Annual Report 2012 (English)

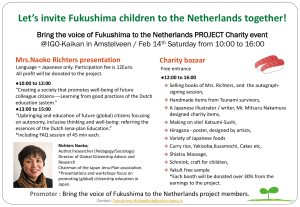

advertisement