and the shareholders of a corporation are called: A) B) C) D) 20) A corporation may incur agency costs because: A) B) C) D) 21) legal costs. bankruptcy costs. administrative costs. agency costs. Managers may not attempt to maximize the value of the firm to shareholders. Shareholders incur monitoring costs. Of the separation of ownership and management. All of the responses are correct. The following groups are some of the claimants to a firm's income stream: 6 A) B) C) D) 22) The financial goal of a corporation is to: A) B) C) D) 23) maximize profits. maximize sales. maximize the value of the firm for the shareholders. maximize managers' benefits. The firm's purchase of real assets is also referred to as the: A) B) C) D) 24) shareholders and bondholders only. shareholders, bondholders, and employees only. shareholders, bondholders, employees, and management only. shareholders, bondholders, employees, management, and government. capital structure decision. CFO decision. financing decision. capital investment decision. The sale of financial assets by a corporation is also referred to as the 7 A) B) C) D) capital budgeting decision. CFO decision. financing decision. investment decision. 25) The choice of the proper mixture of debt and equity, used to finance a corporation, is also referred to as the A) B) C) D) 26) Which of the following groups are referred to as stakeholders? A) B) C) D) 27) capital budgeting decision. capital structure decision. investment decision. liquidity decision. employees, customers, and suppliers only shareholders only employees and customers only employees, customers, shareholders, and suppliers The following are examples of real assets: 8 A) B) C) D) 28) The following are examples of tangible assets except: A) B) C) D) 29) machinery, office buildings, and warehouses only. machinery and office buildings only. common stock only. machinery only. machinery only. machinery and office buildings only. training courses for employees only. machinery, office buildings, and warehouses only. The ultimate financial goal of a corporation is to: A) B) C) D) minimize stockholder risk. maximize profit. maximize the value of the corporation to the stockholders. increase size of the firm. 30) Mr. Free has $100 income this year and zero income next year. The market interest rate is 10 percent per year. If Mr. Free consumes $30 this year and invests the rest in the market, what will be his consumption next year? 9 A) B) C) D) $50 $55 $77 $100 31) Mr. Bird has $100 income this year and zero income next year. The market interest rate is 10 percent per year. Mr. Bird also has an investment opportunity in which he can invest $50 today and receive $80 next year. Suppose Mr. Bird consumes $30 this year and invests in the project. What will be his consumption next year? A) B) C) D) $80 $82 $100 $102 32) Ms. Venus has $100 income this year and $110 next year. The market interest rate is 10 percent per year. Suppose Ms. Venus consumes $60 this year. What will be her consumption next year? A) B) C) D) $120 $154 $170 $210 10 33) Mr. Thomas has $100 income this year and zero income next year. The market interest rate is 10 percent per year. Mr. Thomas also has an investment opportunity in which he can invest $50 this year and receive $80 next year. Suppose Mr. Thomas consumes $50 this year and invests in the project. What will be his consumption next year? A) B) C) D) $50 $55 $80 $110 34) Mr. Dell has $100 income this year and zero income next year. The expected return from investing in the stock market is 10 percent a year. Mr. Dell also has an investment opportunity— having the same risk as the market in which he can invest $50 this year and receive $80 next year. Suppose Mr. Dell consumes $50 this year and invests in the project. What is the NPV of the investment opportunity? A) B) C) D) $0 $5 $22.73 none of the options 35) Ms. Anderson has $60,000 income this year and $40,000 next year. The market interest rate is 10 percent per year. Suppose Ms. Anderson consumes $80,000 this year. What will be her consumption next year? 11 A) B) C) D) $18,000 $30,000 $60,000 $70,000 36) The line that connects the maximum that one can consume this year (now, on the horizontal axis) and the maximum one can consume next year: A) B) C) D) has a slope of (1 + r). has a slope of - (1 + r). has a slope of r. has a slope of 1/ r. 37) Ms. Newcastle has $60,000 income this year and $40,000 next year. The market interest rate is 10 percent per year. Suppose Ms. Newcastle wishes to consume $62,000 next year. What will be her consumption this year? A) B) C) D) $19,000 $40,000 $60,000 $70,000 38) Mr. Smith has an income of $40,000 this year and $60,000 next year. He can invest in a project that costs $30,000 this year, which generates an income of $36,000 next year. The market interest rate is 10 percent. What will be his consumption next year if Mr. Smith invests in the project and consumes $50,000 this year? 12 A) B) C) D) $40,000 $52,000 $60,000 $62,000 SHORT ANSWER. Write the word or phrase that best completes each statement or answers the question. 39) Explain the term corporation. 40) Briefly explain the term limited liability. 41) Briefly explain the advantages of a corporation as a form of business organization. 13 42) Briefly explain the sequence of cash flows between financial markets and the firm. 43) Briefly explain the functions of financial markets. 44) Briefly discuss the role of financial managers. 45) Briefly explain the term agency costs as related to a corporation. 14 46) Briefly discuss principal–agent problems as related to a corporation. 47) Explain why “maximization of shareholders' wealth” is the appropriate ultimate, longterm goal of the firm. 48) Briefly explain some of the institutional arrangements that ensure that managers work toward increasing the value of a firm. 49) Briefly explain how individuals can adjust their current and future consumption according to their preferences. 15 16 17