Dubai Real Estate Market Overview

advertisement

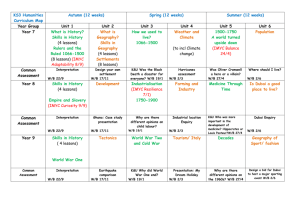

Q1 2015 Dubai Real Estate Market Overview Dubai Market Summary The first quarter of the year continued to see subdued activity in Dubai’s real estate market. While residential rents remained relatively flat, sale prices saw a marginal decline across both apartments and villas. The retail market continues to be constrained by the slowdown in spending, restricting overall growth levels, while the delivery of more Grade A office space has limited rental growth in the office sector. The hospitality market saw RevPAR’s drop on an annual basis. While occupancy rates remain strong at 86%, the increase in supply continues to outstrip demand, placing downward pressure on average daily room rates. Dubai Prime Rental Clock Q1 2014 Residential Hotel* Rental Growth Slowing Rents Falling Rental Growth Accelerating Rents Bottoming Out Retail Office Q1 2015 Retail Rental Growth Slowing Rental Growth Accelerating Residential Hotel* Rents Falling Rents Bottoming Out Office * Hotel clock reflects the movement of RevPAR Note: The property clock is a graphical tool developed by JLL to illustrate where a market sits within its individual rental cycle. These positions are not necessarily representative of investment or development market prospects. It is important to recognise that markets move at different speeds depending on their maturity, size and economic conditions. Markets will not always move in a clockwise direction, they might move backwards or remain at the same point in their cycle for extended periods. Source: JLL Dubai Office Market Overview Market Summary Dubai’s office market remained relatively stable over the first quarter, with average rents across the CBD registering AED 1,880 per sq m and vacancies recording 23%. Demand for Grade A quality stock continues to be robust, particularly in the DIFC and it’s surrounding precinct (e.g. Daman Tower), evident by the rate of leasing activity. In turn, demand for Grade B office space remains weak, exerting downward pressure on asking rents. The first quarter saw the handover of Central Park in DIFC, adding approximately 130,000 sq m of office space to the market. This brings the total GLA to 7.7 million sq m as of Q1 2015. Hot Topic Future supply to constrain rents. The next couple of years are expected to see more Grade A office space enter the market, as the flight to quality remains the trend in Dubai’s office sector. In addition to the handover of Central Park, an additional 900,000 sq m of office GLA is expected to enter the market over the next 9 months. In addition, the DIFC have announced a AED 200 million expansion plan which includes a commercial tower & new retail space; Building 11 of Gate Village is expected to complete in 2017. In 2018, ICD Brookfield are expected to deliver a USD 1 billion development, which includes a 50-storey office tower in the DIFC. While this increases the number of Grade A offerings, the excess supply is expected to exert downward pressure on office rents, leaving the office market situated at the bottom of the property cycle in the short-to-medium term. Office Supply Current Supply (2012–2015) 7.1M sq m (GLA) 2012 7.4M sq m (GLA) 7.6M sq m (GLA) 2013 2014 Future Supply (2015–2017) 7.7M sq m (GLA) Q1 2015 900K sq m (GLA) 9M 2015 332K 200K sq m (GLA) sq m (GLA) 2016 2017 Office Performance CBD Vacancy Rate Prime CBD Rents (per sq m) / Annual Change 26% 23% Q1 2014 Q1 2015 AED 1,860 1,880 1% Q1 2014 Y-o-Y Q1 2015 2015 / 2016 Outlook 2015 / 2016 Outlook COPYRIGHT © JONES LANG LASALLE IP, INC. 2015 Dubai Residential Market Overview Market Summary Q1 saw the delivery of approximately 730 residential units across Dubai. An additional 22,000 are expected to enter the market by the end of 2015, however we remain cautious of the delivery of some projects within the specified timeframe. While Dubai’s rental market has maintained its overall stability during the first quarter, the REIDIN sales index depicts a marginal decline in prices across both apartments & villas. This comes as the REIDIN rental index shows growth levels dropping to 8% Yo-Y in February 2015 (from 23% Y-o-Y in Q1 2014). Similarly, the REIDIN sale price index shows a decline in growth levels from 30% to 6% over the same period. This downward trend is expected to continue throughout 2015, as we foresee prices dropping up to 10% by year end. Hot Topic Increased focus on affordable housing. As Dubai’s residential market moves towards a period of correction, the next driving force is predicted to be end-users or middle-income earners, as opposed to speculative buyers. The first quarter of the year saw developer and government initiatives target the affordable housing sector. On the development side, Nshama launched 2 phases of it’s Town Square project, Zahra & Hayat, consisting of townhouses & apartments below AED 600 per sq ft, located close to the Arabian Ranches. The Dubai Municipality has proposed to introduce mandatory affordable housing quotas for all new residential developments. In addition, it allocated over 100 hectares of land for affordable housing across various locations in Dubai, targeting buyers and tenants with monthly salaries of AED 3,000 – AED 10,000. Residential Supply Current Supply (2012–2015) 356K units 2012 366K units 2013 Future Supply (2015–2017) 377K 379K units units 2014 Q1 2015 22K units 9M 2015 13K 10K units units 2016 2017 Residential Residential Performance Performance Dubai Residential Property Rent and Sale Indices Apartment residential Sales Rentals -2% 0% Villa residential Rentals 7% Source : REIDIN 9% Y-o-Y -1% Rentals 0% Q-o-Q Q-o-Q Sales Sales Source : REIDIN COPYRIGHT © JONES LANG LASALLE IP, INC. 2015 Sales Rentals 6% 2% Y-o-Y Dubai Retail Market Overview Market Summary The first quarter saw Dubai’s retail market remain largely stable. Despite recording strong annual growth levels, average retail rents registered no quarterly increases. Similarly, vacancy levels remained at 8% as no major deliveries took place, except for the handover of ‘Box Park’ by Meraas. The subdued nature of the retail market comes as the industry copes with a drop in the number of visitors from Russia, while the weak euro threatens visitors from the Eurozone. Performance of the retail market is expected to remain stagnant throughout 2015, following estimates of a slowdown in retail sales growth figures. The latter is likely to put pressure on retailers and squeeze out some of the small & mid sized tenants as they become burdened with achieving targets to meet high rents. Hot Topic Importance of Shopping Festival. According to statistics issued by Visa, the total Visa card spend in the first 2 weeks of Dubai’s Shopping Festival (DSF) 2015 increased 12% Y-o-Y to reach USD 54 million. In terms of spending growth patterns, restaurants witnessed the largest annual increase; 31% compared to 2014 figures. Predictably, visitors from Saudi Arabia emerged as the top spenders, contributing USD 35 million to the UAE’s economy, and representing a 29% Y-o-Y increase. Given the general stability in the sector, these figures portray the significant impact the event has on Dubai’s retail market. Retail Supply Current Supply (2012–2015) 2.8M sq m (GLA) 2012 2.9M sq m (GLA) 2.9M Future Supply (2015–2017) 2.9M sq m (GLA) sq m (GLA) 2014 Q1 2015 2013 194K sq m (GLA) 9M 2015 373K sq m (GLA) 219K sq m (GLA) 2016 2017 Retail Performance Vacancy Rate Average Retail Rents (per sq m) / Annual Change 10% 8% Q1 2014 Q1 2015 Primary AED Secondary 2015 / 2016 Outlook 4,230 4,890 16% Q1 2014 Q1 2015 Y-o-Y 1,885 2,180 16% Q1 2014 Q1 2015 Y-o-Y 2015 / 2016 Outlook COPYRIGHT © JONES LANG LASALLE IP, INC. 2015 Dubai Hotel Market Overview Market Summary The hotel sector continued to face downward pressure in the first quarter of the year. While occupancy rates only dipped marginally (2% Y-o-Y), ADR’s saw a 5% decrease to reach USD 273 in the YT February. This negatively impacted RevPar’s, which saw a 7% decline to USD 235 over the same period. While occupancy levels remain healthy and above the MENA average, downside risk remains that ADR’s will soften further in response to the additional 3,600 keys scheduled for delivery over the next 9 months. Hot Topic Demand increasing at a slower rate. Dubai’s hotel market welcomed 11.6 million guests in 2014, according to figures released by the Dubai Tourism & Commerce Marketing. While this represents a 6% Y-o-Y increase, the rate of growth has declined from the 11% registered in 2013. The slowdown can be attributed to a decline in the number of tourists from Russia and the Eurozone. By contrast, tourist numbers from emerging markets have increased significantly. Guests from South Asia, Far East Asia and Africa increased 14%, 13% and 11% respectively. This comes on the back of rising wealth and changing consumer habits in emerging markets, in addition to increased efforts to diversify Dubai’s inbound markets. Hotel Supply Current Supply (2012–2015) 57,000 keys 2012 60,200 64,400 keys keys 2013 2014 Future Supply (2015–2018) 64,900 keys Q1 2015 3,600 keys 9M 2015 8,400 9,200 6,800 2016 2017 2018 keys keys keys Hotel Performance Average Daily Rate / Annual Change Occupancy Rate 88% 86% YT Feb 2014 YT Feb 2015 USD 273 -5% YT Feb 2014 YT Feb 2015 Y-o-Y 2015/2016 Outlook 2015/2016 Outlook Source : STR Global 286 Source : STR Global COPYRIGHT © JONES LANG LASALLE IP, INC. 2015 Definitions and methodology Interpretation of market positions: 6 o’clock indicates a turning point towards rental growth. At this position, we believe the market has reached its lowest point and the next movement in rents is likely to be upwards. 9 o’clock indicates the market has reached the rental growth peak, while rents may continue to increase over coming quarters the market is heading towards a period of rental stabilisation. 12 o’clock Indicates a turning point towards a market consolidation / slowdown. At this position, the market has no further rental growth potential left in the current cycle, with the next move likely to be downwards. 3 o’ clock Indicates the market has reached its point of fastest decline. While rents may continue to decline for some time, the rate of decrease is expected to slow as the market moves towards a period of rental stabilisation. The supply and stock data is based on our quarterly survey of 53 sub markets, starting from 2009. This data excludes labour accommodation and local Emirati housing supply. Completed buildings refer to those handed over for immediate occupation. Future supply is based on projects under construction. Residential performance data is based on the REIDIN monthly index. REIDIN Dubai Residential Property Price Indices (RPPIs) use monthly sample of offered/asked listing price data and land registry price data (trans- action data). Index series are set at 100 starting at the beginning of each data set. The supply data is based on our quarterly survey of 32 sub-markets, starting from 2009. Completed buildings refer to those handed over for immediate occupation. Future supply is based on projects under construction. Central Business District includes DIFC, DTCD, Sheikh Zayed Road, Burj Khalifa Downtown. Prime Office Rent represents the top open-market net rent (exclusive of service charge) for a new lease that could be expected for a notional office unit of the highest quality and specification in the best location in a market, as at the survey date. Data relates to headline rents, exclusive of incentives. Vacancy rate is based on estimates from the JLL Agency team. It represents the average rate across a basket of buildings in the CBD that make up around 80% of the CBD supply and 15% of the total current supply. Classification of Retail Centers is based upon the ULI definition and based on their GLA: • Super Regional Malls have a GLA of above 90,000 sq m • Regional Malls have a GLA of 30,000 - 90,000 sq m • Community Malls have a GLA of 10,000 - 30,000 sq m • Neighborhood Malls have a GLA of 3,000 - 10,000 sq m • Convenience Malls have a GLA of less than 3,000 sq m The supply data is based on our quarterly survey of 45 sub-markets, starting from 2009. Future supply is based on projects under construction. Malls are categorized based on their turnover levels. Primary Malls are the good performing malls with high levels of turnover. Secondary Malls are the average performing malls with lower levels of turnover. Average rents represent the top open market net rent expected for a standard in line unit shop of 100 sq m in a basket of regional and super regional centers. Vacancy rate is based on estimates from the JLL Retail team, and represents the average rate across standard in line unit shops at super regional malls. Hotel room supply is based on existing supply figures provided by DTCM as well as future hotel development data tracked by JLL Hotels. Room supply includes all graded supply and excludes serviced apartments. STR performance data is based on a monthly survey conducted by STR Global on a sample of more than 32,000 rooms across Dubai. Dubai Emaar Square Building 1, Office 403 Sheikh Zayed Road PO Box 214029 Dubai, UAE Tel: +971 4 426 6999 Fax: +971 4 365 3260 For questions and inquires about the Dubai real estate market, please contact: Dana Williamson Head of Agency MENA dana.williamson@eu.jll.com Andrew Williamson Head of Retail MENA andrew.williamson@eu.jll.com Craig Plumb Head of Research MENA craig.plumb@eu.jll.com Dana Salbak Senior Research Analyst MENA dana.salbak@eu.jll.com @JLLMENA youtube.com/joneslanglasalle Chiheb Ben-Mahmoud Head of Hotels & Hospitality MEA chiheb.ben-mahmoud@eu.jll.com linkedin.com/companies/jll joneslanglasalleblog.com/EMEAResearch jll-mena.com COPYRIGHT © JONES LANG LASALLE IP, INC. 2015 This publication is the sole property of Jones Lang LaSalle IP, Inc. and must not be copied, reproduced or transmitted in any form or by any means, either in whole or in part, without the prior written consent of JLL IP, Inc. The information contained in this publication has been obtained from sources generally regarded to be reliable. However, no representation is made, or warranty given, in respect of the accuracy of this information. We would like to be informed of any inaccuracies so that we may correct them. JLL does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication.