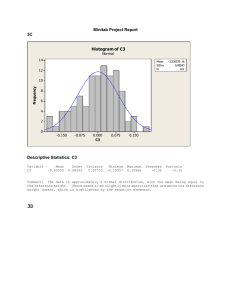

Additional Econometrics Practice Exercises For End of Term Test This is not to be handed but you can show me your workings for comments Theory (make sure you understand what you are writing and write in your own words!): 1. What is the R-squared form of the F-statistics? Outline the steps to test for excluding a set of variables in a multiple linear regression model. (solution: refer to section 4.5c in the book ch 4) 2. Differentiate between the t and the F statistics. (solution: give the t-statistics and F-statistics separately and then explain their importance in the model, refer to section 4.2, 4.5 and 4.5b in Ch 4) 3. For Multicollinearity, Heteroskedasticity, Specification Errors and Autocorrelation, the following apply: a. Define. b. Consequences c. Explain clearly how to test for each of them d. Explain clearly how to remedy each of them Problem Test Remedy Multicollinearity Graphical Add more variables, or remove Formal: VIF irrelevant variable, change functional form of variable … Heteroskedasticity Graphical Robust standard errors…how? Formal: … WLS… Specification Errors Ramsey RESET … Autocorrelation (problem which Formal: Durbin-Watson … arises in time series) … 4. List and clearly explain each type of misspecification errors that can occur in the Classical Linear Regression Model (CLRM). 5. List and write briefly on the assumptions of a time series model. (solution: refer to summary section of ch 10) 6. Suppose you have quarterly data on new housing starts, interest rates and real per capital income. Specify a model for housing starts that accounts for possible trends and seasonality in the variables. (refer to question 5 problem exercises in ch10) 7. Compare OLS (Ordinary Least Squares) and FGLS (Feasible Generalised Least Squares). (solution: refer to section 12.3c in ch 12) Applied Questions 1. The following equation has been estimated by OLS: 2. Time Series dataset: This question is based on information provided in Appendix. Results are based on data for the US for the years 1973-2011 on the following variables: Hstart: New housing starts, monthly data at seasonally annual rate (‘000) UN: Seasonally adjusted civilian unemployment rate (%) M2: Seasonally adjusted M2 money supply (billions of dollars) Mgrate: New home mortgage yield (%) Primerate: Prime rate charged by banks (%) RGDP: Real GDP, billions of chained 2005 dollars, quarterly data at seasonally adjusted annual rates. Note: All the data are from the Economic Report of the President, 2013. (a) Write down the estimated multiple regression model. (b) Do regression results support prior expectations in accordance to economic theory? (c) Since the data involves time series, do you expect autocorrelation in the error term? If so, how would you handle the problem? Explain the diagnostic test you use to check for autocorrelation. (d) Show the autocorrelation-corrected results of your regression model. Discuss results in relation to model in (a). (e) Besides autocorrelation, do you suspect the statistical results suffer from other problems? (f) Detail the steps in solving one of the problems listed in (e). Appendix: