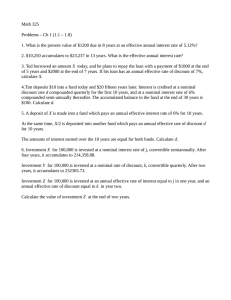

Practice questions/ Set 1/ May 18th 2020 Marks for each question are written in square brackets alongside the question itself. 1. Explain the meaning of the following terms a. Effective rate of interest, i b. Effective rate of discount, d p c. Nominal rate of interest, i p d. Nominal rate of discount, d [4] 2. Explain why 1 i 1 d 1 [2] 4 3. Calculate the present value of 2.5Mn due in 2 years invested to earn interest, i 8.50% . [3] 4. Define the term force of interest [2] 5. Show that for an effective rate of interest i per annum, the equivalent force of interest is also a constant δ. [4] 6. Rework question 3 above but using force of interest δ = 9.5% [3] 7. I invest £450 for 13 months at i = 0.09, then switch to an investment that pays interest at a force of d = 0.086178 for 11 months and then d = 0.113329 for two years. How much has my investment accumulated to? [5] 8. For each of the following calculate the equivalent effective annual rate of interest: a. an effective rate of interest of 12.7% paid every 2 years b. an effective rate of discount of 5.75% pa c. a force of interest of ½% per month d. a nominal rate of discount of 6% pa convertible quarterly e. a rate of interest of 14% pa convertible every 2 years. [5] 9. The force of interest, t , is a function of time and at time t , measured in years, is given by: t 0.03 0.005t 0.001t 2 0 t 10 a. Calculate the equivalent constant force of interest per annum for the period t = 0 to t = 10 [3] b. Calculate the accumulated value at time t = 7 of an investment of £250 at time t = 0 plus a further investment of £150 at time t = 5. [4] [Total 35 Marks]