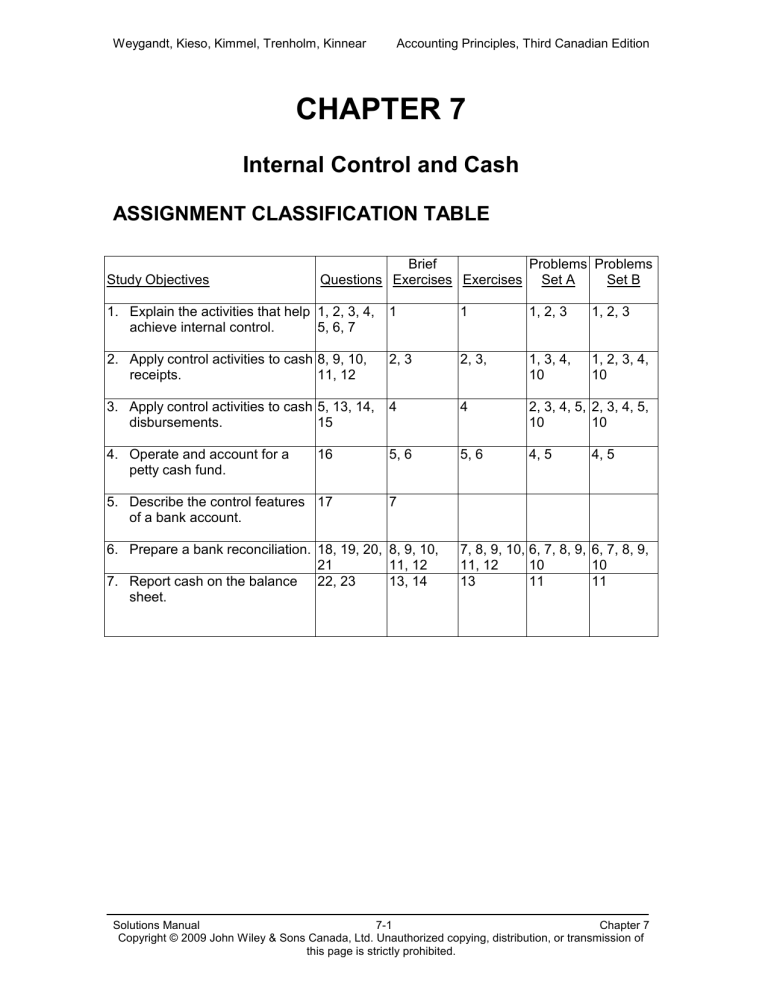

Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition CHAPTER 7 Internal Control and Cash ASSIGNMENT CLASSIFICATION TABLE Study Objectives Brief Problems Problems Questions Exercises Exercises Set A Set B 1. Explain the activities that help 1, 2, 3, 4, achieve internal control. 5, 6, 7 1 1 1, 2, 3 1, 2, 3 2. Apply control activities to cash 8, 9, 10, receipts. 11, 12 2, 3 2, 3, 1, 3, 4, 10 1, 2, 3, 4, 10 3. Apply control activities to cash 5, 13, 14, disbursements. 15 4 4 2, 3, 4, 5, 2, 3, 4, 5, 10 10 4. Operate and account for a petty cash fund. 5, 6 5, 6 4, 5 16 5. Describe the control features 17 of a bank account. 4, 5 7 6. Prepare a bank reconciliation. 18, 19, 20, 8, 9, 10, 21 11, 12 7. Report cash on the balance 22, 23 13, 14 sheet. 7, 8, 9, 10, 6, 7, 8, 9, 6, 7, 8, 9, 11, 12 10 10 13 11 11 Solutions Manual 7-1 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition ASSIGNMENT CHARACTERISTICS TABLE Problem Description Number 1A Identify internal control weaknesses over cash receipts. Difficulty Level Time Allotted (min.) Moderate 25-35 2A Identify internal controls over cash disbursements. Moderate 25-35 3A Identify internal controls for cash receipts and cash disbursements. Simple 25-35 4A Record debit and bank credit card and petty cash transactions and identify internal controls. Moderate 25-35 5A Record and post petty cash transactions and identify internal controls. Moderate 20-30 6A Prepare back reconciliation and related entries. Moderate 25-35 7A Prepare bank reconciliation and related entries. Moderate 40-50 8A Prepare bank reconciliation and related entries. Moderate 40-50 9A Prepare bank reconciliation and related entries. Moderate 40-50 10A Prepare bank reconciliation and identify internal controls. Moderate 30-40 11A Calculate cash balance. Moderate 20-30 1B Identify internal control activities related to cash receipts. Moderate 25-35 2B Identify internal control weaknesses over cash receipts and cash disbursements. Moderate 25-35 3B Identify internal controls for cash receipts and cash disbursements. Simple 25-35 4B Record debit and bank credit card and petty cash transactions and identify internal controls. Moderate 25-35 5B Record and post petty cash transactions and identify internal controls. Moderate 20-30 6B Prepare bank reconciliation and related entries. Moderate 25-35 7B Prepare bank reconciliation and related entries. Moderate 40-50 8B Prepare bank reconciliation and related entries. Moderate 40-50 9B Prepare bank reconciliation and related entries. Moderate 40-50 10B Prepare bank reconciliation and identify internal control weakness. Moderate 30-40 11B Calculate cash balance. Moderate 20-30 Solutions Manual 7-2 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BLOOM’S TAXONOMY TABLE Correlation Chart between Bloom’s Taxonomy, Study Objectives and End-ofChapter Material 1. Study Objective Explain the activities that help achieve internal control. Knowledge Comprehension Q7-2 Q7-1 P7-1A Q7-5 Q7-3 P7-2A Q7-4 P7-3A Q7-6 P7-1B Q7-7 P7-2B BE7-1 P7-3B E7-1 BE7-2 Q7-8 P7-1A Q7-9 P7-3A Q7-10 P7-1B Q7-11 P7-2B Q7-12 P7-3B E7-2 Q7-5 Q7-13 BE7-4 Q7-14 Q7-15 P7-2A P7-3A P7-2B P7-3B 2. Apply control activities to cash receipts. 3. Apply control activities to cash disbursements. 4. Operate and account for a petty cash fund. Q7-16 5. Describe the control features of a bank account. Prepare a bank reconciliation. Q7-17 BE7-7 Q7-18 Q7-19 Q7-20 Q7-21 BE7-9 Report cash on the balance sheet. Q7-22 Q7-23 BE7-14 6. 7. Broadening Your Perspective Application Analysis BE7-3 E7-3 P7-4A P7-4B P7-10A P7-10B P7-4A P7-5A P7-4B P7-5B P7-10A P7-10B BE7-5 BE7-6 E7-5 E7-6 P7-4A P7-5A P7-4B P7-5B BE7-8 BE7-10 BE7-11 BE7-12 E7-7 E7-8 E7-9 E7-10 E7-11 BE7-13 E7-13 E7-12 P7-10A P7-6A P7-10B P7-7A P7-8A P7-9A P7-6B P7-7B P7-8B P7-9B P7-11A P7-11B BYP7-1 BYP7-2 BYP7-3 BYP7-4 Synthesis Evaluation E7-4 Continuing Cookie Chronicle BYP7-5 Solutions Manual 7-3 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition ANSWERS TO QUESTIONS 01. Disagree. Internal control is the process designed and implemented by management to help an organization achieve (1) reliable financial reporting, (2) effective and efficient operations, and (3) compliance with relevant laws and regulations. Thus improving the accuracy of the accounting records is only one of the objectives of internal control. 02. An essential control activity is to make specific employees responsible for specific tasks. When all clerks make change out of the same cash register drawer this is a violation of establishing responsibility. In this case, each sales clerk should have a separate cash register, cash drawer, or password with pre- and post-shift counts. 03. Two applications of segregation of duties are: (1) The responsibility for related activities should be assigned to different individuals. (2) The responsibility for establishing the accountability for an asset should be separate from the physical custody of that asset. 04. Documentation procedures contribute to good internal control by providing evidence of the occurrence of transactions and events. When signatures (or initials) are added, the documents establish responsibility for the transactions. The prompt transmittal of documents to accounting contributes to recording transactions in the proper period. And, the prenumbering of documents helps to ensure that a transaction is not recorded more than once or not at all. 05. Physical controls include safes, vaults, electronic burglary systems and sensors, and locked warehouses. These controls help safeguard a company’s assets. Other controls such as cash registers and computerized accounting equipment contribute to the accuracy and reliability of the accounting records. Physical controls apply to cash disbursements when (a) blank cheques are stored in a safe, and access to the safe is restricted to authorized personnel, and (b) electronic means are used to imprint amounts on cheques. Other controls apply when the approved invoice is stamped PAID after payment. Solutions Manual 7-4 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition QUESTIONS (Continued) 06. Segregating the physical custody of assets from accounting record keeping is not enough to ensure that nothing has been stolen. A performance review still needs to be done. In such a review, the accounting records are compared with existing assets or with external sources of information. 07. A company’s system of internal control can only give reasonable assurance that assets are properly safeguarded and that accounting records are reliable. The concept of reasonable assurance is based on the belief that the cost of control activities should not be more than their expected benefit. Ordinarily, a system of internal control provides reasonable but not absolute, assurance. Absolute assurance would be too costly. The human element is an important factor in a system of internal control. A good system may become ineffective through employee fatigue, carelessness, and indifference. Moreover, internal control may become ineffective as a result of collusion. 08. Cash registers are readily visible to the customer. Thus, they prevent the sales clerk from ringing up or scanning in a lower amount and pocketing the difference. In addition, the customer receives an itemized receipt, and the store’s cash register tape is locked into the register for further verification. 9. At the end of a day (or shift) the cashier should count the cash in the cash register, record the amount, and turn over the cash and the record of the amount to either a supervisor or the person responsible for making the bank deposit. Exact procedures will be different in every company, but the basic principles should be the same. The person or persons who handle the cash and make the bank deposit should not have access to the cash register tapes or the accounting records. The cash register tapes should be used in creating the journal entries in the accounting records. An independent person who does not handle the cash should make sure that the amount deposited at the bank agrees with the cash register tapes and the accounting records. Solutions Manual 7-5 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition QUESTIONS (Continued) 10. Debit cards allow customers to spend only what is in their bank account whereas a bank credit card gives the customer access to money made available by a bank or other financial institution (similar to a short term loan). Sales using debit cards and bank credit cards are both considered cash transactions to retailers. Banks usually charge the retailer a transaction fee for each debit card and a fee that averages 3.5% of the credit card sale. In both types of transaction the retailer’s bank will wait until the end of the day and make a deposit for the full day’s transactions. Fees for bank credit cards are generally higher than debit card fees. 11. Two mail clerks contribute to a more accurate listing of mail receipts. In addition, two clerks reduce the likelihood of mail receipts being diverted to personal use or other fraud, as collusion would be required. 12. From a company’s perspective there are not significant differences between customers using EFT and on-line banking and EFT and automatic pre-authorized monthly payments. The main difference is that with EFT and automatic pre-authorized monthly payments, the company begins the transaction and electronically request the funds. As a result the company knows the transaction is happening and can journalize it. With EFT and on-line banking, the company cannot anticipate in advance when and how much it will collect in cash. Therefore the company will record the cash collection after the funds have been deposited in the bank account and the company has received notification from the bank. 13. Payment by cheque or electronic funds transfer contributes to effective internal control over cash disbursements. Prenumbered cheques help to ensure that all disbursements are accounted for. In addition, the bank provides a double record of the cash disbursements, and safekeeping of the cash until paid. However, effective control is also possible when small payments are made from an imprest petty cash fund. 14. The procedure and related control activity are: Procedures Activities (1) Controller signs cheques Establishment of responsibility (2) Cheques imprinted Documentation; physical controls (3) Comparing cheques with Performance review; segregation approved invoices before signing of duties Solutions Manual 7-6 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition QUESTIONS (Continued) 15. Wanda could potentially commit a fraud by: (1) falsifying a receiving report and approving payment for a nonexistent supplier. She could open a bank account in the name of the nonexistent supplier and deposit the payments in this account allowing her to steal cash from Walter’s Watches. (2) ordering merchandise and stealing the inventory. She could cover her theft by then falsifying the receiving reports and approving the payment to the supplier even though the goods are not in the store. Instructors note: These are only two examples. Students may develop other valid examples. 16. This could be a problem for the company as Olga may start taking longer and longer to repay the cash and may eventually end up stealing cash from the petty cash fund for personal expenses. Another problem is that there may not be cash in the petty cash fund when needed to pay for expenses depending on the amount Olga is borrowing. To strengthen the system the company could implement the following controls: Management should not allow the fund to be used for certain types of transactions (such as making short-term loans to employees). Each payment from the fund must be documented on a prenumbered petty cash receipt, signed by both the custodian and the person who receives the payment. Management should periodically conduct a surprise check of the petty cash fund and ensure the cash on hand plus receipts are equal to the petty cash fund balance—they should make sure there are no unexplained shortages and all payments have been in accordance with company policies. 17. (a) A signature card shows the signatures of authorized cheque signers. It is used by the bank to validate signatures on cheques. Thus, the card should prevent unauthorized persons from signing cheques. (b) A cheque provides documentary evidence of the payment of a specified sum of money to a designated payee. (c) A bank statement provides a double independent record of a depositor's bank transactions. It also is used in making periodic independent bank reconciliations. Solutions Manual 7-7 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition QUESTIONS (Continued) 18. An employee who has no other responsibilities that relate to cash should prepare the bank reconciliation. If a person had responsibility for handling cash and also prepared the bank reconciliation, they could use the bank reconciliation to hide fraud with cash receipts or cash disbursements. 19. Paul should not rely on on-line banking to give him an accurate balance in his bank account. On-line banking can provide an up to date balance but the balance will not be accurate if there are any deposits in transit or outstanding cheques. The balance will also not be accurate if the bank has made an error. Paul should keep his own records and reconcile his calculation of the bank balance with what the bank has reported. This is the only way to know if there are any deposits in transit, outstanding cheques or bank errors and thus have accurate information on his bank account balance. 20. Anah is incorrect, since the March cheque has still not cleared the bank at April 30 it must be included in the April 30 th bank reconciliation as an outstanding cheque because it is still outstanding on April 30 th. 21. (a) An NSF cheque occurs when the customer's bank balance is less than the amount of the cheque. (b) In a bank reconciliation a customer's NSF cheque is deducted from the balance per books. (c) An NSF cheque results in an adjusting entry in the company's books, as a debit to Accounts Receivable and a credit to Cash. 22. Yes, I agree that cash equivalents are basically the same as cash. Cash equivalents are highly liquid investments that may be converted to a specific amount of cash, with maturities of three months or less when purchased. Because of their liquidity, cash equivalents are considered to be “near cash” and are often combined with cash for reporting purposes in the current assets section of the balance sheet. 23. A company may have cash that is not available for general use because it is restricted for a special purpose. If the restricted cash is expected to be used within the next year, the amount should be reported as a current asset. When restricted funds will not be used in that time, they should be reported as a noncurrent asset. A compensating balance is a minimum cash balance that a company is required to keep in its bank account as support for a bank loan. These are similar to restricted funds and are reported as noncurrent assets. Solutions Manual 7-8 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 7-1 The three things that internal control processes are designed to help an organization achieve are: (1) reliable financial reporting (2) effective and efficient operations (3) compliance with relevant laws and regulations. Management is responsible for the design and implementation of internal control. One example of each of these three things for Liberty Parking follows: 1. The use of a bank account and preparation of monthly bank reconciliations will enhance the accuracy and reliability of a company's accounting records. 2. An application of effective and efficient operations for Liberty Parking is to have electronic, timed ticket dispensers coordinated with the entry gate so that an attendant is not required to hand out tickets when cars enter the parking garage. This also facilitates documentation procedures. 3. Liberty Parking must comply with relevant laws and regulations such as collecting and paying GST. By segregating handling cash from record keeping the company can ensure all revenues are properly recorded and GST payable is calculated based on the correct amount. Note to instructor: Students may have different examples. Solutions Manual 7-9 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BRIEF EXERCISE 7-2 1. 2. 3. 4. 5. 6. Physical controls Other controls Performance reviews Segregation of duties Establishment of responsibility Other controls BRIEF EXERCISE 7-3 Credit Card (Visa) July 27 Cash ................................................... Credit Card Expense ($100 x 4%) .... Sales .............................................. 96 4 Petro Shop Credit Card July 27 Accounts Receivable ........................ Sales .............................................. 100 Debit Card July 27 Cash ................................................... Debit Card Expense .......................... Sales .............................................. 99 1 100 100 100 BRIEF EXERCISE 7-4 1. 2. 3. 4. 5. 6. Documentation procedures Performance reviews Physical controls Establishment of responsibility Segregation of duties Documentation procedures Solutions Manual 7-10 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BRIEF EXERCISE 7-5 March 2 20 Petty Cash .......................................... Cash ............................................... 100 Postage Expense .............................. Freight Out ......................................... Supplies Expense ............................. Cash ($100 - $8) ............................ 52 28 12 100 92 BRIEF EXERCISE 7-6 Nov. 17 Petty cash ($200 - $150) ................... Printing Expense ............................... Supplies Expense ............................. Postage Expense .............................. Delivery Expense .............................. Cash Over and Short ........................ Cash ($200 - $10) .......................... 50 34 58 19 26 3 190 BRIEF EXERCISE 7-7 1. 2. 3. 4. 5. T T F T T Solutions Manual 7-11 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BRIEF EXERCISE 7-8 1. 2. 3. 4. (d) (c) (b) (b) 5. (e) 6. (a) 7. (c) 8. (d) 9. (d) 10. (a) 11. (c) 12. (b) Bank debit memorandum for service charges EFT payment made by a customer Outstanding cheques from the current month Outstanding cheques from the prior month that are still outstanding Outstanding cheques from the prior month that are no longer outstanding Bank error in recording a company cheque made out for $200 as $290 Bank credit memorandum for interest revenue Company error in recording a deposit of $1,280 as $1,680 Bank debit memorandum for an NSF cheque Deposit in transit from the current month Company error in recording cheque made out for $360 as $630 Bank error in recording a $2,575 deposit as $2,755 BRIEF EXERCISE 7-9 (a) Items that will result in an adjustment to the companies records: 1. Bank debit memorandum for service charges 2. EFT payment 7. Bank credit memorandum for interest expense 8. Company error in recording a deposit of $1,280 as $1,680 9. Bank debit memorandum for an NSF cheque 11. Company error in recording cheque made out for $360 as $630 Solutions Manual 7-12 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BRIEF EXERCISE 7-9 (Continued) (b) Why the other items do not require an adjustment: 3. Outstanding cheques from the current month need to be deducted from the bank balance to determine the adjusted bank balance. Since the company has already recorded the cheques the company does not need to record an adjustment. 4. Outstanding cheques from the previous month that are still outstanding need to be deducted from the bank balance because they are still outstanding. 5. Outstanding cheques from the previous month that are no longer outstanding will not appear on the bank reconciliation. These cheques have now been deducted from both the company’s cash balance and the bank account and so neither balance needs adjusting. 6. Bank error in recording a company cheque made out for $200 as $290 creates a $90 ($290 - $200) adjustment to the bank balance. The company has not made an error and so does not need to make an adjustment. 10. Deposit in transit from the current month will be added to the bank balance to calculate the adjusted bank balance. It has already been recorded by the company so no adjustment is required. 12. Bank error in recording a $2,575 deposit as $2,755 creates a $180 ($2,755 - $2,575) adjustment to the bank balance. The company has not made an error and so does not need to make an adjustment. Solutions Manual 7-13 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BRIEF EXERCISE 7-10 November: Cheques written and recorded in books in Nov. Less: Cheques paid by bank in Nov. Outstanding cheques at Nov. 30 $9,520 8,677 $ 843 December: Cheques written and recorded in books in Dec. Plus: Outstanding cheques at Nov. 30 Total cheques that could be paid by bank in Dec. Less: Cheques paid by bank in Dec. Outstanding cheques at Dec. 31 $12,617 843 13,460 10,949 $ 2,511 BRIEF EXERCISE 7-11 Manuliak Company Bank Reconciliation July 31 Cash balance per bank ..................................................... Add: Deposits in transit .................................................. Less: Outstanding cheques ............................................ Adjusted cash balance per bank ...................................... $7,920 2,152 10,072 1,144 $8,928 Cash balance per books ................................................... Add: Interest earned ........................................................ $9,100 25 9,125 Less: NSF cheque ............................................................ 162 Service charge........................................................ 00 35 Adjusted cash balance per books ................................... $8,928 Solutions Manual 7-14 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BRIEF EXERCISE 7-12 July 31 31 31 Accounts Receivable ........................ Cash ............................................... 162 Bank Charges Expense .................... Cash ............................................... 35 Cash ................................................... Interest Revenue .......................... 25 162 35 25 BRIEF EXERCISE 7-13 Cash should be reported at $18,850 ($6,000 + $850 + $12,000). The postage stamps are prepaid expenses. The cash refund due from CRA is a receivable. Postdated cheques are also receivables until they can be cashed on their valid date. The Treasury bill is a short-term investment that could be considered a cash equivalent. BRIEF EXERCISE 7-14 Current Assets: Dupré Company should report the Cash in Bank, Payroll Bank, Store Cash Floats and Short-term investments accounts as cash and cash equivalents which are current assets. Noncurrent Assets: The Plant Expansion Fund Cash should be reported as a noncurrent asset, assuming the fund is not expected to be used during the next year. The compensating balance should be reported as a noncurrent asset. Solutions Manual 7-15 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition SOLUTIONS TO EXERCISES EXERCISE 7-1 (a) Weakness or Strength 1. No establishment of responsibility over the cash— weakness (b) Suggested Improvements The employees should use separate cash drawers. Cash counts not performed independently—weakness Cash counts should be performed by a supervisor at the end of the shift and the totals compared to the cash register tape. 2. Improper segregation of duties could result in the misappropriation of cash— weakness Different individuals should receive cash, record cash receipts and deposit the cash. In a small business this may be impossible; therefore, it is imperative that management take an active role in the operations of the business so to be able to detect any accounting irregularities. 3. The lack of documentation procedures—weakness. Control documents around purchasing and shipping ensure that the records are accurate and reliable and help prevent the misappropriation (loss) of assets. 4. Repair of physical controls— strength. 5. External reviews completed regularly and issues resolved— strength. 6. Other controls over employees’ duties including vacations— strength. Solutions Manual 7-16 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-2 (a) Procedure Weakness (b) Principle Violated Recommended Change 1. Cashiers are not bonded. Other controls All cashiers should be bonded. 2. Inability to establish responsibility for cash on a specific clerk. Establishment of responsibility There should be separate cash drawers and register codes for each clerk. 3. Cash is not adequately protected from theft. Physical controls Cash should be stored in a safe until it is deposited in the bank. 4. Cash is not independently counted. Performance reviews A supervisor should count the cash. 5. The accountant should not handle cash. Segregation of duties The cashier's department should make the deposits. 6. All sales are not rung through the cash register. Documentation All sales should be rung through the cash register to ensure sales are complete. Solutions Manual 7-17 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-3 (a) Dec. 20 Cash ($2,550 - $30) .................... Debit Card Expense ($0.75 x 40) .................................. Sales ....................................... 2,520 (b) Nov. 15 Cash ($1,300 - $39) .................... Credit Card Expense ($1,300 x 3%)............................... Sales ....................................... 1,261 30 2,550 39 1,300 Dec. 10 No entry (c) Apr. May 2 Accounts Receivable—Zachos Sales ....................................... 1,450 1 Cash ............................................ 1,450 Accounts Receivable—Zachos 1,450 1,450 Solutions Manual 7-18 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-4 (a) Weaknesses 1. Cheques are not prenumbered (b) Suggested Improvements Use prenumbered cheques 2. The purchasing agent signs cheques Only the controller's department personnel should sign cheques Two signatures should be required 3. Unissued cheques are stored in unlocked file cabinet Unissued cheques should be stored in a locked file cabinet with access restricted to authorized personnel 4. Purchasing agent verifies that the goods have been received An independent party should verify receipt of goods 5. Purchasing agent approves and Purchasing should approve bills pays for goods purchased for payment by the controller 6. After payment, the invoice is simply filed. The invoice should be stamped PAID, to prevent it from being processed again 7. The purchasing agent records payments in the cash disbursements journal Only accounting department personnel should record cash disbursements 8. The controller records the cheques in cash disbursements journal Only accounting department personnel should record cash disbursements 9. The controller reconciles the bank statement An internal auditor or other independent party should reconcile the bank statement Solutions Manual 7-19 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-4 (Continued) (b) (Continued) INTEROFFICE MEMORANDUM TO: CONTROLLER, ABEKAH COMPANY FROM: ACCOUNTING STUDENT SUBJECT: INTERNAL CONTROL OVER CASH DISBURSEMENTS DATE: I have reviewed your cash disbursements system and suggest that you make the following improvements: 1. Abekah Company should use prenumbered cheques. These should be stored in a locked file cabinet or safe with access restricted to authorized personnel. 2. The purchasing department should approve bills for payment. The controller’s department should prepare and sign the cheques. Two signatures should be required on every cheque. The invoices should be stamped paid so that they cannot be paid twice. 3. Only the accounting department personnel should record cash disbursements. 4. An internal auditor or other independent party should reconcile the bank statement. 5. An independent party should verify receipt of goods. If you have any questions suggestions, please contact me. about implementing these Solutions Manual 7-20 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-5 (a) Mar. 10 (b) Mar. 25 (c) Mar. 25 Petty Cash .......................................... Cash ............................................... Petty Cash ($125 - $100) ................... Merchandise Inventory ..................... Miscellaneous Expense ($14 + $12 + $5) Delivery Expense .............................. Cash ($125 - $4) ............................ Cash Over and Short .................... 100 100 25 29 31 38 Merchandise Inventory ..................... 29 Miscellaneous Expense ($14 + $12 + $5) 31 Delivery Expense .............................. 38 Cash ($75 - $4) .............................. Cash Over and Short .................... Petty Cash ($100 - $25) ................ 121 2 71 2 25 Solutions Manual 7-21 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-6 (a) May 1 (b) May 31 (c) May 31 Petty Cash .......................................... Cash ............................................... 250 Newspaper Advertising Expense .... Coffee Supplies Expense ................. Drawings ............................................ Postage Expense .............................. Cash Over and Short ........................ Cash ($200 - $78) .......................... Petty Cash ($250 - $200) .............. 62 46 50 10 4 Newspaper Advertising Expense .... Coffee Supplies Expense ................. Drawings ............................................ Postage Expense .............................. Cash Over and Short ........................ Cash ($200 - $83) .......................... Petty Cash ($250 - $200) .............. 62 46 50 10 250 122 50 1 117 50 Solutions Manual 7-22 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-7 (a) VERWEY COMPANY Bank Reconciliation November 30 Cash balance per bank statement ................................... Add: Deposits in transit .................................................. Less: Outstanding cheques ............................................ Adjusted cash balance per bank ...................................... Cash balance per books ..................................... Add: Correction of error in cheque No. 373 .... EFT deposits ............................................. $8,509 01,575 10,084 0 2,449 $7,635 $7,005 $ 90 883 Less: Bank service charge ................................ $ 24 NSF cheque .............................................. 319 Adjusted cash balance per books ................................... (b) Nov. 30 Cash ............................................ Office Supplies ...................... Accounts Receivable ............ 973 30 Bank Charges Expense ............. Account Receivable ................... Cash ........................................ 24 319 973 7,978 343 $7,635 90 883 343 Solutions Manual 7-23 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-8 (a) Deposit in transit on May 31: $1,353 (b) Other adjustments: Interest earned of $32 must be added to the balance per books. EFT deposit of $849 must be added to the balance per books The error in the May 20th deposit must be corrected on the books; therefore the balance per books must decrease by $9 ($954 - $945). EXERCISE 7-9 (a) Outstanding cheques on May 31st: No. 255 $ 262 No. 261 867 No. 264 650 $1,779 (b) Other adjustments: Decrease balance per books $54 for service charges recorded by bank. Increase balance per books $450 for error in cheque 260—should be $50 not $500. Decrease balance per books for NSF cheque of $395. Solutions Manual 7-24 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-10 (a) HIDDEN VALLEY COMPANY Bank Reconciliation May 31 Cash balance per bank statement ................................... Add: Deposits in transit .................................................. Less: Outstanding cheques ............................................ Adjusted cash balance per bank ...................................... Cash balance per books ................................................... Add: Interest earned ....................................................... Error correction: Cheque # 260 ............................ EFT Deposit ............................................................ Less: Bank service charge ................................ Error correction: May 20 deposit ($954 - $945) NSF cheque ............................................................ Adjusted cash balance per books ..................... (b) May. 31 Cash ($32 + $450 + $849)............ Interest Revenue..................... Accounts Payable ................... Accounts Receivable (EFT) ... 1,331 31 Bank Charges Expense .............. Accounts Receivable (error) ...... Accounts Receivable (NSF) ....... Cash ($54 + $9 + $395) ........... 54 9 395 $7,664 , 1,353 9,017 1,779 $7,238 $6,365 32 450 849 7,696 54 9 395 $7,238 32 450 849 458 Solutions Manual 7-25 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-11 (a) Deposits in transit: July 31 Deposits per books in July .................... Less: Deposits per bank in July ............ Deposits in transit, June 30 ........ July receipts deposited in July.............. Deposits in transit, July 31 .................... Deposits in transit: August 31 Deposits per books in August ............... Less: Deposits per bank in August ....... Deposits in transit, July 31........... August receipts deposited in August ... Deposits in transit, August 31 ............... (b) Outstanding cheques: July 31 Cheques per books in July .................... Add: Outstanding cheques, June 30 .... Total that could be cleared in July ........ Less: Cheques clearing bank in July.... Outstanding cheques, July 31 ............... Outstanding cheques: August 31 Cheques per books in August ............... Add: Outstanding cheques, July 31 ...... Total that could be cleared in August ... Less: Cheques clearing bank in August Outstanding cheques, August 31 .......... $15,750 $15,820 (1,050) 14,770 $ 980 $22,900 $23,500 (980) 22,520 $ 380 $17,200 970 18,170 (16,660) $ 1,510 $21,700 1,510 23,210 (22,250) $ 960 Solutions Manual 7-26 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-12 (a) September 1 adjusted balance................................. Add: Cash receipts (deposits) ................................ Less: Cash payments (cheques) ............................. September 30 unadjusted balance per company... (b) September 1 balance per bank ................................ Add: Deposits cleared.............................................. EFT Collections ............................................... Interest earned ................................................ Less: Cheques cleared ............................... $65,787 NSF cheque: J. Hower ...................... 410 Bank service charge ......................... 30 September 30 unadjusted bank balance ................. $17,350 64,329 (63,746) $17,933 $20,860 62,789 1,825 45 85,519 66,227 $19,292 (c) Deposits in transit: September 30 Deposits per books in September................. $64,329 Less: Deposits per bank in September ........ $62,789 Deposits in transit: August 31 ............ (3,370) September receipts deposited in September 59,419 Deposits in transit: September 30................. $ 4,910 (d) Outstanding cheques: September 30 Cheques recorded per books in September ........ Add: Outstanding cheques, August 31 ................ Total cheques that could be cleared in Sept. ...... Less: Cheques clearing bank in September ........ Outstanding cheques: September 30 ................... $63,746 6,880 70,626 (65,787) $ 4,839 Solutions Manual 7-27 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 7-12 (continued) (e) Unadjusted bank balance, September 30 ............... Add: Deposits in transit ........................................... Less: Outstanding cheques ..................................... Adjusted bank balance, September 30 ................... $19,292 4,910 (4,839) $19,363 (f) Unadjusted cash balance, September 30 ............... Add: EFT Collections ............................................... Interest earned ................................................ Less: NSF cheque: J. Hower .................................... Bank service charge ....................................... Adjusted cash balance, September 30 .................... $17,933 1,825 45 (410) (30) $19,363 EXERCISE 7-13 (a) Cash and cash equivalents 1. Currency and coin ............................................... 2. Guaranteed investment certificate .................... 3. April cheques ....................................................... 5. Royal Bank chequing account ........................... 6. Royal Bank savings account .............................. 9. Cash register floats ............................................. 10. Over-the-counter cash receipts for April 30: Currency and coin........................................... Cheques from customers .............................. Debit card slips ............................................... Bank credit card slips..................................... Total ...................................................................... $ 87 10,000 300 2,575 4,000 250 550 185 685 755 $19,387 (b) 4. Postdated cheque—Balance sheet (accounts receivable) 7. Prepaid postage in postage meter—Balance sheet (prepaid expense) 8. IOU from company receptionist—Balance sheet (accounts receivable) Solutions Manual 7-28 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition SOLUTIONS TO PROBLEMS PROBLEM 7-1A (a) The weaknesses in internal accounting control over collections are: (1) Each usher could take cash from the collection plates en route to the basement office. (2) The head usher counts the cash alone. (3) The head usher’s notation of the count is left in the safe. (4) The financial secretary counts the cash alone. (5) The financial secretary withholds $150 to $200 per week. (6) The cash is vulnerable to robbery when kept in the safe overnight. (7) Cheques are made payable to “cash.” (8) The financial secretary has custody of the cash, maintains church records, and prepares the bank reconciliation. (b) The improvements should include the following: (1) The ushers should transfer their cash collections to a cash pouch (or bag) held by the head usher. The transfer should be witnessed by a member of the finance committee. (2) The head usher and finance committee member should take the cash to the office. The cash should be counted by the head usher and the financial secretary in the presence of the finance committee member. (3) Following the count, the financial secretary should prepare a deposit slip in duplicate for the total cash received, and the secretary should immediately deposit the cash in the bank’s night deposit vault. (4) At the end of each month, a member of the finance committee should prepare the bank reconciliation. (5) All cheques should be made payable in the church’s name. Solutions Manual 7-29 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-1A (Continued) (b) (Continued) (6) A petty cash fund should be set up for small expenditures. All amounts collected at weekly services should be deposited. Solutions Manual 7-30 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-2A A Internal Controls p Application to Cash Disbursements Establishment Only the controller and assistant controller are of responsibility authorized to sign cheques. Segregation of duties Invoices must be approved by both the purchasing agent and the receiving department supervisor. Payment can only be made by the controller or assistant controller, and the cheque signers do not record the cash disbursement transactions. Documentation procedures Cheques are prenumbered. Paid invoices have payment details noted on them. Physical Controls Blank cheques are kept in a safe in the controller's office. Only the controller and assistant controller have access to the safe. A cheque-writer is used in writing cheques. Performance reviews The cheque signer compares the cheque with the approved invoice prior to issue. Bank and book balances are reconciled monthly by the assistant chief accountant. Other controls Following payment, invoices are stamped PAID to prevent duplicate payments. Solutions Manual 7-31 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-3A (a) Weaknesses & (b) Problems 1. Cash is collected and kept in the car. This could result in theft. (c) Suggested Improvements Cash should be deposited in the bank each day. 2. The person purchasing the merchandise is the same person that verifies receipt of the goods and approves invoices for payment. Because this person is responsible for all activities related to purchasing, errors and theft could occur. An independent person should verify the receipt of goods. The purchaser should approve bills for payment by the controller. 3. All three cashiers use the same cash drawer. This could result in difficulty establishing responsibility for errors. Each employee should use a separate cash drawer. 4. The office manager deposits the cheques and posts the entry in the accounting records. This could result in the office manager depositing cheques in his/her own account, taking the cash and not posting the entry for accounting purposes. Mail should be opened by two individuals. The reconciliation of daily cash receipts should be forwarded to the accounting department and used as a basis for entering the receipt information into the accounting records. 5. The custodian creates receipts for employees when they don’t have them. He could create fictitious receipts and take cash himself or give it to friends. Prenumbered petty cash receipts must be signed by the custodian and the individual receiving payment for each payment from the fund. Surprise counts can be made at any time to determine whether the fund is intact. Employees should be required to take vacation. Larry never takes a vacation. Solutions Manual 7-32 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-4A (a) June 1 Petty Cash ................................... Cash ........................................ 150 150 8 Cash ............................................ 15,548 Debit Card Expense (52 X $0.50) 26 Credit Card Expense ($6,400 x 2.75%) ..................... 176 Sales ....................................... 8 Freight Out .................................. Postage Expense ....................... Advertising Expense.................. Miscellaneous Expense ............ Cash Over and Short ................. Cash ($150 - $9) ..................... 42 28 57 10 4 141 15 Cash ............................................ 17,941 Debit Card Expense (78 X $0.50) 39 Credit Card Expense ($8,000 x 2.75%) ..................... 220 Sales ....................................... 15 Petty Cash ($250 - $150) ............ Drawings ..................................... Office Supplies Expense ........... Coffee Supplies Expense .......... Cash Over And Short ................. Cash ($250 - $4) ..................... 15,750 18,200 100 50 77 20 1 246 Solutions Manual 7-33 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-4A (Continued) (b) The advantage of accepting debit and bank credit card transactions as opposed to accepting only cash and personal cheques from customers is that the company knows immediately if the customer has enough money in the bank to pay for their purchases. A second advantage is that it will likely increase sales if customers can use debit or credit cards. The disadvantage is that the bank charges a fee on all transactions using debit and credit cards. (c) The benefit of having a petty cash fund is that it can be used to pay relatively small amounts, while still maintaining control. Some expenses are best made by cash rather than by cheque because of the nature of the expense–there are some instances where either a cheque is not accepted or it is not practical to issue a cheque. The cost-benefit principle justifies paying some expenses with cash rather than issuing a cheque. There are a number of internal controls over the petty cash fund that Gamba should follow: One person should be appointed the petty cash custodian and will be responsible for the fund. A prenumbered petty cash receipt should be signed by the custodian and the individual receiving payment for each payment from the fund. The treasurer’s office should examine all payments and stamps supporting documents to indicate they were paid when the fund is replenished. Surprise counts should be made at any time to determine whether the fund is intact. Solutions Manual 7-34 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-5A (a) Jan. Feb. 2 Petty Cash ................................... Cash ........................................ 200 15 Freight Out .................................. Postage Expense ....................... Office Supplies Expense ........... Miscellaneous Expense ............ Cash Over and Short ................. Cash ($200 - $13) ................... 84 42 47 12 2 31 Freight Out .................................. Charitable Contributions Expense Postage Expense ....................... Miscellaneous Expense ............ Cash Over and Short............. Cash ($200 - $5) ..................... 86 40 28 44 200 187 3 195 1 Petty Cash ................................... Cash ........................................ 100 15 Freight Out .................................. Entertainment Expense ............. Postage Expense ....................... Merchandise Inventory .............. Miscellaneous Expense ............ Cash Over and Short ................. Cash ($300 - $58) ................... 36 53 33 60 54 6 28 Postage Expense ....................... Travel Expense ........................... Freight Out .................................. Office Supplies Expense ........... Cash Over and Short............. Cash ($250 - $63) ................... Petty Cash ($300 - $250) ....... 95 46 44 57 100 242 5 187 50 Solutions Manual 7-35 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-5A (Continued) (b) Date Jan. 2 Feb. 1 28 (c) Explanation Petty Cash Ref. Debit Credit Balance 200 100 50 200 300 250 Some expenses are made from petty cash rather than by cheque because of the nature of the expense–there are some instances where either a cheque is not accepted or it is not practical to issue a cheque. The cost-benefit principle justifies paying some expenses with cash rather than issuing a cheque. There are internal controls over payments from petty cash. A custodian is responsible for the fund. A prenumbered petty cash receipt signed by the custodian and the individual receiving payment is required for each payment from the fund. The treasurer’s office examines all payments and stamps supporting documents to indicate they were paid when the fund is replenished. Surprise counts can be made at any time to determine whether the fund is intact. Solutions Manual 7-36 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-6A (a) AGRICULTURAL GENETICS COMPANY Bank Reconciliation May 31, 2008 Cash balance per bank statement ................................... Add: Deposit in transit ...................................... $1,141 Bank error, May 12 deposit ($638 - $386) 252 Less: Outstanding cheques [($233 + $732 + $813 + $401)] ................................ Adjusted cash balance per bank ...................................... Cash balance per books ................................................... Add: Error in recording cheque No. 1151 ($855 - $585) ............................................. $ 270 EFT collections......................................... 2,382 Interest revenue ....................................... 24 Less: NSF cheque and service charge ............. $820 Error in recording cheque No. 1192 ($1,387 - $1,738) ....................................... 351 Bank service charge ................................ 50 Adjusted cash balance per books ................................... $11,689 1,393 13,082 2,179 $10,903 $ 9,448 2,676 12,124 1,221 $10,903 Solutions Manual 7-37 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-6A (Continued) (b) May 31 Cash ............................................ 270 Accounts Payable—L. Kingston 31 Cash ............................................ Accounts Receivable ............ 2,382 31 Cash ............................................ Interest Revenue ................... 24 31 Accounts Receivable—P. Dell .. Cash ........................................ 820 31 Computer Equipment ................ Cash ........................................ 351 31 Bank Charges Expense ............. Cash ........................................ 50 270 2,382 24 820 351 50 Check: $9,448 + $270 + $2,382 + $24 - $820 - $351 - $50 = $10,903 adjusted cash balance Solutions Manual 7-38 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-7A (a) Cash balance per books, November 30, 2008 (from Nov. 30 bank reconciliation) .................... Add: Cash receipts ................................................ Less: Cash payments ............................................ Unadjusted cash balance per books, December 31, 2008 .............................................. $10,216 16,830 14,816 $12,230 (b) HUANG COMPANY Bank Reconciliation December 31, 2008 Cash balance per bank statement ................................ Add: Deposits in transit ............................................... Less: Outstanding cheques No. 3470 ...................................... $1,100 No. 3474 ...................................... 1,050 No. 3478 ...................................... 538 No. 3481 ...................................... 807 No. 3484 ...................................... 1,274 No. 3486 ...................................... 1,390 Adjusted cash balance per bank .................................. Cash balance per books ............................................... Add: EFT collected by bank ........................................ Less: NSF cheque ..................................... $1,027 Error in recording cheque No. 3485 ($541 - $441) ................................. 100 Bank service charges .................... 45 st Error in Dec. 21 deposit ($2,954 - $2,945) ........................... 9 Adjusted cash balance per books ................................ $19,155 1,198 20,353 6,159 $14,194 $12,230 3,145 15,375 1,181 $14,194 Solutions Manual 7-39 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-7A (Continued) (c) Dec. 31 Cash ............................................ Accounts Receivable ............ Interest Revenue ................... 31 Accounts Receivable —Hilo Holdings .......................... Cash ........................................ 3,145 3,080 65 1,027 1,027 31 Accounts Payable ...................... Cash ........................................ 100 31 Bank Charges Expense ............. Cash ........................................ 45 31 Accounts Receivable ................. Cash ........................................ 9 100 45 9 Check: $12,230 + $3,145 - $1,027 - $100 - $45 - $9 = $14,194 adjusted cash balance Solutions Manual 7-40 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-8A (a) Book balance, May 1 (per Apr. 30 bank reconciliation) $ 7,776 Add: Cash receipts ..................................................... 6,825 Less: Cash payments .................................................. 13,526 Unadjusted cash balance, May 31 ............................. $ 1,075 (b) RIVER ADVENTURES COMPANY Bank Reconciliation May 31, 2008 Cash balance per bank statement ................................... Add: Deposits in transit ............................... $1,286 Error in cheque 564 ($603 - $306)....... 297 Less: Outstanding cheques No. 533 .............................................. $279 No. 555 .............................................. 79 No. 558 .............................................. 943 No. 560 .............................................. 890 No. 566 .............................................. 950 Adjusted cash balance per bank ...................................... Cash balance per books ................................................... Add: EFT proceeds ($1,615 + $35) ............... $1,650 th Error in May 26 deposit ($980 - $890) ..................................... 90 Error in cheque #563 ($2,887 - $2,487) ............................... 400 Less: NSF cheque .......................................... $ 440 Bank service charges .......................... 25 Adjusted cash balance per books ................................... $4,308 1,583 5,891 3,141 $2,750 $1,075 2,140 3,215 465 $2,750 Solutions Manual 7-41 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-8A (Continued) (b) May 31 Cash ........................................... Accounts Receivable ............ Interest Revenue ................... 1,650 31 Cash ........................................... Accounts Receivable ............ 90 31 Cash ............................................ Accounts Payable ................. 400 31 Accounts Receivable—R. King. Cash ........................................ 440 31 Bank Charges Expense ............. Cash ........................................ 25 1,615 35 90 400 440 25 Check: $1,075 + $1,650 + $90 + $400- $440 - $25 = $2,750 adjusted cash balance Solutions Manual 7-42 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-9A (a) Balance per Bank Statement Balance September 30, 2008 .................................... Add: Deposits ............................................ $11,579 Interest .............................................. 27 Less: Cheques cleared .............................. $7,253 NSF cheques .................................... 790 Service charge ................................. 43 Balance, October 31, 2008 ........................................ $ 6,469 11,606 18,075 8,086 $9,989 Balance Per Books Reconciled Balance, (per Sept. 30 bank reconciliation) ($6,469 + $1,084 - $628 - $553 - $159) ...................... $ 6,213 Add: Cash receipts ................................................... 11,736 Less: Cash payments................................................ (10,922) Unadjusted cash balance, October 31, 2008 .......... $ 7,027 Solutions Manual 7-43 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-9A (Continued) (b) HAWORTH’S MARINE CENTRE Bank Reconciliation October 31, 2008 Balance per bank statement ............................................. Add: Deposits in transit .................................................. ................................................................................. Less: Outstanding cheques No. 391 .................................................. $ 159 No. 408 .................................................. 3,266 No. 411 .................................................. 1,984 Adjusted cash balance per bank ...................................... Balance per books ............................................................. Add: Interest ..................................................... $ 27 th Error in Oct. 12 deposit ($3,818 - $3,118) 700 Less: NSF cheque .............................................. $790 Error in cheque No. 409 ($1,848 - $1,448) 400 Bank service charges .............................. 43 Adjusted cash balance ...................................................... (c) Oct. 31 Cash ........................................... Accounts Receivable ............ Interest Revenue ................... 727 31 Accounts Receivable—Y. Fujii . Office Equipment ...................... Bank Charges Expense ............. Cash ........................................ 790 400 43 $ 9,989 1,941 11,930 5,409 $6,521 $7,027 727 7,754 1,233 $6,521 700 27 1,233 Check: $7,027 + $727 - $1,233 = $6,521 adjusted cash balance (d) The reported cash balance on the October 31, 2008 balance sheet is $6,521. Solutions Manual 7-44 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-10A (a) CAREFREE COMPANY Bank Reconciliation March 31, 2008 Balance per bank statement ............................................. Add: Deposit in transit .................................................... ................................................................. Less: Outstanding cheques .............................. $1,650 Bank error deposit Careless Company . 1,100 Adjusted cash balance per bank ...................................... $7,350 750 8,100 Balance per books ............................................................. Add: Error in cheque No. 173 ($294 - $249) .... $ 45 Interest earned ......................................... 15 Proceeds of EFT ....................................... 2,645 $3,125 Less: Service charge .......................................... $ 40 Hydro ......................................................... 120 Telephone ................................................. 85 NSF cheque ($220 + $15 service charge) 235 Adjusted cash balance per books ................................... (b) Mar. 31 Cash ............................................ Accounts Payable ................. Interest Revenue ................... Accounts Receivable ............ 2,705 31 Bank Charges Expense ............. Hydro Expense ........................... Telephone Expense ................... Accounts Receivable ................ Cash ........................................ 40 120 85 235 2,750 $5,350 2,705 5,830 480 $5,350 45 15 2,645 480 Check: $3,125 + $2,705 - $480 = $5,350 adjusted cash balance Solutions Manual 7-45 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-10A (Continued) (c) Internal control features added by the bank reconciliation process: Performance review: Allows for an independent check on accounting records But having a bank account also assists with internal control as follows: Safeguards assets: Safeguards cash Documentation: Creates a double record of all bank transactions Solutions Manual 7-46 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-11A (a) Cash and Cash Equivalents balance: 1. 2. 3. 4. 6. 7. Cash on hand ....................................................... Petty cash fund .................................................... Bank chequing account ...................................... BMO money market fund .................................... US Dollar Account ............................................... American Express credit card slips* [$500 - ($500 x 4%)] ......................................... Total .................................................................. $ 1,600 43 7,460 5,000 2,241 480 $16,824 *American Express credit card slips are effectively a deposit in transit because the funds will be deposited in the bank account in two days. (b) 2. The petty cash fund should have been replenished at year-end. Since this has not happened, the company must record: Accounts receivable of $100 for the IOU Expenses of $55 ($155 - $100 IOU) Cash shortage of $2 and a reduction of petty cash of $157 ($200 $43) 4. The 6-month term deposit should be recorded as a short-term investment, and reported as a current asset on the balance sheet. 5. The cash due from the customer should be recorded as an account receivable, and reported as a current asset on the balance sheet. The remainder of the entry should update merchandise inventory (current asset), sales (revenue), and cost of goods sold (expense). Solutions Manual 7-47 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-11A (Continued) (b) (Continued) 8. The cash received from the property sale is restricted and should be reported as either a current or noncurrent asset depending on when the property sale will be completed. 9. The deposit with Ontario Hydro should be recorded as an advance or deposit in the current assets section of the balance sheet. Solutions Manual 7-48 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-1B (a) Activities Application to Cash Receipts Establishment of responsibility Only cashiers are authorized to sell tickets. Only the manager and cashier can handle cash. Segregation of duties The duties of receiving cash and admitting customers are assigned to the cashier and to the usher. The manager maintains custody of the cash, and the company accountant records the cash. Documentation procedures Tickets are prenumbered. Cash count sheets are prepared. Deposit slips are prepared. Copies are used for verification and recording. Physical controls A safe is used for the storage of cash and a machine is used to issue tickets. Performance reviews Cash counts are made by the manager at the end of each cashier's shift. Daily comparisons are made by the company controller. Other controls Cashiers are bonded. Solutions Manual 7-49 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-1B (Continued) (b) Actions by the usher and cashier to misappropriate cash could include: (1) Instead of tearing the tickets, the usher could return the tickets to the cashier who could resell them, and the two could divide the cash. (2) The cashier could issue a less expensive ticket than paid for, and the usher would admit the customer. The difference between the ticket issued and the cash received could be divided between the usher and cashier. (3) The cashier and usher could agree to let friends into the theatre at no cost (or in exchange for an "under the table" payment). Solutions Manual 7-50 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-2B Roger has created a situation that leaves many opportunities for undetected theft. Here is a list of some of the deficiencies in internal control. You may find others. 1. Establishment of responsibility 2. Inadequate control over the cash box. In effect, it was operated like a petty cash fund, but too many people had the key. Instead, Roger should have had the key and dispersed funds when necessary for purchases. Segregation of duties Freda Stevens counted the funds, made out the deposit slip, and took the funds to the bank. This made it possible for Freda to take some of the money and deposit the rest since there was no external check on her work. Roger should have counted the funds, with someone observing him. Then he could have made out the deposit slip and had Freda deposit the funds. Sara Billings was collecting tickets and receiving cash for additional tickets sold. Instead, there should have been one person selling tickets at the door and a second person collecting tickets. Solutions Manual 7-51 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-2B (Continued) 3. 4. Documentation procedures The tickets were unnumbered. By numbering the tickets, the students could have been held more accountable for the tickets. No record was kept of which students took tickets to sell or how many they took. In combination with items 1 and 2 above, the student assigned control over the tickets should have kept a record of which tickets were issued to each student for resale. (Note: This problem could have been largely avoided if the tickets had been sold at the door on the day of the dance.) There was no control over unsold tickets. This deficiency made it possible for students to sell tickets, keep the cash, and tell Roger that they had disposed of the unsold tickets. Instead, students should have been required to return the unsold tickets to the student maintaining control over tickets, and the cash to Roger. In each case, the students should have been issued a receipt for the cash they turned in and the tickets they returned. Instead of receipts, students simply wrote notes saying how they used the funds. Instead, it should have been required that they provided a valid receipt. A receipt was not received from Obnoxious Al. Without a receipt, there is no way to verify how much Obnoxious Al was actually paid. For example, it is possible that he was only paid $100 and that Roger took the rest. Physical controls and establishment of responsibility The tickets were left in an unlocked box on his desk. Instead, Roger should have assigned control of the tickets to one individual, in a locked box which that student alone had control over. Solutions Manual 7-52 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-3B (a) Weaknesses & (b) Problems 1. No separation of duties between receiving the cash and admitting students to the lessons. The teachers could admit students for free or charge extra and pocket the difference or report fewer students and pocket the extra money. (c) Suggested Improvements The duties of receiving cash and admitting students should be assigned to separate individuals. 2. There is no segregation of duties in the accounting function. The general manager could prepare fictitious invoices for payment and it would not be detected. An independent person should approve the invoices for payment and prepare the bank reconciliations. 3. Each sales person is responsible for determining credit policies and they receive a commission based on sales. They could provide credit to an bad credit risk in order to receive the commission on the sale. An independent person should be responsible for providing credit to customers. 4. All programmers have access to the accounting software which could provide unauthorized changes to the accounting records. Access to the accounting records should be restricted and protected with password or biometric restrictions. 5. Receiving and purchase orders have been eliminated which could result in unauthorized purchases and/or receipts or fictitious invoices being paid as no support is required. An employee could set up a bank account and collect the payment. Receiving reports and purchase orders should be reinstated. Solutions Manual 7-53 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-4B (a) Apr. 1 Petty Cash ................................... Cash ........................................ 200 200 8 Cash ............................................ 30,997 Debit Card Expense (116 X $0.75) 87 Credit Card Expense ($12,800 X 3.25%) .................. 416 Sales ....................................... 8 Freight Out .................................. Office Supplies Expense ........... Advertising Expense.................. Drawings ..................................... Cash Over and Short ................. Cash ($200 - $56) ................... 44 34 50 20 4 144 15 Cash ............................................ 35,760 Debit Card Expense (160 X $0.75) 120 Credit Card Expense ($16,000 X 3.25%) .................. 520 Sales ....................................... 15 Postage Expense ....................... Advertising Expense.................. Cleaning Supplies Expense ...... Cash Over and Short ................. Petty Cash ($200 - $175) ....... Cash ($175 - $55) ................... 31,500 36,400 53 39 48 5 25 120 Solutions Manual 7-54 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-4B (Continued) (b) The advantage of accepting debit and bank credit card transactions as opposed to accepting only cash and personal cheques from customers is that the company knows immediately if the customer has enough money in the bank to pay for their purchases. A second advantage is that it will likely increase sales if customers can use debit or credit cards. The disadvantage is that the bank charges a fee on all transactions using debit and credit cards. (c) The benefit of having a petty cash fund is that it can be used to pay relatively small amounts, while still maintaining control. Some expenses are best made by cash rather than by cheque because of the nature of the expense–there are some instances where either a cheque is not accepted or it is not practical to issue a cheque. The cost-benefit principle justifies paying some expenses with cash rather than issuing a cheque. There are a number of internal controls over the petty cash fund that Rossi should follow: One person should be appointed the petty cash custodian and will be responsible for the fund. A prenumbered petty cash receipt should be signed by the custodian and the individual receiving payment for each payment from the fund. The treasurer’s office should examine all payments and stamps supporting documents to indicate they were paid when the fund is replenished. Surprise counts should be made at any time to determine whether the fund is intact. Solutions Manual 7-55 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-5B (a) July Aug. 1 Petty Cash ................................... Cash ........................................ 250 15 Freight Out .................................. Postage Expense ....................... Entertainment Expense ............. Miscellaneous Expense ............ Cash Over and Short ................. Cash ($250 - $12) ................... 94 42 47 51 4 31 Freight Out .................................. Charitable Contributions Expense Postage Expense ....................... Miscellaneous Expense ............ Cash over and Short ............. Cash ($250 - $10) ................... 82 50 68 42 250 238 2 240 1 Petty Cash................................... Cash ........................................ 100 15 Freight Out .................................. Entertainment Expense ............. Postage Expense ....................... Supplies Expense ...................... Cash Over and Short ................. Cash ($350 - $57) ................... 90 77 63 59 4 31 Postage Expense ....................... Entertainment Expense ............. Freight Out .................................. Cash Over and Short ................. Petty Cash ($350 - $300) ....... Cash ($300 - $65) ................... 122 91 73 100 293 1 50 235 Solutions Manual 7-56 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-5B (Continued) (b) Date July Aug. (c) Explanation 1 1 31 Petty Cash Ref. Debit Credit Balance 250 100 50 250 350 300 If the petty cash fund had not been replenished at year-end the company must record the petty cash expenses and an accounts payable (to petty cash) of $285 ($122 + $91 + $73 $1). Only $65 is actually cash at this point in time not $350 as in the petty cash account prior to the August 31 transaction. Solutions Manual 7-57 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-6B (a) LISIK COMPANY Bank Reconciliation October 31, 2008 Cash balance per bank statement ................................... Add: Deposit in transit ...................................... $963 Bank error—Lasik cheque ...................... 600 Less: Outstanding cheques ($330 + $466 + $587 + $293) ................................ Adjusted cash balance per bank ...................................... Cash balance per books ................................................... Add: Collection of EFT ....................................... $2,055 Interest revenue ....................................... 39 Less: NSF cheque............................................... $715 Error in Oct. 12 deposit ($856 - $836) ..... 20 Error in recording cheque No. 1181 ($685 - $568) ........................................... 117 Bank service charge 35 Cheque printing charge ........................... 40 Adjusted cash balance per books ................................... $10,973 1,563 12,536 1,676 $10,860 $ 9,693 2,094 11,787 927 $10,860 Solutions Manual 7-58 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-6B (Continued) (b) May 31 Cash ............................................. Accounts Receivable ............. Interest Revenue .................... 2,094 31 Accounts Receivable—W. Hoad 715 Sales ............................................. 20 Accounts Payable—Helms & Co. 117 Bank Charges Expense ($35 + $40) 75 Cash ......................................... 2,055 39 927 Check: $9,693 + $2,094 - $927 = $10,860 adjusted cash balance Solutions Manual 7-59 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-7B (a) General Ledger Cash Balance: Book balance, February 29 (Adjusted cash balance per bank reconciliation) Add: Cash receipts ................................................... Less: Cash payments ................................................ Unadjusted cash balance, March 31 ....................... $12,258 10,673 (11,821) $11,110 (b) YAP CO. Bank Reconciliation March 31, 2008 Cash balance per bank statement ................................... Add: Deposits in transit .................................................. $12,500 1,025 13,525 Less: Outstanding cheques No. 3470 ................................................ $1,535 No. 3479 ................................................ 159 No. 3481 ................................................ 862 No. 3482 ................................................ 1,126 Bank error—cheque #3474 ....................... 200 Adjusted cash balance per bank ...................................... 3,882 $9,643 Solutions Manual 7-60 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-7B (Continued) (b) (Continued) Cash balance per books ................................................... Add: Correction to cheque #3473 ($1,641 – $1,461)................................................... Interest revenue ..................................................... Less: Loan payment—principal ........................ $1,000 Loan payment—interest .......................... 62 NSF cheque Mr. Jordan ........................... 550 Service charge.......................................... 49 Correction in recording cash receipts March 20 ($1,823 - $1,832) ..................... 9 Adjusted cash balance per books ................................... (c) Mar. 31 Cash ............................................ Accounts Payable ................. Interest Revenue ................... 203 31 Note Payable............................... Interest Expense ........................ Accounts Receivable ................. Bank Charges Expense ............. Sales ............................................ Cash ........................................ 1,000 62 550 49 9 $11,110 180 23 11,313 1,670 $9,643 180 23 1,670 Check: $11,110 + $203 - $1,670 = $9,643 adjusted cash balance Solutions Manual 7-61 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-8B (a) Book balance, October 31 (from Oct. 31 bank reconciliation) ....................................................... Add: Cash receipts per journal ............................ Less: Cash payments per journal ......................... Unadjusted cash balance, November 30 ............. $ 8,496 15,690 (14,026) $10,160 (b) MALONEY COMPANY Bank Reconciliation November 30, 2008 Cash balance per bank statement .................................. Add: Deposits in transit ................................................. Less: Outstanding cheques No. 2451 ........................................... $1,260 No. 2472 ........................................... 504 No. 2478 ........................................... 538 No. 2482 ........................................... 612 No. 2484 ........................................... 830 No. 2485 ........................................... 975 No. 2487 ........................................... 1,200 Adjusted cash balance per bank ..................................... Cash balance per books .................................................. Add: EFT collected by Bank ........................ $2,479 Error in Nov. 20 deposit ($2,966 - $2,699) 267 Less: NSF cheque – Pendray Holdings ....... $ 260 Error in recording cheque No. 2476 ($2,830 - $2,380) ................................ 450 Loan payment ...................................... 2,250 Adjusted cash balance per books .................................. $14,527 1,338 15,865 5,919 $ 9,946 $10,160 2,746 12,906 2,960 $ 9,946 Solutions Manual 7-62 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-8B (Continued) (c) Nov. 30 Cash ............................................ Accounts Receivable ............ Interest Revenue ................... Accounts Receivable ............ 2,746 30 Accounts Receivable ................. Accounts Payable ...................... Note Payable............................... Interest Expense ........................ Cash ........................................ 260 450 2,000 250 2,430 49 267 2,960 Check: $10,160 + $2,746 - $2,960 = $9,946 adjusted cash balance Solutions Manual 7-63 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-9B (a) Balance per Bank Statement Balance April 30, 2008............................................... Add: Deposits ............................................. $10,528 Interest ............................................... 12 Less: Cheques cleared ............................... $5,608 NSF cheques ..................................... 280 Service charge................................... 28 Unadjusted bank balance, May 31, 2008 ............. $ 4,261 10,540 14,801 5,916 $8,885 Balance Per Books Reconciled balance, (per April 30 bank reconciliation) ($4,261 – $217 – $326 – $105) ................................. $ 3,613 Add: Cash receipts ................................................... 11,172 Less: Cash payments ................................................ 10,776 Unadjusted cash balance, May 31, 2008 ................. $ 4,009 Solutions Manual 7-64 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-9B (Continued) (b) KURJI’S APPLIANCES Bank Reconciliation May 31, 2008 Unadjusted bank balance ................................................. Add: Deposits in transit .................................................. Less: Outstanding cheques No. 290 .................................................. $ 105 No. 307 .................................................. 3,266 No. 310 .................................................. 2,400 Adjusted bank balance...................................................... Unadjusted cash balance ................................................. Add: Interest ..................................................... $ 12 Error in cheque # 306 ($150 - $105)........ 45 th Error in May 5 deposit ($2,620 – $2,260) 360 Less: NSF cheque .............................................. $280 Bank service charges .............................. 28 Adjusted cash balance ...................................................... $8,885 1,004 9,889 5,771 $4,118 $4,009 417 4,426 308 $4,118 Solutions Manual 7-65 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-9B (Continued) (c) May 31 Cash ........................................... Interest Revenue ................... Telephone Expense............... Accounts Receivable ............ 417 31 Accounts Receivable—M. Rafique 280 Bank Charges Expense ............. 28 Cash ........................................ 12 45 360 308 Check: $4,009 + $417 - $308 = $4,118 adjusted cash balance (d) The reported cash balance on the May 31, 2008 balance sheet is $4,118. Solutions Manual 7-66 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-10B AURA WHOLE FOODS Bank Reconciliation October 31, 2008 (a) Cash balance per bank statement Less: Outstanding cheques No. Amount 762 $514 783 160 784 267 862 171 863 325 864 173 Adjusted cash balance per bank $19,460 Cash balance per books Add: Credit memo (collection of EFT) Adjusted balance per books (before theft) Less: Amount of theft Adjusted cash balance per books $19,641 750 20,391 2,541 $17,850 1,610 $17,850 (b) The cashier attempted to cover the theft of $2,541 by: 1. Not including three outstanding cheques totalling $941 (No. 762, $514; No. 783, $160; and No. 784, $267) in the list of outstanding cheques. 2. Added the outstanding cheques to the cash balance per books incorrectly. The total should have been $100 higher ($20,310 not $20,210). 3. Subtracted the $750 credit memo from the bank balance. It should be added to the book balance. This concealed $1,500 ($750 x 2) of the theft. Check: $941 + $100 + (2 x $750) = $2,541 Solutions Manual 7-67 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-10B (Continued) (c) Combining the duties of cashier and bookkeeper is not a correct application of these internal control activities: Performance reviews have not been properly conducted because the cashier/bookkeeper prepared the bank reconciliation. Segregation of duties has not been properly followed because the cashier had access to the accounting records and also prepared the bank reconciliation. Solutions Manual 7-68 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-11B (a) Cash balance: 1. Cash on hand ...................................................... $ 5,000 2. Petty cash fund ................................................... 125 3. Commercial bank savings account .................. 100,000 Commercial bank chequing account ........... 25,000 US bank account ............................................ 48,000 10. Special bank account–customer cash deposits 9,250 Total................................................................. $187,375 (b) If the company combined its cash and cash equivalents, the money market fund of $32,000 and the treasury bills of $75,000 would also be included. (c) 2. The petty cash fund should have been replenished at year-end. Since this has not happened, the company must record the petty cash expenses and reduce petty cash by $375. Only $125 is actually cash at this point in time. Once the petty cash fund is reimbursed, $500 cash will be available once again. 4. Restricted cash of $150,000 would be reported as a current or noncurrent asset, depending on the intended period of use. 5. An unused line of credit would not be reported on the balance sheet. It may be disclosed in the notes. 6. Amounts due from employees (travel advances) would be included in Accounts Receivable. 7. Short-term investments (money market fund, treasury bills and shares) would be listed separately in the current asset section (unless combined as the money market fund and t-bills were in (b)). Solutions Manual 7-69 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 7-11B (Continued) (c) (Continued) 8. Unused postage stamps would be included in prepaid expenses or supplies. 9. NSF cheques would be included in Accounts Receivable, assuming the company expects collection. Solutions Manual 7-70 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition CONTINUING COOKIE CHRONICLE Part 1 The weaknesses in internal accounting controls in the system recommended by John are: (1) (2) (3) (4) The cash could be stolen from John’s vehicle before it is deposited in the bank. John could potentially steal from the company and then cover the theft because of a lack of segregation of duties between the handling of cash, bank reconciling process and recording of transactions in the accounting records. The accounting information for the business could be lost or stolen if it is all stored on John’s laptop. John should not be able to write cheques to himself as this leaves the company vulnerable to theft. Improvements should include the following: (1) (2) (3) Cash should be deposited in the bank daily. At a minimum the cash should be locked in a safe until such as time as it can be deposited. John should be responsible for the accounting function only. Natalie (or some other independent person) should sign all cheques and make all deposits. Cheques should only be signed when there is documentation present to support the payment. All invoices should be stamped “PAID” to avoid duplicate payment. Bank reconciliations should be prepared by a person independent of the handling and recording of cash. However, this may not be possible in a small organization such as Cookie Creations. At a minimum, Natalie and not John should prepare bank reconciliations monthly. Solutions Manual 7-71 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition CONTINUING COOKIE CHRONICLE (Continued) Part 1 (Continued) (4) (5) The accounting records should be maintained on site and regular back-ups should be prepared. It would be best if John used a computer at Cookie Creations to prepare the accounting information; however, if he is going to use his laptop, Natalie should ensure that she is provided with a regular back-up of all the accounting records. This ensures that if John should ever lose his laptop or decide to no longer perform Cookie Creation’s accounting, Natalie would still have access to the company’s accounting records. John should submit a monthly invoice to Natalie for her approval. Natalie should then write and sign the cheque. Part 2 (a) COOKIE CREATIONS Bank Reconciliation June 30, 2008 Cash balance per bank statement ................................... Add: Deposit in transit ..................................... $110 Bank error Cheque No. 603 ($452 - $425) 27 Less: Outstanding cheques ($238 + $247) .................... Adjusted cash balance per bank ......................... Cash balance per books ................................................... Less: Service charge .......................................... $ 13 th Error in deposit June 20 ($155 - $125) . 30 Telus .......................................................... 85 NSF cheque ($100 + $35 service charge) 135 Adjusted cash balance per books ................................... $3,359 137 3,496 485 $3,011 $3,274 263 $3,011 Solutions Manual 7-72 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition CONTINUING COOKIE CHRONICLE (Continued) Part 2 (Continued) (b) June 30 Bank Charge Expense ............... Teaching Revenue ..................... Telephone Expense ................... Accounts Receivable—Ron Black Cash ........................................ 13 30 85 135 263 Check: $3,274 - $263 = $3,011 adjusted cash balance (c) If a balance sheet were prepared, cash at June 30 th, 2008 would be $3,011. Solutions Manual 7-73 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BYP 7-1 FINANCIAL REPORTING AND ANALYSIS (a) Regarding the company’s system of internal control, the Management’s Responsibilities for Financial Reporting states that “such systems are designed to provide reasonable assurance that the financial information is accurate, relevant and reliable, and that the Company’s assets are appropriately accounted for and adequately safeguarded. The Auditor’s Report does not comment on the company’s system of internal controls. (b) According to the Statement of Management’s Responsibility for Financial Reporting, management is responsible for the financial statements. Management has responsibility for preparing the statements and ensuring the company maintains an adequate system of internal controls. (c) The Company’s external auditors are Ernst & Young LLP. (d) In 2006, cash decreased by $6,752,000. (e) (1) (2) (3) (4) $19,266,000 2.95% ($19,266,000 $653,206,000) 5.22% ($19,266,000 $368,842,000) 7.72% ($19,266,000 $249,428,000) Solutions Manual 7-74 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BYP 7-2 INTERPRETING FINANCIAL STATEMENTS (a) Cash equivalents are highly liquid investments, with maturities of three months or less when purchased, that can be converted into specific amounts of cash. They include money market funds, money market savings certificates, bank certificates of deposit, and treasury bills and notes. Cash equivalents differ from other types of short-term investments in that they are very liquid (that is, easily turned into cash) and have a low risk of declining in value while held. (b) Working Capital Current Ratio 2005 2004 $80,089 - $7,688 = $72,401 $72,804 - $7,271 = $65,533 $80,089 10.4 : 1 $7,688 $72,804 10.0 : 1 $7,271 The company’s current ratio has remained fairly constant over 2005 whereas the industry average has decreased. The company’s current ratio is significantly above the industry average in both 2005 and 2004. (c) Having cash and cash equivalents available provides a company with flexibility; however, uninvested cash does not earn a very high return. Therefore a company will want to carefully monitor the amount of cash it keeps on hand to provide a balance between flexibility and return. (d) Restricted cash is cash that is not available for general use because it is restricted for a special purpose. Solutions Manual 7-75 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BYP 7-3 COLLABORATIVE LEARNING ACTIVITY All of the material supplementing the collaborative learning activity, including a suggested solution, can be found in the Collaborative Learning section of the Instructor Resources site accompanying this textbook. Solutions Manual 7-76 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BYP 7-4 COMMUNICATION ACTIVITY Ms. L.S. Osman Tenacity Corporation Dear Ms. Osman: During our audit of your financial statements, we reviewed the internal controls over cash. Based on our review we offer the following recommendation. Your company has grown significantly over the past several years to the point where controls over cash must be implemented. The most significant weakness we identified was the lack of segregation of duties in the accounting department. In the past, operations were small enough that one person could perform the accounting and the owners could review almost all transactions. However, this is no longer the situation and the lack of segregation of duties could have adverse consequences for your business. For example, because the same person is responsible for ordering parts, taking delivery, authorizing payments and signing cheques it is possible that the clerk could pay himself as a payee. Also, without segregating the signing process from the bank reconciliation process, any misappropriation of funds could proceed undetected. Solutions Manual 7-77 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BYP 7-4 (Continued) To minimize the risk of misappropriation of cash the following segregation of duties should be implemented: 1. There should be segregation between the individuals who order parts, take delivery of the auto parts, authorize the payments and then sign the cheques for the payments of the auto parts. 2. Different individuals should sign cheques and prepare the monthly bank reconciliation. 3. Monthly bank reconciliations should be performed / reviewed by a person independent of the recording process. We would be pleased to discuss the weaknesses and our recommended improvements with you, at your convenience. Yours sincerely, Solutions Manual 7-78 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BYP 7-5 ETHICS CASE (a) The stakeholders in this situation are the clients of the banks and the bank’s managers, employees, and shareholders. (b) The amount of revenue depending on order of processing would be: (1) (2) (3) (c) Largest to smallest: 5 bounced cheques x $35 = $175 Smallest to largest: 1 bounced cheque x $35 = $35 In order of cheque number: 4 bounced cheques x $35 = $140 Whether this is ethical is subject to debate. On the one hand, it can be argued that customers have a responsibility to maintain an adequate balance in their accounts. Some customers are frequently overdrawn; thus only severe penalties will persuade them to maintain an adequate balance. However, it could be argued that charging $35 for something that has a cost to the bank of $1.50 is “gouging”—that is, taking unfair advantage of the customer. (d) In deciding what approach to take, the bank must consider its relationship with the customer. Clearly, by adopting a “largest to smallest” approach, it is going to anger some customers, who may well decide to leave the bank and go to a more customer-friendly bank. However, it could be argued that some of the customers the bank may lose are customers that are frequently overdrawn and therefore costly to the bank. Also, it can be time-consuming to change banks, and most people don’t have the spare time to change banks unless they really need to. (e) Answer will vary depending on student’s opinion. Solutions Manual 7-79 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition Legal Notice Copyright Copyright © 2009 by John Wiley & Sons Canada, Ltd. or related companies. All rights reserved. The data contained in these files are protected by copyright. This manual is furnished under licence and may be used only in accordance with the terms of such licence. The material provided herein may not be downloaded, reproduced, stored in a retrieval system, modified, made available on a network, used to create derivative works, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise without the prior written permission of John Wiley & Sons Canada, Ltd. Solutions Manual 7-80 Chapter 7 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.