WMATA Oversight Responses - Council of the District of Columbia

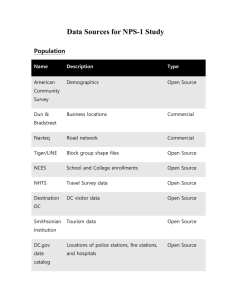

advertisement