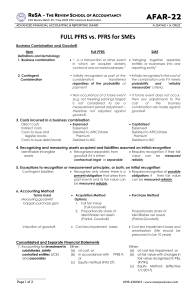

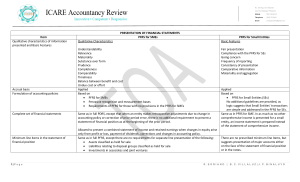

NFJPIA NCR Charlwin Lee Cup Financial Accounting and Reporting 1. On January 1, 2014, Luther Company sold land with carrying amount of P 1,500,000 in exchange for a 9-month, 10% note with face value of P2,000,000. The 10% rate properly reflects the time value of money for this type of note. On April 1, 2014, Luther Company discounted the note with recourse. The bank discount rate is 12%. The discounting transaction is accounted for as a secured borrowing. On October 1, 2014, the maker dishonored the note receivable. Luther Company paid the bank the maturity value of the note plus protest fee of P 10,000. On December 31, 2014, Luther Company collected the dishonored note in full plus 12% annual interest on the total amount due. What is the interest expense to be recognized by Luther Company on April 1, 2014? a. b. c. d. 21,000 29,000 50,000 25,000 Answer: B Principal Interest (2,000,000 x 10% x 9/12) Maturity value Discount (2,150,000 x 12% x 6/12) Net proceeds Principal Accrued interest receivable (2,000,000 x 10% x 3/12) Book value of note receivable Net proceeds Less: Book value of note receivable Interest expense 2,000,000 150,000 2,150,000 129,000 2,021,000 2,000,000 50,000 2,050,000 2,021,000 2,050,000 (29,000) 2. Jent Company purchases bonds at a discount of 100,000. Subsequently, Jent sold these bonds at a premium of 140,000. During the period that Jent hold this long term investment, amortization of the discount amounted to 20,000. What amount should be recorded as gain on sale of bonds? a. 140,000 b. 260,000 c. 240,000 d. 220,000 Answer: D Discount Less: Amortized Discount Total Add: Premium on Sale of Bond GAIN ON SALE 100,000 20,000 80,000 140,000 220,000 3. Read the following statements below I. If an entity publishes a complete set of financial statements in its interim financial report, those statements shall include, at a minimum, each of the headings and subtotals that were included in its most recent financial statements and the selected explanatory notes as required by the standard. II. If an entity publishes a set of condensed financial statements in its interim financial report, the forma and content of those statements shall conform to the requirements of IAS 1. a. b. c. d. First statement is false, second statement is true Both statements are false Both statements are true First statement is true, second statement is false Answer: B Refer to IAS 34 par 9-10 4. A key provision of IAS 34-Interim Financial Reporting is that an entity should use the same accounting policy throughout a single financial year. If a decision is made to change a policy midyear, the change is implemented ______________ and previously reported interim data is __________. a. retrospectively ; not restated b. retrospectively ; restated c. prospectively ; not restated d. prospectively ; restated Answer: B 5. Under PFRS for SMEs, Companies should record investment property after initial recognition using: a. Fair value b. Historical cost less depreciation c. Present Value of minimum lease payments discounted using the original discount rate from initial recognition d. The Company can decide whether fair value or historical cost less depreciation provided that it will be applied consistently during the period. Answer: A Under PFRS for SMEs Section 16, Investment Property, Investment property whose fair value can be measured reliably without undue cost or effort shall be measured at fair value at each reporting date with changes in fair value recognized in profit or loss. If a reliable measure of fair value is no longer available without undue cost or effort for an item of investment property measured using the fair value model, the entity shall thereafter account for that item as property, plant and equipment in accordance with Section 17 until a reliable measure of fair value becomes available. 6. Which of the following is true for PFRS for SMEs: a. Under PFRS for SMEs, the use of an accrued benefit valuation method (the projected unit credit method) for employee benefit obligation is required for calculating defined benefit obligations. b. Under PFRS for SMEs, Intangible assets, including goodwill are assumed to have finite lives and are amortized. c. Under PFRS for SMEs, Research costs and development costs are expenses, however, development costs are capitalized if certain criteria are met. d. Under PFRS for SMEs, only equity method is permitted in accounting for investment in associates. Answer: B Under PFRS for SMEs, Intangible assets, including goodwill are assumed to have finite lives and are amortized. In PFRS for SMEs, The cost model is the only permitted model. All intangible assets, including goodwill, are assumed to have finite lives and are amortized. Answer A, C and D are wrong as they pertain to the measurement in Full PFRS. SMEs are accounted for as follows: A. The circumstance-driven approach is applicable, which means that the use of an accrued benefit valuation method (the projected unit credit method) is required if the information that is needed to make such a calculation is already available, or if it can be obtained without undue cost or effort. If not, simplifications are permitted in which future salary progression, future service or possible mortality during an employee’s period of service are not considered. [IFRS for SMEs 28.18-28.20] C. All research and development costs are recognised as an expense. [IFRS for SMEs 18.14] D. An investor may account for its investments using one of the following: The cost model (cost less any accumulated impairment losses); The equity method, and; The fair value through profit or loss model. [IFRS for SMEs 14.4] 7. PFRS for SMEs strictly requires disclosure of information about: a. Related party transactions b. Earnings per share c. Segment information d. Interim financial reports Answer: A PFRS for SMEs states that the combined financial statements shall disclose the following: (a) the fact that the financial statements are combined financial statements. (b) the reason why combined financial statements are prepared. (c) the basis for determining which entities are included in the combined financial statements. (d) the basis of preparation of the combined financial statements. (e) the related party disclosures required by Section 33 Related Party Disclosures. 8. Given the table below, compute for the total net exposure and the financial effect of collateral or credit enhancement to the maximum exposure to credit risk for PFRS 7 Disclosures. Gross Maximum Exposure to Credit Risk Loan 1 1,000,000 FV of Collateral or Credit Enhancement 1,200,000 Net Exposure Financial effect of collateral or credit enhancements Loan 2 1,000,000 1,000,000 Loan 3 1,000,000 800,000 Total 3,000,000 3,000,000 a. b. c. d. ?? ?? 0; 0 200,000; 2,800,000 -200,000; 2,000,000 0; 3,000,000 Answer: B Solution: Gross Maximum Exposure to Credit Risk FV of Collateral or Credit Enhancement Net Exposure Financial effect of collateral or credit enhancements Loan 1 1,000,000 1,200,000 - 1,000,000 Loan 2 1,000,000 1,000,000 - 1,000,000 Loan 3 1,000,000 800,000 200,000 800,000 Total 3,000,000 3,000,000 200,000 2,800,000 9. The Evita Company uses cash-basis accounting for their records. During 2016, Evita collected P500,000 from its customers, made payments of P200,000 to its suppliers for inventory, and paid P140,000 for operating costs. Evita wants to prepare accrual-basis statements. In gathering information for the accrual-basis financial statements, Evita discovered the following: a. b. c. d. e. Customers owed Evita P50,000 at the beginning of 2016 and P35,000 at the end of 2016. Evita owed suppliers P20,000 at the beginning of 2016 and P27,000 at the end of 2016. Evita's beginning inventory was P42,000, and its ending inventory was P44,000. Evita had prepaid expenses of P5,000 at the beginning of 2016 and P7,400 at the end of 2016. Evita had accrued expenses of P12,000 at the beginning of 2016 and P19,000 at the end of 2016. f. Depreciation for 2016 was P51,000. Determine the accrual basis net income of Evita Company for the year ended December 31, 2008. a. P84,400 c. P91,400 b. P79,600 d. P98,400 Answer: A 500,000-200,000-140,000-50,000+35,000+20,000-27,000-42,000+44,000-5,000+7,400+12,00019,000-51,000 = 84,400 10. In presenting Employee Benefits in the financial statements, an entity shall disclose: a. A sensitivity analysis for all actuarial assumption as of the end of the reporting period, showing how the defined benefit obligation would have been affected by changes in the relevant actuarial assumption that were reasonably possible at that date. b. The methods and assumptions used in preparing the sensitivity analyses and the limitations of those methods. c. The expected changes in the methods and assumptions used in preparing the sensitivity analyses. d. The number of retired employees that claimed their benefits during the year. Answer: B Under Revised PAS 19, paragraph 145, an entity shall disclose: - A sensitivity analysis for each significant actuarial assumption (as disclosed under paragraph 144) as of the end of the reporting period, showing how the defined benefit obligation would have been affected by changes in the relevant actuarial assumption that were reasonably possible at that date. - The methods and assumptions used in preparing the sensitivity analyses required by (a) and the limitations of those methods; and - Changes from the previous period in the methods and assumptions used in preparing the sensitivity analyses, and the reasons for such changes.