Law of 2 August 2002 on the supervision of the financial

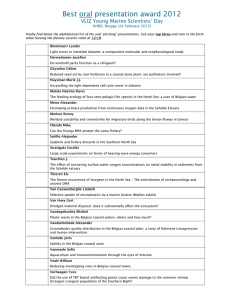

advertisement