Segment Reporting – Example 1

Chapter 6

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

6-2

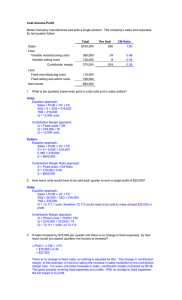

Example

Cairo Company sells three products, Product A,

Product B and Product C, and had sales of $1,000,000

during the month of June. The company's overall

contribution margin ratio was 37% and fixed expenses

totaled $340,000. Sales were: Product A, $500,000;

Product B, $300,000; and Product C, $200,000.

Traceable fixed costs were: Product A, $120,000;

Product B, $100,000; and Product C, $60,000. The

variable expenses of Product A were $300,000 and the

variable expenses of Product B were $180,000.

Required: Prepare a Complete segmented income

statement.

6-3

1-Design the following illustration

Company

Sales

- Variable costs

CM

-Traceable Fixed

Costs

Segment Margin

-Common Fixed

Costs

Net Operating

Income

A

B

C

6-4

2-set the given data:

Sales

Company

A

B

C

$1000,000

500,000

300,000

200,000

300,000

180,000

120,000

100,000

- Variable costs

CM

370,000

-Traceable Fixed Costs

300,000

Segment Margin

-Common Fixed Costs

Net Operating Income

Total Fixed Expenses =$340,000

60,000

6-5

3- Prepare the segmented Income

Statement :

Company

A

B

C

Sales

$1000,000

500,000

300,000

200,000

- Variable costs

630,000*

300,000

180,000

150,000**

CM

370,000

200,000

120,00

50,000

-Traceable Fixed Costs

280,000

120,000

100,000

60,000

Segment Margin

90,000

80,000

20,000

(10,000)

-Common Fixed Costs

60,000****

Net Operating Income

30,000

Total Fixed Expenses =$340,000

6-6

Explanations

• *CM=37%(given) X $1000,000 =$370,000

So, Variable costs=1000,000370,000=630,000

• **Variable costs for

B=630,000-(300,000+180,000)=150,000

• ***Segment Margin= CM- Traceable fixed costs

• ****Common fixed costs=340,000-280,000

=60,000

• Net Operating Income=90,000-60,000=30,000

6-7

The End