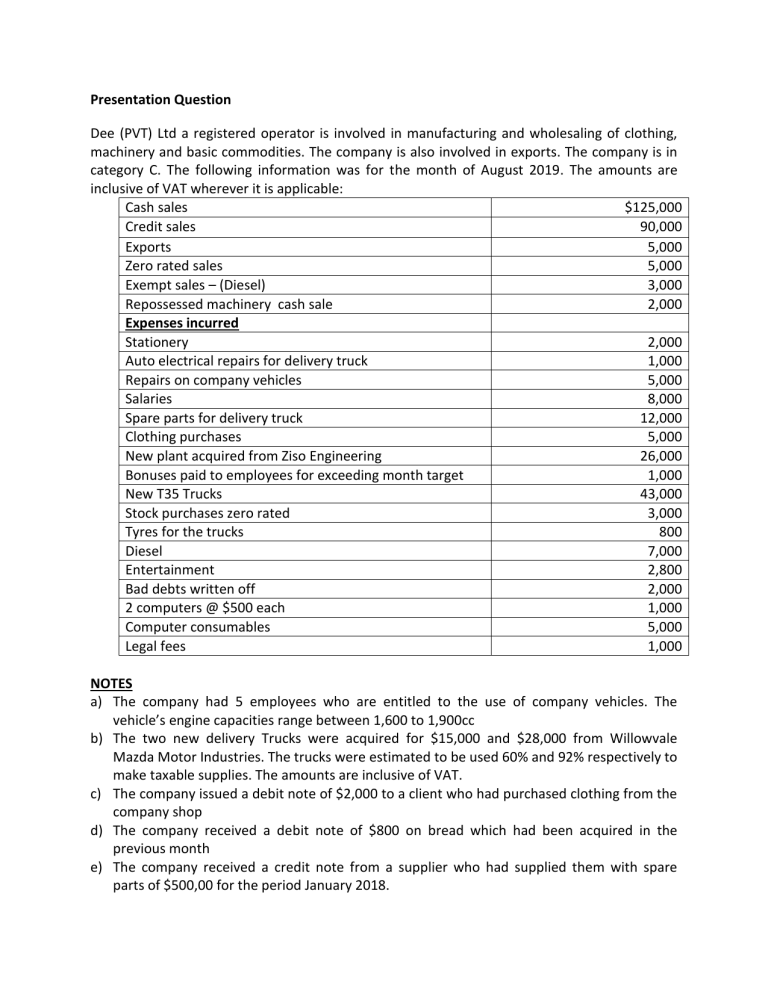

Presentation Question Dee (PVT) Ltd a registered operator is involved in manufacturing and wholesaling of clothing, machinery and basic commodities. The company is also involved in exports. The company is in category C. The following information was for the month of August 2019. The amounts are inclusive of VAT wherever it is applicable: Cash sales $125,000 Credit sales 90,000 Exports 5,000 Zero rated sales 5,000 Exempt sales – (Diesel) 3,000 Repossessed machinery cash sale 2,000 Expenses incurred Stationery 2,000 Auto electrical repairs for delivery truck 1,000 Repairs on company vehicles 5,000 Salaries 8,000 Spare parts for delivery truck 12,000 Clothing purchases 5,000 New plant acquired from Ziso Engineering 26,000 Bonuses paid to employees for exceeding month target 1,000 New T35 Trucks 43,000 Stock purchases zero rated 3,000 Tyres for the trucks 800 Diesel 7,000 Entertainment 2,800 Bad debts written off 2,000 2 computers @ $500 each 1,000 Computer consumables 5,000 Legal fees 1,000 NOTES a) The company had 5 employees who are entitled to the use of company vehicles. The vehicle’s engine capacities range between 1,600 to 1,900cc b) The two new delivery Trucks were acquired for $15,000 and $28,000 from Willowvale Mazda Motor Industries. The trucks were estimated to be used 60% and 92% respectively to make taxable supplies. The amounts are inclusive of VAT. c) The company issued a debit note of $2,000 to a client who had purchased clothing from the company shop d) The company received a debit note of $800 on bread which had been acquired in the previous month e) The company received a credit note from a supplier who had supplied them with spare parts of $500,00 for the period January 2018. f) Legal fees were in respect of fees paid by the company to Musvi and Partners Legal Firm for representing the Managing Director for a divorce lawsuit from his estranged wife g) The entertainment was in respect of a cocktail party held for customers h) The company also recovered a bad debt during the tax period of about $1,000 in respect of supplies of clothing. The company had claimed input tax on the bad debt in November 2017 i) The company repossessed machinery whose value including VAT was $4200. The client had only paid $1000. The consideration was the cash price of the machine. The machinery was resold for $2000 during the tax period. j) The two computers bought at $500 each were used one 95% and the other 85% for making taxable supplies. k) The bad debts included the following; Spare parts- $1200,00 Diesel -$800,00 Required Calculate the VAT payable or refundable for August 2019 (show all your workings). (30 Marks)