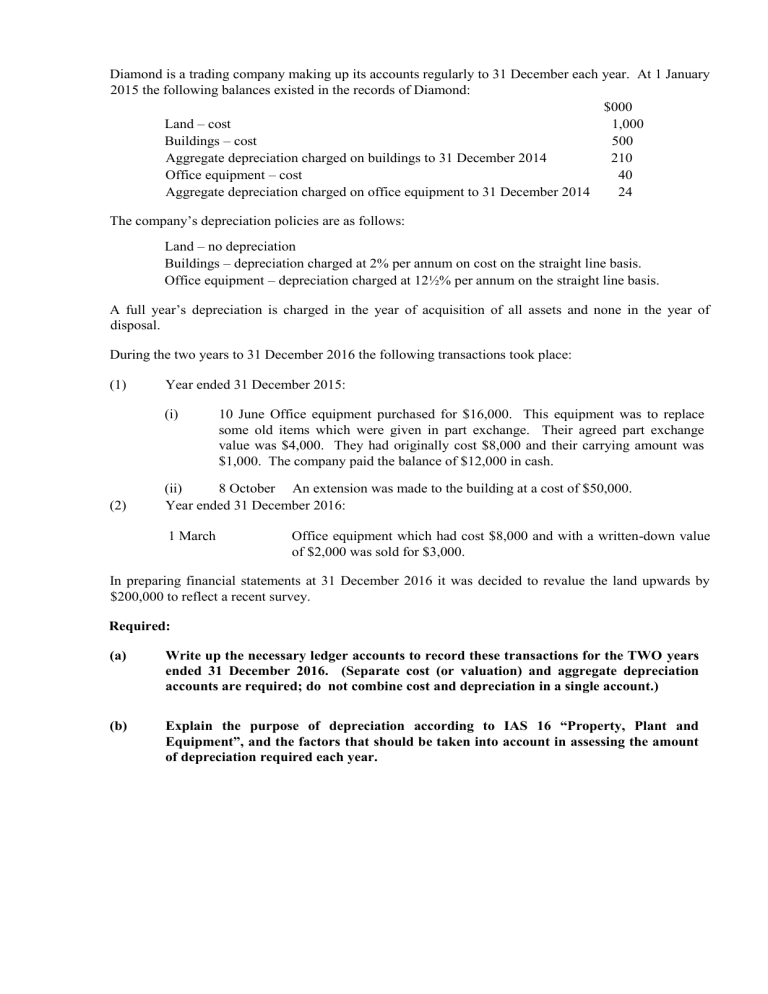

Diamond is a trading company making up its accounts regularly to 31 December each year. At 1 January 2015 the following balances existed in the records of Diamond: $000 Land – cost 1,000 Buildings – cost 500 Aggregate depreciation charged on buildings to 31 December 2014 210 Office equipment – cost 40 Aggregate depreciation charged on office equipment to 31 December 2014 24 The company’s depreciation policies are as follows: Land – no depreciation Buildings – depreciation charged at 2% per annum on cost on the straight line basis. Office equipment – depreciation charged at 12½% per annum on the straight line basis. A full year’s depreciation is charged in the year of acquisition of all assets and none in the year of disposal. During the two years to 31 December 2016 the following transactions took place: (1) Year ended 31 December 2015: (i) (2) 10 June Office equipment purchased for $16,000. This equipment was to replace some old items which were given in part exchange. Their agreed part exchange value was $4,000. They had originally cost $8,000 and their carrying amount was $1,000. The company paid the balance of $12,000 in cash. (ii) 8 October An extension was made to the building at a cost of $50,000. Year ended 31 December 2016: 1 March Office equipment which had cost $8,000 and with a written-down value of $2,000 was sold for $3,000. In preparing financial statements at 31 December 2016 it was decided to revalue the land upwards by $200,000 to reflect a recent survey. Required: (a) Write up the necessary ledger accounts to record these transactions for the TWO years ended 31 December 2016. (Separate cost (or valuation) and aggregate depreciation accounts are required; do not combine cost and depreciation in a single account.) (b) Explain the purpose of depreciation according to IAS 16 “Property, Plant and Equipment”, and the factors that should be taken into account in assessing the amount of depreciation required each year. #2 Lion is a company producing medicinal drugs. At 1 April 2016 the following balances existed in the records: Deferred development expenditure $1,200,000 Project Q. $800,000. This is the balance remaining of expenditure totalling $1,000,000 on a completed project which is being amortised on the straight line basis over 10 years. Project R. $400,000. This is the accumulated costs to 31 March 2016 of developing a new drug. The project was completed in January 2017 and sales of the drug are expected to begin in July 2017. Equipment used in research $300,000 (cost $500,000, depreciation to date $200,000). During the year ended 31 March 2017 the following costs were incurred: Project R Costs to complete $250,000 Project S (a research project) $140,000 Purchase of testing equipment for use in the research department $180,000. All equipment has an estimated useful life of five years, and a full year’s depreciation is charged in the year of acquisition. Required: (a) Calculate the figures to be included in Lion’s statement of profit or loss for the year ended 31 March 2017 and statement of financial position as at that date, and state the headings under which they will appear. (b) Prepare the disclosure notes required by IAS 38 “Intangible Assets”. (The note detailing the accounting policy for research and development expenditure is NOT required.) #3 A company manufacturing aircraft engages in a number of research and development projects. At 1 January 2016 the company’s records showed total capitalised development costs of $18 million made up as follows: Project A17: This project was completed in 2015 at a total cost of $16 million and is being amortised over eight years on the straight line basis, beginning on 1 January 2015. Project J9: This project began in 2014 and the $4 million balance represents expenditure qualifying for capitalisation to 31 December 2015 This $000 14,000 4,000 project is due to be completed in 2019 –––––– 18,000 –––––– During the year ended 31 December 2016 the following further expenditure was incurred: $000 Project J9: Further expenditure qualifying for capitalisation $1,500 Project A20: Investigation into new materials for aircraft construction $3,000 Required: (a) Calculate the amounts for research and development to be included in the company’s statement of profit or loss and statement of financial position for the year ended 31 December 2016. (b) Discuss the principle accounting concepts applicable to the accounting treatment of development expenditure. You are NOT required to provide the criteria for recognition of an intangible asset arising from development in IAS 38 Intangible Assets.