(csr) in encapsulating environment, social, and governance (esg)

THE IMPORTANCE OF CORPORATE SOCIAL RESPONSIBILITY

(CSR) IN ENCAPSULATING ENVIRONMENT, SOCIAL, AND

GOVERNANCE (ESG) PRACTICES

Chee Yeung Wong a , Tee Keng Kok b , and Ng, Siew Imm c a

Putra Business School, 43400 Serdang, Selangor, Malaysia

Email: chee.mba13@grad.putrabs.edu.my b

Putra Business School, 43400 Serdang, Selangor, Malaysia

Email: tee@putrabs.edu.my c Universiti Putra Malaysia, 43400 Serdang, Selangor, Malaysia

Email: Imm_ns@upm.edu.my

ABSTRACT

The adoption of FTSE4Good Bursa Malaysia Index (FT4GM) in 2014 reveals

Malaysia's interest in attracting socially responsible investment (SRI) funds. The FT4GM has been designed to identify Malaysian companies with recognised corporate responsibility practices incapsulated in the Environment, Social, and Governance (ESG) criteria. In the introduction of FT4GM, only 24 companies (less than 10% of Malaysian companies) were included. This study is motivated to investigate how these 24 companies qualify for the FTSE4Good listing and the differences among the various sectors in

Malaysia. A comparative analysis was adopted on CSR reports between 12 FTSE4Good

Bursa Malaysia (FT4GM) companies and another 12 companies that are not. From the evaluation of the case studies, it is established that there is a clear distinction between

FT4GM companies and non-FT4GM companies. The findings revealed that firms with a social responsible goal in mind are companies with a (1) clear distinctive ESG policy, (2) direction from the management, (3) strategy towards effective resources allocation, and

(4) measurement system to gauge its effectiveness. This paper suggests legislative and regulatory bodies continue to educate and benchmark corporations in social responsibility and ESG effectiveness in order to understand the future advantages and benefits to the corporations.

Keyword: 1) Environment, Social, and Governance (ESG), 2) Corporate Social Responsibility

(CSR), and 3) Socially Responsible Investment (SRI).

45

1. Introduction

Lydenberg (2013) defined ESG companies as those seeking to create environmental and societal value through their business operations. Key to ESG initiatives is that investors take the longterm view of the investment process. It is with this view of attracting these responsible investors that Bursa Malaysia has decided to introduce a new ESG index based on the Financial Times Stock

Exchange (FTSE) model (Lee, 2014).

Research found that ESG centric companies in Socially Responsbile Investing (SRI) funds do not generate notable costs and benefits as compared to conventional funds and therefore, presents itself as a better alternative (Revelli & Viviani, 2014;

Eccles & Serafeim, 2013; Collison, Cobb,

Power, & Stevenson, 2008; Curran &

Moran, 2007). That is the reason why rating agencies and indices (e.g. FTSE4Good,

Dow Jones Sustainability Index (DJSI),

Domini Social Index, etc.) are important because they provide screening mechanisms and benchmarking for interested parties.

What is Corporate Social Responsibility and why is it important for ESG? Curran and Moran (2007) defined CSR as a company's responsibility for its social and environmental impacts and how companies sought to evaluate and manage these impacts accordingly. In Malaysia, publiclisted companies have been asked to disclose their CSR practices or activities in their annual reports since 2007 (Sustainable

Stock Exchange Initiative online, 2014). In essence, CSR disclosure is the report listing for ESG practices in a company and this is used by ESG indices as a preliminary indicator of the company's ESG policies

(Gates, 2013).

Indices like FTSE4Good and Dow

Jones Sustainability Indices (DJSI) are where SRI companies and firms come to review suitable ESG companies (Lydenberg,

2013). The adoption of FTSE4Good

Malaysia (FT4GM) on 22 December 2014 reveals Malaysia's interest in attracting

SRI funds. A component of SRI is that companies need to be ethical as well as

ESG conscious (Hebb, Louche, & Hachigian,

2014). Yet, according to United Nation’s

Principles for Responsible Investment

(UNPRI), only one Malaysian based company has signed its principles (PRI,

2014). In the introduction of FT4GM, only

24 companies were included (Bursa

Malaysia, 2014). That number indicates less than 10% of Malaysian companies.

Therefore, this indicated that Malaysian public listed companies either do not have adequate ESG structures in place or the mechanism to report (e.g. CSR reports) or are simply not interested in ESG. From a review of current literature, it is found that there is a dearth of research when it comes to ESG practices in Malaysia. Global ESG research focuses mainly on environmental issues and then on governance with minimal investigation on social initiatives.

Furthermore, these studies are conducted primarily in the USA (Galbreath, 2013).

Therefore, it is hoped that this would be able to contribute and fill some gaps in

ESG knowledge and issues in Malaysia and internationally.

1.1 Research Questions and Objectives

It is part of Malaysia's Listing

Requirements that public listed companies disclose their CSR activities in their annual reports and to comply with the Malaysian

Code of Corporate Governance (MCCG)

2012 (Suruhanjaya Sekuriti Malaysia,

2012). In fact, the World Bank has shown in its reports that Malaysia is a country with good investment protection and is a top emerging country for its adoption and compliance with governance standards

(Alnasser, 2012). Therefore, why are there only 24 companies that are initially listed on the FTSE4Good Index of Bursa Malaysia and what did these companies do differently?

This study is set up to ask these specific questions:

RQ1: How do these companies qualify for the FTSE4Good listing?

46

Galbreath (2013) established that the type of industrial impact will affect CSR and categorized these into three types: high, medium, and low impact industries based on FTSE classification. Hence, the next question:

RQ2: What are the differences among the different sectors in Malaysia?

The introduction of FT4GM will put greater emphasis on ESG practices and for

Malaysian companies to update, revise, and implement better ESG and CSR programs and disclosure in a bid to attract

SRI investors. Therefore:

RQ3: Are current CSR measures introduced by the Securities Commission and Bursa Malaysia enough to promote

ESG initiatives in Malaysian companies?

The importance of this knowledge will prepare and inform the readers of the current CSR disclosure required by Bursa

Malaysia. By studying and researching companies that are included in the

FTSE4Good Bursa Malaysia, we can observe how these companies prioritize and integrate

ESG practices into their operations. By conducting an analysis of companies in

Malaysia that is included in the index, it can be established how these companies are included in the index in the first place.

The gap between these two types of companies will provide an insight as to the differences and ESG practices between these two types of companies. Abdul

Razak and Ahmad (2014) theorize that in order for CSR to work in Malaysia,

Malaysia must customize its approach to

CSR. Therefore, from a study of companies included in the initial listing of FT4GM, it is hoped a recommendation can be suggested as to how Malaysian regulatory and rating agencies may be able to encourage CSR.

2. Literature Review

SRI initiatives first started through faith-based investing arms. The 1970's anti-war movement, the civil rights movement, and the Apartheid crisis in

South Africa were key drivers to this early stage of SRI (Louche & Hebb, 2014;

Renneboog, Horst, & Zhang, 2008, Macquet

& Sjostrom, 2013). SRI funds used a variety of strategies to measure a company's ESG practices. Renneboog et. al. (2008) and

Royal and O'Donnell (2014) classified these into 4 broad categories. The first generation is the most common of all and sometimes referred to as negative screening.

Negative screening involves excluding and divesting businesses that do not meet the criteria (Reeneboog et.al., 2008; Gates,

2013; Royal & O'Donnell, 2014). Second generation SRI portfolios are involved with positive screening methods in addition to negative screening (Rennebog et. al.,

2008). The third generation includes average environmental management practices such as triple bottom line (Royal &

O'Donnell, 2014). The fourth generation of screening methods involved a combination of sustainable investing approach with shareholder activism (Renneboog et al.,

2008). The evolution of screening methods signal the continual interest in responsible investing and engagement.

Renneboog et al. (2008) stated that environmental measurements remain the most disclosed of all ESG categories due to their quantitative and financial implications.

This is followed by governance structures.

Research on governance structures of a corporation revealed that there is no one element of the governance code that can affect ethical corporate behavior, but a multitude of contributing factors (Abdifatah,

2013; Esa & Ghazali, 2012; Erwin, 2011;

Saleh, Zulkifli, & Muhamad, 2010; Kaptein

& Schwartz, 2008; Haniffa & Cooke,

2005). Evaluation of societal impact of

ESG companies remains a controversial issue with no clear measurement method and at best, left to individual ratings agencies' discretion (Royal & O'Donnell,

2014; Darus, 2012; Lu & Castka, 2009).

Poor performance in the ESG matrix ensures changes in policies for better ESG

47

performance because of increased scrutiny, poor reputation, and a sharper drop in share price as compared to inclusion

(Louche & Hebb, 2014; Mackenzie, Rees,

& Rodionova, 2013; Stubbs & Rogers,

2013; Consolandi et al., 2009; Collision et al., 2008). Furthermore, responsible investing funds do not suffer as much from financial performance as compared to conventional funds (Collison et al., 2008;

Arora & Dharwadkar, 2011; Escrig-Olmedo,

Munoz-Torres, & Fernandez- Izquierdo,

2013; Revelli & Viviani; 2014) and this contributes to its attractiveness for discerning investors (Hebb et al., 2014). It is discovered that inclusion in FTSE4Good Index has an indirect way of increasing accountability and change, as well as to company reputation and image (Collision, Cobb,

Power, & Stevenson, 2009). It is established that SRI indices and their screening methods provide an incentive towards better ESG practices and CSR disclosure in a firm's financial and corporate activities

(Collison et al., 2009; Consolandi, Jaiswal-

Dale, Poggiani, & Vencelli, 2009; Murphy

& McGrath, 2013; Louche & Hebb, 2014).

CSR disclosure represents an indicator of ESG practices undertaken by the company. It may indicate product quality, conflicts with stakeholders, capital financing, and labor issues (Mackenzie et al., 2013; Jo & Harjoto, 2011). Therefore, the importance of CSR to SRI investors and analysts represent an important step in evaluating ESG practices (or lack of) in corporations and signal the type of business value of a corporation. The impact of CSR has been investigated by many researchers. Gates (2013) established that in the short-term CSR has a negative impact and increases cost, but this is offset by value-creation and provides more legitimacy in the long-term. Rakotomavo

(2012) establishes that CSR investment does not cut into dividends and implies that CSR may increase shareholder value and larger firms tend to engage in CSR.

Erhemjamts, Li, and Venkateswaran (2013) concluded that whether CSR is financially rewarding is a contentious issue with various studies conducted that produce inconclusive or contradictory results. The consequences of better CSR disclosure revealed that companies' are more transparent, and it increases competitive advantage, attracts investments, and is crucial to a corporation's survival (Renneboog et.al.,

2008; Consolandi et.al., 2009; Collison et. al., 2009; Darus, 2012; Filatochev &

Nakajima, 2014; MacKenzie et. al., 2013,

Louche & Hebb, 2014; Eweje, 2014).

How are CSR, ESG, and SRI connected? SRI is a way to identify companies with strong sustainability records and to evaluate as well as improve on ESG standards and performance. Corporate social performance and reports remain one of the first tools SRI analysts and investors will scrutinize when evaluating a corporation's ESG standards (Gates, 2013).

As a result of this literature review, it is observed that SRI has a positive impact upon improved ESG practices and the benefits can be observed primarily in terms of company reputation and its relationship with its stakeholders and indirectly on long term company value.

3. Research Methodology

3.1 Sample Selection and Data Sources

This paper aims to investigate the

ESG practices by using a comparative analysis between FTSE4Good Bursa

Malaysia (FT4GM) companies and a stratified random selection of companies that are not. This allows comparisons to be made by evaluating the actions and practices of both types of companies in the hopes of observing and documenting any differences. A case study approach is used to explore CSR within the context of the

ESG scenario because a case study approach enables the researcher to generate answers to questions of 'why', 'what' and 'how'

(Saunders, Lewis, & Thornhill, 2012).

Furthermore, a multiple case study approach focuses on whether these findings are

48

repeated across the different companies

(Saunders et al., 2012).

Secondary data is used to present an effective preliminary tool to assess ESG practices in a company. Twelve companies

(non-government linked) that were included in the FT4GM index were evaluated.

Another 12 "non-ESG" companies in the same sector (selected randomly) were evaluated. Although these annual reports represent a portion of corporate social activities and performance, it represented the best available and reliable information and is constantly being used by financial of this framework is to support managers in the reporting of the CSR portfolio of the company and is broadly-based as Bursa recognized that 'one size does not fit all'

(Bursa Malaysia online, 2014).

The FTSE4Good index uses a framework that focuses on environmental, social, and governance spheres. The ESG rating for FTSE is a weighted measure as their design takes into consideration that not all companies face the same challenges in ESG practices.

As no similar studies has been conducted a scoring method was formulated analysts (ESG and non-ESG) and investors in their preliminary assessment of ESG practices (Abdifatah, 2013; Erwin, 2011).

3.2 Evaluation and Scoring Method

For this study, a comparative and content analysis based on the FTSE4Good framework and the CSR framework by

Bursa Malaysia (BM) was conducted. The

BM CSR framework is categorized into four focus areas: environment, workplace, community, and marketplace (Bursa

Malaysia online, 2014). Environment covers a firm's environmental impact as well as mitigation practices. Workplace concerns itself with employees' physical and psychological well-being and marketplace takes into consideration the corporation's impact on their customers and suppliers.

Community discusses the company's impact on its surrounding environment. The aim to evaluate the company based on content analysis of the annual reports. When a company addresses any of these components, a score of 1 will be given and an additional score of 1 for any additional data, information or audits that can help boost the transparency of the information presented. Therefore, for the BM CSR there will be a maximum score of 8

(maximum of 2 per category). It will be a little different for the FTSE framework.

There will be a total score of 28 (with three categories). There will be 4 categories in governance (for a maximum score of 8) and 5 in environment and social (for a maximum score of 10). This study represents a general look at the current situation and hence the simplified scoring of the ESG rating that would be appropriate for this level of study (Refer to

Table 1 & 2)

Table 1: Scoring system for Bursa Malaysia CSR Framework

SCORE

Total

Market Place

Components Additional

Data

1 1 2 Bursa Malaysia (BM) CSR

Framework

Total

Work Place

Environment

Community

1

1

1

4

1

1

1

4

2

2

2

8

49

Table 2: Scoring system for FTSE Framework

SCORE

Components Additional Data Total

5 5 10 FTSE Framework Environment

(5 categories)

Social

(5 categories)

Governance

(4 categories)

Total

5

4

14

5

4

14

10

8

28

3.3 Companies Selected

The analysis of annual reports is conducted on annual reports for the year

2013 because the FTSE4Good index conducted their initial analysis based on these reports. A total of 24 companies was chosen and Table 3 shows the industry sector which these companies belong to.

Table 3: Companies and the related industrial sectors

Industry Sector Companies included in

FTSE4Good Index

1. Consumer Company A

Products

2. Industrial Products Company B and H

Companies not included in FTSE4Good Index

Company 1

Company 2 and 8

3. Finance

4. Trading and

Services

5. Plantation

Company C

Company D, F, I, and L Company 4, 6, 7, 9, and 12

Company E

6. Infrastructure

Project Companies

7. Property

Company G

Company J and K

Company 3

Company 5

N/A

Company 10 and 11

The analysis is divided into seven sections, namely consumer products, finance, industrial products, plantation, infrastructure projects, property, and trading and services. The results of the analysis is reported in the next section with a detailed analysis on Appendix 1.

4. Analysis, Findings and Discussion

4.1 Overview

From the evaluation of the case studies, it was established that there is a clear distinction between ESG companies and non-ESG companies. For Bursa Malaysia

CSR, an average score of 3.7 (out of 8) was recorded for non-ESG companies with a high of 8 and with one company not complying. Companies listed in the FT4GM index have an average score of 7.6 with a high of 8 and a minimum of 6. Table 4 and

5 shows the scoring of the CSR framework of Bursa Malaysia and FT4GM between

ESG and non-ESG companies. Appendix 1 displays a more comprehensive table for the evaluation of FT4GM listed companies.

Appendix 2 charts the evaluation for non-

FT4GM companies.

50

Table 4: Bursa Malaysia CSR and FTSE4Good Framework scoring on FT4GM listed using Content Analysis

List of Companies

(FT4GM)

Company A

Company B

Company C

Company D

Company E

Company F

Company G

Company H

Company I

Company J

Company K

Company L

Bursa Malaysia CSR score (max 8)

7

7

7

6

8

8

8

8

8

8

8

8

FTSE4Good Framework

Score (max 28)

19

15

13

14

24

19

19

18

24

20

23

19

Table 5: Bursa Malaysia CSR and FTSE4Good Framework scoring on non -FT4GM listed companies using Content Analysis

List of Companies

( non -FT4GM)

Bursa Malaysia CSR score (max 8)

FTSE4Good Framework

Score (max 28)

Company 1

Company 2

Company 3

Company 4

Company 5

Company 6

Company 7

Company 8

Company 9

Company 10

Company 11

Company 12

0

5

5

1

8

2

6

4

1

2

8

2

4

15

10

5

24

6

13

10

5

7

16

6

For the FT4GM framework, an analysis of the results shows that FT4GM firms have an average score of 18.8 (out of

28), minimum of 13 and maximum of 24.

An evaluation of the other companies indicated that the average score was 10.1 with a maximum of 21 and a minimum of

4. All the companies complied with the

MCCG 2012 requirements for publiclylisted companies.

Table 6 presents average, median, and standard deviation figures for the companies analyzed. As expected, when it comes to ESG and CSR practices and disclosure, companies in the FT4GM performed better. Therefore, corporations in the non-ESG sector in this study display an unclear and confusing picture as to CSR disclosure with only some complying with the requirements for local CSR standards.

51

Table 6: Average, Median, and Standard Deviation Scores

All

Companies

ESG

Companies

Average Scores for Bursa

5.63 7.58

Malaysia CSR Framework

Average Scores for FTSE ESG

Rating

14.54 18.92

Non-ESG

Companies

3.67

10.17

Median for BM Rating

Median for FTSE Rating

Standard Deviation for BM

Rating

Standard Deviation for FTSE

Rating

A further analysis based on the industrial sector will be presented below, highlighting the essential observations of sectoral ESG engagement of the individual companies involved in this study.

4.2 Findings by Sectors

4.2.1. Findings of Consumer

Products Sectors

Company A has a Bursa Malaysia

CSR score of 7 and a combined FT4GM score of 19. Its company annual report is geared towards international standards and represents a consolidated effort for this company to provide an overall objective towards global CSR objective. By comparison, Company 1 has a very sparse annual report. Details about its CSR impact was minimal. The annual report mainly focuses on its operations and financial position, perhaps the company stresses more on its shareholders than their stakeholders.

4.2.2 Findings of Industrial

Products Sectors

Company B achieved a score of 7 out of 8 (BM CSR) and 15 out of 28 in the

FT4GM score. Company 2 scored 5 out of 8 in local standards and 15 out of 28 (FT4GM).

Both companies were in similar industry.

They state that sustainability is the key to their strategy and that environmentallyfriendly manufacturing processes represent part of their innovativeness. Differences between the two companies is negligible with

7

15

2.794599

6.606842

8

19

0.668558

3.629634

3

8.5

2.741378

6.027714

Company B providing more information to back their processes.

Company H has a score of 8 (BM

CSR) and 18 (FT4GM). It has strong environmental, sustainable, and labor practices which are audited and in addition has a whistle-blowing policy. Company 8 has a score of 4 in the BM CSR framework and 10 in the ESG framework. The annual report provides information about the company's impact on the environment with no additional data to support their claims and reports its social concerns as philanthropic support.

4.2.3 Findings of Financial Sector

The financial sector is considered a low impact industry because of the minimal impact it has on environmental aspects. The scores of the Bursa CSR framework for both these companies are 5 for Company 3 and 7 for Company C. As for the FT4GM framework, Company C has a score of 13 out of 28 and Company 3 has a score of 10.

In Company C, it is observed that the company's CSR and ESG commitment and work are enshrined in its corporate mission.

On the other spectrum, Company 3 does not elaborate much on its CSR, ESG, and corporate philosophy about them.

4.2.4 Findings of Infrastructure

Project Companies (IPC) Sector

Company G is a foreign-owned company. It achieves full score for Malaysian

52

CSR requirements and 19 in the ESG framework. The management sets the direction for the company's ESG practices and highlights the importance in its business strategy. Its CSR measures are aligned with those described in the annual report with some shortcomings about data presentation. Company 7 scored a 6 (BM

CSR) and 13 (FT4GM). The company's

ESG emphasis is concentrated on workplace practices and community involvement, with minimal information on marketplace responsibility and little information to back up their sustainability strategy.

4.2.5 Findings of the Plantation

Sector

The plantation sector represents a high-impact industry as its impact is felt throughout the environment and affects a large percentage of stakeholders. Company

E and Company 5 are plantation companies with a wide range of commercial farms.

The scores for both the companies are 8

(BM CSR) and 24 (FT4GM framework).

Company E and Company 5 have a very similar strategy when it comes to ESG practices. Both companies emphasized sustainability in all aspects of ESG in their vision and mission. Furthermore, they provided information and were audited by external and internal bodies for their commitment. The differences are minor and boils down to how each company chose to implement that strategy.

4.2.6 Findings of the Property Sector

Company J highlighted the company's concept of applying green technology into selected construction projects. Company J adheres to the BM framework for CSR and has a score of 20 out of 28 in the ESG framework. Although not specifically stating its ESG objective,

Company J's practices and direction points towards a sustainability approach. Company

K's vision involves synergistic sustainable value creation that comes with quality and excellence. The company fulfills the local

CSR standards and has an evaluation of 23 in the FT4GM framework. Company K has integrated some of the principles for synergistic sustainable practices within the company's operations, and auditing of those practices by a third party.

The annual report for company 10 is brief when it comes to CSR reporting and had very limited data to support its claims. Therefore, the company scored poorly in the BM CSR (2) and the ESG matrix (7). Company 11 is involved in property and plastics manufacturing. The corporation states that it is committed to sustainability practices and stressed that

CSR is embedded into their company philosophy, but the annual report did not state their corporate philosophy. There is no independent verification of its health and safety practices nor any data provided to substantiate its claims. It did not explain how CSR fits into the corporation's overall strategy and focus.

4.2.7 Findings of Trades/Services

Sector

Company D emphasizes teaching

"green" methods and has several awards in the service sector. The company's CSR projects are not quantifiable and verifiable in its annual report; therefore, the company achieved a score of 6 (BM CSR) and 14

(FT4GM). Company D's ESG initiatives are less descriptive and may be understandable due to the nature of their service business. Company F is an integrated facilities management, property developer and realty company. The company complies with all of the local CSR requirements and has a score of 19 in terms of ESG framework. The company explains its rationale in its corporate responsibility practices as implementing an agenda of sustainability and responsibility in its services and its impact on stakeholders.

Company I is involved in entertainment, communications, and multimedia operations.

Based on Bursa Malaysia's CSR requirements, the company scored an 8, while Company

I obtained a score of 24 in the FT4GM analysis. Company I's annual report gave

53

substantial and relevant information about the company's business operations and practices through human development and performance management. Company L is a holding company for a variety of multimedia companies. The company scored an 8 on the Bursa Malaysia CSR framework and a

19 in terms of FT4GM ESG framework.

Company L's stated their commitment towards social and environmental responsible behavior through engagement and communication and focusing their resources towards a sustainable ethical

CSR strategy.

Company 4 is a software solutions company with core business on e-mercantile services. In terms of BM CSR framework, the company scored a 1 with a description of its community services. Company 4's annual report focuses on a shareholder perspective. Company 6 main business operations are dealing with electronic equipment. The annual report of the company is brief and does not provide any CSR direction. In terms of local CSR standards, the company achieved a 2 and 6 for FT4GM.

Company 9 is an office, hotel, residences, and facility services company. Company concentrating on advertising and billboards.

In terms of BM CSR framework, the company achieved a score of 1 and a score of 6 out of 28 (FT4GM). The annual report for Company 12 represents an analysis of the corporation's outlook and a historical description of the company's success.

It can be observed from the results of the content analysis and case studies of these companies that there is a clear distinction when it comes to implementing good ESG practices of a company. It is observed that a majority of

ESG companies conduct an evaluation of the social impact and channel the resources towards those goals.

4.2.8 Comparison and Analysis of the Sectors

Giannarakis, Konteos, and

Sariannidis (2014) discovered that ESG determinants and industry profile affects how a corporation's CSR is disclosed, hence the observed distinctive differences amongst the industry sectors. This difference is also recognized by analysts of FTSE4 ESG ratings (2014), which categorizes the ESG practices of the companies based on their the 9's CSR score is 1 and 9 on FT4GM framework. Company 9's annual report concentrated on its financial prospects and impact on their stakeholders. Table 7 exhibits the ratings based on Bursa Malaysia

(BM) CSR standards and FT4GM ratings for the sectors. the company's successful projects. Company

12 is a media group with its core operations

Table 7: Ratings based on evaluation of Industrial Sectors

Sector

Consumer

Products

Number of

Companies

2

Bursa Malaysia CSR

Average

Rating

Lowest

Score

Highest

Score

3.5 0 7

Average

Rating

11.5

FT4GM

Lowest

Score

4

Highest

Score

19

Industrial

Products

Financial

Sector

4

2

6

6

4

5

8

7

14.5

11.5

8

10

10

13

IPC Sector 1 8 8 8 19 19 19

Plantation 2 8 8 8 24 24 24

Property 4 6.5 2 8 16.5 7 23

Trade/Services 9 4.6 1 8 12.5 5 24

54

The results show that the plantation sector has applied better ESG and CSR disclosure practices compared to the other sectors. This is followed by the property sector. This might be because high impact industries disclose more on their ESG and CSR practices to comply with higher expectations of their stakeholders to be transparent and sustainable corporate citizens in ensuring the survival of a corporation (Patten, 2002; Brammer &

Pavelin, 2006: Hopwood, 2009; Pahuja,

2009; Jackson & Apostolakou, 2009;

Ferrell, Thorne, & Ferrell, 2011; Young &

Marais, 2012; Galbreath, 2013; Kilian &

Hennigs, 2014; Giannarakis et al., 2014).

However, not all high-impact industries are as ESG minded as also evidenced by the ratings obtained by consumer and industrial products. It was found by some researchers that ESG practices and CSR disclosures depend on the particular industry's risk impact and the different institutional pressures that affect them (Pahuja, 2009; Black, Marais,

Allender, Lambell, Sweeney, & Bice,

2011; Young & Marais, 2012; Locke and

Seele, 2015). Locke and Seele (2015) further extrapolated that risky sectors have a higher impact due to their longer supply chain which affects more stakeholders. As a result, it was observed that as the stakeholders increase, the disclosure increases. This in turn provides an opportunity for other factors come to influence the degree of ESG reporting in the company.

How individual companies conduct their CSR can be evaluated by the type of business of the individual companies and their strategies and management policies. From a review of literature, it can be summarized that comparison across industries is limited due to risk characteristics and environmental factors facing the particular industry and differences in impact values that makes comparison difficult. This is because a baseline, benchmark, or challenges for one type of industry are different from another.

4.2.9 Discussion

The first research question was

(RQ1): How did these companies qualify for the FT4GM index? An analysis of their strategies revealed that a majority of these

ESG companies stated sustainability as a core issue in their objectives. Of the 12

ESG companies evaluated, eleven of these companies stated their stand in achieving sustainability either in their vision, mission, values, or objectives, which is backed up by data and information.

Alternatively, most non-ESG companies state the importance of corporate social responsibility and sustainability with very limited evidence to support it.

On the whole, firms with a social responsible goal in mind are companies with a (1) clear distinctive ESG policy, (2) direction from the management, (3) strategy towards effective resources allocation, and

(4) measurement system to gauge its effectiveness. Therefore, in response to the first research question (RQ1), the 12 companies were included in the FTSE

ESG index because of the ESG goals, policies, and management systems that these companies have set up, documented, and implemented with results and data to back up their claims of ESG compliance. It can be observed that there is a distinctive difference in ESG policies amongst companies in the FT4GM as compared to the non-ESG companies. Furthermore, companies that have quality ESG practices

"customize" their ESG policies according to their industry and the impact to ensure corporate accountability and competitiveness

(Pahuja, 2009; Young and Marais, 2012;

Galbreath, 2013; Eccles & Serafeim,

2013). Perhaps this is why FT4GM categorize companies according to the impact that they have on their environment and community.

The second research question was

(RQ2): what are the differences observed among the different industrial sectors in

Bursa Malaysia? The answer for RQ2

55

remains inconclusive as there cannot be a clear comparison of CSR work across industries due to the nature of the business and operations of the individual companies

(Pahuja, 2009; MacKenzie et al., 2013;

Galbreath, 2013). The majority of companies in the non-ESG index recognize the fact that there is a convergence towards engagement with stakeholders, but do not understand nor have a clear strategy for

ESG and CSR practices. In conclusion, companies evaluated here see or are beginning to see the importance the value of the stakeholder and taking steps to identify, communicate, and address stakeholder concerns.

What can Malaysian institutions do to encourage ESG practices? This question was presented as research question 3 (RQ3). What is needed is time and a change in thinking. It is observed from the analysis of the companies that there are clear differences in the ways ESG companies fulfilled their social obligations as compared to the rest of the companies involved in the study. A company's engagement in CSR is dictated by culture that drives their social responsibility contribution and type of CSR activity

(Silberhorn & Warren, 2007; Lu & Castka,

2009; Eccles & Serafeim, 2013; Hebb et al., 2014; Macquet & Sjostrom, 2013;

Abdulrazak & Ahmad, 2014; Knudsen &

Brown, 2015). In response to RQ3, legislative and regulatory bodies should continue to educate corporations in social responsibility effectiveness and the advantages and benefits to the corporations.

Educating and benchmarking would help corporations in divesting the misconceptions of CSR and ESG practices because CSR is crucial to a company's survival (Filatochev

& Nakijama, 2014, Darus, 2012; Renneboog et al., 2008).

5. Limitations and Future Direction of the Study and Conclusion

The generalizability of this study should not be inferred due to limited sample size. As this study is conducted based on annual reports, further work should be conducted through interviews with managers and officers of the corporations regarding their ESG initiatives and their views on it. In addition, the application to companies outside Malaysia may be limited as the analysis is conducted on Malaysian companies only. Therefore, in order to generalize the findings, a greater sample size is required. It is also suggested that a study focusing on primary data be collected to answer the question

“why” companies opted to disclose their

CSR activities in a more or less systematic fashion is important to eliminate some questions on the possible SRI opportunities.

Furthermore, a longitudinal study of these companies would be appropriate and would represent the next step to evaluate and observe ongoing ESG practices. In addition, the content analysis was a selfformulated tool. Further work will be required to verify the tool.

The introduction of FTSE4Good

Malaysia represents a step towards better corporate social responsibility and sustainability in Malaysia and signals the increasing awareness of ESG practices in the country. From the critical analysis of the 12 companies included in the FT4GM, it is found that these companies are included because of better ESG practices and disclosure of such practices to the stakeholders. The key to good ESG practices lies in identifying ESG issues most critical to that particular industry and communicating with stakeholders about them (Eccles & Serafaim, 2013). Companies need to then initiate and ensure that these practices need to be continued and improved on to ensure continued inclusion in the index. Public companies who are interested in being listed in this type of index should invest in ESG practices that are most relevant in their industry. ESG and good CSR practices adds long-term value to the company and improves the company's competitiveness (Louche &

Hebb, 2014; Gates, 2013; Rakotomavo,

56

2012; Collison et. al., 2009). Finally, the regulatory bodies, such as Bursa Malaysia and Registrar of Companies ( Suruhanjaya

Syarikat Malaysia, SSM), have constantly the opinion that CSR should remain voluntary and regulatory agencies should continue to educate what social responsibility is really about and promote encouraged corporations to engage in

CSR. Should the regulatory bodies make

CSR a requirement? The researcher is of the positive effects of contributing back to the community and society.

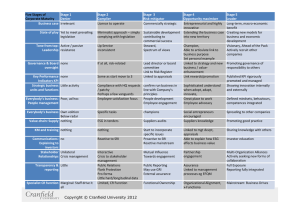

Appendix 1: ESG Evaluation for listed FT4GM companies

A B C D E F G H I J K L Company

Bursa Malaysia

Environment

Workplace

Community

Marketplace

Total Score

FTSE4GM

2

2

2

1

2

2

1

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2

2 2 1 1 2 2 2 2 2 2 2 2

1 2 2 2 2 2 2 2 2 2 2 2

7 7 7 6 8 8 8 8 8 8 8 8

Environment

Supply Chain 1 1 1 1 2 1 2 1 2 2 1 2

Climate Change 2 1 - 1 2 2 2 1 2 1 2 -

Water Use

Biodiversity

Pollution &

Resources

Scores

Governance

2

-

2

1

1

2

-

-

1

-

-

1

2

2

2

1

-

2

-

-

2

2

-

2

2

-

2

-

1

2

1

2

2

-

1

2

7 6 2 3 10 6 6 6 8 6 8 5

Anti-corruption - - - -

Tax

Transparency

Risk

- - 1 1 1 1 1 -

- - - 1 - - - - 1 - - -

2 2 2 1 2 1 2 1 2 2 2 2 Management

Corporate

Governance 2 2 2 2 2 2 2 2 2 2 2 2

Scores

Social

Customer

Responsibility

4 4 4 4 4 3 5 4 6 5 5 4

2 1 2 1 2 2 1 - 2 2 2 2

Human Rights &

Community 2 2 2 2 2 2 2 2 2 2 2 2

Labor Standards 2 1 2 2 2 2 2 2 2 2 2 2

Health & Safety 1 1 - 1 2 2 2 2 2 1 2 2

Social Supply

Chain

Scores

Total Scores for

FTSE4Good

1

8

19

-

5

15

1

7

13

1

7

14

2

10

24

2

10

19

1

8

19

2

8

18

2

10

24

2

9

20

2

10

23

2

10

19

57

Appendix 2: Evaluation for non-listed FT4GM companies.

Company 1 2 3 4 5 6 7 8 9 10 11 12

Bursa Malaysia

Environment

Workplace

Community

Marketplace

Total Score

-

-

2

1

1

2

-

-

2

2

-

1

2

2

1

1

-

-

1

-

2

2

-

1

- 2 1 1 2 - 2 2 1 1 2 1

- - 1 - 2 1 - - - - 2 -

0 5 5 1 8 2 6 4 1 2 8 2

FTSE4GM

Environment

Supply Chain - 2 1 - 1 - 1 - - - 1 -

Climate Change - 1 - - 2 - 2 1 - - 2 -

Water Use - 1 1 - 2 - - - - - - -

- - - - 2 - - - - - - - Biodiversity

Pollution &

Resources

Scores

-

0

2

6

1

3

-

0

2

9

-

0

2

5

1

2

-

0

1

1

2

5

-

0

Governance

Anti-corruption

Tax

Transparency

-

-

1

-

-

-

-

-

1

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Risk

Management

Corporate

Governance

1 2 2 2 2 2 2 2 2 2 2 1

Scores

Social

2 2 2 2 2 2 2 2 2 2 2 2

3 5 4 4 5 4 4 4 4 4 4 3

Customer

Responsibility 1 - - - 2 - 1 - - - 2 1

Human Rights &

Community - 1 1 1 2 - 2 2 1 1 2 1

Labor Standards - 2 2 - 2 1 2 1 - - 2 1

Health & Safety - - - - 2 1 - 1 - 1 1 -

Social Supply

Chain

Scores

-

1

1

4

-

3

-

1

2

10

-

2

-

5

-

4

-

1

-

2

-

7

-

3

Total Scores for

FTSE4Good 4 15 10 5 24 6 14 10 5 7 16 6

58

REFERENCES

Abdifatah, A. H. (2013). Corporate Social Responsibility Disclosures Over Time:

Evidence from Malaysia. Managerial Auditing Journal 28(7): 647 - 676.

Abdulrazak, S.R. and Ahmad, F.S. (2014). The Basis for Corporate Social Responsibility in Malaysia. Global Business and Management Research: An International Journal

6.3: 210 - 218.

Alnasser, S. (2012). What has changed? The development of Corporate Governance in

Malaysia. The Journal of Risk Finance 13(3): 269 - 276.

Arora, P. and Dharwadkar, R. (2011). Corporate Governance and Corporate Social

Responsibility (CSR): The moderating roles of attainment discrepancy and organizational slack. Corporate Governance: An International Review 19.2: 136 - 152.

Black, L., Marais, M., Allender, J., Lambell, R., Malinda, N., Sweeney, T., and Bice, S.

(2011). The state of CSR in Australia . Melbourne: Australian Centre for Corporate

Social Responsibility.

Brammer, S. and Pavelin, S. (2006). Voluntary environmental disclosures by large UK companies. Journal of Business Finance and Accounting 33.7/8: 1168 - 1188.

Bursa Malaysia online. (2014). Sustainability: Bursa Malaysia CSR Framework. http://www.bursamalaysia.com/market/listed-companies/sustainability/frameworks/ bursa-malaysias-csr-framework/. Accessed on 22 November 2014

Collison, D, Cobb, G., Power, D., and Stevenson, L. (2009). FTSE4Good: Exploring its implications for corporate conduct. Accounting, Audit, & Accountability Journal 22.1:

35 - 58.

Collison, D.J, Cobb, G., Power, D.M., and Stevenson, L.A. (2008). The Financial

Performance of the FTSE4Good Indices. Corporate Social Responsibility and

Environmental Management 15: 14 - 28.

Consolandi, C., Jaiswal-Dale, A., Poggiani, E., and Vencelli, A. (2009). Global Standards and Ethical Stock Indexes: The Case of the Dow Jones Sustainability Stoxx Index.

Journal of Business Ethics 87: 185 - 197.

Curran, M.M. and Moran, D. (2007). Impact of the FTSE4Good Index on firm price. An event study. Journal of Environmental Management 82: 529 - 537.

Darus, F. (2012). Embracing Corporate Social Responsibility in Malaysia-Towards sustaining value creation. Malaysian Accounting Review, Special Issue 11.2: 1 - 13

Eccles, R.G. and Serafeim, G. (May 2013). Performance Frontier: Innovating for sustainable strategy. Harvard Business Review May 2013: 51 - 60.

Erhemjamts, O., Li, Q., and Venkateswaran, A. (2013). Corporate social responsibility and its impact on firms' investment policy, organizational structure, and performance.

Journal of Business Ethics 118: 395 - 412.

Erwin, P.M. (2011). Corporate Codes of Conduct: The Effects of Code Content and

Quality on Ethical Performance. Journal of Business Ethics 99: 535 - 548.

Esa, E. and Mohd Ghazali, N.A. (2012). Corporate social responsibility and corporate governance in Malaysian GLCs. Corporate Governance: The International Journal of Business in Society 12(3): 292 - 305.

Escrig-Olmedo, E, Munoz-Torres, M.J, and Fernandez-Izquierdo, M.A. (2013). Sustainable

Development and the Financial System: Society’s Perceptions about

Socially

Responsible Investing. Business Strategy and the Environment 22: 410 - 428.

Eweje, G. (2014). Introduction: Trends in corporate social responsibility and sustainability in emerging economies. Corporate Social Responsibility and Sustainability: Emerging

Trends in Developing Economies : 3 - 17.

59

Ferrell, O.C., Thorne, D.M., and Ferrell, L. (2011). Social Responsibility and Business.

Canada: South-Western, Cengage Learning.

Filatochev, I. and Nakajima, C. (2014). Corporate governance, responsible managerial behavior, and corporate social responsibility: Organizational efficiency versus organizational legitimacy. The Academy of Management Perspectives 28.3: 289 - 306.

Friedman, M. (1962). Capitalism and Freedom . Chicago: University of Chicago Press.

FTSE ESG Ratings. (2014). Integrating ESG into Investments and Stewardship.

London: ESG FTSE Publications.

Galbreath, J. (2013). ESG in Focus: The Australian Evidence. Journal of Business

Ethics 118: 529 - 541.

Gates, S. (2013). Proactive Investor Relations: How corporations respond to pressures from social responsibility investors. Critical Studies on Corporate Responsibility,

Governance, and Sustainability 5: 397 - 423.

Giannarakis, G., Konteos, G., and Sariannidis, N. (2014) Financial, governance, and environmental determinants of corporate social responsible disclosure.

Management Decision 52.10: 1928 - 1951.

Haniffa, R.M. and Cooke, T.M. (2005). The impact of culture and governance on corporate social reporting. The Journal of Accounting and Public Policy 24: 391 - 430.

Hebb, T., Louche, C. and Hachigian, H. (2014). Exploring the societal impacts of SRI.

Socially Responsible Investment in the 21st Century: Does it Make a Difference for

Society?

: 3-20.

Hopwood, A.G. (2009). Accounting and the environment. Accounting, Organizations, and Society 34.3: 433 - 439.

Jackson, G. and Apostolakou, A. (2009) corporate social responsibility in Western

Europe: An institutional mirror or substitute? Journal of Business Ethics 94: 371 - 394.

Jo, H. and Harjoto, M.A. (2011). Corporate governance and firm value: The impact of corporate social responsibility. Journal of Business Ethics 103: 351 - 383.

Kaptein, M. and Schwarz, M.S. (2008). The Effectiveness of Business Codes: A Critical

Examination of Existing Studies and the Development of an Integrated Research

Model. Journal of Business Ethics 77: 111 - 127.

Kilian, T. and Hennigs, N. (2014). Corporate social responsibility and environmental reporting in controversial industries. European Business Review 26.1: 79 - 101.

Knudsen, J.S. and Brown, D. (2015). Why governments intervene: Exploring mixed motives for public policies on corporate social responsibility. Public Policy and

Adminstration 30.1: 51 - 72.

Lim, M., How, J., and Verhoeven, P. (2014). Corporate ownership, corporate governance reform and timeliness of earnings: Malaysian evidence . Journal of Contemporary

Accounting & Economics 10: 32 - 45

Lee, L. (10 June 2014). Bursa to introduce Environmental, Social, and Government

Index. http://www.thestar.com.my/Business/Business-News/2014/06/10/Bursa-tointroduce-more-products-The-sophisticated-products-include-Environmental-

Social-and/?style=biz. Accessed on the 4 November 2014.

Locke, I. and Seele, P. (2015). Analyzing sector-specific CSR reporting: Social and environmental disclosure to investors in the chemical and banking and insurance industry. Corporate Social Responsibility and Environmental Management 22: 113- 128.

Louche, C and Hebb, T (2014). SRI in the 21 st

Century: Does it make a difference to society? Critical Studies on Corporate Responsibility, Governance, and Sustainability

7: 275 - 297.

Lu, J.Y. and Castka, P. (2009). CSR in Malaysia-Experts' Views and Perspectives.

Corporate Social Responsibility and Environmental Management 16: 146 - 154.

60

Lydenberg, S. (2013). Responsible Investors: Who they are, what they want. Journal of

Applied Corporate Finance 25.3: 44 - 49.

Mackenzie, C., Rees, W., and Rodionova, T. (2013). Do Responsible Investment Indices

Improve Corporate Social Responsibility? FTSE4Good's Impact on Environmental

Management. Corporate Governance: An International Review 21.5: 492 - 512.

Macquet, M. and Sjostrom, E. (2014). The Development of SRI in China. Critical

Studies on Corporate Responsibility, Governance, and Sustainability 5: 253 - 275.

Murphy, D. and McGrath, D. (2013). ESG reporting-class actions, deterrence, and avoidance. Sustainability Accounting, Management, and Policy Journal 4.2: 216-235.

Pahuja, S. (2009). Relationship between environmental disclosures and corporate characteristics: A study of large manufacturing companies in India. Social

Responsibility Journal 5.2: 227 - 244.

Patten, D.M. (2002). The relation between environmental performance and environmental disclosure: a research note. Accounting Organizations and Society 27.8: 763 - 773.

PRI online. (2014). Introducing responsible investing. http://www.unpri.org/ introducing-responsible-investment/. Accessed on 21 November 2014.

Rakotomavo, M.T.J. (2012). Corporate investment in social responsibility vs. dividends?

Social Responsibility Journal 8.2: 119 - 207.

Renneboog, L., Horst, J.T., and Zhang, C. (2008). Socially responsible investments:

Institutional aspects, performance, and investor behavior. Journal of Banking and

Finance 32: 1723 - 1742.

Revelli, C. and Vivani, J. (2014). Financial Performance of socially responsible investing

(SRI): What have we learned? A meta-analysis. Business Ethics: A European

Review : 1-28.

Royal, C., and O'Donnell, L. (2014). ESG: From negative screening to human capital analysis.

Institutional Investors’ Power to Change Corporate Behavior: International

Perspectives. Critical Studies in Corporate Responsibility, Governance, and

Sustainability 5: 339 - 366.

Said, R., Zainuddin, Y.H, and Haron, H. (2009). The relationship between corporate social responsibility disclosure and corporate governance characteristics in

Malaysian public listed companies. Social Responsibility Journal 5. 2: 212 - 226

Saleh, M., Zulkifli, N. and Muhamad, R. (2010). Corporate social responsibility disclosure and its relation on institutional ownership. Managerial Auditing Journal

25.6: 591 - 613.

Saunders, M., Lewis, P., and Thornhill, A. (2012). Formulating Research Design. In Research

Methods for Business Students . pp 158 - 207. England: Pearson Education Ltd.

Silberhorn, D. and Warren, R.C. (2007). Defining corporate social responsibility.

European Business Review 19.5: 352 - 372.

Stubbs, W. and Rogers, P. (2013). Lifting the veil on environmental social governance rating methods. Social Responsibility Journal 9.4: 622 - 640.

Suruhanjaya Sekuriti Malaysia. (2012). Malaysian Code of Corporate Governance .

Malaysia: Securities Commission Malaysia.

Sustainable Stock Exchanges Initiative online. Bursa Malaysia (Malaysia Exchange). http://www.sseinitiative.org/fact-sheet/bursa/. Accessed on 22 November 2014.

Teoh, H.Y. and Thong, G. (1984). Another look at corporate social responsibility and reporting: an empirical study in a developing country. Accounting, Organizations, and Society 9.2: 189 - 206.

Young, S. and Marais, M. (2012). A multi-level perspective of CSR reporting: The implications of national institutions and industry risk characteristics. Corporate

Governance: An International Review 20.5: 432 - 450.

61