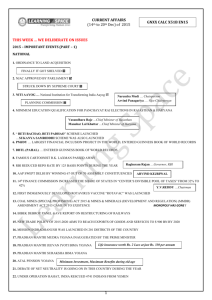

One Pager V2.cdr - IndiaFirst Life Insurance

advertisement

IndiaFirst Pradhan Mantri Jeevan Jyoti Bima Yojna (Non Linked, Non Participating, Yearly Renewable Group Protection Plan) Your customers… Our responsibility We all have big financial goals in life that we want to achieve. We ensure that we do every single thing possible to accomplish them. But in the struggle, we sometimes forget that there are simpler aspects that can help us succeed. The most basic need in terms of financial planning is Protection. If we have protection as a part of our financial planning, rest of our financial goals are certain to fall in place. MARRIED COUPLE WITH CHILDREN MARRIED Buy a car Education of Children Marriage of Children Retirement & Healthcare Expenses Buy a house Higher Education 18 yrs 50 yrs BASIC NEED OF PROTECTION Have you ever said any of this to yourself? It won't happen to me I have more than enough I live for today I can do it later Now is my time to enjoy If yes, then it's time you revisit your financial planning. You can start with the simple solution we have for you! We present to you IndiaFirst Pradhan Mantri Jeevan Jyoti Bima Yojana, a scheme conceptualized by the Indian Government with an aim of providing life insurance cover to all segments of the society and hence taking India to new heights. The IndiaFirst Pradhan Mantri Jeevan Jyoti Bima Yojana is designed to: Provide a life insurance cover at a reasonable standard rate Protect your family with a life cover of INR 2,00,00 in case of unforeseen events Save your time with simpler process through minimum documentation Kickstart your cover with “over the counter” issuance Ease the process of renewal with auto debit of premium from your bank account Enjoy tax benefits on the premium you pay under Section 80 ( C ) Along with its striking features, the simplistic buying process will also leave you happy. You can buy the plan in 5 simple steps – 1 2 3 4 5 Visit your nearest bank branch Fill in the member cum consent declaration form Pay the premium (through auto debit) from your linked account Ensure premium successfully transferred to bank Collect instantly issued COI So do not wait anymore. Contact your bank manager today!! (For the bank staff) Refer to this quick snapshot in case you need any assistance in selling this scheme – Who can you cover in this scheme? Your savings account customer between 18 and 50 years. Maximum maturity age for a customer is 55 years What is the standard premium? The member has to pay a standard premium of INR 330/- What is the Death Benefit? The nominee gets a death benefit of INR 2,00,000 Who should buy this plan? You should encourage every eligible customer to buy this plan specially the younger earning members of their family What is the term of the plan? 1 year Go ahead and create a secure customer, organization, and future for everyone! BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS / FRAUDULENT OFFERS. IRDAI clarifies to public that - IRDAI or its officials do not involve in activities like sale of any kind of insurance or financial products nor invest premiums. IRDAI does not announce any bonus. Public receiving such phone calls are requested to lodge a police complaint along with details of phone call, number. Disclaimer: Insurance is the subject matter of the solicitation. IndiaFirst Pradhan Mantri Jeevan Jyoti Bima Yojana is a yearly renewable group term plan. Please read the sales brochure carefully before concluding the sale. Tax benefits are subject to change from time to time. You are advised to consult your tax consultant. IndiaFirst Life Insurance Company Limited, IRDAI Registration No. 143. Trade logo displayed above belongs to M/s Bank of Baroda, M/s Andhra Bank and M/s Legal & General and is being used by IndiaFirst Life Insurance Co. Ltd. under license. CIN: U66010MH2008PLC183679, Product Name: IndiaFirst Pradhan Mantri Jeevan Jyoti Bima Yojana, Product UIN: 143G025V01, Registered and Corporate Office Address: 301, 'B' Wing, The Qube, Infinity Park, Dindoshi - Film City Road, Malad (East), Mumbai - 400 097. Website: www.indiafirstlife.com ,SMS to 5667735 SMS Charges apply. Toll free No - 1800 209 8700. Advtg. Ref. No.: IndiaFirst Pradhan Mantri Jeevan Jyoti Bima Yojana / one Pager / E / 001