Application of the Power Exchange

advertisement

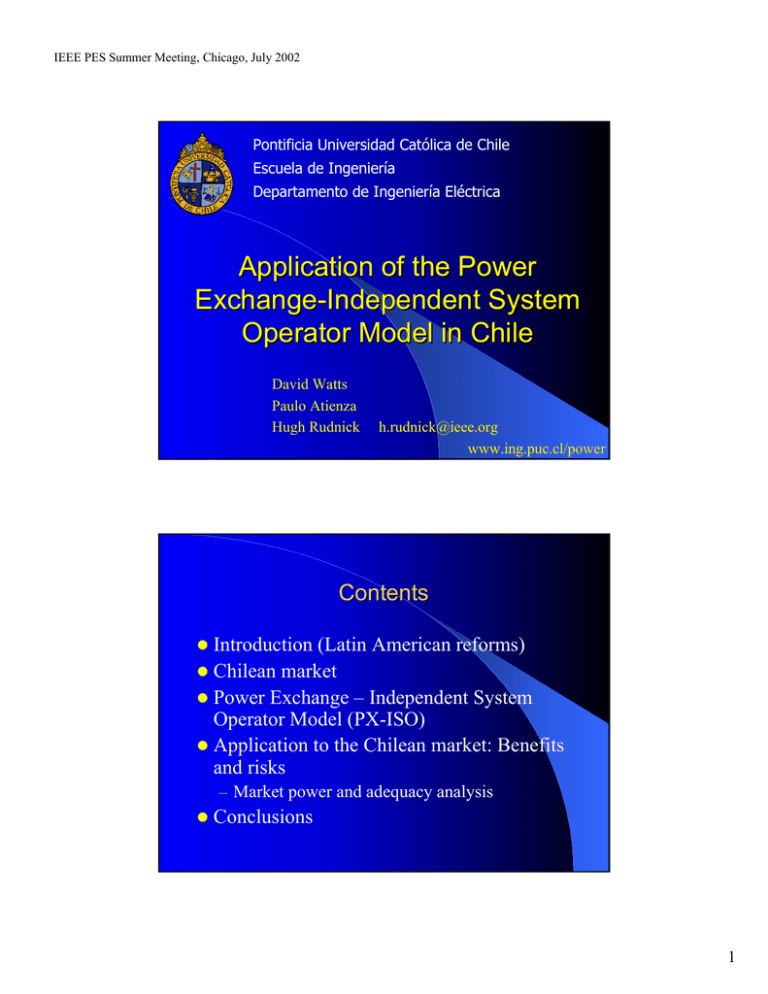

IEEE PES Summer Meeting, Chicago, July 2002 Pontificia Universidad Católica de Chile Escuela de Ingeniería Departamento de Ingeniería Eléctrica Application of the Power Exchange-Independent System Operator Model in Chile David Watts Paulo Atienza Hugh Rudnick h.rudnick@ieee.org www.ing.puc.cl/power Contents z Introduction (Latin American reforms) z Chilean market z Power Exchange – Independent System Operator Model (PX-ISO) z Application to the Chilean market: Benefits and risks – Market power and adequacy analysis z Conclusions 1 IEEE PES Summer Meeting, Chicago, July 2002 Objectives z z Describe Chilean reform process in the Latin American environment. Analyze the actual regulatory framework and its performance – Energy crisis and its results z Describe PX – ISO Model – Identify the risks associated with the implementation of the proposed model in the Chilean market Latin American Reforms 1 z High load growth z Mainly hydro systems z Lower PGB and KWh per capita than developed nations z ¿Why reform? – State unable to continue high investments – Other reasons: z Political intervention (very low tariffs) z Management problems z High losses z Economic and financial crisis 2 IEEE PES Summer Meeting, Chicago, July 2002 Latino American Reforms 2 1997-9 CENTRAL AMERICA & PANAMA 1994 COLOMBIA 1993 PERU 1998 BRAZIL 1994 BOLIVIA 1982 CHILE 1992 ARGENTINA Latin American Reforms 3 z Objective: To establish conditions for economic efficiency and attract private investment z Centralized planning and operation replaced by market-oriented approaches z Only subsidiary role by State: z z Intervenes only when private sector does not Monopoly regulation and control 3 IEEE PES Summer Meeting, Chicago, July 2002 Wholesale Market z Wholesale market deregulation – Large consumers (FREE): unregulated prices, use bilateral financial contracts – Small consumers (REGULATED): pass through z Competition at generation level with centralized generation dispatch (Poolco model) – Audited costs: Chile, Perú, Brazil, Central America – Bids: Colombia, Argentina Chilean Wholesale Market (2000) Central SIC SING Northern SING Composition Hydro: 61% Thermal: 39% Hydro: 0% Thermal: 100% I Consumers (% Load) Regulated: 60% Free: 40% Regulated: 10% Free: 90% C Installed capacity: 6642 MW 3352 MW Max Demand 4576 MW 1175 MW Energy Consumption 29577 GWh 9327 GWh Others Mainly residential, 90% of Chilean population. Mainly industrial and mining S 4 IEEE PES Summer Meeting, Chicago, July 2002 Chilean Wholesale Market z z z z z Central cost based dispatch, by the pool CDEC (Centro de Despacho Económico de Carga) Thermal Gen variable costs are audited Hydro Gen dispatched according to the alternative cost of water calculated by CDEC models Marginal cost transactions only among generators Capacity payment: to generators contributing with capacity in the yearly peak demand period (may-sep). Depends on availability, time to start and time to full load. Independent of dispatch z z Capacity price defined by regulator every six month, fixed cost of gas turbine. Contracts are financial hedges Chilean Wholesale Market Small Generator CDEC (pool) Generator CMg Physical, economic and commercial system operation by CDEC (pool) Generator Transmitter Regulated Price Distributor Regulated Price + VAD (value added distribution cost) Regulated consumer Bilateral financial contracts Unregulated consumer 5 IEEE PES Summer Meeting, Chicago, July 2002 Actual Chilean Model: Results Price Reductions Second Chilean System: Northern SING (Thermal Main Chilean System: Central SIC (Hydrothermal) Actual Chilean Model: Results z Price reductions (Mainly at SING) z Investments following high growth (but it was reduced at SIC after crisis) z Tight poolco has limited market power z Prices reflecting marginal costs z Increasing coverage, security of supply and efficiency z State focused on other social needs 6 IEEE PES Summer Meeting, Chicago, July 2002 Electricity Chilean Crisis z Centennial drought 1998-99 z Important natural gas combined cycle failure z Crisis in Central System (SIC), mainly hydro system z Rotating blackouts Electricity Chilean Crisis z Reservoir Stored Energy 7.000 5.000 4.000 3.000 2.000 1.000 RAPEL INVERNADA COLBUN CHAPO 07-2001 04-2001 01-2001 10-2000 07-2000 04-2000 01-2000 10-1999 07-1999 04-1999 01-1999 10-1998 07-1998 04-1998 01-1998 10-1997 07-1997 04-1997 01-1997 10-1996 07-1996 04-1996 01-1996 10-1995 07-1995 04-1995 01-1995 10-1994 07-1994 04-1994 0 01-1994 GIGAWATTS HORA (GWh) 6.000 LAJA 7 IEEE PES Summer Meeting, Chicago, July 2002 Electricity Chilean Crisis z Poor handling of supply crisis z Conflicts in wholesale market (deficiencies in market design) – Absence of prices to cope with crisis – Contracts do not oblige generators to serve or compensate (law changed during emergency) z Investment trend slows down z No new agents coming into the market Chilean Reform Draft z Creation of Power Exchange PX and Independent System Operator ISO replacing the actual pool. – PX: Economic and commercial operation. It performs auctions, settlement process, and manages day ahead and hour ahead markets. – ISO: Physical operation. It operates transmission grid. It validates PX operations making adjustments if necessary, it determines additional generation and ancillary services. z The law draft proposes to use annual bids in the first years to mitigate market power. 8 IEEE PES Summer Meeting, Chicago, July 2002 PX-ISO Model Bids Transmission Traders Transmission Power Exchange ISO Physical Operation Economic Generators Commercial and Operation Bids Contract s Informs Standardized Forward Markets Demand Real Time Markets Demand Distribution Retailers Major Consumers Supplies Regulated Consumers Benefits z z Transparency and efficiency in commercialization Independence of the market operator from the other agents (present pool is managed by generators and transmission companies with important governance problems) z z z Development of ancillary market Development of future and options market Less centralized decisions – No more discussions about the real marginal cost for transfers among generators – No more centralized models estimating marginal cost of energy and water usage – No more discussion about the costs used for dispatch z Etc. 9 IEEE PES Summer Meeting, Chicago, July 2002 Major Risks in Chilean Market z Market Power* – Cost based scheme and centralized dispatch of water reservoir contribute to mitigate MP z Adequacy** problems – Energy price alone is a weak signal for investment of capacity in hydro systems z High contract levels desirable – When spot market is so profitable, it could be attractive to participate in spot market instead of full contracts coverage * MP: The capacity of a firm to establish prices above the marginal cost. ** Adequacy: Secure Peak Load Capacity in Long Term Market Power z Highly concentrated ownership (SING – SIC) Central SIC Market Share (according to installed capacity) Northern SING: Market Share Colbun S.A 16% AES Gener S.A 22% Others 7% Endesa S.A. 55% (according to Installed Capacity) Endesa 22% Southern Energy 20% 28% AES Gener 30% Tractebel 10 IEEE PES Summer Meeting, Chicago, July 2002 Market Power at SIC z z z z z Small reserve Largest company almost has a technology monopoly over the hydro resources Very high hydro dependence Strategic use of water Market simulations with free bids: z z z z z Watts – Rudnick: Annual bids dispatch would bring price increases around 17-27% in Chile Villar – Rudnick: Short term dispatch using a Nash-Cournot equilibrium also showed important M.P. in Chile Pereira-Barroso-Kelman: Strategic use of water in Brazil High importance of regulated consumers (60% of demand ) Transmission constrains (a strategic issue) Simulation exercise in main Chilean system -Nash-Cournot simulation,everything sold in spot market Resultant prices 100 90 80 Price 70 Competitive 60 50 Unit games 40 30 Company games 20 10 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Periods Game simulation (competitive market; games by generating units and games by companies, maximizing benefits) 11 IEEE PES Summer Meeting, Chicago, July 2002 Market Power at SING z Lower Risk of MP – Excess installed capacity – No hydro dependence – High importance of free consumers (90% of demand). Their bilateral contracts mitigate MP. z This system has important problems of continuity and reliability of service, so an explicit payment for ancillary services in the new scheme could help Adequacy & Capacity Payment z z Adequacy is a very big issue in hydro systems Different ways to remunerate the Capacity – The explicit Capacity Payment has worked well. – Chilean law draft eliminated Capacity Payment, going to a simple energy price scheme. z Why is the Capacity Payment important ? – It is a strong signal for new capacity investments – It reduces the entrant risk, anticipating the entrance of new agents with lower discount rates. 12 IEEE PES Summer Meeting, Chicago, July 2002 Conclusions: Is it the Solution? z z z z PX-ISO Model could bring some improvements to the Chilean model (transparency, independency, financial market development, etc.). The model would work better in Northern SING but problems need to be solved at Central SIC before its establishment. The new model does not present a better solution for market power, strategic use of water, transmission constrains than the older one. Price signals for new capacity additions and promotion of new agents are not clearer under this scheme. Conclusions: Is it the Solution? z The proposed model needs some adjustment to be applied to the main Chilean market (SIC), and to effectively avoid a new crisis and MP exercise. z The proposed use of annual bids could solve transitorily some of these troubles, but denaturalizes the PX. – Possible interconnection of SING-SIC-SADI (Chile-Argentina) would help, opening the market to new agents, but some of them are the same global energy companies installed in Chile now. – The entrance of new economic combined cycle plants would promote competition at base level. With the sustained growth of the demand and the installation of these plants, the strategic hydro plant will loose relevance quickly. z Chilean system needs to increase number of free clients by reducing their power size. 13 IEEE PES Summer Meeting, Chicago, July 2002 Pontificia Universidad Católica de Chile Escuela de Ingeniería Departamento de Ingeniería Eléctrica Application of the Power Exchange-Independent System Operator Model in Chile David Watts Paulo Atienza Hugh Rudnick h.rudnick@ieee.org www.ing.puc.cl/power 14