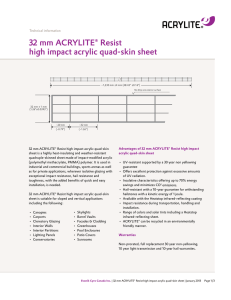

power to create

advertisement