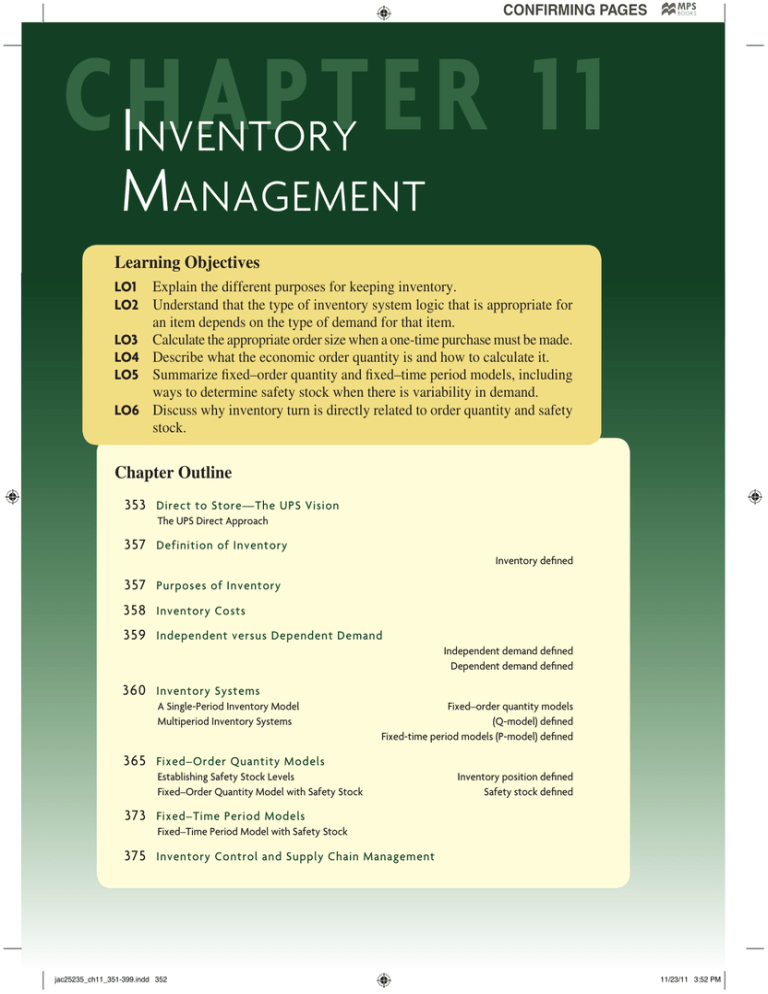

Inventory Management - McGraw Hill Higher Education

advertisement