Guide for Canadian Small Businesses

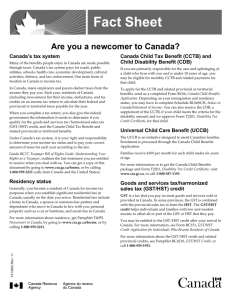

advertisement