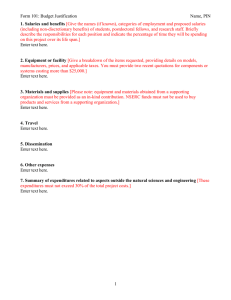

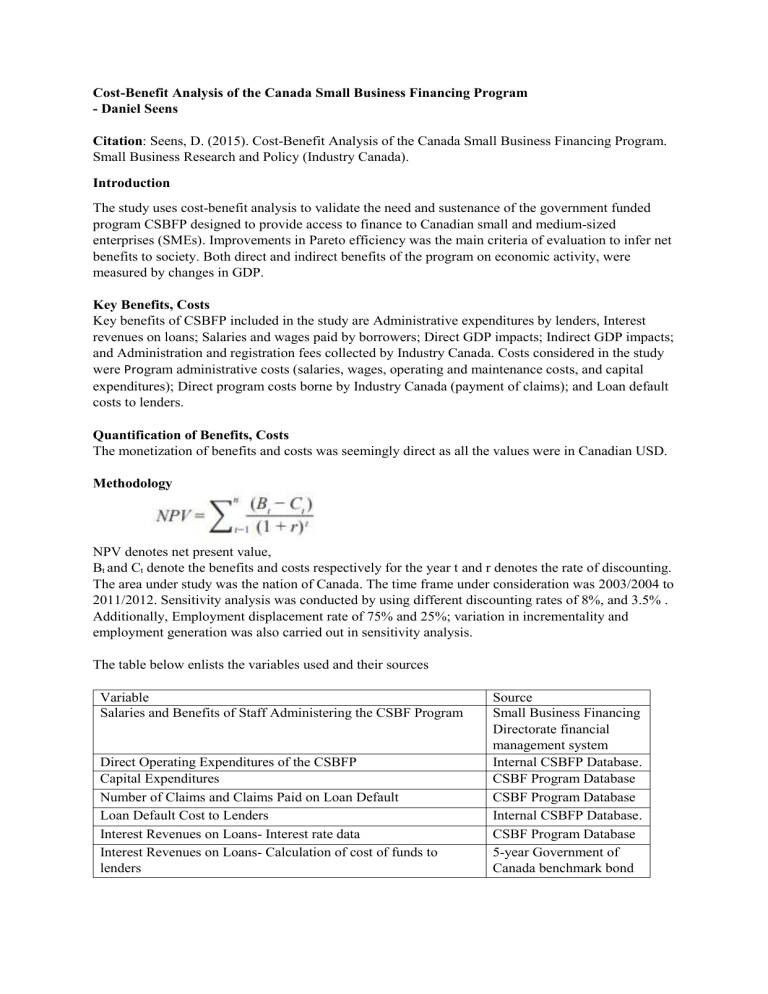

Cost-Benefit Analysis of the Canada Small Business Financing Program - Daniel Seens Citation: Seens, D. (2015). Cost-Benefit Analysis of the Canada Small Business Financing Program. Small Business Research and Policy (Industry Canada). Introduction The study uses cost-benefit analysis to validate the need and sustenance of the government funded program CSBFP designed to provide access to finance to Canadian small and medium-sized enterprises (SMEs). Improvements in Pareto efficiency was the main criteria of evaluation to infer net benefits to society. Both direct and indirect benefits of the program on economic activity, were measured by changes in GDP. Key Benefits, Costs Key benefits of CSBFP included in the study are Administrative expenditures by lenders, Interest revenues on loans; Salaries and wages paid by borrowers; Direct GDP impacts; Indirect GDP impacts; and Administration and registration fees collected by Industry Canada. Costs considered in the study were Program administrative costs (salaries, wages, operating and maintenance costs, and capital expenditures); Direct program costs borne by Industry Canada (payment of claims); and Loan default costs to lenders. Quantification of Benefits, Costs The monetization of benefits and costs was seemingly direct as all the values were in Canadian USD. Methodology NPV denotes net present value, Bt and Ct denote the benefits and costs respectively for the year t and r denotes the rate of discounting. The area under study was the nation of Canada. The time frame under consideration was 2003/2004 to 2011/2012. Sensitivity analysis was conducted by using different discounting rates of 8%, and 3.5% . Additionally, Employment displacement rate of 75% and 25%; variation in incrementality and employment generation was also carried out in sensitivity analysis. The table below enlists the variables used and their sources Variable Salaries and Benefits of Staff Administering the CSBF Program Direct Operating Expenditures of the CSBFP Capital Expenditures Number of Claims and Claims Paid on Loan Default Loan Default Cost to Lenders Interest Revenues on Loans- Interest rate data Interest Revenues on Loans- Calculation of cost of funds to lenders Source Small Business Financing Directorate financial management system Internal CSBFP Database. CSBF Program Database CSBF Program Database Internal CSBFP Database. CSBF Program Database 5-year Government of Canada benchmark bond Profits for CSBFP Borrowers Employment Creation and Salaries and Wages paid by Borrowers Direct GDP Impacts of Expenditures by CSBFP Borrowers Indirect GDP Impacts of Expenditures by CSBFP Borrowers Administration and Registration Fees Paid by Borrowers to Industry Canada yields, obtained from the Bank of Canada Industry Canada’s 2014 Economic Impact Study CSBF Program Database Statistics Canada Canadian Input-Output Mode Statistics Canada Canadian Input-Output Mode CSBF Database Scope for Analysis The similar analysis can be extrapolated to include the years after 2011-12. This exercise can help in ascertaining if the CSBFP still plays a significant role in recent years.