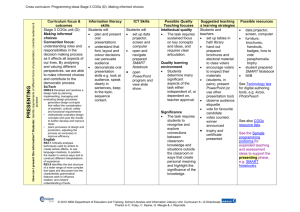

The following scenario illustrate a short example of a Revenue / COGS matching for a sales order where Accounting rule used is: 3 Months, Deferred Navigation 1. Inventory>Item Master>Define item MM-ITEM65 (Purchase Item) Figure 1 2. Miscellaneous Receipt Navigation: Miscellaneous Transactions>Receive MM-ITEM65 in Subinventory Store. Qty 100@15USD 3.View Material Transactions Figure 2 4. View Material Distribution Figure 3 5. Review the Item cost : Costs>Item Cost Figure 4 6. Define Accounting Rules in Account Receivables Account Receivables>Setup>Transactions>Accounting Rules There are two Predefined Accounting rules a-3 Months , Deferred b-Immediately Figure 5 Figure 6 7. Enter a SO (eg 63849) Figure 7 8. SO 63849 booked with Ordered item MM-ITEM65/qty=5/ price=15/ Accounting rule=3 Months, Deferred Shipping warehouse=M3 Figure 8 9. Pick Release the SO Figure 9 10. Ship Confirm the SO Figure 10 11.Item is shipped 12. Line is closed 13. Review the Material Transactions form 14. Distribution of the SO issue When a Sales order is shipped the following accounting takes place: Inventory Valuation Account: Credit. Deferred COGS account: Debit 15. Run the Workflow Background Process request 16 . Create the Invoice with the Autoinvoice request Sales Order Accounts Receivables>Interfaces>Autoinvoice 17.Check the Invoice in AR Accounts Receivables>Control>Accounting 18. Invoice generated: Invoice= 10033708 19. Recognize the revenue in AR 20. After recognizing the revenue. We need to accept it. Manage Revenue: 21. Now the revenue has been recognized according to our accounting rule: 3 Months, Deferred 50% August 25%September 25%October For August 50% of the revenue has been recognized 22. Now we run a set of concurrent processes to record sales order and revenue recognition transactions and to create and cost COGS recognition transactions. These COGS recognition transactions adjust deferred and earned COGS in an amount that synchronizes the % of earned COGS to earned revenue on sales order shipment lines. 23. Record Order Management Transactions: records new sales order transaction activity such as shipments and RMA returns in Oracle Order Management. 24. Collect Revenue Recognition Information: determines the percentage of recognized or earned revenue related to invoiced sales order shipment lines in Oracle Receivables. 25. Generate COGS Recognition Events: creates and costs COGS recognition events for new sales order shipments/returns and changes in revenue recognition and credits for invoiced sales order shipment lines. 26. A non-physical transaction has been generated Transaction Type= COGS Recognition The distribution for the COGS Recognition transaction associated with the Sales Order transaction now would be as follows: Deffered COGS : Debit y revenue percentage COGS : Credit (Actual revenue percentage ) Thus, essentially the recognized COGS balance is to move the value from Deferred COGS to COGS. This particular COGS recognition transaction actually corresponds to a revenue recognition percentage change.