Tests15 17Questions

Table 15-1

Quantity

5

6

7

8

1

2

3

4

9

10

Price

23

17

35

29

Total

Revenue

35

64

120

99

80

Average

Revenue

32

11

8

Marginal

Revenue

29

17

11

-1

-7

-13

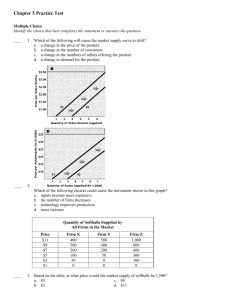

67. Refer to Table 15-1 . If the monopolist sells 8 units of its product, how much total revenue will it receive from the sale? a. 14 b. 40 c. 112 d. 164

68. Refer to Table 15-1 . If the monopolist wants to maximize its revenue, how many units of its product should itsell? a. 4 b. 5 c. 6 d. 8

69.

Refer to Table 15-1 . When 4 units of output are produced and sold, what is average revenue? a. 17 b. 21 c. 23 d. 26

70. Refer to Table 15-1 . What is the marginal revenue for the monopolist for the sixth unit sold? a. 3 b. 5 c. 11 d. 17

71. Refer to Table 15-1 . Assume this monopolist's marginal cost is constant at $12. What quantity of output (Q) will it produce and what price (P) will it charge? a. Q = 4, P = $29 b. Q = 4, P = $26 c. Q = 5, P = $23 d. Q = 7, P = $17

102. What is the monopolist's profit under the following conditions? The profit-maximizing price charged for goods produced is $12. The intersection of the marginal revenue and marginal cost curves occurs where output is 10 units and marginal cost is $6. Average total cost for 10 units of output is $5. a. $60 b. $70 c. $100 d. $120

103. What is the monopolist's profit under the following conditions? The profit-maximizing price charged for goods produced is $14. The intersection of the marginal revenue curve and the marginal cost curve occurs where output is 15 units and marginal cost is $7. a. $90 b. $105 c. $180 d. Not enough information is given to determine the answer.

106. If a monopolist sells 100 units at $8 per unit and realizes an average total cost of $6 per unit, what is the monopolist's profit? a. $200 b. $400 c. $600 d. $800

107.Suppose a firm has a monopoly on the sale of widgets and faces a downward-sloping demand curve. When selling the 100 th widget, the firm will always receive a. less marginal revenue on the 100 th widget than it received on the 99 th widget. b. more average revenue on the 100 th widget than it received on the 99 th widget. c. more total revenue on the 100 widgets than it received on the first 99 widgets. d. a lower average cost per unit at 100 units output than at 99 units of output.

112. A monopolist can sell 200 units of output for $36.00 per unit. Alternatively, it can sell 201 units of output for

$35.80 per unit. The marginal revenue of the 201 st unit of output is a. $-4.20. b. $-0.20. c. $4.20. d. $35.80.

113. A monopoly firm can sell 150 units of output for $10.00 per unit. Alternatively, it can sell 151 units of output for $9.95 per unit. The marginal revenue of the 151 st unit of output is a. $-2.45. b. $-0.05. c. $2.45. d. $9.95.

Scenario 15-2

A monopoly firm maximizes its profit by producing Q = 500 units of output. At that level of output, its marginal revenue is $30, its average revenue is $60, and its average total cost is $34.

114.

Refer to Scenario 15-2 . The firm's profit-maximizing price is a. $30. b. between $30 and $34. c. between $34 and $60. d. $60.

115. Refer to Scenario 15-2 . At Q = 500, the firm's total revenue is a. $13,000. b. $15,000. c. $17,000. d. $30,000.

116. Refer to Scenario 15-2.

The firm's maximum profit is a. $13,000. b. $15,000. c. $17,000. d. $30,000.

117. Refer to Scenario 15-2 . At Q = 500, the firm's marginal cost is a. less than $30. b. $30. c. $34. d. greater than $34.

Start with:

129. Suppose when a monopolist produces 75 units its average revenue is $10 per unit, its marginal revenue is $5 per unit, its marginal cost is $6 per unit, and its average total cost is $5 per unit. What can we conclude about this monopolist? a. The monopolist is currently maximizing profits and its total profits are $375. b. The monopolist is currently maximizing profits and its total profits are $300. c. The monopolist is not currently maximizing profits; it should produce more units and charge a lower price to maximize profits. d. The monopolist is not currently maximizing profits; it should produce fewer units and charge a higher price to maximize profits.

3

4

5

6

7

8

Table 15-2

Dreher's Designer Shirt Company, a monopolist, has the following cost and revenue information.

COSTS

Quantity

Produced

Total Cost

($)

Marginal

Cost

REVENUES

Quantity

Demanded

Price

($/unit)

Total

Revenue

Marginal

Revenue

0

1

100

140

-- 0

1

170

160

--

2 184 2 150

230

280

335

395

475

565

3

4

5

6

7

8

140

130

120

110

100

90

132. Refer to Table 15-2 . What is the marginal cost of the 6th shirt? a. $44 b. $46 c. $55 d. $60

133. Refer to Table 15-2 . What is the marginal cost of the 8th shirt? a. $50 b. $60 c. $90 d. $110

134. Refer to Table 15-2 . What is the total revenue from selling 6 shirts? a. $100 b. $600 c. $625 d. $660

135. Refer to Table 15-2 . What is the total revenue from selling 8 shirts? a. $90 b. $695 c. $720 d. $800

136. Refer to Table 15-2 . What is the marginal revenue from selling the 2nd shirt? a. $140 b. $150 c. $160 d. $170

137. Refer to Table 15-2 . What is the marginal revenue from selling the 8th shirt? a. $10 b. $20 c. $40 d. $90

138. Refer to Table 15-2 . What is the average revenue when 7 shirts are sold? a. $40 b. $90 c. $100 d. $700

139. Refer to Table 15-2 . Which of the following quantities will achieve the maximum profit? a. 3 b. 4 c. 6 d. 7

140. Refer to Table 15-2 . What is total profit at the profit-maximizing quantity? a. $100 b. $245 c. $265 d. $395

141. Refer to Table 15-2 . What are Dreher's Designer Shirt Company's fixed costs? a. $0 b. $100 c. $600 d. $745

142. Refer to Table 15-2 . What is the total variable cost of production when six units are produced? a. $100 b. $295 c. $600 d. $620

149.If a monopolist has zero marginal costs it will produce a. the output at which total revenue is maximized. b. in the range in which marginal revenue is still increasing. c. at the point at which marginal revenue is at a maximum. d. in the range in which marginal revenue is negative.

ANS: A PTS: 1 DIF: 3 REF: 15-2 TOP: Pricing MSC: Analytical

162.Consider a profit-maximizing monopoly pricing under the following conditions. The profit-maximizing price charged for goods produced is $12.The intersection of the marginal revenue and marginal cost curves occurs where output is 10 units and marginal cost is $6. The socially efficient level of production is 12 units. The demand curve and marginal cost curves are linear. What is the deadweight loss? a. $4 b. $6 c. $12 d. $16

ANS: B PTS: 1 DIF: 3 REF: 15-3 TOP: Deadweight loss MSC: Applicative

176. Which of the following statements is correct? a. The benefits that accrue to a monopoly’s owners are equal to the costs that are incurred by consumers of that firm's product. b. The deadweight loss that arises in monopoly stems from the fact that the profit-maximizing monopoly firm produces a quantity of output that exceeds the socially-efficient quantity. c. The deadweight loss caused by monopoly is similar to the deadweight loss caused by a tax on a product. d. The primary social problem caused by monopoly is monopoly profit.

ANS: C PTS: 1 DIF: 3 REF: 15-3 TOP: Deadweight loss MSC: Interpretive

Figure 15-6

177. Refer to Figure 15-6 . To maximize total surplus, a benevolent social planner would choose which of the following outcomes? a. 100 units of output and a price of $10 per unit b. 150 units of output and a price of $10 per unit c. 150 units of output and a price of $15 per unit d. 200 units of output and a price of $10 per unit

ANS: C PTS: 1

TOP: Total surplus

DIF: 2 REF: 15-3

MSC: Analytical

178. Refer to Figure 15-6 . To maximize its profit, a monopolist would choose which of the following outcomes? a. 100 units of output and a price of $10 per unit b. 100 units of output and a price of $20 per unit c. 150 units of output and a price of $15 per unit d. 200 units of output and a price of $20 per unit

179. Refer to Figure 15-6 . The monopolist's maximum profit a. is $800. b. is $1,000. c. is $1,250. d. cannot be determined from the diagram.

ANS: D

TOP: Profit

PTS: 1

MSC: Analytical

DIF: 2 REF: 15-3

180. Refer to Figure 15-6 . The deadweight loss caused by a profit-maximizing monopoly amounts to a. $150. b. $200. c. $250. d. $300.

ANS: C PTS: 1

TOP: Deadweight loss

DIF: 2 REF: 15-3

MSC: Applicative

22.For a long while, electricity producers were thought to be a classic example of a natural monopoly. People held this view because a. the average cost of producing units of electricity by one producer in a specific region was lower than if the same quantity were produced by two or more producers in the same region. b. the average cost of producing units of electricity by one producer in a specific region was higher than if the same quantity were produced by two or more produced in the same region. c. the marginal cost of producing units of electricity by one producer in a specific region was higher than if the same quantity were produced by two or more producers in the same region. d. electricity is a special non-excludable good that could never be sold in a competitive market.

ANS: A PTS: 1 DIF: 2 REF: 15-4

TOP: Natural monopoly MSC: Interpretive

Scenario 15-3

Black Box Cable TV is able to purchase an exclusive right to sell a premium movie channel (PMC) in its market area. Let's assume that Black Box Cable pays $150,000 a year for the exclusive marketing rights to PMC. Since

Black Box has already installed cable to all of the homes in its market area, the marginal cost of delivering PMC to subscribers is zero. The manager of Black Box needs to know what price to charge for the PMC service to maximize her profit. Before setting price, she hires an economist to estimate demand for the PMC service. The economist discovers that there are two types of subscribers who value premium movie channels. First are the

4,000 die-hard TV viewers who will pay as much as $150 a year for the new PMC premium channel. Second, the

PMC channel will appeal to about 20,000 occasional TV viewers who will pay as much as $20 a year for a subscription to PMC.

29. Refer to Scenario 15-3 . If Black Box Cable TV is unable to price discriminate, what price will it choose to maximize its profit, and what is the amount of the profit? a. price = $20; profit = $400,000 b. price = $20; profit = $330,000 c. price = $150; profit = $450,000 d. price = $150; profit = $600,000

ANS: C PTS: 1

TOP: Price discrimination

DIF: 2 REF: 15-5

MSC: Applicative

30. Refer to Scenario 15-3 . If Black Box Cable TV is able to price discriminate, what would be the maximum amount of profit it could generate? a. $500,000 b. $600,000 c. $850,000 d. $925,000

ANS: C PTS: 1

TOP: Price discrimination

DIF: 2 REF: 15-5

MSC: Applicative

31. Refer to Scenario 15-3 . What is the deadweight loss associated with the nondiscriminating pricing policy compared to the price discriminating policy? a. $375,000 b. $400,000 c. $475,000 d. It cannot be determined from the information provided.

ANS: B PTS: 1 DIF: 3 REF: 15-5

TOP: Deadweight loss MSC: Applicative

60. A monopolist faces the following demand curve:

Price

$8

Quantity Demanded

300

$7

$6

$5

$4

$3

400

500

600

700

800

$2

$1

900

1,000

The monopolist has fixed costs of $1,000 and has a constant marginal cost of $2 per unit. If the monopolist were able to perfectly price discriminate, how many units would it sell? a. 400 b. 500 c. 900 d. 4,200

66. An airline knows that there are two types of travelers: business travelers and vacationers. For a particular flight, there are 100 business travelers who will pay $600 for a ticket while there are 50 vacationers who will pay $300 for a ticket. There are 150 seats available on the plane. Suppose the cost to the airline of providing the flight is $20,000, which includes the cost of the pilots, flight attendants, fuel, etc. How much profit will the airline earn if it sets the price of a ticket at $600? a. -$5,000 b. $15,000 c. $40,000 d. $70,000

ANS: C PTS: 1

TOP: Price discrimination

DIF: 2

MSC: Analytical

REF: 15-5

67. An airline knows that there are two types of travelers: business travelers and vacationers. For a particular flight, there are 100 business travelers who will pay $600 for a ticket while there are 50 vacationers who will pay $300 for a ticket. There are 150 seats available on the plane. Suppose the cost to the airline of providing the flight is $20,000, which includes the cost of the pilots, flight attendants, fuel, etc. How much additional profit can the firm earn by charging each customer their willingness to pay relative to charging a flat price of

$600 per ticket? a. $15,000 b. $25,000 c. $40,000 d. $70,000

ANS: A PTS: 1

TOP: Price discrimination

DIF: 3

MSC: Analytical

REF: 15-5

Ch.17

Questions to Test # 4

119. A monopolistically competitive firm has the following cost structure:

Output 1 2 3 4 5 6 7

Total Cost($) 30 32 36 42 50 63 77

The firm faces the following demand curve:

Price ($) 20 18 15

Quantity 1 2 3

12

4

The firm faces the following demand curve:

Price ($) 20 18 15

Quantity 1 2 3

12

4

9

5

To maximize profit (or minimize losses), the firm will produce a. 2 units. b. 3 units. c. 4 units. d. 5 units.

ANS: B PTS: 1

TOP: Profit maximization

DIF: 3 REF: 17-1

MSC: Applicative

120. A monopolistically competitive firm has the following cost structure:

Output 1 2 3 4 5 6 7

Total Cost($) 30 32 36 42 50 63 77

9

5

7

6

7

6

4

7

4

7

If the government forces this firm to produce at its efficient scale, it will a. produce 3 units and make $9. b. produce 4 units and make $6. c. produce 5 units and lose $5. d. produce 7 units and lose $49.

ANS: C PTS: 1 DIF: 3 REF: 17-1

TOP: Regulation MSC: Applicative

Figure 17-5

123. Refer to Figure 17-5.

This figure depicts a situation in a monopolistically competitive market. What price will the monopolistically competitive firm charge in this market? a. $60 b. $70 c. $75 d. $80

124. Refer to Figure 17-5.

This figure depicts a situation in a monopolistically competitive market. How much consumer surplus will be derived from the purchase of this product at the monopolistically competitive price? a. $200.00 b. $312.50 c. $400.00 d. $800.00

ANS: A PTS: 1

TOP: Consumer surplus

DIF: 3

MSC: Analytical

REF: 17-1

125. Refer to Figure 17-5.

This figure depicts a situation in a monopolistically competitive market. How much profit will the monopolistically competitive firm earn in this situation? a. A $10 profit. b. A $20 profit. c. A $200 profit. d. No profit, since monopolistically competitive firms never earn economic profit.

ANS: C PTS: 1 DIF: 2 REF: 17-1

TOP: Profit MSC: Analytical

126. Refer to Figure 17-5.

This figure depicts a situation in a monopolistically competitive market. How much output will the monopolistically competitive firm produce in this situation? a. 20 units b. 25 units c. 40 units d. No output, since producing in this situation will result in a loss for the firm.

ANS: A PTS: 1 DIF: 2 REF: 17-1

TOP: Output MSC: Analytical

Table 17-3

Traci’s Hairstyling is one salon among many in the market for hairstyling. The following table presents cost and revenue data for Traci’s Hairstyling.

Quantity

Produced

0

1

2

3

4

5

6

7

8

COSTS

Total

Cost

$10

$15

$21

$28

$36

$45

$55

$66

$78

Marginal

Cost

--

Quantity

Demanded

0

1

2

3

4

5

6

7

8

REVENUES

Price

Total

Revenue

$50

$45

$40

$35

$30

$25

$20

$15

$10

Marginal

Revenue

--

144. Refer to Table 17-3.

What is the profit-maximizing output for Traci’s Hairstyling? a. 3 hair treatments b. 4 hair treatments c. 5 hair treatments d. 6 hair treatments

ANS: B PTS: 1

TOP: Profit maximization

DIF: 2 REF: 17-1

MSC: Applicative

145. Refer to Table 17-3.

When maximizing profit, what price does Traci’s charge for hairstyling? a. $20 b. $25 c. $30 d. $35

ANS: C PTS: 1

TOP: Profit maximization

DIF: 2 REF: 17-1

MSC: Applicative

146.

Refer to Table 17-3.

At the profit-maximizing quantity, what is Traci’s total profit? a. $30 b. $59 c. $77 d. $84

ANS: D

TOP: Profit

PTS: 1 DIF: 2

MSC: Applicative

REF: 17-1

147. Refer to Table 17-3.

Given the cost and revenue data, Traci’s is a. not in a long-run equilibrium. More businesses will enter the hair treatment market in the long-run. b. not in a short-run equilibrium. c. not in a long-run equilibrium. Some businesses currently in the hair treatment market will exit the market in the long-run. d. in a long-run equilibrium.

ANS: A PTS: 1

TOP: Long-run equilibrium

DIF: 2 REF: 17-1

MSC: Interpretive

148. Refer to Table 17-3.

If the government required Traci’s to produce at the efficient scale of output, how many hair treatments would Traci’s sell? a. Either 3 or 4 b. Either 4 or 5 c. Either 5 or 6 d. Either 6 or 7

ANS: B PTS: 1

TOP: Efficient scale

DIF: 2 REF: 17-1

MSC: Analytical

149. Refer to Table 17-3.

If the government forced Traci’s to produce at the efficient scale of output, what is the maximum profit Traci’s could earn? a. $77 b. $80 c. $84 d. $96

ANS: C

TOP: Profit

PTS: 1 DIF: 2

MSC: Applicative

REF: 17-1

150. Refer to Table 17-3.

Suppose the government forced Traci’s to produce at the efficient scale of output. Who would be better off as a result of this policy? Who would be worse off as a result of this policy? a. Traci’s; Consumers b. Consumers; Traci’s c. No one; Consumers d. No one; No one

ANS: D PTS: 1 DIF: 2

TOP: Welfare MSC: Interpretive

REF: 17-1

Scenario 17-2

Consider the problem facing two firms, Firm A and Firm B, in the fast-food restaurant market. Each firm has just come up with an idea for a new fast-food menu item which it would sell for $4. Assume that the marginal cost for each new menu item is a constant $2, and the only fixed cost is for advertising. Each company knows that if it spends $12 million on advertising it will get 2 million consumers to try its new product. Firm A has done market research which suggests that its product does not have any "staying" power in the market. Even though it could get 2 million consumers to buy the product once, it is unlikely that they will continue to buy the product in the future. Firm B's market research suggests that its product is very good, and consumers who try the product will continue to be consumers over the ensuing year. On the basis of its market research, Firm B estimates that its initial 2 million customers will buy one unit of the product each month in the coming year, for a total of 24 million units.

186. Refer to Scenario 17-2 . If Firm A decides to advertise its product it can expect to a. get repeat sales above and beyond the initial 2 million consumers. b. increase its market power. c. incur a loss of $8 million. d. have a profit of $4 million.

ANS: C PTS: 1 DIF: 2

TOP: Advertising MSC: Applicative

REF: 17-2

187.

Refer to Scenario 17-2 . If firm B decides to advertise its product it can expect to a. have a profit of $48 million per year. b. have a profit of $36 million per year. c. incur a loss of $12 million per year. d. exit the industry.

ANS: B PTS: 1 DIF: 2

TOP: Advertising MSC: Applicative

REF: 17-2

188. Refer to Scenario 17-2 . By its willingness to spend money on advertising, Firm B a. signals the quality of its new product to consumers. b. signals that it is not a profit maximizer. c. is detracting from the efficiency of markets. d. will drive Firm A out of the market.

ANS: A PTS: 1 DIF: 2 REF: 17-2

TOP: Advertising MSC: Interpretive

189. Refer to Scenario 17-2 . On the basis of a theory that people buy a product because it is advertised, the content of advertisements for Firm B's product a. should focus on quality comparisons in order to be successful. b. should definitely include celebrity endorsements in order to be successful. c. is critical to the success of the product in the market. d. is irrelevant to the success of the advertisement.

ANS: D PTS: 1 DIF: 2 REF: 17-2

TOP: Advertising MSC: Interpretive

Table 16-10

Two discount superstores (Ultimate Saver and SuperDuper Saver) in a growing urban area are interested in expanding their market share. Both are interested in expanding the size of their store and parking lot to accommodate potential growth in their customer base. The following game depicts the strategic outcomes that result from the game. Growth-related profits of the two discount superstores are shown in the table below.

SuperDuper Saver

Increase the size of store and parking lot

Do not increase the size of store and parking lot

Ultimate

Saver

Increase the size of store and parking lot

Do not increase the size of store and parking lot

SuperDuper Saver = $50

Ultimate Saver = $65

SuperDuper Saver = $250

Ultimate Saver = $35

SuperDuper Saver = $25

Ultimate Saver = $275

SuperDuper Saver = $85

Ultimate Saver = $135

136. Refer to Table 16-10 . The dominant strategy is to increase the size of its store and parking lot for a. SuperDuper Saver, but not for Ultimate Saver. b. Ultimate Saver, but not for SuperDuper Saver. c. both stores. d. neither store.

ANS: C PTS: 1

TOP: Dominant strategy

DIF: 2 REF: 16-3

MSC: Applicative

137. Refer to Table 16-10 . If both stores follow a dominant strategy, Ultimate Saver's growth-related profits will be a. $35. b. $65. c. $135. d. $275.

ANS: B PTS: 1 DIF: 2 REF: 16-3

TOP: Game theory MSC: Applicative

138. Refer to Table 16-10 . If both stores follow a dominant strategy, SuperDuper Saver's growth-related profits will be a. $25. b. $50. c. $85. d. $250.

ANS: B PTS: 1

TOP: Game theory

DIF: 2 REF: 16-3

MSC: Applicative

139. Refer to Table 16-10 . When this game reaches a Nash equilibrium, the dollar value of growth-related profits will be a. Ultimate Saver $35 and SuperDuper Saver $250. b. Ultimate Saver $65 and SuperDuper Saver $50. c. Ultimate Saver $275 and SuperDuper Saver $25. d. Ultimate Saver $135 and SuperDuper Saver $85.

ANS: B PTS: 1

TOP: Nash equilibrium

DIF: 2 REF: 16-3

MSC: Applicative

140. Refer to Table 16-10 . Suppose the owners of SuperDuper Saver and Ultimate Saver meet for a friendly game of golf one afternoon and happen to discuss a strategy to optimize growth related profit. They should both agree to a. increase their store and parking lot sizes. b. refrain from increasing their store and parking lot sizes. c. be more competitive in capturing market share. d. share the context of their conversation with the Federal Trade Commission.

ANS: B PTS: 1 DIF: 2 REF: 16-3

TOP: Cartels MSC: Applicative