New Section 501(r) Reporting Requirements for

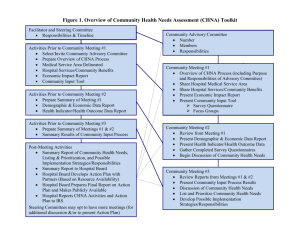

advertisement

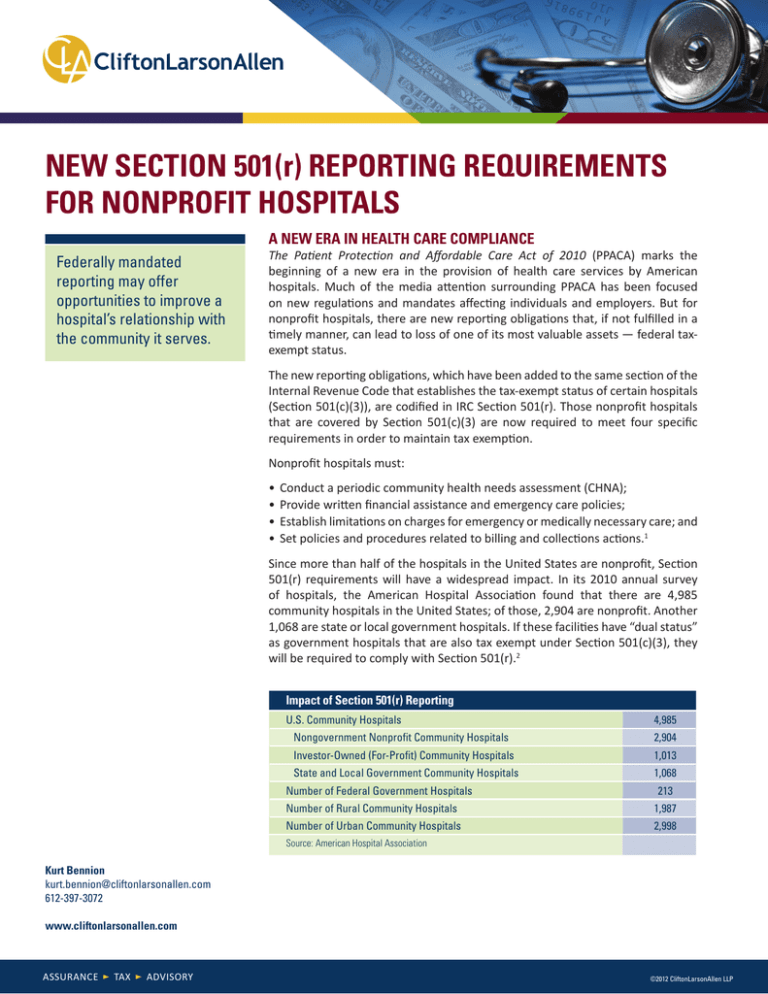

NEW SECTION 501(r) REPORTING REQUIREMENTS FOR NONPROFIT HOSPITALS A NEW ERA IN HEALTH CARE COMPLIANCE Federally mandated reporting may offer opportunities to improve a hospital’s relationship with the community it serves. The Patient Protection and Affordable Care Act of 2010 (PPACA) marks the beginning of a new era in the provision of health care services by American hospitals. Much of the media attention surrounding PPACA has been focused on new regulations and mandates affecting individuals and employers. But for nonprofit hospitals, there are new reporting obligations that, if not fulfilled in a timely manner, can lead to loss of one of its most valuable assets — federal taxexempt status. The new reporting obligations, which have been added to the same section of the Internal Revenue Code that establishes the tax-exempt status of certain hospitals (Section 501(c)(3)), are codified in IRC Section 501(r). Those nonprofit hospitals that are covered by Section 501(c)(3) are now required to meet four specific requirements in order to maintain tax exemption. Nonprofit hospitals must: • Conduct a periodic community health needs assessment (CHNA); • Provide written financial assistance and emergency care policies; • Establish limitations on charges for emergency or medically necessary care; and • Set policies and procedures related to billing and collections actions.1 Since more than half of the hospitals in the United States are nonprofit, Section 501(r) requirements will have a widespread impact. In its 2010 annual survey of hospitals, the American Hospital Association found that there are 4,985 community hospitals in the United States; of those, 2,904 are nonprofit. Another 1,068 are state or local government hospitals. If these facilities have “dual status” as government hospitals that are also tax exempt under Section 501(c)(3), they will be required to comply with Section 501(r).2 Impact of Section 501(r) Reporting U.S. Community Hospitals 4,985 Nongovernment Nonprofit Community Hospitals 2,904 Investor-Owned (For-Profit) Community Hospitals 1,013 State and Local Government Community Hospitals 1,068 Number of Federal Government Hospitals 213 Number of Rural Community Hospitals 1,987 Number of Urban Community Hospitals 2,998 Source: American Hospital Association Kurt Bennion kurt.bennion@cliftonlarsonallen.com 612-397-3072 www.cliftonlarsonallen.com ASSURANCE TAX ADVISORY ©2012 CliftonLarsonAllen LLP COMPLIANCE TIME AND EFFORT federal, state and local taxes, from income tax to property tax. There would be implications for hospitals that issue tax-exempt bonds. An exempt hospital would also lose its charitable fundraising ability and could face damage to its public image. Complying with Section 501(r) is not easy. It can take anywhere from four months to a year, and can require a significant investment of time and money. Among the possible outcomes are a decrease in the amounts a hospital is able to charge for services, and a less aggressive approach to debt collection. Depending on the size and complexity of the organization, it may be necessary to hire a new employee or a consultant just to manage this issue. A reasonable question is whether the IRS would actually follow through and revoke the exempt status of a hospital, especially in areas that are underserved. Although the IRS has been silent on this issue, it seems reasonable to assume that revocation will ultimately depend on the specific facts and circumstances. Examples of relevant facts would be indicators of noncompliance from accidental, limited oversight; indicators of noncompliance from intent to disregard, manipulate or abuse the rules; and the speed with which the necessary steps are taken to correct noncompliance. However, a hospital should not count on the benevolence of any government agency when deciding how it will meet the Section 501(r) requirements. In light of these new obligations and the new risk to a hospital’s tax-exempt status, an organization might ask itself what that status is worth, and how hard the organization is willing to fight to maintain it. The nonfinancial benefits of tax-exempt status should also be considered, including goodwill in the community and fundraising ability. This white paper looks at each of the proposed new requirements individually, and discusses how each can be viewed as an opportunity to strengthen the hospital at the same time as the hospital strengthens its community. It should be noted that much of the currently available information on Section 501(r) is from IRS Notice 201152 and the Technical Analysis of the PPACA, which are not considered “authoritative.” Eventually, the IRS and U.S. Department of Treasury will issue one or more authoritative regulations covering Section 501(r). The Exempt Organizations division of the IRS has stated that those regulations are a priority for the current fiscal year.3 It is critical that all efforts made to meet these requirements be thoroughly documented. Proper documentation is a requirement of Section 501(r), but it can also be used to show that a hospital is making good-faith efforts to comply with the rest of Section 501(r) requirements. FOCUS ON NONPROFIT HOSPITALS Section 501(r) applies to “hospital organizations,” which are defined as organizations that operate state-licensed or registered facilities, or any other organization which the IRS determines has hospital care as its principal function or constituting the basis for its exemption under Section 501(c)(3).7 Hospital organizations include organizations that own any interests in a hospital through a joint venture, partnership, LLC or similar legal structure.8 PPACA means that tremendous changes are on the horizon for nonprofit hospitals. How a hospital responds to these changes — as a compliance burden or as an opportunity to strengthen ties with patients and the community — will ultimately determine the impact of this sweeping law on that hospital and its community. Section 501(r) also applies to “dual status” hospitals,9 which are government hospitals that also have exempt status under Section 501(c)(3). They typically seek exempt status so they can sponsor a 403(b) pension plan (government agencies have a separate required pension plan). A hospital can check the pension footnote in its financial statements as an indicator of whether it has 501(c)(3) status. An additional resource is the IRS’ new Select Check tool, available at apps.irs.gov/app/eos, which identifies most 501(c)(3) charities. If the issue still isn’t clear, the hospital can contact a qualified lawyer or accountant for assistance. PENALTIES FOR NONCOMPLIANCE If a hospital fails to demonstrate compliance with the CHNA requirement (501(r)(3)), a $50,000 excise tax may be assessed for that year and in each succeeding year of noncompliance.4 Organizations with multiple hospitals can be hit even harder.5 For instance, if a health system owns three hospitals and fails to comply for any of them, a $150,000 excise tax will be assessed ($50,000 x 3). If the hospitals fail to complete the assessment the following year, another $150,000 will be due. It should also be noted that the definition of “hospital organizations” does not apply to facilities located outside of the 50 states and the District of Columbia, nor does it apply to facilities in U.S. possessions or territories.10 The lesser-known, but perhaps more serious penalty, is the loss of tax-exempt status for noncompliance with any of the Section 501(r) requirements.6 This is a major risk issue and concern for all nonprofit hospitals. Loss of exempt status would make them subject to a host of www.cliftonlarsonallen.com 2 ©2012 CliftonLarsonAllen LLP Finally, Section 501(r) requires that if a single tax-exempt organization operates more than one hospital facility, each facility must meet the requirements separately.11 A comparison of the definition of a hospital in Section 501(r) and the definition on Form 990’s Schedule H (filed annually by certain nonprofits) shows that they are virtually the same. A hospital that must file Schedule H will also be required to comply with Section 501(r), although some hospitals that don’t file a Form 990 (e.g. dual status government hospitals) are still required to comply with Section 501(r). POLICIES AND PROCEDURES Federal and state governments continually evaluate the activities of tax-exempt and taxable hospitals, seeking a clear delineation of why some hospitals deserve tax exemption while other hospitals provide similar or identical services under a taxable structure. One differentiating factor is a focus on individuals in greater need. Several requirements of Section 501(r) appear to address this issue by requiring hospitals to have in place policies and procedures that provide greater protection to individuals in need of financial assistance. Under Section 501(r), two written policies and two practices should already have been implemented by the end of the tax year that started after March 23, 2010:12 Financial assistance policy This written policy must include the eligibility criteria for financial assistance from the hospital; a determination of whether the financial assistance includes free or discounted care; the basis for calculating amounts charged; and the method(s) of applying for financial assistance. If there is no separate billing and collection policy, the financial assistance policy must also include the actions that are allowed in the event of nonpayment.13 The financial assistance policy must also include a description of how it is “widely publicized” to the community,14 using methods such as posting on the hospital’s website, attaching the policies to invoices, posting policies in emergency rooms and waiting rooms, and distribution through the admissions office. None of these methods is “preferred,” and a combination of methods is the most common approach. Emergency medical care policy Section 501(r)(4)(B) requires a hospital to have a written policy stating that the hospital will provide care for emergency medical conditions without discrimination, and regardless of an individual’s qualification under the hospital’s financial assistance policy.15 An emergency medical condition is defined by Section 1867 of the Social Security Act, which was enacted in 1986 as part of the Emergency Medical Treatment and Labor Act (EMTALA). Based on EMTALA, an emergency medical condition is an acute medical condition that, if not given immediate medical attention, could reasonably be expected to result in: • Placing the health of the individual in serious jeopardy • Serious impairment of bodily functions • Serious dysfunction of any bodily organ or part For a pregnant woman having contractions, an emergency exists if there is inadequate time for a safe transfer to another hospital before delivery, or if such a transfer would pose a threat to the health or safety of the woman or the child.16 www.cliftonlarsonallen.com 3 ©2012 CliftonLarsonAllen LLP EMTALA already required hospitals to follow these rules; Section 501(r) simply requires that the specific practices and procedures of the facility be formally written into their policies. collection practices uniformly applied to all patients, regardless of whether or not they qualify for financial assistance. Policies and practices should be in place to Limitations on charges Under Section 501(r), gross charges are not allowed for any individual who qualifies for assistance under the financial assistance policy, regardless of the type of treatment received.17 This means that a hospital can’t actually charge the patient gross charges; gross charges can be used as the starting point for calculating rates. One method that is commonly used is to reduce charges by a standard amount, thereby ensuring that gross charges are never actually billed. The CHNA is a process, but the process, conclusions and responses must be thoroughly documented. ensure compliance with this requirement. One extremely useful step is a “brainstorming session” to consider any random scenario in which collection practices violate this requirement. Once a robust policy and/or procedure is in place, development of a regular, periodic internal control and/or internal audit review process is important to ensure continued compliance. Policies and practices must also be in place to ensure that, for individuals who qualify under a hospital’s financial assistance policy, the amounts charged for emergency and other medically necessary care do not exceed amounts charged to those with insurance coverage.18 The IRS currently recognizes three options to arrive at the allowable charges: COMMUNITY HEALTH NEEDS ASSESSMENT The intention of the community health needs assessment requirement appears to be to hold nonprofit hospitals accountable for meeting health needs as a condition for maintaining tax-exempt status. Some hospitals and health systems voluntarily conduct a form of assessment for marketing and strategic planning purposes, or to comply with state community benefit requirements. Under the new rules, specific information must be gathered from individuals, government agencies, and other area organizations, submitted to the IRS, and made available to the public. • Average the three lowest negotiated commercial rates, • Lowest negotiated commercial rate, or • Medicare rate.19 The goal is to protect the financial interests of the poor by having charges uniformly applied to all patients, regardless of whether or not they qualify for financial assistance. Policies and practices should be in place to ensure compliance with this requirement. A useful practice is a “brainstorming session” to consider any random scenario in which a person could possibly be charged in a way that violates this requirement. Once a robust policy and procedure is in place, development of a regular, periodic internal control and/or internal audit review process is important to ensure continued compliance. The CHNA is a process, but the process, conclusions and responses must be thoroughly documented.23 People tend to use the term “community health needs assessment” (CHNA) to refer to the process of conducting the assessment, the documents that result from the process, or all of the above. The deadline for completing the first CHNA is the end of the tax year that starts after March 23, 2012.24 Beginning with that year, Section 501(r) requires hospitals to do the following within the tax year or the two prior years:25 Billing and collection Before engaging in extraordinary collection actions a hospital must make reasonable efforts at determining if the patient qualifies for assistance under the financial assistance policy.20 Congress has identified lawsuits, liens on residences, arrests, body attachments, and similar collection processes as “extraordinary collection actions.” 21 Congress has also indicated that “reasonable efforts” include such actions as notifying the patient of the financial assistance policy upon admission, in any communications (written and oral) regarding the patient’s bill, and on invoices and in phone calls.22 • Conduct a CHNA that meets all of the procedural requirements;26 • Document the CHNA process in a CHNA report that is made widely available to the public;27 and • Adopt an implementation strategy that responds to the identified community health needs.28 After a hospital’s initial assessment, the CHNA must be conducted every three years. The IRS has said that it will treat the CHNA as being conducted in the year the report is made available to the public, regardless of when the process began.29 The IRS has said that it considers Similar to the limitation on charges, the goal here is to protect the financial interests of the poor by having www.cliftonlarsonallen.com 4 ©2012 CliftonLarsonAllen LLP the implementation strategy “adopted” on the day it is approved by the governing body, or by a duly authorized committee or individual.30 care), and the target population (based on gender, age, ethnicity, or certain health risks).31 Demographic data can be collected from hospital records, the U.S. Census Bureau, state and county health agencies, and other resources. The IRS specifications for completing the CHNA and implementation strategy provides an opportunity for hospitals to manipulate the timing of their next required CHNA. For example, a hospital with a December 31 year end would have to complete its first CHNA by December 31, 2013, and its next CHNA by December 31, 2016. If the same hospital chose to finish its first CHNA by December 31, 2012, the next assessment would be due by December 31, 2015. If the hospital had finished its CHNA report and implementation strategy in December 2012, it could wait until January 2013 to widely publicize the report and approve the implementation strategy, effectively pushing back the deadline for the next CHNA for 47 months to December 2016. The community should be defined broadly enough to include all of the individuals who should reasonably be included.32 If the community is defined too narrowly, the government may say that target populations were intentionally excluded. This could lead to unwanted consequences, such as the government saying that an acceptable CHNA was not conducted. These target populations — minorities and those with low income, those who are underserved and those with chronic diseases — are generally more likely to need financial assistance and specialized medical care, and may be less likely to be served by a for-profit hospital. The government hasn’t specified what demographic information must be collected or reported, but examples of relevant demographic data include: The CHNA process Although the CHNA is driven by the IRS and the U.S. Department of Treasury, it is neither a tax analysis nor a financial analysis. Rather, it is a snapshot of the health care needs in a designated community. It combines demographic data with public input to see how a nonprofit hospital can further fulfill its tax-exempt mission. • Household income • Percentage below the federal poverty level • Population growth • Ethnicity • Age • Education level • Insurance status • Population density • Disability rates • Health outcomes • Health factors • Births • Deaths • Disease incidence and prevalence The only way for a hospital to avoid Section 501(r) compliance is to forfeit its 501(c)(3) status, either intentionally or by default. Since these are not viable options for most organizations, a hospital really has two choices: • View Section 501(r) as one more government regulation that the hospital has to comply with; only put in minimal time and resources to comply with Section 501(r) requirements (no return on investment) • View Section 501(r) as an opportunity to grow and improve; invest reasonable additional time and resources to go beyond the minimum (and get a return on investment) Soliciting community input A properly conducted CHNA must include input from persons who represent the broad interests of the community served by the hospital.33 These include: Either approach is acceptable, but it is important to decide on a path before trying to walk it. • Persons with special knowledge or expertise in public health.34 • Government departments and agencies with current data or other information relevant to the health needs of the community.35 • Leaders, representatives or members of the specific populations, including:36 Defining the community A critical early step is to clearly identify the hospital’s community. This identification determines who will be targeted for information-gathering activities, which in turn impacts the health needs identified. Identifying a hospital’s community may be very easy or very difficult, depending on the records available and the people served. To define the community, all relevant facts and circumstances must be used, including the hospital’s stated mission and purpose, the geographic area served, the hospital’s principal functions (including specialized www.cliftonlarsonallen.com oo The medically underserved37 oo Persons with low income38 oo Minorities39 oo Persons with chronic diseases40 5 ©2012 CliftonLarsonAllen LLP Section 501(r) Issues to Resolve In Notice 2011-52, the IRS identified various issues subject to further consideration: 1. Section 501(r) applies to organizations that “operate” a state-licensed hospital facility. If a partnership owns a hospital, what amount of ownership interest will trigger the “operate” requirement? 2. What alternative methods could dual status hospitals use to satisfy the community health needs assessment requirement? 3. What are the potential consequences for an organization that operates multiple hospitals when one (or more) hospital facility fails to comply with 501(r) while other hospitals successfully comply? 4. What guidance is needed (if any) regarding when a hospital organization must conduct a CHNA for a new hospital facility that it either acquires or places into service after March 23, 2010? 5. Can documenting the CHNA process for multiple hospitals together in one written report improve the quality of the CHNAs? If so, under what circumstances? 6. Does the IRS define the geographic community as the Metropolitan Statistical Area (MSA) or Micropolitan Statistical Area (µSA) in which the facility is located. If the hospital is a rural facility located in neither statistical area, is the geographic community the county where the facility is located? 7. What specific qualifications (degrees, positions, experience, or affiliations) should be necessary for an individual or organization to be considered as having special knowledge or expertise in public health? 8. Should future guidance provide additional methods that a hospital can or must use to make a CHNA widely available to the public? 9. Can documenting implementation strategies for multiple hospitals together in one written document improve the quality of the implementation strategies? If so, under what circumstances? 10. What (if any) transition rule is necessary for a hospital organization to be given additional time to adopt an implementation strategy for the first taxable year in which the hospital is subject to the CHNA requirements? www.cliftonlarsonallen.com Input may be obtained directly from the medically underserved, low income, minority, and chronically ill populations, or it may be obtained from their leaders or representatives. A person can fall into more than one of these categories, and can be listed as satisfying all applicable categories.41 The law does not specify how many people must be interviewed or surveyed in each category. A hospital should talk to enough people that there is a high level of confidence in the breadth and depth of the results. SOURCES OF COMMUNITY INPUT Some hospitals may not know where to start looking for community input. Below are a few suggestions: Individuals and Organizations Health care consumer advocates, nonprofit organizations, academic experts, local government officials, community-based organizations, health care providers, private businesses, health insurance organizations, managed care organizations, board members. Government Officials County health director, director of public health nursing, county coroner, school superintendent, mayor, county commissioners, state representatives Forming committees Committees can be useful in developing and conducting a CHNA and in responding through the implementation strategy. Forming these committees is not a requirement of Section 501(r), but it is a good way to solicit community input and draw attention to outreach efforts. A steering committee may be created to guide and monitor the CHNA process and make decisions. Because the CHNA is a medical analysis that involves community members, that requires financial consideration, and that may ultimately impact the strategic plans of the hospital, it is helpful to include individuals from the medical staff, nursing, finance, marketing, and administration. Such a group would result in a steering committee of approximately four to six people. It may also be beneficial to create a community committee to analyze data, form conclusions, generate ideas, and make recommendations to the steering committee. This group may include eight to 15 individuals who are internal and external to the hospital, including a member of the steering committee, doctors, nurses, local business leaders, government officials, community leaders, and local nonprofit leaders. An additional benefit of the community committee is that the hospital is required to get input from most of these people anyway; creating the committee gets their input and involves them in 6 ©2012 CliftonLarsonAllen LLP the process. Finally, the community committee can also help the hospital develop valuable outside collaboration when the time comes to follow the implementation strategy. Gathering input Although it is necessary to gather input regarding community health needs, there is no specific requirement as to how much information must be gathered. The main goal is to collect it from all of the required sources. Some guidance is available. First, research should not be limited to those who actually use the hospital’s services. Try to go outside of the hospital to get information, and let outsiders provide their input about how to address health needs. Some useful, original ideas may surface. Second, a number of methods can be used to gather input from the community. For example: • Interviews • Surveys • Questionnaires • Focus groups • Community forums • Dedicated email addresses or websites where people can provide input Because the specified process for gathering information is vague, it would be very easy for a hospital to stop gathering data too early, or to keep gathering data for way too long. At each step, the key is to monitor for a general consensus of issues. Once that consensus has been identified (and the hospital feels relatively confident that no other major issues would arise through further research), it is probably time to move on to the next step. Definition of “community” Profile and Demographics Health Indicator Data Key Interviews Steering Committee Meeting(s) Develop and Refine the Implementation Strategy Findings and Results Refine needs, priorities and strategies Priorities Widely Distribute the CHNA Follow the Implementation Strategy Develop the implementation plan Initial Strategies Forums, Surveys, etc. Develop the dissemination plan Other Data and Inputs Documentation www.cliftonlarsonallen.com 7 ©2012 CliftonLarsonAllen LLP WRITING THE CHNA REPORT must be completely free of charge for the individual accessing it, and the document must be in a format that exactly reproduces the original document when accessed, downloaded, viewed, and printed.47 A user must also be able to access, download, view, or print the CHNA report without having to purchase special software or hardware.48 The easiest way to satisfy these requirements is to create the document in the .pdf format using Adobe Acrobat. A link to the free Adobe Reader software would then allow users to view and print the document. Section 501(r) requires that specific information must be included in the CHNA report:42 • Description of the community served • How the community was determined • Process and methods used to conduct the assessment • Sources and dates of data used • Analytical methods applied • Information gaps that impact the hospital’s ability to assess community health needs • List of organizations that collaborated with the hospital • Identity and qualifications of any third parties contracted to assist in the process • Methods the hospital used to receive input from persons representing the broad interests of the community, including when and how the organization consulted with the persons • List of organizations that provided input, including the name and title of each organization’s representative(s) • List of individuals representing government departments or agencies • Name, title, affiliations, and qualifications of any individual who has special knowledge or expertise in public health • Name and qualifications of any individual whose comments are intended to represent the underserved, low income, minority, and chronically ill populations • Prioritized description of all community health needs identified • Process and criteria used to prioritize the needs • Existing health care facilities and other resources available within the community to meet the identified health needs If anyone requests a copy of the CHNA report for any reason, the hospital can satisfy its obligation by providing the website URL or a printed copy.49 Once the report is available on the site, it must remain available until the date on which a new report is made available.50 THE IMPLEMENTATION STRATEGY Section 6033(b)(15) requires that the hospital specifically address each identified community health need regardless of its size or significance. The implementation strategy is considered complete when it is officially approved by the hospital’s governing body, an authorized committee of the governing body, or any other authorized party.51 If a committee or individual is going to approve the implementation plan, the approval process must comply with state laws concerning the delegation of powers to committees52 and others. If an individual is approving the plan, that person must also follow a process laid out by the governing body.53 Unlike the CHNA report, Section 501(r) does not require the implementation strategy to be widely publicized. However, the IRS is planning to require that a copy of the implementation strategy be attached to Form 990, Schedule H.54 The IRS has created a group to review the Schedule H of hospitals for compliance with Section 501(r).54 PUBLICIZING THE CHNA The implementation strategy must address each of the community needs identified through the assessment, as well as either how the hospital plans to meet those needs, or why it does not intend to meet a specific need56. As with many details of Section 501(r), the government hasn’t specified how a hospital must respond to the health needs identified. Doing so is a logical future step for the government, though. As the law now stands, it is acceptable to say that a hospital will take no action to address certain issues, as long as there is a good reason. Some examples of reasons to take no action include: There are a number of ways to make a CHNA report “widely available,” but posting it online is the primary method. When the CHNA report is posted online, there must be a link to the report that is easy to locate, along with clear instructions for accessing the report.43 The report is considered widely available if it is on one of the following websites:44 • The hospital’s website • The hospital’s parent’s website • A third party’s website — the hospital must provide the web address of the site to anyone who requests a copy of the CHNA report45 • The hospital is addressing other factors that are more important • The issue is too big for the hospital to handle singlehandedly (e.g., disease research) • It’s not the hospital’s specialty • The hospital has limited resources When a website is used, it must clearly inform readers that the report is available.46 The site must provide instructions on how to download the report, accessing the report www.cliftonlarsonallen.com 8 ©2012 CliftonLarsonAllen LLP The Hidden Value in the Section 501(r) Requirements The more thought and effort that a hospital puts into Section 501(r) compliance, the more it is likely to get back as a return on its investment. Answering these questions can be a first step toward realizing the value that may be hidden in the compliance efforts. General questions: • What is tax-exempt status worth to your hospital? • Is the hospital better off with a change in its tax status to “for profit”? • Is the hospital’s specialty/focus one that works well with policy and procedure requirements? • If the hospital is considering a new specialty/focus, how will 501(r) impact that decision? Questions related to policies and procedures: • Does the hospital have the necessary written policies? • Do the hospital’s policies include all of the required provisions? • Do the hospital’s practices around billing and collection comply with the 501(r) requirements? • What internal review/internal control procedures are in place to ensure continued compliance? • Does the hospital have any FIN 48 disclosures associated with the 501(r) requirements? • What is the procedure for correcting mistakes that are discovered? • How can the hospital guarantee that the “limit on charges” thresholds are never being exceeded? • Are there any public relations or marketing steps the hospital can take to capitalize on adjustments to financial assistance, billing and collection policies and procedures? • Is the hospital’s qualification level for financial assistance at the optimal level? • Is this the right time to increase the hospital’s focus on the needy segments of the community? • If the hospital’s focus is changing, what is the best method to get that message out to the target audience? • Is it time to put a greater emphasis on encouraging people to actually read the information on the availability of financial assistance? Questions related to the CHNA: • How much is the hospital willing to invest in responding to the identified health needs? • Does the hospital’s budget include the costs, both in terms of dollars and time, for completing the CHNA process and following through with the implementation strategy? • How can responses in the implementation strategy be used to make the hospital a more visible member of the community? • What result(s) does the hospital want and/or expect to see from each response? • How is the hospital going to measure change and effectiveness for each response? • Can the CHNA be combined with a strategic assessment? • Are other organizations interested in collaborating during the CHNA process in an effort to share resources and reduce costs? • Since the CHNA documents are open to the public, are they being used effectively as marketing tools? www.cliftonlarsonallen.com 9 Collaborating with other hospitals Collaboration in collecting and assessing data, and in responding to identified health needs, is allowed.57 A hospital could collaborate with related hospitals, unrelated hospitals in the geographic area, government agencies, associations, nonprofit organizations, or others. When there is collaboration on the CHNA process, it is important to remember that every hospital must prepare a separate CHNA report specific to its community and a separate implementation plan that responds to the health needs of its community, and that each hospital must identify other organizations with which it has collaborated or plans to collaborate.58 The IRS is currently considering if and how it will allow joint reports59, but there is no clear indication which direction it will take. Opportunities to strengthen a hospital The Section 501(r) requirements regarding financial assistance policies and practices are designed to soften the treatment toward those who are struggling financially. Consider the public relations value in pointing out that the hospital is actively working to be more accommodating to those who are struggling financially. For example, a hospital could highlight compliance efforts in interviews, articles/ editorials, advertisements, flyers, posters, blogs, and online postings to Facebook, Twitter and other social media. In addition, how a hospital responds to its implementation strategy can make it a more active and visible member of the community. Brainstorming sessions may reveal creative responses that give the hospital a unique position. For example, a hospital could: • Sponsor community events like 5K runs, marathons, bike races and sports leagues to illustrate a concern for the physical fitness of the community. • Make long-term investments in capital projects like fitness and recreation facilities that are open to the public. • Work with schools and employers to improve nutrition. ©2012 CliftonLarsonAllen LLP • Re-evaluate the food and snacks offered at the hospital. • Buy back Halloween candy from children to raise nutrition awareness. At the same time, consider the interaction of policies and practices, or the contents of the CHNA, that could have negative consequences. For example, the CHNA may reveal that there is a specific unmet medical need in the community, and also indicate that the hospital is doing very little to address that need. The reason(s) may seem rational and convincing to administrators, but might be interpreted differently by the public. Be ready to answer those questions from the media, or proactively address them. Since the CHNA must be completed every three years, it can also be a resource for strategic planning. Coordinate the hospital’s strategic plans with its implementation strategy to build a long-term plan. Overall, this is an opportunity to be seen as an institution that dedicates resources to improving the health of the community. When the information that must be collected is used to manage health rather than just provide services, it can often show the hospital in a positive light. Footnotes Internal Revenue Code Section 13 Internal Revenue Code Section Explanation of the Revenue 501(r)(1) 501(r)(4)(A) Provisions of the “Reconciliation Act of 2010,” 2 14 Notice 2011-52 Internal Revenue Code Section as Amended, in Combination 501(r)(4)(A)(v) 3 Internal Revenue Service with the “Patient Protection 15 Exempt Organizations 2011 Internal Revenue Code Section and Affordable Care Act” Annual Report and 2012 Work 501(r)(4)(B) 20 Internal Revenue Code Section Plan 16 Social Security Act Section 501(r)(6) 4 Internal Revenue Code Section 1867(e)(1) 21-22 The Joint Committee on 4959 17 Internal Revenue Code Section Taxation’s Technical 5 Notice 2011-52 501(r)(5)(B) and the Joint Explanation of the Revenue Committee on Taxation’s Provisions of the 6 Internal Revenue Code Section Technical Explanation of “Reconciliation Act of 2010,” 501(r)(1) the Revenue Provisions of the as Amended, in Combination 7 Internal Revenue Code Section “Reconciliation Act of 2010,” as with the “Patient Protection 501(r)(2)(A) Amended, in Combination and Affordable Care Act” with the “Patient Protection 8-10 23 Notice 2011-52 Notice 2011-52 and Affordable Care Act” 11 24 Internal Revenue Code Section 18 The Patient Protection and Internal Revenue Code Section 501(r)(2)(B)(i) Affordable Care Act of 2010 501(r)(5)(A) 12 Section 9007(f)(2) The Patient Protection and 19 The Joint Committee on 25 Affordable Care Act of 2010 Internal Revenue Code Section Taxation’s Technical Section 9007(f)(1) 1 501(r)(3)(A)(i) Internal Revenue Code Section 501(r)(3)(B)(i) and Notice 2011-52 26 Internal Revenue Code Section 501(r)(3)(B)(ii) 27 Internal Revenue Code Section 501(r)(3)(A)(ii) 28 Notice 2011-52 29-32 Internal Revenue Code Section 501(r)(3)(B)(i) 33-34 Notice 2011-52 35-54 Internal Revenue Service Exempt Organizations 2011 Annual Report and 2012 Work Plan 55 Internal Revenue Code Section 6033(b)(15)(A) 56 Notice 2011-52 57-59 ABOUT CLIFTONLARSONALLEN CliftonLarsonAllen is one of the nation’s top 10 certified public accounting and consulting firms. Structured to provide clients with highly specialized industry insight, the firm delivers assurance, tax and advisory capabilities. CliftonLarsonAllen offers unprecedented emphasis on serving privately held businesses and their owners, as well as nonprofits and governmental entities. The firm has a staff of more than 3,600 professionals, operating from more than 90 offices across the country. For more information about CliftonLarsonAllen, visit www.cliftonlarsonallen.com. The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting, or tax advice or opinion provided by CliftonLarsonAllen LLP to the reader. The reader also is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances or needs, and may require consideration of nontax and other tax factors if any action is to be contemplated. The reader should contact his or her CliftonLarsonAllen LLP or other tax professional prior to taking any action based upon this information. CliftonLarsonAllen LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. www.cliftonlarsonallen.com 10 ©2012 CliftonLarsonAllen LLP