ch08

advertisement

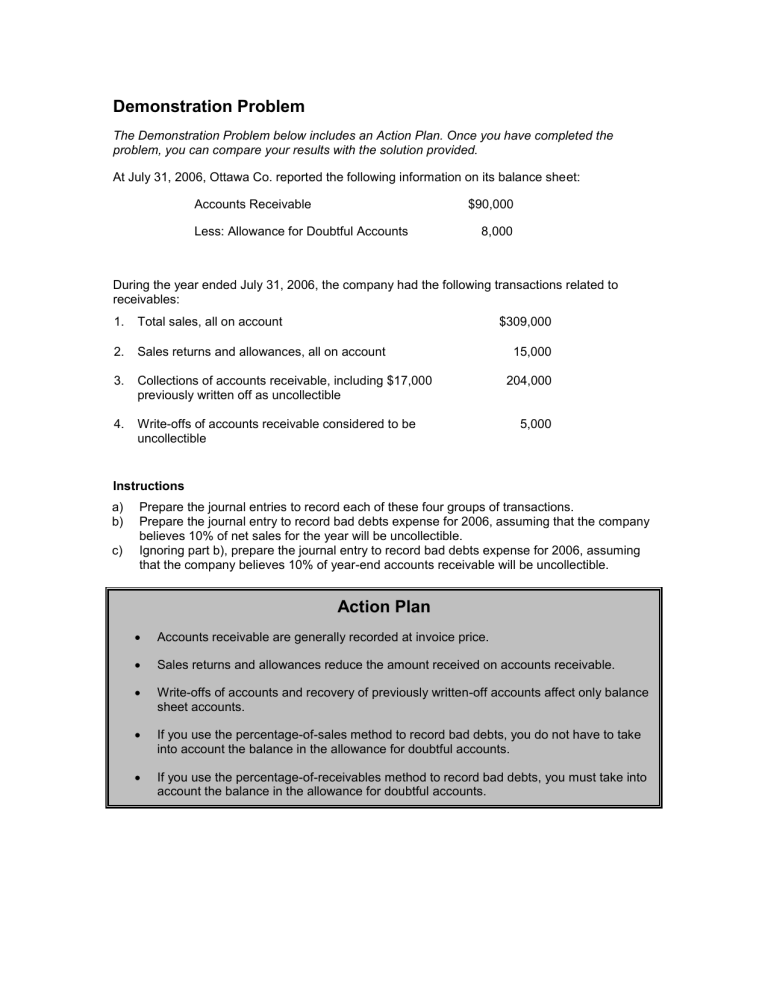

Demonstration Problem The Demonstration Problem below includes an Action Plan. Once you have completed the problem, you can compare your results with the solution provided. At July 31, 2006, Ottawa Co. reported the following information on its balance sheet: Accounts Receivable $90,000 Less: Allowance for Doubtful Accounts 8,000 During the year ended July 31, 2006, the company had the following transactions related to receivables: 1. Total sales, all on account $309,000 2. Sales returns and allowances, all on account 3. Collections of accounts receivable, including $17,000 previously written off as uncollectible 4. Write-offs of accounts receivable considered to be uncollectible 15,000 204,000 5,000 Instructions a) b) c) Prepare the journal entries to record each of these four groups of transactions. Prepare the journal entry to record bad debts expense for 2006, assuming that the company believes 10% of net sales for the year will be uncollectible. Ignoring part b), prepare the journal entry to record bad debts expense for 2006, assuming that the company believes 10% of year-end accounts receivable will be uncollectible. Action Plan Accounts receivable are generally recorded at invoice price. Sales returns and allowances reduce the amount received on accounts receivable. Write-offs of accounts and recovery of previously written-off accounts affect only balance sheet accounts. If you use the percentage-of-sales method to record bad debts, you do not have to take into account the balance in the allowance for doubtful accounts. If you use the percentage-of-receivables method to record bad debts, you must take into account the balance in the allowance for doubtful accounts. Solution to Demonstration Problem a) 2006 Accounts Receivable Sales 309,000 309,000 To record credit sales for the year Sales Returns and Allowances Accounts Receivable 15,000 15,000 To record sales returns and allowance for the year Accounts Receivable Allowance for Doubtful Accounts 17,000 17,000 Cash 204,000 Accounts Receivable 204,000 To reverse the write-off of accounts receivable and record collections for the year Allowance for Doubtful Accounts Accounts Receivable 24,000 24,000 To write off accounts receivable that are considered uncollectible b) Bad Debt Expense 30,900 Allowance for Doubtful Accounts 30,900 To record the bad debt estimate for the year, 10% x $309,000 c) Bad Debt Expense 10,700 Allowance for Doubtful Accounts 10,700 To record the bad debt estimate for the year, 10% x $117,000* – existing allowance of $1,000** * Year-end Accounts Receivable balance ** Year-end Allowance for Doubtful Accounts before adjustment Opening Returns Collections Reinstated Written off Opening Re-instated Write-offs 90,000 DR (15,000) (204,000) 17,000 (5,000) 117,000 DR 8,000 CR 17,000 CR (24,000) DR 1,000 CR