17

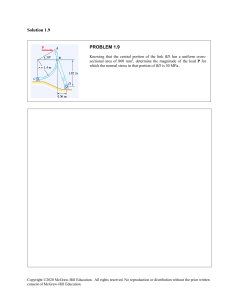

Flexible Budgets,

Overhead Cost

Management, and

Activity-Based

Budgeting

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-2

Learning Objective 1

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-3

Flexible Overhead Budget

A flexible budget is a budget that is valid for a

relevant range of activity. It is not based on only

one level of activity as we have seen with the

static budget.

Activity (machine hours)

Budgeted electricity cost

Static

Budget

6,000

$ 1,200

Based on

only one

activity

level.

McGraw-Hill/Irwin

$

4,500

900

Flexible

Budget

6,000

$ 1,200

7,500

$ 1,500

Includes several

possible activity

levels.

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-4

Advantages of Flexible Budgets

A manager is faced with the following information from the

static budget for June when the level of activity was 4,500

machine hours. Was there good control of electric costs?

Actual

Electricity

Cost

$

1,050

Budgeted

Electricity

Cost

$

1,200

Cost

Variance

$

150 Favorable

After preparing a flexible budget, the manager

obtained the following information about cost control

at 4,500 machine hours.

Actual

Electricity

Cost

$

1,050

McGraw-Hill/Irwin

Budgeted

Electricity

Cost

$

900

Cost

Variance

$

150 Unfavorable

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-5

Activity Measure: Based on Input or

Output?

The number of units of output usually is not a

meaningful measure in a multiproduct firm

because it requires the addition of numbers of

dissimilar products. Output should be measured

in terms of the standard input allowed given

actual output.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-6

Formula Flexible Budget

Total budgeted

monthly

=

overhead cost

McGraw-Hill/Irwin

Budgeted variable

Total

Budgeted fixed

overhead cost per × activity + overhead cost

activity unit

units

per month

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-7

Learning Objective 2

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-8

Flexible Overhead Budget Illustrated

$2.15 × 6,000 = $12,900

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-9

Flexible Overhead Budget Illustrated

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-10

Flexible Overhead Budget Illustrated

$24,360 + $16,550 = $40,910

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-11

Flexible Overhead Budget Illustrated

Normal costing

Standard costing

Manufacturing Overhead

Manufacturing Overhead

Actual

Overhead

Actual

Overhead

Applied

Overhead

Applied

Overhead

Actual

activity

Standard

allowed activity

×

×

Predetermined

overhead rate

Predetermined

overhead rate

The difference lies in the quantity of hours used

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-12

Learning Objective 3

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-13

Overhead Application in a StandardCosting System

In a normal-costing system, overhead is applied

based on the actual amount of resources

used (e.g., labor hours, machine hours).

In a standard-costing system, the standard

amount of resources forms the basis of

application.

Since the application rate would be the same in

both cases, the difference between them lies

in the quantity of resources that is recorded.

Standard costing =

Standard quantity

* application rate

McGraw-Hill/Irwin

Normal costing =

Actual quantity used

* application rate

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-14

Learning Objective 4

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-15

Choice of Activity Measure

1. The activity measure should be one that

varies in a similar pattern to the way that

variable overhead varies.

2. As automation increases, many companies

are using measures such as machine hours

or process time for their flexible overhead

budget.

3. Dollar measures are subject to price-level

changes and fluctuate more than physical

measures.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-16

Learning Objective 5

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-17

Overhead Cost Variances

Variable-Overhead Variances

Actual Hours

×

Actual Rate

AH × AR

Actual Hours Standard Hours

×

×

Standard Rate

Standard Rate

AH × SR

Variable-overhead

spending variance

McGraw-Hill/Irwin

SH × SR

Variable-overhead

efficiency variance

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-18

Variable-Overhead Variances

Matrix Inc. has the following variable

manufacturing overhead standard to

manufacture one tent:

1.5 standard hours per tent at $13.00 per

direct labor hour

Last week 1,550 hours were worked to make

1,000 tents, and $20,460 was spent for

variable manufacturing overhead.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-19

Overhead Cost Variances

Variable-Overhead Variances

Actual Hours

×

Actual Rate

Actual Hours Standard Hours

×

×

Standard Rate

Standard Rate

AH × AR

AH × SR

SH × SR

1,550

×

$13.20

1,550

×

$13.00

1,500

×

$13.00

$20,460

$20,150

$19,500

$310 Unfavorable

$650 Unfavorable

Variable-overhead

spending variance

Variable-overhead

efficiency variance

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-20

Overhead Cost Variances

Variable-Overhead Variances

Actual Hours

×

Actual Rate

AH × AR

1,550

×

$13.20

$20,460

Actual Hours Standard Hours

×

×

Standard Rate

Standard Rate

AH × SR

SH × SR

1,550

1,500

×

×

$20,460$13.00

actual overhead costs

$13.00

1,550 actual hours

$20,150

$19,500

$310 Unfavorable

$650 Unfavorable

Variable-overhead

spending variance

Variable-overhead

efficiency variance

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-21

Overhead Cost Variances

Variable-Overhead Variances

Actual Hours

×

Actual Rate

Actual Hours Standard Hours

×

×

Standard Rate

Standard Rate

AH × AR

AH × SR

SH × SR

1,550

×

$13.20

1,000 tents1,550

× 1.5 hours

×

$13.00

1,500

×

$13.00

$20,460

$20,150

$19,500

$310 Unfavorable

$650 Unfavorable

Variable-overhead

spending variance

Variable-overhead

efficiency variance

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-22

What Does the Efficiency Variance

Reveal?

Variable-overhead efficiency

variance did not result from using

more of the variable-overhead

items than the standard allowed

amount.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-23

What Does the Spending Variance

Reveal?

An unfavorable spending variance

simply means that the total actual

cost of variable overhead is higher

than expected after adjusting for

the actual quantity of activity used.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-24

Fixed-Overhead Variances

Fixed-overhead

Actual fixed- _ Budgeted fixed=

budget variance

overhead

overhead

Fixed-overhead

Budgeted fixed- _ Applied fixed=

volume variance

overhead

overhead

Predetermined fixedStandard hours

×

overhead rate

allowed

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-25

Fixed-Overhead Variances

Matrix, Inc. prepared this flexible budget for overhead:

Machine

Hours

2,000

4,000

Total

Variable

Overhead

Variable

Overhead

Rate

Budgeted

Fixed

Fixed

Overhead

Overhead

Rate

$

$

$

4,000

8,000

2.00

2.00

9,000

9,000

$

4.50

2.25

The company’s actual fixed overhead for the

period was $8,450, and it operated at a standard

3,200 machine hours. Matrix budgeted 3,000

machine hours during the period.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-26

Fixed-Overhead Budget Variance

Fixed-overhead

Actual fixed- _ Budgeted fixed=

budget variance

overhead

overhead

$550 Favorable =

$8,450

_

$9,000

Budget Variance

Results from paying more or less than

expected for overhead items.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-27

Fixed-Overhead Variances

Fixed-overhead

Budgeted fixed- _ Applied fixed=

volume variance

overhead

overhead

Volume Variance

Results from operating at an activity

level different from the denominator

activity.

$600 Favorable =

$9,000

3,200 hours

×

$3.00 per hour

=

_

$9,600

$9,000 Budgeted cost ÷ 3,000 Budgeted hours

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-28

Fixed Overhead Variances

Cost

$550

Favorable

Budget

Variance

$9,000 budgeted fixed OH

{ $8,450 actual fixed OH

Volume

3,000 Hours

Expected

Activity

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-29

Fixed Overhead Variances

Cost

$600

Favorable

Volume

Variance

$9,600 applied fixed OH

{ $9,000 budgeted fixed OH

3,000 Hours

Expected

Activity

McGraw-Hill/Irwin

Volume

3,200

Standard

Hours

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-30

Capacity Utilization

Volume

Variance

Results when standard hours

allowed for actual output differs

from the denominator activity.

Unfavorable

when standard hours

< denominator hours

McGraw-Hill/Irwin

Favorable

when standard hours

> denominator hours

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-31

Several Types of Analyses

Variableoverhead

spending

variance

$1,680 U

Fixedoverhead

budget

variance

$2,500 U

Combined

spending

variance

$4,180 U

Variableoverhead

efficiency

variance

$1,800 U

Fixedoverhead

volume

variance

$7,500 U

$1,800 U

$7,500 U

Combined

budget

variance

$5,980 U

$7,500 U

Underapplied overhead

$13,480 U

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-32

Learning Objective 6

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-33

Overhead Cost Performance Report

= Unfavorable variance

$19,200 - $19,350 = $ 150

$18,000 - $19,200 = $1,200

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-34

Overhead Cost Performance Report

$1,680 + $1,800 + $2,500 = $5,980 unfavorable

$57,000 - $62,980 = $5,980 unfavorable

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-35

Learning Objective 7

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-36

Standard Costs in Product Costing

In a standard

cost system:

Unfavorable

variances are equivalent

to underapplied overhead.

Favorable

variances are equivalent

to overapplied overhead.

The sum of the overhead variances

equals the under- or overapplied

overhead cost for a period.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-37

Disposition of Variances

Manufacturing Overhead

Actual

Overhead

Applied

Overhead

$50,000

$44,500

$5,500

$5,500

Cost of Goods Sold

$5,500

An alternative accounting treatment is to prorate underapplied

or overapplied overhead among Work-in-Process Inventory,

Finished-Goods Inventory, and Cost of Goods Sold.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-38

Learning Objective 8

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-39

Activity-Based Flexible Budget

$18,000 ÷ 4,500 units = $4.00 per unit

$5,000 ÷ 10 runs = $500 per run

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-40

How Does ABC Affect Performance

Reporting?

The activity-based flexible budget

provides a more accurate benchmark

against which to compare actual costs.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-41

Standard Costing in A JIT Environment

A just-in-time manufacturing setting minimizes

inventories.

Some companies have simplified their

accounting system by charging all

manufacturing costs directly to Cost of Goods

Sold.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-42

Learning Objective 9

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-43

Proration of Cost Variances

Generally, variances for direct and indirect costs

are closed at the end of each period to the Cost

of goods sold account.

Logically, though, those variances are also

related to the ending inventories of Materials,

Work-in-process and Finished goods.

The Cost Accounting Standards Board, which

publishes rules for government contractors,

requires that part of any cost variance be

assigned to the related inventories.

Example: The company purchased $5,000 of direct materials, of

which 30% remained in inventory. If there is an unfavorable

materials price variance of $250, we add $75 to Materials inventory.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-44

Learning Objective 10

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-45

Standard Costing in a Just-in-Time

Environment

Businesses with a JIT management

philosophy try to minimize their

inventories.

They simplify their accounting by charging

purchases immediately to Cost of goods

sold.

Then, if any inventory exists at the end of

the period, its cost is recorded and part of

the Cost of goods sold is reduced.

McGraw-Hill/Irwin

This method is known as backflush costing.

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-46

Learning Objective 11

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-47

Sales Variance Analysis

Sales are also subject to deviation from plans.

The two most common types of analysis focus

on (1) sales revenue and (2) contribution

margin.

Once again the variance measures the difference

between budgeted and actual amounts. But

now a variance is favorable if actual exceeds

budget.

Sales variances can be further divided into (1)

sales-price and (2) revenue sales-volume

variances.

Additional analyses can be carried out on (1)

revenue sales-mix, (2) revenue sales-quantity,

(3) revenue market-size and (4) revenue

market-share variances.

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

17-48

End of Chapter 17

McGraw-Hill/Irwin

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.