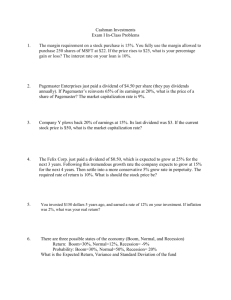

FORMULA SHEET Time value of money: C FV = C × (1 + 𝑟)𝑡 PV of a perpetuity = PV = (1+𝑟)𝑡 𝐶 𝐶1 PV of a growing perpetuity = 𝑟 1−(1+𝑟)−𝑡 𝐶 1 𝑟 (1+𝑟)𝑡 PV of annuity = × [1 − PV of growing annuity = 𝐶1 𝑟−𝑔 Interest rates: 1+ EAR = (1+ APR/k)k r = (1+ EAR)k/f-1 ] =𝐶×[ × [1 − ( 𝑟 ] 𝑟−𝑔 FV of annuity = 𝐶 × [ (1+𝑟)𝑡 −1 𝑟 1+𝑟 )] with k the number of compounding periods; APR=Annual percentage rate=quoted rate with f the number of payments within a year Bond valuation: 1 1 𝑟 𝑟(1+𝑟)𝑡 Price of a Bond = 𝐶 × [ − ]+ Face Value 𝐶 = (1+𝑟)𝑡 𝑟 × [1 − 1 (1+𝑟)𝑡 ] + Future Value (1+𝑟)𝑡 1 + Nominal rate = (1 + Real rate) ( 1 + inflation) If f is the m-year forward rate in n years, then: (1 + rn)n(1 + f)m = (1 + rm + n)m + n Dividend discount model: Price of a share = 𝑃0 = ] 1+𝑔 𝑡 DIV1 1+𝑟 + DIV2 (1+𝑟)2 +. . . + DIV𝑇 (1+𝑟)𝑇 DIV1 No-Growth Dividend Discount Model: 𝑃0 = + DIV1 𝑃0 g = ROE x b 𝑟 Constant-Growth Dividend Discount Model: 𝑃0 = Expected Rate of Return Formula: 𝑟 = 𝑃𝑇 (1+𝑟)𝑇 DIV1 𝑟−𝑔 , + 𝑔 𝑜𝑟 𝑟 = 𝐷𝐼𝑉1 1 𝑃0 + 𝑃1 −𝑃0 𝑃0