Community Employment Operating Procedures

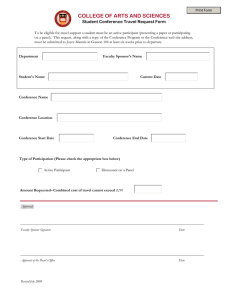

advertisement