MACROECONOMICS

advertisement

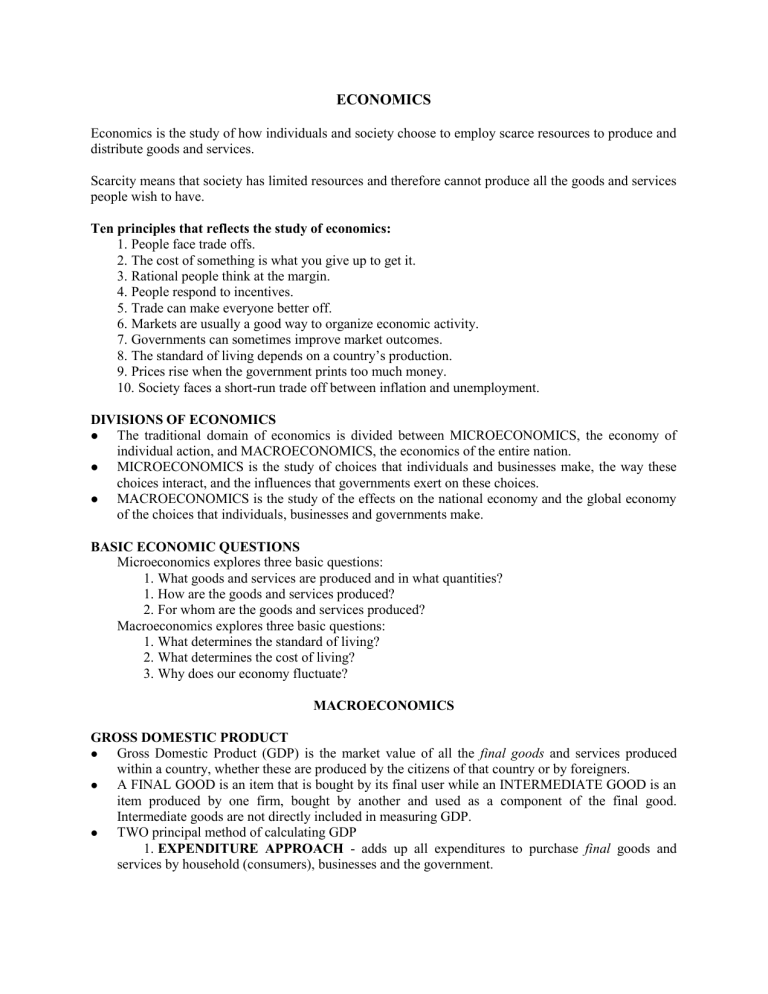

ECONOMICS Economics is the study of how individuals and society choose to employ scarce resources to produce and distribute goods and services. Scarcity means that society has limited resources and therefore cannot produce all the goods and services people wish to have. Ten principles that reflects the study of economics: 1. People face trade offs. 2. The cost of something is what you give up to get it. 3. Rational people think at the margin. 4. People respond to incentives. 5. Trade can make everyone better off. 6. Markets are usually a good way to organize economic activity. 7. Governments can sometimes improve market outcomes. 8. The standard of living depends on a country’s production. 9. Prices rise when the government prints too much money. 10. Society faces a short-run trade off between inflation and unemployment. DIVISIONS OF ECONOMICS The traditional domain of economics is divided between MICROECONOMICS, the economy of individual action, and MACROECONOMICS, the economics of the entire nation. MICROECONOMICS is the study of choices that individuals and businesses make, the way these choices interact, and the influences that governments exert on these choices. MACROECONOMICS is the study of the effects on the national economy and the global economy of the choices that individuals, businesses and governments make. BASIC ECONOMIC QUESTIONS Microeconomics explores three basic questions: 1. What goods and services are produced and in what quantities? 1. How are the goods and services produced? 2. For whom are the goods and services produced? Macroeconomics explores three basic questions: 1. What determines the standard of living? 2. What determines the cost of living? 3. Why does our economy fluctuate? MACROECONOMICS GROSS DOMESTIC PRODUCT Gross Domestic Product (GDP) is the market value of all the final goods and services produced within a country, whether these are produced by the citizens of that country or by foreigners. A FINAL GOOD is an item that is bought by its final user while an INTERMEDIATE GOOD is an item produced by one firm, bought by another and used as a component of the final good. Intermediate goods are not directly included in measuring GDP. TWO principal method of calculating GDP 1. EXPENDITURE APPROACH - adds up all expenditures to purchase final goods and services by household (consumers), businesses and the government. GDP = C + I + G + (X - M) Where: C- Consumption expenditures (total household spending on consumption goods and services) I- Investment (firm’s purchase of plants, equipment, buildings, and addition to inventories) G- Government purchases (government spending on goods and services) (X-M)- Net exports (exports minus imports = ‘foreign’ sales- ‘foreign’ purchases) 2. INCOME APPROACH - adds the compensation of employees, net interest, rental income, corporate profits and proprietors’ income. Where: National income- is the total income earned by citizens and businesses of a country. It consists of employee compensation, rent, interest, and profits. Other Income Terms: Personal income- measures all income actually received by individuals. Disposable personal income- is personal income minus personal income taxes and payroll taxes. GNP = GDP + NFFY NFFY= Factor income from the rest of the world – Factor income to the rest of the world NET FOREIGN FACTOR INCOME (NFFY)- is the income from foreign domestic factor sources minus foreign factor incomes earned domestically. Gross National Product (GNP)- is the total and final output of land, labor, capital, and entrepreneurial ability produced by the country’s citizens, produced whether inside the country or elsewhere abroad. GDP is measured either in current prices (nominal GDP) or in prices of a given year (real GDP): NOMINAL GDP - the value of final goods and services produced by a domestic economy for a year at current market prices. REAL GDP - the value of final goods and services produced in a given year when valued at constant prices. INFLATION AND UNEMPLOYMENT INFLATION exists when there is a sustained increase in the price level. The PRICE LEVEL is the average level of prices. FREQUENTLY USED MEASURES OF THE PRICE LEVEL CONSUMER PRICE INDEX (CPI) -measures the price changes for goods and services purchased by consumers. Inflation Rate (CPI thisyear ) (CPIlast year ) CPIlast year X100 PRODUCER PRICE INDEX (PPI) - measures the price changes for goods at the wholesale level, specifically finished goods, intermediate goods, and crude materials. GDP DEFLATOR - measures the changes in price for goods and services included in GDP. GDP Deflator Normal GDP 100 Real GDP Primary causes of inflation: DEMAND-PULL INFLATION - happens when there is excess or too much demand for certain goods and services that are not met by a corresponding increase in the supply of those goods and services. COST- PUSH INFLATION- happens when there is a general increase in the cost of production that may be due to higher wages or increase in the cost of raw materials and other inputs. The PHILIP CURVE shows a historical inverse relationship between the rate of unemployment and the rate of inflation in an economy People are unemployed because of: FRICTIONAL UNEMPLOYMENT STUCTURAL UNEMPLOYMENT CYCLICAL UNEMPLOYMENT FISCAL POLICY vis-a`-vis MONETARY POLICY A country uses FISCAL and MONETARY policies to effectively counter inflation and inflationary tendencies. FISCAL POLICY- is a government actions, such as taxes, subsidies and government spending, designed to achieve economic goals. Taxes are levied by a government based on two general principles; (1)ability to pay (2) derived benefit. The following are the major types of taxes: INCOME TAX PROPERTY TAX VALUE ADDED TAX Changing interest rates and the amount of money in the economy is called MONETARY POLICY; these actions, done to counter inflation, are under the control of BANGKO SENTRAL NG PILIPINAS (BSP); When economy is in rescission, BSP might lower interest rates and inject money in the economy. Whn economy is in rapid expansion, BSP might increase interest rates to slow real GDP growth and prevent inflation from increasing. INTERNATIONAL TRADE AND FOREIGN EXCHANGE RATE The value of exports minus the value of imports is called the BALANCE OF TRADE TRADE SURPLUS - when a nation exports more than it imports. TRADE DEFICIT - when a nation imports more that it exports. Government restricts international trade to protect domestic industries from foreign competition by imposing TARIFF (a tax on an imported product) and QUOTA (a restrictions on the amount of a good that may be imported during a period). FLOATING EXCHANGE RATE – the value of dollar in terms of peso is determined by the forces of supply and demand. FOREIGN CURRENCY RATE - is the price at which one currency exchanges for another. Currency Depreciation -Decrease in the value of domestic currency in terms of foreign currency -Makes domestic goods cheaper in foreign country -Philippine peso depreciating from $1=P55 to $1=P60 Currency Appreciation -Increase in the value of domestic currency in terms of foreign currency -Makes foreign goods cheaper in domestic country -Philippine peso appreciating from $1=P60 to $1=P55 FOREIGN EXCHANGE MARKET- A market in which kind of money is traded for a different kind of money, that is, where the currency of a foreign country can be purchased or sold. GLOBALIZATION The growing integration of economies and societies around the world (The World Bank) Three Major Areas: Economic Globalization - refers to the free movement of goods, capital, services, technology and information. Cultural Globalization- refers to the transmission of ideas, meanings, and values around the world. Political Globalization- refers to the growth of the worldwide political systems, both in size and complexity. Features of Globalization Growth of Multinational Companies Reduction of Trade Barriers Spread Ideas, Technology and Scientific Advances Advantages of Globalization Reducing Poverty Peace Promote International Equality Disadvantages of Globalization Has the potential for powerful nations to take advantage of weaker ones Spread of ideas and goods that are dangerous Free Trade Risk Detrimental to Middle Class Countries Contribute to Global Warming