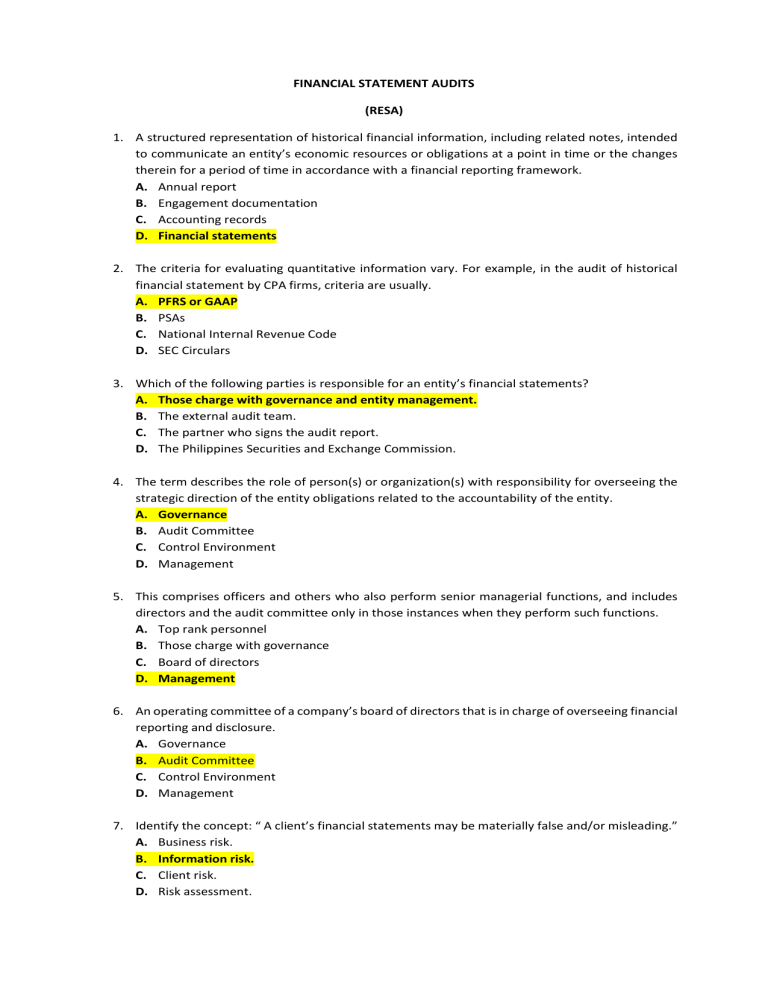

FINANCIAL STATEMENT AUDITS (RESA) 1. A structured representation of historical financial information, including related notes, intended to communicate an entity’s economic resources or obligations at a point in time or the changes therein for a period of time in accordance with a financial reporting framework. A. Annual report B. Engagement documentation C. Accounting records D. Financial statements 2. The criteria for evaluating quantitative information vary. For example, in the audit of historical financial statement by CPA firms, criteria are usually. A. PFRS or GAAP B. PSAs C. National Internal Revenue Code D. SEC Circulars 3. Which of the following parties is responsible for an entity’s financial statements? A. Those charge with governance and entity management. B. The external audit team. C. The partner who signs the audit report. D. The Philippines Securities and Exchange Commission. 4. The term describes the role of person(s) or organization(s) with responsibility for overseeing the strategic direction of the entity obligations related to the accountability of the entity. A. Governance B. Audit Committee C. Control Environment D. Management 5. This comprises officers and others who also perform senior managerial functions, and includes directors and the audit committee only in those instances when they perform such functions. A. Top rank personnel B. Those charge with governance C. Board of directors D. Management 6. An operating committee of a company’s board of directors that is in charge of overseeing financial reporting and disclosure. A. Governance B. Audit Committee C. Control Environment D. Management 7. Identify the concept: “ A client’s financial statements may be materially false and/or misleading.” A. Business risk. B. Information risk. C. Client risk. D. Risk assessment. 8. Which pf the following methods is most commonly used to reduce information risk? A. Allow users to verify information B. Users share information risk with management C. Have the financial statements audited. D. Allow all users to prepare the statements. 9. The following are conditions that created a demand from users for assurance on reliability of financial information: A. Transactions that are numerous and complex. B. Users separated from accounting records by distance and time. C. Financial decisions that are important to investors and users D. All of the choices are examples of the said conditions. 10. Which of the following best describes the reason why independent auditors report on financial statements? A. A management fraud may exist and it is more likely to be detected by independent auditors. B. A poorly designed internal control structure may be in existence. C. A misstatement of account balances may exist and is generally corrected as the result if the independent auditor’s work. D. Different interests may exist between the company preparing the statements and the persons using the statements. 11. The best statement of the responsibility of the auditor with respect to audited financial statement is: A. The auditor’s responsibility of fair presentation of financial statements is limited only up to the date of the report. B. The auditor’s responsibility is confined to his expression of opinion about the audited financial statements. C. The responsibility over the financial statements rest with the management and the auditor assumes responsibility with respect to the notes of financial statements. D. The auditor is responsible only to his qualified opinion but not for any other type of opinion. 12. The principles for conducting financial statement audits include which of the following? A. Compliance with the Code of Ethics for CPAs. B. Compliance with Philippines Standards on Auditing. C. Planning for performing the audit professional skepticism. D. All the choices apply. 13. Philippines Standards on Auditing (PSAs) should be looked upon by practitioners as: A. Ideal to strive for, but which are not achievable. B. Maximum standards which denote excellent work. C. Benchmark to be used on all audits, reviews and compilations. D. Minimum standard or performance which must be achieved on each audit engagement. 14. An attitude that includes a questioning mind, being alert to conditions which may indicate possible misstatement due to error fraud, and a critical assessment of evidence. A. Professional skepticism B. Materiality C. Conservative advocacy D. Reasonable assurance 15. The phase used to express the auditors opinion is: A. “absence of material and pervasive misstatements in the financial statements” B. “present fairly, in all material respects” C. “provide reasonable, but not acceptable assurance” D. All these choices are acceptable phrases to express the auditor’s opinion. 16. This means the gathering of the audit evidence necessary for the auditor to conclude that there are no material misstatements in the financial statements, taken as a whole. A. Professional judgment B. Conservatism C. Audit risk D. Reasonable assurance 17. This term refers to the possibility of harm, lost or danger. It can also refer to a factor, things or element of course involving uncertain danger or hazard. A. Materiality B. Jeopardy C. Contingency D. Risk 18. Which of the following best describes audit risk? A. The susceptibility of an account balance or class of transactions to misstatement that could be material, individually or when aggregated with misstatements in other balances of classes, before consideration of any related controls. B. The risk that misstatement that could occur in an account balance or class of transactions and could be material individually or in the aggregate, will not be prevented or detected and corrected on a timely basis by the company’s internal control. C. The risk that an auditor’s substantive procedure will not detect a misstatement that exists in an account balance or class of transactions that could be material, individually or when aggregated with misstatements in other balances or classes. D. The risk that the auditors gives an inappropriate audit opinion when the financial statements are materially misstated. 19. Inherit risk and control risk collectively are known as: A. A dual risk team B. The risk of information dissemination C. The risk if material misstatement D. The dependent variable of risk 20. This term refers to the application of relevant training, knowledge and experience, within the context provided by auditing, accounting and ethical standards, in making informed decisions about the courses of action that are appropriate in the circumstance of the audit engagement. A. Professionalism B. Conservatism C. Professional judgment D. Materiality 21. An audit has inherent limitations that affect the auditor’s ability to detect material misstatements. Which of the following is among the factors that result to these inherent limitations? A. Use of testing. B. Inherit limitation of accounting and internal control system. C. Evidence that is basically persuasive rather than conclusive. D. All of the choices properly describe factors that result to inherent limitations of audits. Nation’s Foremost CPA Review 1. The criteria for evaluating quantitative information vary. Example, in the audit of historical financial statements by CPA firms, the criteria is usually a. Philippine Auditing Standards b. Generally Accepted Accounting Principles c. Regulations of the Bureau of Internal Revenue d. Regulations of the Securities and Exchange Commission 2. Financial statements need to be prepared in accordance with one, or a combination of: Philippine International Other Authoritative GAAP in the Standards on Financial Reporting or comprehensive Philippines Auditing Standards financial reporting framework a. Yes Yes Yes Yes b. No Yes Yes Yes c. No Yes No Yes d. Yes No No No 3. The following factors could affect the quantity and quality of available evidence that are attributable to the circumstance of the engagement. Which is the exception? a. The fact that the subject matter information is prospective. b. The timing of the practitioner’s appointment. c. An entity’s document retention policy. d. Restriction imposed by the responsible party. 4. Which is incorrect concerning evidence? a. The higher the risk involved, the more is required. b. The better the quality, the less is required. c. The volume of evidence can compensate for its poor quality. d. The reliability of evidence is influenced by its source and its nature. 5. Select the incorrect statement from the following generalization on the reliability of evidence. a. Evidence is more reliable when it is obtained from independent sources outside the entity. b. Evidence that is generated internally is more reliable when the related controls are effective. c. Evidence obtained directly by the practitioner is more reliable than when obtained indirectly, even if the source is not competent. d. Evidence provided by the original documents is more reliable than evidence provided by photocopies or facsimiles. 6. Which is incorrect? a. Consistent evidence obtained from various sources of different nature is more reliable. b. It is generally more difficult to obtain assurance about subject matter information at a point in time than about subject matter information covering a period of time. c. When it is cost prohibitive or difficult to obtain an evidence, the auditor may shift to obtain from other alternatives. d. The practitioner considers the relationship between cost of obtaining the evidence and the usefulness of the information. 7. The objective of a review of financial statements a. Is to enable the auditor to express an opinion whether the financial statements are prepared, in all material respects, in accordance with an identified financial reporting framework. b. Is to enable an auditor to state whether, on the basis of procedures which do not provide all the evidence that would be required in an audit, anything that has come to the auditor’s attention that causes the auditor to believe that the financial statements are not prepared, in all material respects, in accordance with an identified financial reporting framework. c. Is to carry out those procedures of an audit nature to which the auditor and the entity and any appropriate third parties have agreed and to report on factual findings. d. Is to use accounting expertise as opposed to auditing expertise to collect, classify and summarize financial information. 8. Which of the following types of audits is performed to determine whether an entity’s financial statements are fairly stated in conformity with generally accepted accounting principles? a. Operational audit c. Financial statement audit b. Compliance audit d. Performance audit 9. The overall objectives of the auditor in conducting an audit of financial statements are I. To obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether caused by fraud or error. II. To report on the financial statements. III. To obtain conclusive rather than persuasive evidence. IV. To detect all misstatements, whether due to fraud or error. a. I and II only b. II and IV only c. I, II, and III only d. I, II, III, and IV 10. Which of the following types of auditing is performed most commonly by CPAs on a contractual basis? a. Internal auditing c. Government auditing b. BIR auditing d. External auditing 11. Which of the following is an appraisal activity established within an entity as a service to the entity? a. External auditing c. Financial auditing b. Internal auditing d. Compliance auditing 12. What is the proper organizational role of internal auditing? a. To serve as an independent, objective assurance and consulting activity that adds value to operations. b. To assist the external auditor on order to reduce external audit fees. c. To perform studies to assist in the attainment of more efficient operations. d. To serve as the investigative arm of the audit committee of the board of directors. 13. To operate effectively, an internal auditor must be independent of a. The line of functions of the organizations b. The entity c. The employer-employee relationship which exists for other employees in the organization d. All of the above 14. To provide for the greatest degree of independence in performing internal auditing functions, an internal auditor most likely should report to a. Board of Directors c. Corporate Controller b. Vice-President for Finance d. Corporate Stockholders 15. Internal auditors should review the means of physically safeguarding assets from losses arising from a. Exposure to the elements c. Misapplication of accounting principles b. Underusage of physical facilities d. Procedures that are not cost justified 16. Internal auditors review the adequacy of the company’s internal control system primarily to a. Help determine the nature, timing, and extent of tests necessary to achieve audit objectives. b. Determine whether the internal control system provides reasonable assurance that the company’s objectives and goals are met efficiently and economically. c. Ensure that material weaknesses in the system of internal control are corrected. d. Determine whether the internal control system ensures that financial statements are fairly presented. 17. The scope and objectives of internal auditing vary widely and depend on the size and structure of the entity and the requirements of its management. Ordinarily, internal auditing activities include one or more of the following: A. B. C. D. Reviews of the accounting and internal control Yes Yes Yes Yes systems Examination of financial and operating information Yes Yes Yes No Review of the economy, efficiency and effectiveness Yes Yes No No of operations Review of compliance with laws, regulations and Yes No No No other external requirements 18. Which statement is correct regarding the relationship between internal auditing and external auditor? a. Some judgments relating to the audit of the financial statements are those of the internal auditor. b. The external audit function’s objectives vary according to management’s requirements. c. Certain aspects of internal auditing may be useful in determining the nature, timing and extent of external audit procedures. d. The external auditor is responsible for the audit opinion expressed, however that responsibility may be reduced by any use made of internal auditing. 19. Which of the following statements is not a distinction between independent auditing and internal auditing? a. Independent auditors represent third party users external to the auditee entity, whereas internal auditors report directly to management. b. Although independent auditors strive for both validity and relevance of evidence, internal auditors are concerned almost exclusively with validity. c. Internal auditors are employees of the auditee, whereas independent auditors are independent contractors. d. The internal auditor’s span of coverage goes beyond financial auditing to encompass operational and performance auditing. 20. Operational audits generally have been conducted by internal and COA auditors, but may be performed by certified public accountants. A primary purpose of an operational audit is to provide a. A measure of management performance in meeting organizational goals. b. The results of internal examinations of financial and accounting matters to a company’s top-level management. c. Aid to the independent auditor, who is conducting the examination of the financial statements. d. A means of assurance that internal accounting controls are functioning as planned. 21. Operational audit is primarily oriented toward a. Future improvements to accomplish the goals of management. b. The accuracy of data reflected in management’s financial records. c. The verification that a company’s financial statements are fairly presented. d. Past protection provided by existing internal control. 22. An objective of a performance audit is to determine whether an entity’s a. Operational information is in accordance with government auditing standards. b. Specific operating units are functioning economically and efficiently. c. Financial statements present fairly the results of operations. d. Internal control is adequately operating as designed. 23. AAA Corp. has engaged a public accounting firm to issue a report on the accuracy of the product quality specifications included trade sales agreements. This is an example of a (an): a. Financial statement audit c. Attestation service b. Compliance audit d. Operational audit 24. Governmental auditing beyond examinations leading to the expression of opinion on the fairness of financial presentation and includes audits of efficiency, economy, effectiveness, and also a. Accuracy b. Evaluation c. Compliance d. Internal control 25. An audit designed to determine the extent to which the desires results of an activity established by the legislative or other authorizing body are being achieved is a (an) a. Economy audit c. Program audit b. Efficiency audit d. Financial related audit 26. A government audit evaluates a disbursement to determine if it is necessary, excessive or extravagant in accordance with existing rules and regulations. What kind of audit is he conducting? Compliance Audit Economy Audit a. Yes No b. No Yes c. Yes Yes d. No No 27. Which of the following terms best describe the audit of a taxpayer’s return by a BIR auditor? a. Operational audit b. Internal audit c. Compliance audit d. Government audit 28. Which of the following statements refers to the definition of auditing? a. A service activity which function is to provide quantitative information primarily financial in nature about economic entities that is intended to be useful in making economic decisions. b. The art of recording, classifying and summarizing in a significant manner in terms of money, transactions and events which are in part at least of a financial character and interpreting the results thereof. c. The process of identifying, measuring and communicating economic information to permit informed judgment and decisions by users of the information. d. A systematic process of objectively obtaining and evaluating evidence regarding assertions about economic actions and events to ascertain the degree of correspondence between these assertions and established criteria and communicating the results thereof. 29. In “auditing” accounting data, the concern is with a. Determining whether recorded information properly reflects the economic events that occurred during the accounting period. b. Determining if fraud has occurred. c. Determining if taxable income has been calculated correctly. d. Analyzing the financial information to be sure that it complies with government requirements. 30. The underlying conditions that create demand by users for reliable information include the following, except a. Transactions that are numerous and complex b. Users separated from accounting records by distance and time c. Financial decisions that are important to investors and users d. Decisions are not time sensitive 31. There are four conditions that give rise to the need for independent audits of financial statements. One of these conditions is consequence. In this context, consequence means that the: a. Users of the statements may not fully understand the consequences of their actions. b. Auditor must anticipate all possible consequences of the report issued. c. Impact of using different accounting methods may not be fully understood by the users of the statements. d. Financial statements are used for important decisions. 32. Which of the following best describes the reason why an independent auditor reports on financial statements? a. A poorly designed internal control system may be in existence. b. A management fraud may exist and it is more likely to be detected by independent auditors. c. Different interest may exist between the company preparing the statements and the persons using the statements. d. A misstatement of account balance may exist and is generally corrected as the result of the independent auditor’s work. 33. Which of the following is a cause of information risk? a. Voluminous data c. Remoteness of the information b. Bias motives of the provider of information d. Each of the above is a cause of information risk 34. Which of the following best describes the objective of an audit of financial statements? a. To express an opinion whether the financial statements are prepared in accordance with prescribed criteria. b. To express an assurance as to the future viability of the entity whose financial statements are being audited. c. To express an assurance about the management’s efficiency or effectiveness in conducting the operations of entity. d. To express an opinion whether the financial statements are prepared, in all material respect, in accordance with an identified financial reporting framework CRC- ACE REVIEWER Chapter 2: Audits of Historical Financial Information 1. An audit of financial statements is conducted to determine if the a. Organization is operating efficiency and effectively b. Auditee is following specific procedures or rules set down by some higher authority c. Overall financial statement statements are stated in accordance with the applicable financial reporting framework d. Client’s internal control is functioning as intended 2. Most of the independent auditor’s work in formulating an opinion on financial statement consist of a. Studying and evaluating internal control b. Obtaining and examining evidential matter c. Examining cash transaction d. Comparing recorded accountability with assets 3. In financial statement audits, the audit process should be conducted in accordance with a. The audit program b. Philippine standard on auditing c. Philippine accounting standards d. Philippine Financial Reporting Standards 4. Which of the following best describe the operational audit? a. It requires the constant review by internal auditors of the administrative controls as they relate to operations of the company. b. It concentrates on implementing financial and accounting control in a newly organized company. c. In attempts and is designed to verify the fair presentation of a company’s results of operations. d. It concentrates on seeking out aspects of operations in which waste would be reduced by the introduction of controls. 5. The auditor communicates the results of his or her work through the medium if the a. Engagement letter b. Audit report c. Management letter d. Financial statement 6. Which of the following types of auditing is performed most commonly by CPA’s on a contractual basis? a. Internal Auditing b. Income tax auditing c. Government auditing d. External auditing 7. Independent auditing can best be describe as a a. Professional activity that measures and communicates financial accounting data b. subset accounting c. Professional activity that attest to the fair presentation of financial statement d. Regulatory activity that prevents the issuance of improper financial information 8. Which of the following statements is not a distinction between independent auditors and internal auditors? a. Independent auditors represent third party users external to the auditee entity, whereas internal auditors report directly to management. b. Although independent auditors strive for both validity and relevance of evidence, internal auditors are concerned almost exclusively with validity. c. Internal auditors are employees of the auditee, whereas independent auditors are independent contractors. d. The internal auditor’s span of coverage goes beyond financial auditing to encompass operational and performance auditing. 9. Which of the following has the primary responsibility for the fairness of the representations made in the financial statements? a. Client’s management b. Audit Committee c. Independent auditor d. Board of Accountancy 10. An audit of the financial statements of KIA Corporation is being conducted by an external auditor. The external auditor is expected to a. Express an opinion as to the fairness of KIA’s financial statements. b. Express an opinion as to the attractiveness of KIA for investment purposes. c. Certify the correctness of KIA’s Financial Statements. d. Examine all evidence supporting KIA’s financial statements. 11. Which of the following statements about independent financial statements audit is correct? a. The audit of financial statements relieves management of its responsibilities for the financial statement b. An audit is designed to provide limited assurance that the financial statements taken as a whole are free from material misstatement c. The procedures required to conduct an audit in accordance with PSAs should be determined by the client who engaged the services of the auditor. d. The auditor’s opinion is not an assurance as to the future viability of the entity as well as the effectiveness and efficiency with which management has conducted the affairs of the entity. 12. The reason an independent auditor gathers evidence is to a. Form an opinion on the financial statements b. Detect fraud c. Evaluate management d. Evaluate internal controls 13. Jack has been retained as auditor of EVC Company. The function of Jack’s opinion on financial statements of EVC Company is to a. Improve financial decisions of company management b. Lend Credibility to management’s representation c. Detect fraud and abuse in management operations d. Serve requirements of BIR, SEC, or Central Bank 14. Which of the following is not one of the limitations of an audit? a. The use of testing b. Limitations imposed by client c. Human error d. Nature of evidence that the auditor obtains 15. Which of the following statements does not properly describe a limitation of an audit? a. Many audit conclusions are made on the basis of examining a sample of evidence. b. Some evidence supporting peso representation in the financial statement must be obtained by oral or written representation of management. c. Fatigue can cause auditors to overlook pertinent evidence. d. Many financial statement assertions cannot be audited. 16. Which of the following is not one of the general principles governing the audit of financial statements? a. The auditor should plan and perform the audit with an attitude of professional skepticism. b. The auditor should obtain sufficient appropriate evidence primarily through inquiry and analytical procedure to be able to draw reasonable conclusions. c. The auditor should conduct the audit in accordance with PSA. d. The auditor should comply with the Philippine Code of Professional Ethics. 17. Which of the following statements does not describe a condition that creates a demand for auditing? a. Conflict between an information preparer and a user can result in biased information. b. Information can have substantial economic consequence for a decisionmaker. c. Expertise is often required for information preparation and verification. d. Users can directly assess the quality of information. 18. Which of the following statements does not properly describe an element of theoretical framework of auditing? a. The data to be audited can be verified. b. Short-term conflicts may exist between mangers who prepare the data and auditors who examine the data. c. Auditors act on behalf of the management. d. An audit benefits the public Auditing in General (PRTC) 1. Auditing includes all of the following except: a. A systematic process b. An objective obtaining and evaluating evidence concerning assertions about economic actions and events. c. Ascertain degree of correspondence between assertions and financial statements. d. Communicate audit results to intended users. 2. The definition of auditing includes both a(an) a. Documentation process and an evaluation process. b. Evaluation process and a reporting process. c. Investigative process and a reporting process. d. Documentation process and a reporting process. 3. The subject matter of audit in general is: a. b. c. d. Financial statements Assertions Economic data Operating data Types of Audit 4. The following are the three types of audits according to subject matter, except: a. b. c. d. Financial statements audits Operational audits Compliance audits External audits 5. The following are the three types of audits according to auditor, except: a. b. c. d. External audits Internal audits Governmental audits Performance audits 6. The following statements relate to auditing in general. Which is false? a. Compliance audits and independent financial statements audits are similar in nature. b. Evaluating the efficiency and effectiveness of operations of an entity is subjective, which depends on the entity's meaning of efficiency and effectiveness. c. Both a and b. d. Neither a nor b. 7. Which of the following is true? a. The criteria for any audit (an operational audit or a financial audit) are GAAP. b. Both external and internal auditors can provide management advice to the company. c. A financial audit is designed to determine if the company is acquiring resources at the lowest cost. d. External auditors may perform operational audits and internal auditors may perform financial audits. Financial Statements Audits 8. An external auditor is conducting an audit of the financial statements of Camden Corporation under PSAs. The external auditor is expected to a. b. c. d. Express an opinion as to the fairness of Camden's financial statements. Express an opinion as to the attractiveness of Camden for investment purposes. Certify to the correctness of Camden's financial statements. Critique the wisdom and legality of Camden's business decision. 9. Auditing is important in a free market society because a. b. c. d. The public requires CPAs functioning as divisions of regulatory bodies. Auditors detect all errors and fraud made by the company employees. It provides reliable information based upon which to judge economic performance. The auditor is an amiable insurance policy for investors. 10. Which of the following statements about theoretical framework of financial statements auditing is (are) incorrect? I. The data to be audited can be verified. II. Long-term conflicts may exist between managers who prepare the data and auditors who examine the data. III. Auditors act on behalf of management. IV. An audit benefits the public. a. b. c. d. II and III only II, III, and IV only II only III only 11. The auditor's opinion a. b. c. d. Guarantees the credibility of the financial statements. Is an assurance as to the future viability of the entity. Certifies the correctness of the financial statements. Is not an assurance as to the efficiency with which management has conducted the affairs of the entity. 12. An "integrated audit", as required by Sarbanes-Oxley Act for U.S. public companies, includes an audit of a. The company's internal control b. The company's financial statements c. The company's compliance with its rules and policies d. Both A and B 13. Which type of auditor may perform a financial statements audit? a. b. c. d. External auditor Internal auditor Governmental auditor Both A and C Operational Audits 14. The objective of an operational audit is to a. Evaluate fairness of presentation of financial statements b. Evaluate the effectiveness and efficiency with which resources are employed and identifying areas for improvement. c. Evaluate whether laws have been broken by management. d. Evaluate compliances with company rules and regulations. 15. The auditor's judgment concerning the entity's operation (or the "criteria" used) in an operational audit should be based on a. b. c. d. GAAP Effectiveness and efficiency Rules and regulations Company policies 16. Which type of auditor would typically perform an operational audit? a. b. c. d. External auditor Governmental auditor Internal auditor Both B and C 17. Usually, an operational audit is performed a. b. c. d. By independent external auditors. By a team consisting of an equal number of external and internal auditors. Only when an operating divisions is experiencing declines in productivity or profitability. By the internal auditors at the request of top management or board of directors. 18. Which of the following best describes the operational audit? a. It requires the constant review by internal auditors of the administrative controls as they relate to operations of the company. b. It concentrates on implementing financial and accounting control in a newly organized company. c. It attempts and is designed to verify the fair presentation of a company's results of operations. d. It concentrates on seeking out aspects of operations in which waste would be reduced by the introduction of controls. Compliance Audits 19. Results of compliance audits are typically reported to someone within the organizational unit being audited rather than to a broad spectrum of outside users. Which of the following audits can be regarded as generally being a compliance audit? a. b. c. d. COA auditor's evaluation of the computer operations of governmental units. An internal auditor’s review of a company's payroll authorization procedures. BSP examiner's examination of banks. A CPA firm's audit of the local school district. External (Independent) Audits 20. Which of the following statements is true concerning an external auditor's responsibilities regarding financial statements? a. b. c. d. Making suggestions that are adopted about the form and content of an entity's financial statements impairs an auditor's independence. An auditor may draft an entity's financial statements based on information from management's accounting system. The fair presentation of audited financial statements in conformity with GAAP is an implicit part of the auditor's responsibilities. An auditor's responsibilities for an audited financial statements is not confined to the auditor's expression of opinion. Internal Audits 21. This is an independent appraisal activity established within an entity as a service to the entity: a. b. c. d. Internal audit function Independent auditing Government auditing Compliance audit function 22. Internal auditing means an independent, objective assurance and consulting activity designed to add value and improve an organization's operations. Its overall objective is to: a. Attest to the efficiency with which resources are employed. b. Ascertain that controls are cost-justified. c. Provide assurance that financial data have been accurately recorded. d. Assist the members of the organization in the effective discharge of their responsibilities. 23. To provide for the greatest degree of independence in performing internal auditing functions, an internal auditor most likely should report to the a. b. c. d. Financial vice president. Corporate controller. Those charged with governance. Corporate stockholders. 24. For an internal auditor to render impartial and unbiased judgments, he or she must be independent of the entity's a. b. c. d. Stockholders. Personnel and operating activities. Independent (external) auditors. Board of directors. 25. Internal auditors may perform all of the following types of audits except a. b. c. d. Operational audits Compliance audits Computer system audits All of the above may be performed by the internal auditors Governmental Audits 26. Which of the following audits does governmental encompass? a. b. c. d. Financial statements audit Operational audits Compliance audits All of the above CPA REVIEW SCHOOL OF THE PHILIPPINES Manila Overview of Auditing Related PSAs : PSA 100, 120, 200 and 610 1. Certain fundamental beliefs called "postulates" underlie auditing theory. Which of the following is not a postulate of auditing? a. No long-term conflict exists between the auditor and the management of the enterprise under audit. b. Economic assertions can be verified. c. The auditor acts exclusively as an auditor. d. An audit has a benefit only to the owners. 2. In all cases, audit reports must a. Be signed by the individual who performed the audit procedures. b. Certify the accuracy of the quantitative information which was audited. c. Communicate the auditor’s finding to the general public. d. Inform readers of the degree of correspondence between the quantifiable information and the established criteria. 3. The auditor communicates the results of his or her work through the medium of the a. Engagement letter c. Management letter. b. Audit report d. Financial statements. 4. As used in auditing, which of the following statements best describes "assertions"? a. Assertions are the representations of management as to the reliability of the information system. b. Assertions are the auditor's findings to be communicated in the audit report. c. Assertions are the representations of management as to the fairness of the financial statements. d. Assertions are found only in the footnotes to the financial statements. 5. The expertise that distinguishes auditors from accountants is in the a. Ability to interpret generally accepted accounting principles. b. Requirement to possess education beyond the Bachelor’s degree. c. Accumulation and interpretation of evidence. d. Ability to interpret ASC Statements. 6. The framework for auditing and related services as addressed by PSA excludes a. Review b. Compilation c. Tax services d. Agreed upon procedure 7. It refers to the level of auditor’s satisfaction as to the reliability of an assertion being made by one party for use by another party. a. Confidence level b. Assurance level c. Reasonableness level d. Tolerable level 8. Indicate the level of assurance provided by audit and related services. • Audit High High Negative Absolute • Review Moderate None Moderate High • Agreed-upon procedures None None None Limited • Compilation None None None None A High Moderate None B High None None C Negative Moderate None D Absolute High Limited None None None None 9. Which of the following is true of the report based on agreed-upon-procedures? a. The report is restricted to those parties who have agreed to the procedures to be performed. b. The CPA provides the recipients of the report limited assurance as to reasonableness of the assertion(s) presented in the financial information. c. The report states that the auditor has not recognized any basis that requires revision of financial statements. d. The report should state that the procedures performed are limited to analytical procedures and inquiry. 10. Which of the following is an objective of a review engagement? a. Expressing a positive opinion that the financial information is presented in conformity with generally accepted accounting principles. b. Expressing a limited assurance to users who have agreed as to procedures that will be performed by the CPA. c. Reporting whether material modifications should be made to such financial statements to make them conform with generally accepted accounting principles. d. Reporting that the financial statements, in all materials respects, fairly present the financial position and operating results of the client. 11. According to Philippine Standard on Auditing, the procedures employed in doing compilation are: a. Designed to enable the accountant to express a limited assurance. b. Designed to enable the accountant to express a negative assurance. c. Not designed to enable the accountant to express any form of assurance. d. Less extensive than review procedures but more extensive than agreed-upon procedures. 12. Any services in which the CPA firm issues a written communication that express a conclusion with respect to the reliability of a written assertion that is the responsibility of another party is a (n) a. Accounting and bookkeeping service b. Attestation service c. Management advisory service d. Tax service 13. The three types of attestation services are: a. Audits, review, and compilations b. Audits, compilations, and other attestation services c. Reviews, compilations, and other attestation services d. Audits, reviews, and other attestation services 14. Which of the following is not primary category of attestation report? a. Compilation report b. Review report c. Audit report d. Special audit report based on a basis of accounting other than generally accepted accounting principles. 15. The primary goal of the CPA in performing the attest function is to a. Detect fraud b. Examine individual transactions so that the auditor may certify as to their validity c. Determine whether the client's assertions are fairly stated d. Assure the consistent application of correct accounting procedures 16. Which of the following criteria is unique to the independent auditor’s attest function? a. General competence b. Familiarity with the particular industry of each client c. Due professional care d. Independence 17. Assurance engagement a. Is an engagement in which a practitioner is engaged to issue, or does issue, a written communication that expresses a conclusion about the reliability of a written assertion that is the responsibility of another party. b. Is a systematic process of objectively obtaining and evaluating evidence regarding assertions about economic actions and events to ascertain the degree of correspondence between those assertions and established criteria and communicating the results to interested users. c. Is an engagement in which the auditor provides a moderate level of assurance that the information subject to the engagement is free of material misstatement. d. Is an engagement intended to enhance the credibility of information about a subject matter by evaluating whether the subject matter conforms in all material respects with suitable criteria, thereby improving the likelihood that the information will meet the needs of an intended user. 18. The single feature that most clearly distinguishes auditing, attestation, and assurance is a. Type of service. b. Scope of services. c. Training required to perform the service d. CPA’s approach to the service 19. Identify the following as financial audit (FA), compliance audit (CA), and operational audit (OA). • A supervisor is not carrying out his assigned responsibilities. • A company’s tax return does not conform to income tax laws and regulations. • A municipality’s financial statements correctly show actual cash receipts and disbursements. • A company’s receiving department is inefficient. a. CA, CA, FA, OA b. OA, CA, FA, OA c. OA, CA, CA, OA d. CA, CA, FA, CA 20. The criteria for evaluating quantitative information vary. For example, in the audit of historical financial statements by CPA firms, the criteria are usually a. Generally accepted auditing standards. b. Generally accepted accounting principles. c. Regulations of the Internal Revenue Service. d. Regulations of the Securities and Exchange Commission. 21. Which of the following types of audit uses as its criteria laws and regulations? a. Operational audit b. Financial statement audit c. Compliance audit d. Financial audit 22. An operational audit is designed to a. Assess the efficiency and effectiveness of management’s operating procedures b. Assess the presentation of management’s financial statements in accordance with generally accepted accounting principles c. Determine whether management has complied with applicable laws and regulations d. Determine whether the audit committee of the board of directors is effectively discharging its responsibility to oversee management’s operations 23. A review of any part of an organization’s procedures and methods for the purpose of evaluating efficiency and effectiveness is classified as a (n) a. Audit of financial statements b. Compliance audit c. Operational audit d. Production audit 24. Which one of the following is more difficult to evaluate objectively? a. Efficiency and effectiveness of operations. b. Compliance with government regulations. c. Presentation of financial statements in accordance with generally accepted accounting principles. d. All three of the above are equally difficult.. 25. Independent auditing can best be described as a a. Branch of accounting b. Discipline that attests to the results of accounting and other operations and data c. Professional activity that measures and communicates financial and business data d. Regulatory function that prevents the issuance of improper financial information 26. A financial statement audit: a. Confirms that financial statement assertion are accurate. b. Lends credibility to the financial statements. c. Guarantees that financial statements are presented fairly. d. Assures that fraud had been detected. 27. Which of the following best describes the objective of an audit of financial statements? a. To express an opinion whether the financial statements are prepared in accordance with prescribed criteria. b. To express an assurance as to the future viability of the entity whose financial statements are being audited. c. To express an assurance about the management’s efficiency or effectiveness in conducting the operations of entity. d. To express an opinion whether the financial statements are prepared, in all material respect, in accordance with an identified financial reporting framework. 28. Because an external auditor is paid a fee by a client company, he or she a. Is absolutely independent and may conduct an audit b. May be sufficiently independent to conduct an audit c. Is never considered to be independent d. Must receive approval of the Securities and Exchange Commission before conducting an audit 29. Which of the following is responsible for an entity’s financial statements? a. The entity’s management b. The entity’s internal auditors c. The entity’s audit committee d. The entity’s board of directors 30. The best statement of the responsibility of the auditor with respect to audited financial statement is: a. The audit of the financial statements relieves management of its responsibilities b. The auditor’s responsibility is confined to his expression of opinion about the audited financial statements. c. The responsibility over the financial statements rests with the management and the auditor assumes responsibility with respect to the notes of financial statements. d. The auditor is responsible only to his unqualified opinion but not for any other type of opinion. 31. Which of the following least likely limits the auditors ability to detect material misstatement? a. Most audit evidences are conclusive rather than being persuasive. b. The inherent limitations of any accounting and internal control system. c. Audit is based on testing d. Audit procedures that are effective in detecting ordinary misstatements are ineffective in detecting intentional misstatements. 32. Because an examination in accordance with generally accepted auditing standards is influenced by the possibility of material errors, the auditor should conduct the examination with an attitude of a. Professional responsiveness b. Conservative advocacy c. Objective judgment d. Professional skepticism 33. Which of the following best describes why an independent auditor reports on financial statements? a. Independent auditors are likely to detect fraud b. Competing interests may exist between management and the users of the statements c. Misstated account balances are generally corrected by an independent audit. d. Ineffective internal controls may exist. 34. An audit can have a significant effect on a. Information Risk b. The risk-free interest rate c. Business Risk d. All of these 35. The main way(s) to reduce information risk is to have a. The user verify the information b. The user share the information risk with management c. Audited financial statements provided d. All of the above 36. Which of the following is an appraisal activity established within an entity as a service to the entity? a. External auditing b. Internal auditing c. Financial auditing d. Compliance auditing 37. The scope and objectives of internal auditing vary widely and depend on the size and structure of the entity and the requirements of its management. Ordinarily, internal auditing activities include one or more of the following: A • Review of the accounting and internal control systems • Examination of financial and operating Information • Review of the economy, efficiency and effectiveness of operations • Review of compliance with laws, regulations and other external requirements B C D Yes Yes Yes Yes Yes Yes Yes No Yes Yes No No Yes No No No 38. To operate effectively, an internal auditor must be independent of a. The line functions of the organizations b. The entity c. The employer-employee relationship which exists for other employees in the organization d. All of the above 39. Internal auditors cannot be independent a. Since they do not possess the CPA license. b. Because they don’t audit financial statements. c. Unless their immediate supervisor is a CPA. d. As long as an employer-employee relationship exists. 40. To provide for the greatest degree of independence in performing internal auditing functions, an internal auditor most likely should report to a. Board of Directors. b. Vice-President for Finance. c. Corporate Controller. d. Corporate Stockholders. 41. Which statement is correct regarding the relationship between internal auditing and the external auditor? a. Some judgments relating to the audit of the financial statements are those of the internal auditor. b. The external audit function's objectives vary according to management's requirements. c. Certain aspects of internal auditing may be useful in determining the nature, timing and extent of external audit procedures. d. The external auditor is responsible for the audit opinion expressed, however that responsibility may be reduced by any use made of internal auditing. 42. Which of the following statements is not a distinction between independent auditing and internal auditing? a. Independent auditors represent third party users external to the auditee entity, whereas internal auditors report directly to management. b. Although independent auditors strive for both validity and relevance of evidence, internal auditors are concerned almost exclusively with validity. c. Internal auditors are employees of the auditee, whereas independent auditors are independent contractors. d. The internal auditor's span of coverage goes beyond financial auditing to encompass operational and performance auditing. 43. Which of the following is a correct qualification of the Chairman and Two Commissioners of the Commission on Audit? a. A citizen of the Philippines. b. At least 40 years of age upon appointment. c. CPA’s with no less than 5 years of auditing experience or members of Philippine bar who have been engaged in law practice for at least 5 years. d. Must not have been candidates for any elective position preceding appointment. 44. The 1986 Constitution provides that the Chairman and Commissioners of the Commission on Audit shall be a. All Certified Public Accountants b. All lawyers c. One or two lawyers and one or two CPAs for a total of three d. Two lawyers and one CPA 45. Which of the following is not one of the duties of the Commission on Audit a. Define the scope of its audit and examination b. Assume fiscal responsibility for the government and its instrumentalities c. Keep the general accounts of the government d. Promulgate accounting rules and regulations 46. A governmental audit may extend beyond an examination leading to the expression of an opinion on the fairness of financial presentation to include Program results Yes Yes No No A B C D Compliance Yes Yes Yes No Economy and efficiency No Yes Yes Yes 47. An audit designed to determine the extent to which the desired results of an activity established by the legislative or other authorizing body are being achieved is a (an) a. Economy audit b. Efficiency audit c. Program audit d. Financial related audit 48. A government auditor evaluates a disbursement to determine if it is necessary, excessive or extravagant in accordance with existing rules and regulations. What kind of audit is he conducting? A B C D Compliance audit Yes No Yes No QUIZZERS 1. Which of the following is an incorrect phrase? a. Auditing is a systematic process. Economy audit No Yes Yes No b. Auditing subjectively obtains and evaluates evidence. c. Auditing evaluates evidence regarding assertions. d. Auditing communicates results to interested users. s 2. Which of the following is a correct statement relating to the theoretical framework of auditing? a. The financial data to be audited can be verified. b. Short-term conflicts do not exist between managers who prepare data and auditors who examine data. c. Auditors do not necessarily need independence. d. An audit has a benefit only to the owners. 3. The essence of the attest function is to a. Detect fraud b. Examine individual transactions so that the auditor can certify as to their validity c. Determine whether the client’s financial statements are fairly stated d. Ensure the consistent application of correct accounting procedures 4. In “auditing” accounting data, the concern is with a. Determining whether recorded information properly reflects the economic events that occurred during the accounting period. b. Determining if fraud has occurred. c. Determining if taxable income has been calculated correctly. d. Analyzing the financial information to be sure that it complies with government requirements. 5. Users of financial statements demand independent audit because a. Users demand assurance that fraud does not exist b. Management may not be objective in reporting. c. Users expect auditors to correct management errors. d. Management relies on the auditor to improve internal control. 6. Which of the following types of audits is performed to determine whether an entity’s financial statements are fairly stated in conformity with generally accepted accounting principles? a. Operational audit b. Compliance audit c. Financial statement audit d. Performance audit 7. Which of the following types of auditing is performed most commonly by CPAs on a contractual basis? a. Internal auditing b. BIR auditing c. Government auditing d. External auditing PSA 100 – Assurance engagements 8. Which of the following is incorrect regarding the Philippine Standards on Assurance Engagements (PSAE)? a. It provides an overall framework for assurance engagements intended to provide either a high or moderate level of assurance. b. It provides basic principles and essential procedures for engagements intended to provide a moderate level of assurance. c. When a professional accountant is engaged to perform an assurance engagement for which specific standards exist, those standards apply. d. If no specific standards exist for an assurance engagement, PSAE apply. 9. An assurance engagement should exhibit the following elements except a. A three party relationship b. A conclusion c. Appropriate professional fee d. A subject matter 10. Which of the following is incorrect regarding the “three-party relationship” element of assurance engagements? a. Professional accountants as those persons who are members of an IFAC member body, which should be in public practice. b. The responsible party and the intended user will often be from separate organizations but need not be. c. The responsible party is the person or persons, either as individuals or representatives of an entity, responsible for the subject matter. d. The intended user is the person or class of persons for whom the professional accountant prepares the report for a specific use or purpose. 11. The following are assurance engagements except a. Financial statements audit b. Information system reliability services c. Review of financial statements d. Tax consulting 12. Engagements frequently performed by professional accountants that are not assurance engagements include the following except a. Agreed-upon procedures. c. Compilation b. Compliance audit c. Compilation d. Management consulting. 13. The subject matter of an assurance engagement may take many forms, including a. Data b. Systems and processes c. Behavior d. All of these 14. The decision as to whether the criteria are suitable involves considering whether the subject matter is capable of reasonably consistent evaluation against or measurement using such criteria. The characteristics for determining whether criteria are suitable include the following, except a. Relevance b. Reliability: c. Understandability: d. Sufficiency 15. When the professional accountant has obtained sufficient appropriate evidence to conclude that the subject matter conforms in all material respects with identified suitable criteria, he or she can provide what level of assurance? a. None b. High c. Moderate d. Absolute 16. Absolute assurance is generally not attainable as a result of such factors as: • the use of selective testing • the inherent limitations of control systems • the fact that much of the evidence available to the professional accountant is persuasive rather than conclusive • the use of judgment in gathering evidence and drawing conclusions based on that evidence PSA 120 – Framework of PSA 17. The Framework of PSA applies to a. Taxation b. Consultancy c. Accounting advice d. Compilation A Yes Yes Yes B Yes Yes Yes C Yes Yes No D No Yes Yes Yes No No No 18. Agreed-upon procedures provides what level of assurance? a. None b. High c. Moderate d. Absolute 19. Which of the following procedures ordinarily performed during an audit are also performed in review? a. Assessment of accounting and internal control systems b. Test of controls c. Tests of records and of responses to inquiries d. Inquiry and analytical procedures 20. The objective of a review of financial statements a. Is to enable the auditor to express an opinion whether the financial statements are prepared, in all material respects, in accordance with an identified financial reporting framework. b. Is to enable an auditor to state whether, on the basis of procedures which do not provide all the evidence that would be required in an audit, anything has come to the auditor’s attention that causes the auditor to believe that the financial statements are not prepared, in all material respects, in accordance with an identified financial reporting framework. c. Is to carry out those procedures of an audit nature to which the auditor and the entity and any appropriate third parties have agreed and to report on factual findings. d. Is to use accounting expertise as opposed to auditing expertise to collect, classify and summarize financial information. 21. An auditor is associated with financial information when • the auditor attaches a report to that Information • consents to the use of the auditor’s name in a professional connection A Yes B No C Yes D No Yes Yes No No PSA 200 – Objective and general principles governing an audit of FS 22. The auditor’s opinion a. Enhances the credibility of the financial statements. b. Is an assurance as to the future viability of the entity. c. Is an assurance as to the efficiency with which management has conducted the affairs of the entity, but not effectiveness. d. Certifies the correctness of the financial statements. 23. Which of the following is incorrect regarding the general principles of an audit? a. The auditor should comply with the “Code of Ethics for Professional Ethics for Certified Public Accountants” promulgated by the Philippine Professional Regulation Commission. b. The auditor should conduct an audit in accordance with PSAs. c. The auditor should plan and perform an audit with an attitude of professional skepticism recognizing that circumstances may exist that cause the financial statements to be materially misstated. d. The auditor would ordinarily expect to find evidence to support management representations and assume they are necessarily correct. 24. It refers to the audit procedures deemed necessary in the circumstances to achieve the objective of the audit. a. Scope of an audit b. Audit program c. Objective of an audit d. Reasonable assurance 25. Which of the following are sources of procedures to be considered by the auditor to conduct an audit in accordance with PSAs? A B C D PSA Legislation Yes No No Yes No No Yes Yes Terms of Audit Engagement No Yes Yes Yes Type of Opinion No Yes No No