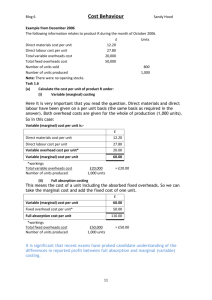

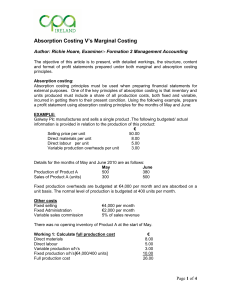

Example: Marginal and absorption costing compared Big Woof Co manufactures a single product, the Bark, details of which are as follows. Per unit $ 180.00 40.00 16.00 10.00 Selling price Direct materials Direct labour Variable overheads Annual fixed production overheads are budgeted to be $1.6 million and Big Woof expects to produce 1,280,000 units of the Bark each year. Overheads are absorbed on a per unit basis. Actual overheads are $1.6 million for the year. Budgeted fixed selling costs/overheads are $320,000 per quarter. Actual sales and production units for the first quarter of 2018 are given below. Sales Production January-March 240,000 280,000 There is no opening inventory at the beginning of January. Prepare statements of profit or loss for the quarter, using: (a) Absorption costing (b) Marginal costing 1 Solution: Step 1 Calculate the overhead absorption rate per unit 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝑎𝑏𝑠𝑜𝑟𝑝𝑡𝑖𝑜𝑛 𝑟𝑎𝑡𝑒 = 𝐵𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑓𝑖𝑥𝑒𝑑 𝑜𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝐵𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑢𝑛𝑖𝑡𝑠 You are dealing with a three month period but the figures in the question are for a whole year. You will have to convert these to quarterly figures. 𝐵𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑜𝑣𝑒𝑟ℎ𝑒𝑎𝑑𝑠 (𝑞𝑢𝑎𝑟𝑡𝑒𝑟𝑙𝑦) = 𝐵𝑢𝑑𝑔𝑒𝑡𝑒𝑑 𝑝𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 (𝑞𝑢𝑎𝑟𝑡𝑒𝑟𝑙𝑦) = Overhead absorption rate per unit = Step 2 $1.6 𝑀𝑖𝑙𝑙𝑖𝑜𝑛 = $400,000 4 1,280,000 = 320,000 𝑢𝑛𝑖𝑡𝑠 4 $400,000 = $1.25 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡 320,000 𝑢𝑛𝑖𝑡𝑠 Calculate total cost per unit 𝑇𝑜𝑡𝑎𝑙 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡(𝐴𝑏𝑠𝑜𝑟𝑝𝑡𝑖𝑜𝑛 𝑐𝑜𝑠𝑡𝑖𝑛𝑔) = 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡 + 𝐹𝑖𝑥𝑒𝑑 𝑝𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝑐𝑜𝑠𝑡 𝑇𝑜𝑡𝑎𝑙 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡(𝐴𝑏𝑠𝑜𝑟𝑝𝑡𝑖𝑜𝑛 𝑐𝑜𝑠𝑡𝑖𝑛𝑔) = (40 + 16 + 10) + 1.25 = $67.25 𝑇𝑜𝑡𝑎𝑙 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡(𝑀𝑎𝑟𝑔𝑖𝑛𝑎𝑙 𝑐𝑜𝑠𝑡𝑖𝑛𝑔) = 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡 = $66 Step 3 Calculate closing inventory in units 𝐶𝑙𝑜𝑠𝑖𝑛𝑔 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 = 𝑂𝑝𝑒𝑛𝑖𝑛𝑔 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 + 𝑝𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 – 𝑠𝑎𝑙𝑒𝑠 𝐶𝑙𝑜𝑠𝑖𝑛𝑔 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 = 0 + 280,000 – 240,000 = 40,000 𝑢𝑛𝑖𝑡𝑠 Step 4 Calculate under/over absorption of overheads This is based on the difference between actual production and budgeted production. Actual production = 280,000 units Budgeted production = 320,000 units (see Step 1 above) Under-production = 40,000 units As Big Woof produced 40,000 fewer units than expected, there will be an under absorption of overheads of 40,000 x $1.25 (see Step 1 above) = $50,000. This will be added to production costs in the statement of profit or loss. 2 Step 5 Produce statements of profit or loss Sales (240,000 x $180) Less cost of sales: Opening inventory Plus: production cost 280,000 x $66 280,000 x $67.25 Less: Closing inventory 40,000 x $66 40,000 x $67.25 Marginal Costing $000 $000 43,200 0 Absorption Costing $000 $000 43,200 0 18,480 18,830 (2,640) (15,840) Add under-absorbed O/H (2,690) 16,140 50 (16,190) Contribution Gross Profit Less: Fixed production O/H Fixed selling O/H Net profit 27,360 27,010 400 320 NIL 320 (720) 26,640 (320) 26,690 3 No Changes in Inventory You will notice from the calculations in the example that there are differences between marginal and absorption costing profits. Before we go on to reconcile the profits, how would the profits for the two different techniques differ if there were no changes between opening and closing inventory (that is, if production = sales)? For the first quarter we will now assume that sales were 280,000 units. Sales (280,000 x $180) Less cost of sales: Opening inventory Plus: production cost 280,000 x $66 280,000 x $67.25 Less: Closing inventory Marginal Costing $000 $000 50,400 0 Absorption Costing $000 $000 43,200 0 18,480 NIL (18,480) Add under-absorbed O/H 18,830 NIL 18,830 50 18,880 Contribution Gross Profit Less: Fixed production O/H Fixed selling O/H Net profit 31,920 31,520 400 320 NIL 320 (720) 31,200 (320) 31,200 Reconciling Profits The profits reported under absorption costing and marginal costing for January to March in the Big Woof question above can be reconciled as follows: $’000 Marginal costing profit Adjust for fixed overhead included in inventory: Inventory increase of 26,640 50 40,000 units x $1.25 Absorption costing profit 26,690 4