MODULARITY, VERTICAL INTEGRATION, AND OPEN ACCESS

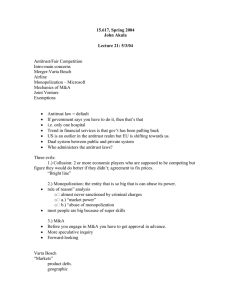

advertisement