4Q15 Management Report - Baptist Foundation of Illinois

advertisement

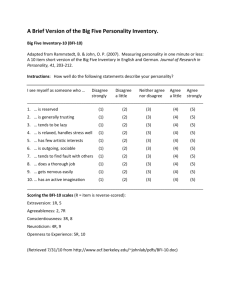

FourthQuarterManagementReport Bap$stFounda$onofIllinois December31,2015 3085StevensonDriveSpringfield,IL62703BaptistFoundationIL.org217.391.3102 Execu$veSummary BFIcon<nuedtomakeprogressduringthefinalquarterof2015.TFUMgrewto$29.25Min617accounts managed.Threehighlightsarenotedbelow. BFIBond/LoanProgram: ThequartersawloanclosingsfromChicagolandtoNorrisCityandseveralloca<onsinbetween. Theprogramcon<nuestogrow,achievingthegoalofretainingmoneygiventothechurch,doing churchworkacrossIllinoisandbeyond. CustodialInves$ng: BFICustodialaccountsbeganofferingIRAop<onsinthefourthquarter.CurrentIRA(bothRoth andTradi<onal)ownershavechosentoinves<ngintheIndividualLongTermFixedIncome PorXolioaswellasBFIbonds. LifeStewardshipProgram: InBFImanagedchurchproperty,severalpointsofprogressmaybenoted.First,thetransferwas completedfortheLamon AvenueBap<stChurch andthefacilityis currentlybeingu<lizedby twocongrega<ons— Star<ngPointBap<stand CasadeGracia.Galena Roadisnowhometo GalenaParkBap<st Galena Park Baptist Church, Peoria Heights, IL Church. Stained Glass in the Sanctuary at Lamon Avenue Baptist, Chicago, IL Fortheyear,expensesexceededrevenueby$152,019,withournetsubsidy(a]ertransferring endowmentsupporttoIBSA)at$76,049. Onceagain,thankyoufortheopportunityofservice. RespecXullysubmi`ed, Execu<veDirector 2009 2013 2010 2014 2011 2015 2012 $30 2015 BFI Endowment Support, $175,619 $26 $21 BCHFS 2% CAC NAMB 1% 1% $17 IBSA & Church Planting 34% $13 Churches and Associations 4% IMB 1% $9 CP (via IBSA) 9% Other 2% $4 Educational Scholarships 45% $0 TotalFundsUnder Management2015(market) $29.25M BFIAccountsbyType 8 617accounts DAF 29 26 OrgCustodialLTFI 38 CustodialTerm(CBLPool) CustodialMarket CustodialCash 10 11 4Q15 140 CharitableTrust CGA Endowment BFIBondHolders 164 178 10 CustodialTrust 1 CustodialIndLTFI 2 RetainedLifeEstate 0 90 180 BFIEarningsby CustodialPartner& AccountType 2015 2014 2013 2012 SBFINCOME(TR) 1.33% 1.60% -0.55% 5.67% 2.87% 4.12% 4.2% SBFBALANCED(TR) 0.09% 9.27% 15.7% 9.29% 1.12% 10.32% 17.38% SBFGROWTH(TR) -0.24% 11.78% 33.3% 11.33% -3.1% 14.89%29.69% SBFFLEXIBLEINCOME(TR) .42% 6.76% -1.91% 7.26% 5.82% 6.16% 7.47% BFO1MONTH 0.75% 0.73% 0.96% 1.02% 1.73% 1.9% NA BFO6MONTH 1.29% 1.11% 1.32% 1.38% 2.13% 2.44% NA BFO9MONTH 1.61% BFO1YEAR (EFFECTIVEDEC) 1.93% 1.71% 1.87% 1.92% 2.89% NA BFO2YEAR (EFFECTIVEDEC) 2.38% 2.33% 2.45% 2.31% 3.67% 3.73% BOSCASHMANAGEMENT 0.75% 0.75% 0.75% 0.6% 1.2% NA NA BOS/LPLTRUSTACCOUNT 2.89% 18.63% -4.58% 10.5% NA NA NA BOS/LPLINTERMEDIATETRUST ACCOUNT(TR-GROSS) NA 7.43% BOS/LPLNETINCOMETRUST ACCOUNT(YIELD-GROSS) 5.60% 5.59% BOS/LPLCUSTODIALINDLONGTERM FIXEDINCOME(YIELD-GROSS) 6.3% BOS/LPLCUSTODIALORGLONG TERMFIXEDINCOME(YIELD-GROSS) 6.2% 6.15% 6.21% 8.1% NA NA NA BOS/LPLENDOWMENT 6.0% 6.01% 5.94% 4.96% NA NA NA BFIBONDYIELD —- 3.25% 3.00% ONEYEARBFIBOND 1.25% TWOYEARBFIBOND 2.25% THREEYEARBFIBOND 3.0% FOURYEARBFIBOND 3.6% FIVEYEARBFIBOND 4.25% (EFFECTIVEDEC) (EFFECTIVEDEC) (EFFECTIVEDEC) (TR-GROSS) (YIELD-GROSS) 2011 2010 3% 2009 NA