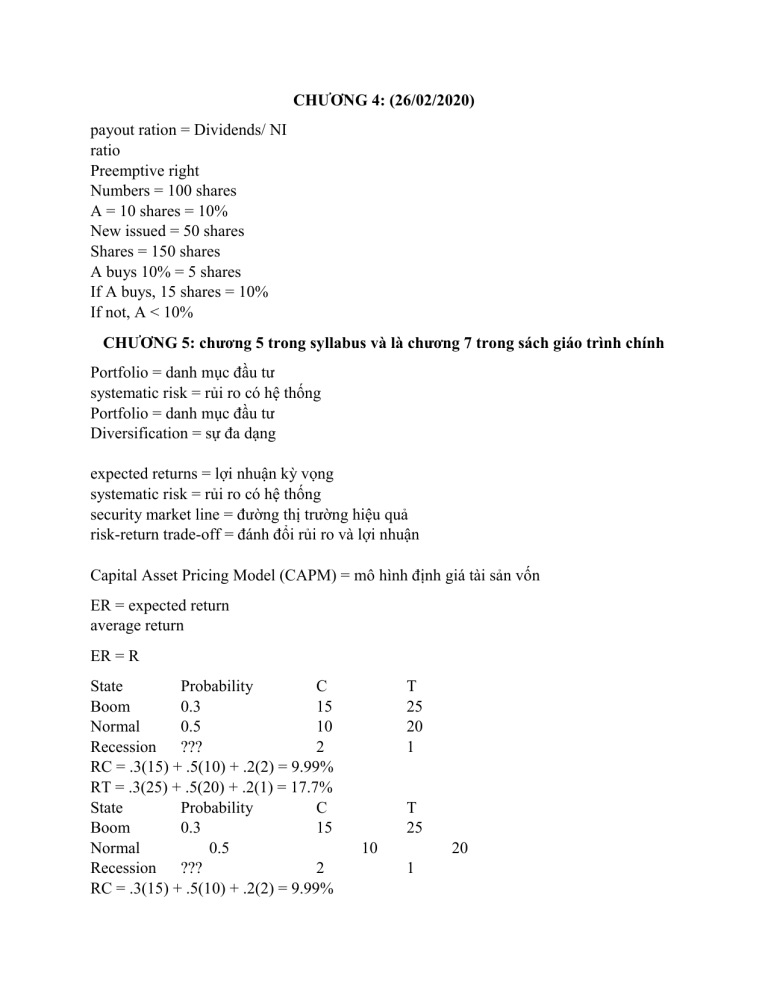

CHƯƠNG 4: (26/02/2020) payout ration = Dividends/ NI ratio Preemptive right Numbers = 100 shares A = 10 shares = 10% New issued = 50 shares Shares = 150 shares A buys 10% = 5 shares If A buys, 15 shares = 10% If not, A < 10% CHƯƠNG 5: chương 5 trong syllabus và là chương 7 trong sách giáo trình chính Portfolio = danh mục đầu tư systematic risk = rủi ro có hệ thống Portfolio = danh mục đầu tư Diversification = sự đa dạng expected returns = lợi nhuận kỳ vọng systematic risk = rủi ro có hệ thống security market line = đường thị trường hiệu quả risk-return trade-off = đánh đổi rủi ro và lợi nhuận Capital Asset Pricing Model (CAPM) = mô hình định giá tài sản vốn ER = expected return average return ER = R State Probability C Boom 0.3 15 Normal 0.5 10 Recession ??? 2 RC = .3(15) + .5(10) + .2(2) = 9.99% RT = .3(25) + .5(20) + .2(1) = 17.7% State Probability C Boom 0.3 15 Normal 0.5 Recession ??? 2 RC = .3(15) + .5(10) + .2(2) = 9.99% T 25 20 1 T 25 10 20 1 RT = .3(25) + .5(20) + .2(1) = 17.7% got the same answers? Giải: E(R) = .25(15) + .5(8) + .15(4) + .1(-3) = 8.05% Variance = .25(15-8.05)2 + .5(8-8.05)2 + .15(4-8.05)2 + .1(-3-8.05)2 = 26.7475 Standard Deviation = 5.1717985% CHƯƠNG 6: INTRODUCE RISK AND RETURN Portfolio Weights = TỶ TRỌNG weights % average return = expected return DCLK: 2/15 = .133 KO: 3/15 = .2 INTC: 4/15 = .267 KEI: 6/15 = .4 E(RP) = expected return of the portfolio the portfolio variance and standard deviation using the same formulas as for an individual asset p = probability R(i) = lợi nhuận của DMDT trong tình trạng kinh tế E(R) = lợi nhuận trugn bình của DMDT Asset A: E(RA) = .4(30) + .6(-10) = 6% Variance(A) = .4(30-6)2 + .6(-10-6)2 = 384 Std. Dev.(A) = 19.6% Asset B: E(RB) = .4(-5) + .6(25) = 13% Variance(B) = .4(-5-13)2 + .6(25-13)2 = 216 Std. Dev.(B) = 14.7% Invest 50% of your money in Asset A w(A) = 50% Expected return (P) = .5(6) + .5(13) = 9.5 E(RP) = 0.5x6+0.5x13 = 9.5% p = prob R(i) = lợi nhuận của DMDT trong từng tình trạnh kinh tế E(RP) = lợi nhuận kỳ vọng của port how to calculate R(i)? State Prob A(50%) Boom .4 30% Bust .6 -10% B(50%) -5%. 25%. ? Port ? Portfolio return in boom = .5(30) + .5(-5) = 12.5 Portfolio return in bust = .5(-10) + .5(25) = 7.5 R(i) Expected return = .4(12.5) + .6(7.5) = 9.5 or Expected return = .5(6) + .5(13) = 9.5 Variance of portfolio = .4(12.5-9.5)2 + .6(7.5-9.5)2 = 6 Standard deviation = 2.45% Note that the variance is NOT equal to .5(384) + .5(216) = 300 and Standard deviation is NOT equal to .5(19.6) + .5(14.7) = 17.17% Portfolio return in Boom: .6(15) + .4(10) = 13% Portfolio return in Normal: .6(10) + .4(9) = 9.6% Portfolio return in Recession: .6(5) + .4(10) = 7% Expected return = .25(13) + .6(9.6) + .15(7) = 10.06% Variance = .25(13-10.06)2 + .6(9.6-10.06)2 + .15(7-10.06)2 = 3.6924 Standard deviation = 1.92% the total risk for a diversified portfolio is essentially equivalent to the systematic risk The standard deviation of returns is a measure of total risk the beta coefficient to measure systematic risk A beta of 1 implies the asset has the same systematic risk as the overall market A beta < 1 implies the asset has less systematic risk than the overall market A beta > 1 implies the asset has more systematic risk than the overall market the relationship between the risk premium and beta Security Market Line =The Capital Asset Pricing Model (CAPM) R(f) = risk free rate E(RM) = expected return of market E(RA) = expected return of asset