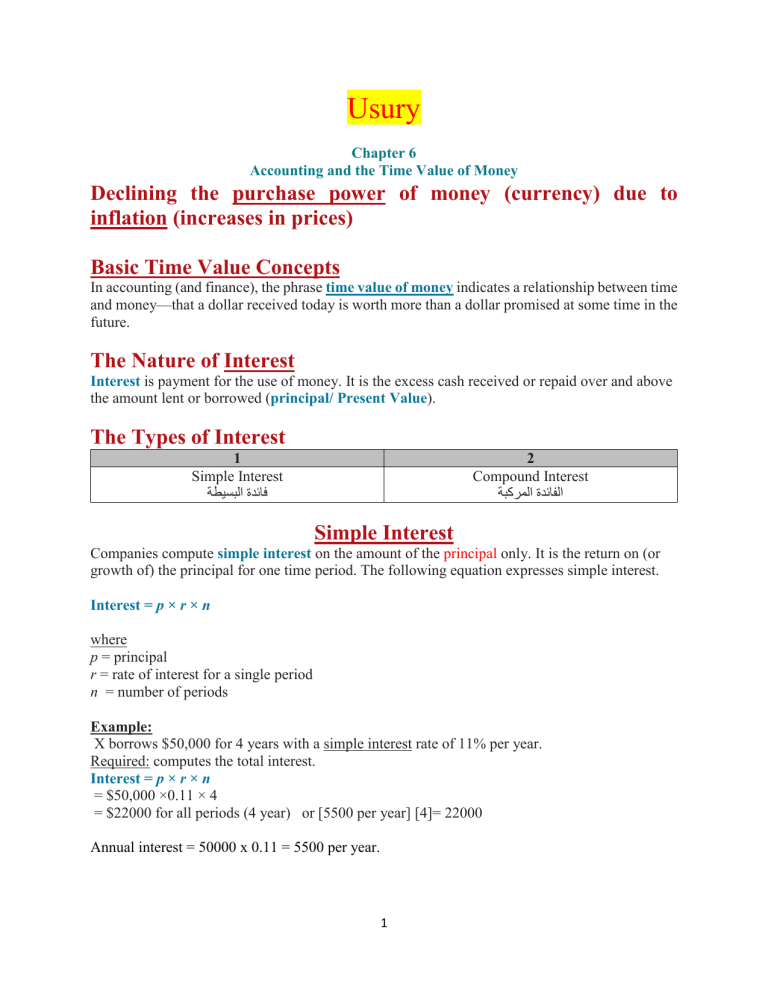

Usury Chapter 6 Accounting and the Time Value of Money Declining the purchase power of money (currency) due to inflation (increases in prices) Basic Time Value Concepts In accounting (and finance), the phrase time value of money indicates a relationship between time and money—that a dollar received today is worth more than a dollar promised at some time in the future. The Nature of Interest Interest is payment for the use of money. It is the excess cash received or repaid over and above the amount lent or borrowed (principal/ Present Value). The Types of Interest 1 Simple Interest فائدة البسيطة 2 Compound Interest الفائدة المركبة Simple Interest Companies compute simple interest on the amount of the principal only. It is the return on (or growth of) the principal for one time period. The following equation expresses simple interest. Interest = p × r × n where p = principal r = rate of interest for a single period n = number of periods Example: X borrows $50,000 for 4 years with a simple interest rate of 11% per year. Required: computes the total interest. Interest = p × r × n = $50,000 ×0.11 × 4 = $22000 for all periods (4 year) or [5500 per year] [4]= 22000 Annual interest = 50000 x 0.11 = 5500 per year. 1 Example: If X borrows $20,000 for 5 months at 12% annual interest. Interest = $20,000 × 0.12 × 5/12 = $1000 Compound Interest We compute compound interest on principal and on any interest earned that has not been paid or withdrawn. It is the return on (or growth of) the principal for two or more time periods. Compounding computes interest not only on the principal but also on the interest earned to date on that principal, Example: simple interest Assume that Kamal deposits $10,000 in the Arab Bank, where he will earn simple interest of 3% per year. He invested the amount for three years. Interest = [10000][0.03][3]= 900 Year 1 : I = 10000x 0.03 = 300 Year 2: I = 10000x 0.03 = 300 Year 3: I = 10000x 0.03 = 300 2 Example: Compound interest Assume that Kamal deposits $10,000 in the Arab Bank, where he will earn compound interest of 3% per year compounded annually. In both cases, Kamal will not withdraw any interest until 3 years from the date of deposit. Total Interest = Future Value – Principal Total Interest = ([principal][1+r]n ) – [Principal ] Total Interest = ([10000][1+0.03]3 ) – [10000 ] Total Interest = 927.27 Year 1: I = [10000][0.03] = 300 Year 2: I = [10300][0.03]= 309 Year 3: I= [10609][0.03]=318.27 3 Year Interest for first year Interest for second year Interest for third year Equation = ([principal][1+r] ) - Principle = [10000][1.03]1 -10000 = 300 = ([principal][1+r]2 ) - ([principal][1+r]1 ) = [10000][1.03]2 – [10000][1.03]1 = 10609 -10300= 309 = ([principal][1+r]3 ) - ([principal][1+r]2 ) = [10000][1.03]3 – [10000][1.03]2 = 10927.27 -10609= 318.27 1 The Future Value Single-Sum Problems دفعة واحدة Future value = (Present Value) (1+r)n Where FV = future value PV = present value (principal or single sum) r = interest rate n = time periods. Example 1: Ali wants to determine the future value of $50,000 invested for 5 years compounded annually at an interest rate of 6%. Future value = (Present Value) (1+r)n Future value = (50000) (1+0.06)5 = 66911.2788 At the end of fifth year Ali will receive 66911.2788 Example 2: Assume that Ali deposited $10000 in an escrow account with Arab Bank at the beginning of 2020 as a commitment toward a power plant to be completed December 31, 2025. How much will Ali have on deposit at the end of 6 years if interest is 12% annually, compounded semiannually? Future value = (10000) (1+0.06)12 Future value = 20122 Example 3: Assume that Ali deposited $10000 in an escrow account with Arab Bank at the beginning of 2020 as a commitment toward a power plant to be completed December 31, 2025. How much will Ali have on deposit at the end of 6 years if interest is 12% annually, compounded quarterly? Future value = (10000) (1+0.03)24 Future value = 20328 Example 4: Assume that Ali deposited $10000 in an escrow account with Arab Bank at the beginning of 2020 as a commitment toward a power plant to be completed December 31, 2025. How much will Ali have on deposit at the end of 6 years if interest is 12% annually, compounded monthly? Future value = (10000) (1+0.01)72 Future value = 20328 4 Interest Due: (annual interest 0.12, and periods = 5 years) Interest Due: (annual interest 0.08, and periods = 4) Annually R= 0.08 Periods = 4 x 1 =4 Semiannually R=0.08/2=0.04 Periods = 4 x 2 =8 Quarterly R=0.08/4=0.02 Periods = 4 x 4 =16 Monthly R=0.08/12=0.00667 Periods = 4 x 12 =48 Present Value of a Single Sum Present Value= Future Value (1+r)n Example: How many dollars should be invested today at an annually compounded interest rate of 6% to receive 66912.5 after 5 years? Future Value Present Value= (1+r)n Present Value= 66912.5 (1+0.06)5 Present Value= 50000 Natural Logarithm 5 Example—Computation of the Number of Periods [n=???] Ali wants to accumulate $70,000 for the construction. At the beginning of the current year, Ali deposited $47,811 in Arab Bank that earns 10% interest compounded annually. How many years will it take to accumulate $70,000? Future value = (Present Value) (1+r)n 70000 = (47811) (1+0.10)n 70000=[47811][1.1]n 70000/47811= [1.1]n 1.46409822 = [1.1]n Compute the natural logarithm for the two sides Log (1.46409822) = Log (1.1)n Log (1.46409822) = [n] [Log (1.1)] N= Log (1.46409822) [Log (1.1)] N= 0.165570212 0.041392685 N= 4 prove Future value = (47811) (1+0.10)4 = 70000 Example—Computation of the Interest Rate X needs $1,070,584 for basic research 5 years from now. X currently has $800,000 to invest for that purpose. At what rate of interest must it invest the $800,000 to fund basic research projects of $1,070,584, 5 years from now? Future value = (Present Value) (1+r)n 1070584=(800000) (1+r)5 1.33823 = (1+r)5 Log (1.33823) = log (1+r)5 0.12653 =5 Log X 0.025306=log x 100.025306 = X X= 1.06 1+r=1.06 R=0.06 0.05888888 6 Annuities (Future Value) دفعات دورية The preceding discussion involved only the accumulation or discounting of a single principal sum. However, many situations arise in which a series of dollar amounts are paid or received periodically, such as installment loans or sales; regular, partially recovered invested funds; or a series of realized cost savings. Note that the rents may occur at either the beginning or the end of the periods. 1. If the rents occur at the end of each period, an annuity is classified as an ordinary annuity. 2. If the rents occur at the beginning of each period, an annuity is classified as an annuity due. Case 1: Future Value of an Ordinary Annuity Example: What is the future value of five $5,000 deposits made at the end of each of the next 5 years, earning interest of 6%? Ahmad decided to invest $5000 in Arab Bank at the end of each year with annual interest of 0.06. If you know that the time period of investments is 5 years. What is the amount of money that will be received at the end of period? FV= [Rent] (1+r)n - 1 r FV= [5000] (1+0.06)5 - 1 0.06 FV= [5000] 1.338225578 - 1 0.06 FV= [5000] 0.338225578 0.06 FV= [5000] [5.63709296] FV=28185.465 7 Future Value of an Annuity Due FV= (1+r)n - 1 r [Rent] [1+r] What is the future value of five $5,000 deposits made at the beginning of each of the next 5 years, earning interest of 6%? FV= [5000] (1+0.06)5 - 1 0.06 [1+0.06] FV= [5000] (1+0.06)5 - 1 0.06 [1+0.06] =29876.6 Example: Ali invests 5000 at the end of each accounting period to receive 28185, the annual interest is 0.06. compute the number of years. FV= [Rent] (1+r)n - 1 r 28185= [5000] (1+0.06)n - 1 0.06 (1+0.06)n - 1 0.06 5.6371= [5.6371][0.06]= (1.06)n -1 0.338225577 = (1.06)n – 1 1.338225577 = (1.06)n Log[1.338225577] = Log(1.06)n 0.126529326 = n log [1.06] 0.126529326 = n [0.025305] N= 5 year Annuities (Present Value) Present Value of an Ordinary Annuity PV= ( Rent r ) ( 1- 1 (1+r)n ) Example: What is the present value of rental receipts of $6,000 each, to be received at the end of each of the next 5 years when discounted at 6%? PV= 6000 0.06 1- 1 (1+0.06)5 PV=25274 8 Present Value of Annuity due Rent 1 1(1+r) r (1+r)n To illustrate, Space Odyssey, Inc., rents a communications satellite for 4 years with annual rental payments of $4.8 million to be made at the beginning of each year. If the relevant annual interest rate is 5%, what is the present value of the rental obligations? 4.8 1 PV= 1(1+0.05) 0.05 (1+0.05)4 PV= 17,871,590 PV= Application: Selling price of bond (intermediate accounting 2: Chapter 14 (long-term liabilities: bonds and notes) There are 3 situations 1- Issuing bonds at face value (sated interest = Market interest). 2- Issuing bond at discount (market interest > stated interest). 3- Issuing bond at premium (market interest < stated). Bond certificate # of bonds Face value = coupon value or nominal value $1000 per bond Stated interest rate 5% (annual) Market interest rate = Effective interest rate Valuation of Long-Term Bonds Selling price of bond = present value (pv) PV = Present value of principal + present value of rent (interest) PV= Principal (1+r)n + [( Rent r ) ( 1- 1 (1+r)n R= market interest rate. N= periods. Rent = interest expense = [principal][stated interest] 9 )] 1- Issuing bonds at face value (sated interest = Market interest). X Corporation on January 1, 2020, issues $100,000 (100 bond @ $1000 face value) of 5% bonds due in 5 years with interest payable annually at year-end. The current market rate of interest for bonds of similar risk is 5%. What will the buyers pay for this bond issue? PV= 100000 (1+0.05)5 + [( 5000 0.05 ) ( 1- 1 (1+0.05)5 )] PV= 78352.617 + 21647.38335 = 100000 No discount or premium Note: rent = interest expense = [principal][stated interest] = [100000][0.05] = 5000 X Corporation will record this journal entry Dr. Cash 100000 Cr. Bonds Payable 100000 2- Issuing bond at discount (market interest > stated interest). X Corporation on January 1, 2020, issues $100,000 (100 bond @ $1000 face value) of 5% bonds due in 5 years with interest payable annually at year-end. The current market rate of interest for bonds of similar risk is 6%. What will the buyers pay for this bond issue? PV= 100000 (1+0.06)5 + [( 5000 0.06 ) ( 1- 1 (1+0.06)5 )] PV= 74725.817 + 21061.819 = 95787 selling price X Corporation will record this journal entry Dr. Cash 95787 Dr. Discount on bonds 4213 Cr. Bonds Payable 100000 Balance sheet Long –term liabilities Bonds payable 100000 Less: discount on bonds 4213 Adjunct account (add) versus contra account (deduct) A/R Less: ADA 10 3- Issuing bond at premium (market interest < stated). X Corporation on January 1, 2020, issues $100,000 (100 bond @ $1000 face value) of 5% bonds due in 5 years with interest payable annually at year-end. The current market rate of interest for bonds of similar risk is 4%. What will the buyers pay for this bond issue? PV= 100000 (1+0.04)5 + [( 5000 0.04 ) ( 1- 1 (1+0.04)5 )] PV= 82192.711 + 22259.911 = 104452 selling price X Corporation will record this journal entry Dr. Cash 104452 Cr. Bonds Payable 100000 Cr. Premium on bonds 4452 Balance sheet Long –term liabilities Bonds payable 100000 Plus: premium on bonds 4452 Notes: 1 – The discount on bonds is deferred cost. 2 – The premium on bonds is deferred revenue. 3 – The discount or premium should be allocated (amortized) among useful life by using a – The straight-line methods. b. Effective interest method. (In chapter 14 of intermediate II we will discuss this issue). 4 – In Chapter 7, we will apply the time value of money (valuation of notes receivable). 11