Antioquia Goldʼs Prolific Progress in Colombia

By James West

Midas Letter.com

Monday, July 29th, 2010

Antioquia Gold Corpʼs (TSX.V:AGD) ongoing successes at their 100% controlled Cisneros gold

project in Antioquia, Colombia are largely overlooked by the market because they donʼt mimic the

dramatic numbers generated by the belle of the Colombian mining ball, Ventana Gold.

(TSX:VEN). This oversight might be an opportunity for astute (and risk tolerant) investors.

Why? Simply because if you look at the numbers from the drill results, every indication is that

there is a major feeder system lurking somewhere close by (in geological terms), and if its under

the ground that constitutes the Cisneros project, its likely just a matter of time before it is located

by the Antioquia technical team.

Cisneros is Shaping Up

From the most recent press release, excellent grades were intercepted across narrow widths, and

lower grades were intersected across more substantial lengths. The highlights include 4.4 meters

@16.6 grams per tonne gold, including 1.0 meter @ 61.8 grams per tonne gold from Guaico,

11.2 meters @ 5.4 grams per tonne gold, including 1.6 meters @ 16.7 grams per tonne gold from

Nus, and at Guayabito, 37.2 meters @ 4.5 grams per tonne gold, including, 7.25 meters @ 9.27

grams per tonne gold and 1.1meters @ 40 grams per tonne of gold.

Brad Van Den Bussche, P.Geol., the Company's Vice-President of Exploration (one of the

founders) said: "These drilling results have increased our confidence in these two structures by

confirming the high-grade potential of the north-south trending Guaico structure and the 10 meterplus width of the mineralized east-west trending Nus structure. Most importantly, both structures

can be traced over significant distances along strike and to depth."

According to company CEO and founder Rick Thibault:

“Weʼve been able to confirm the size and grade on the Guaico structure, so weʼre starting

to pull the numbers together on these structures that are guiding us towards the main

parts of the ore bodies. 9 months ago, there wasnʼt a drill hole anywhere on this property,

and now, 8,000+ meters of drilling later, weʼve been able to confirm that we have both

low grade disseminated gold and high grade feeder structures. And weʼre literally just

scratching the surface here.

These things (the structures) are so far open along strike and to depth. Now we have a

better idea of where the best places are to try some deeper holes and hopefully intersect

increasingly higher grades in these structures at depth. Weʼve only released about 25%

of the information that will come from this drill program, so thereʼs a lot more coming.

Weʼve purchased our own geophysics equipment, which we are using to define the

drilling targets, and weʼve attracted some rather significant talent to help us interpret the

geological structures.”

© 2009 MidasLetter.com – All Rights Reserved- Unauthorized duplication or distribution of all content herein prohibited.

This document is copyright protected and may not be copied, disseminated or distributed without the prior express

consent of Resourcex Financial Publishing LLC. Contact darryl.kelley@resourcex.com for permissions and licensing.

The significant talent heʼs referring to is Bob Casaceli, who has until recently served as Chief

Geologist for CA$3.7 Billion gold royalty company Franco Nevada Corporation. (TSX:FNV).

Casaceli, is a highly-respected geologist with 35+ years of experience with gold systems similar

to Cisneros. A new interpretation of the geological structures by Casaceli has identified zones of

dilation (open space) that resulting in a modification of drill target identification that, if Casaceliʼs

theories prove accurate, could dramatically improve the chances for even more success in the

upcoming and ongoing drill programs.

Keep in mind weʼre talking Colombia here. Systems have a tendency to be very big, once

delineated. Ventanaʼs land holdings were dropped repeatedly due to low grades and poor drill

results before deep drilling finally encountered the major intercepts that has made that company a

success story for investors today.

As if the Cisneros story wasnʼt compelling enough in its own right, Antioquia went ahead and

acquired 31,983 hectares of prime exploration lands comprising six project areas from Sociedad

Soratama, Sucursal Colombia ("Soratama"), a wholly-owned subsidiary of Barrick Gold

Corporation ("Barrick"), thus consolidating Antioquia's land position in Colombia.

Antioquia's gaining control of the 31,983 hectares is part of a pre-existing agreement between

Soratama and Ingeniería y Gestión del Territorio S.A. ("IGTER"), Antioquia's wholly-owned

subsidiary.

Over the remainder of 2010, Antioquia intends to review previous work done and data collected

on the six projects, and to conduct field work to determine the viability of each project within

Antioquia's long-term strategy.

Rick Thibault in a press release commented: "These properties provide Antioquia with a solid

land portfolio which it can explore either by itself or with a joint-venture partner, or farm out. The

transaction also demonstrates how strategic the recent purchase of IGTER has become to the

growth and permanence of Antioquia in Colombia."

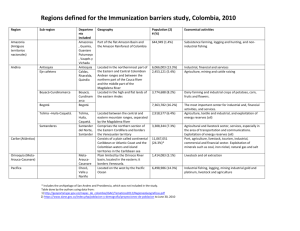

6 New Projects

The projects are in six different locations, 4 in the Department of Antioquia and 2 in the

Department of Caldas. They are situated along the length of the Cauca Porphyry Belt where there

are existing mining camps, including the renowned Marmato and La Colosa areas, as well as new

discoveries.

All the projects lie below 2,800m elevation and are not affected by the new Colombian mining law

protecting the Paramo Highland ecosystems (+3,200m).

Concordia-Betulia, Department of Antioquia (12,387 hectares): Concordia-Betulia consists of

three concessions, 40 kilometers from Medellin (mainly on paved roads). Antioquia geologists

have visited the site and conducted surface mapping and sampling (rock and stream). Anomalous

gold (Au), copper (Cu) and bismuth (Bi) soil samples have indicated gold values up to 7.5 grams

per tonne in grab (surface) samples and the Au/AG relationship is 1:3.

© 2009 MidasLetter.com – All Rights Reserved- Unauthorized duplication or distribution of all content herein prohibited.

This document is copyright protected and may not be copied, disseminated or distributed without the prior express

consent of Resourcex Financial Publishing LLC. Contact darryl.kelley@resourcex.com for permissions and licensing.

Numerous attractive targets have been identified based on the geological field work done to date.

Concordia-Betulia is in proximity to the Titiribi project of Sunward Resources Ltd., where Sunward

has reported an inferred resource estimate of 3.7 million ounces of gold and 1 billion lbs of

copper.

Caicedo, Department of Antioquia (3,156 hectares): Caicedo comprises one concession, 50

kilometers from Medellin. Preliminary field visits by Antioquia geologists have identified attractive

opportunities for future exploration targets based on the potential for discovering epithermalsheeted vein deposits. (Epithermal deposits are characterized by having high potential for base

metal sulphides that may contain significant amounts of ore.) Caicedo is located to the south,

along trend and in the same geological and geotectonics environment as Continental Gold

Limited's (TSX: property, Buritica, where it is currently exploring its large land package.

Jerico, Department of Antioquia (3,105 hectares): Jerico consists of two concessions, 40

kilometers from Medellin. The regional geology shows the presence of pyroclastic volcanic rocks,

similar to the rocks found at Marmato. Jerico is located about 4 kilometers from the Quebradona

Project being explored by the AngloGold/B2Gold Joint Venture. Other companies active around

Jerico include Continental Gold Limited and Colombian Mines Corporation.

Gavia, Department of Antioquia (2,887 hectares): Gavia comprises one concession, 90

kilometers from Medellin, and is approximately 6 kilometers southwest of Marmato. The Marmato

gold district is located on the eastern side of the Western Cordillera of Colombia, 60 km

southwest of Medellin. This district was well-known for its pre-colonial gold and silver mining

camps, and small-scale mining is still active in the area. The largest player in the district is

Medoro Resources Ltd., which has reported measured and indicated resources of 7.5 million

ounces of gold and inferred resources of 2.2 million ounces of gold. Gavia shares the same

mineralized events as that found at Marmato.

Manizales Norte, Department of Caldas (10,091 hectares): Manizales Norte consists of three

concessions, about 110 kilometers from Medellin. Studies by Soratama show anomalous values

of Cu and molybdenum (Mo), as well as magnetic anomalies that may indicate the presence of a

porphyry Cu deposit at depth. Manizales Norte is located just to the south of the mining district of

Marmato and close to Seafield Resources Ltd.'s Quinchia Project.

Aquadas, Department of Caldas (371 hectares): Aquadas consists of three concessions, 50

kilometers from Medellin. Studies by Soratama show anomalous values of Cu and Mo, as well as

magnetic anomalies that may indicate the presence of a possible porphyry Cu deposit at depth.

Aquadas is located 17 km to the northeast of Medoro's Marmato Project and, similar to

Antioquia's Gavia Project, shares the same geological events as found at Marmato.

Next Up on Antioquia

Antioquia is just closing a private placement that will put enough money in the coffers to complete

the rest of the 2010 field season. But in reality, there is no ʻfield seasonʼ because the weather in

Colombia is benign year round. Compared to companies working at high altitudes or in extreme

latitudes, this should be perceived by investors as a competitive advantage. An investor is going

to know more sooner about a prospective project than a company not so luckily oriented

geographically as Antioquia.

© 2009 MidasLetter.com – All Rights Reserved- Unauthorized duplication or distribution of all content herein prohibited.

This document is copyright protected and may not be copied, disseminated or distributed without the prior express

consent of Resourcex Financial Publishing LLC. Contact darryl.kelley@resourcex.com for permissions and licensing.

There are other advantages to working in Colombia too, which many investors both institutional

and private arenʼt really considering when they evaluate a company like Antioquia.

Labor is very inexpensive, which means 10 men on the ground in Colombia costs the same as 1

on the ground, in many cases, in a place like the United States. Currency superiority has an

obvious effect on the bottom line too. Costs associated with exploration and production are

substantially lower for just that reason.

Colombia also has a mature and reasonable mining code, so the likelihood of a Venezuelan-style

nationalization or even an Australian-style schizophrenic self-cannibalization, is extremely

unlikely.

All this adds up to a pretty attractive package in the case of Antioquia, if you ask me. At current

price levels, the chance of an exponential win is inherently greater. Kind of like Ventana was at

$0.50.

DISCLOSURE: A fee has been paid for the production and distribution of this article and as such

it should be viewed in the context of advertising.

© 2009 MidasLetter.com – All Rights Reserved- Unauthorized duplication or distribution of all content herein prohibited.

This document is copyright protected and may not be copied, disseminated or distributed without the prior express

consent of Resourcex Financial Publishing LLC. Contact darryl.kelley@resourcex.com for permissions and licensing.