1 April 2010 - Bangalore Branch of SIRC of ICAI

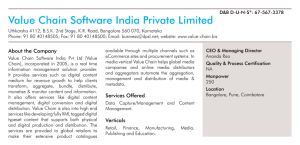

advertisement

1 April 2010 Bangalore Branch of SIRC of the Institute of Chartered Accountants of India April 2010 2 CPE PROGRAMS - April / May 2010 Date/Day Topic /Speaker Venue/Time CPE Credit 07.04.10 Wednesday Basics of Business Valuation CA. Gurudutt Branch Premises 06.00 PM to 08.00 PM 2 Hrs 14.04.10 Wednesday Foreign Direct Investment Regulatory Frame Work - Draft Press Note 2010 CA. D. S. Vivek Branch Premises 06.00 PM to 08.00 PM 2 Hrs 17.04.10 Saturday Workshop on Legal & Financial Safeguards for Challenging Times Delegate Fee: Rs. 250/- Details page no. 18 Branch Premises 09.00AM to 01.00 PM 4 Hrs 21.04.10 Wednesday Tax implications for Employees on Foreign Deputation (Inbound and Outbound) CA. Natarajan S Branch Premises 06.00 PM to 08.00 PM 2 Hrs 24.04.10 Saturday Workshop on KVAT & CST Delegate Fee: Rs. 250/- Details page no. 18 Branch Premises 09.30 AM to 01.30 PM 4 Hrs 28.04.10 Wednesday FEMA Latest Circulars CA. B.D. Chandrasekar Branch Premises 06.00 PM to 08.00 PM 2 Hrs 01.05.10 Saturday Workshop on Service Tax Delegate Fee: Rs. 500/- Details page no. 18 Branch Premises 09.00 AM to 05.30 PM 6 Hrs Note : High Tea at 5.30 pm for programmes at 6.00 pm at branch premises. Important Dates to remember during the month of April 2010 7-Apr-10 10-Apr-10 15-Apr-10 20-Apr-10 21-Apr-10 25-Apr-10 30-Apr-10 - Payment of Tax deducted &Tax collected for the month of March 2010. (However, TDS made on credit entries passed on last day of the financial year based on accrual system of accounting, the due date for remittance is 31st May, 2010. - Deliver to the Commissioner, one copy of declaration received in Form 15 G & Form 15H in the month of March 2010 - Filing of monthly returns of Central Excise for the month of March 2010. - Filing of VAT 120 under KVAT Laws for the month of March 2010. - Payment of Provident Fund for the month of March 2010. - Filing of VAT 100 under KVAT Laws for the month of March 2010. - Filing of Professional Tax returns for the month of March, 2010. - Payment of Employee State Insurance for the month of March 2010. - Filing of Service Tax Return for the Half year ending 31.03.2010. - Filing of Monthly returns of Provident Fund for the month of March 2010. - Filing of Quarterly Statement in Form 27EQ for tax collected at source for the quarter ended 31st March, 2010. - Payment of Professional Tax for the year 2010-11. - Filing of Provident Fund Annual return for the year 2008-09. Advertisement Tariff for the Branch Newsletter Colour full page Inside Black & White Outside back Rs. 20,000/Full page Rs. 10,000/Inside front Rs. 15,000/Half page Rs. 6,000/Inside back Rs. 15,000/Quarter page Rs. 3,000/Advt. material should reach us before 22nd of previous month. Editor : CA. Shambhu Sharma H. Sub Editor : CA. Prasad S.R. DISCLAIMER : The Bangalore Branch of ICAI is not in anyway responsible for the result of any action taken on the basis of the advertisement published in the newsletter. The members, however, bear in mind the provision of the code of ethics while responding to the advertisements. The views and opinions expressed or implied in the Branch Newsletter are those of the authors and do not necessarily reflect those of Bangalore Branch of ICAI. 3 April 2010 Bangalore Branch of SIRC of the Institute of Chartered Accountants of India Managing Committee Members of Bangalore Branch 2010-13 Name Address st Residence Mobile CA. Shambhu Sharma H. Chairman E-mail: casharmaca@gmail.com No. 61, 1 Floor, BTS Main Road, Near 11th Cross, Wilson Garden, Bangalore – 560027 22227201 22273819 25716851 98450–77362 CA. Venkatesh Babu T. R. Vice Chairman E-mail: vbaca@sify.com # 40/1, 2nd Floor 5th Cross 3rd Main Wilson Garden, Bangalore-560027 22103247 41329264 22103247 23444564 98450–31028 CA. Babu K. Secretary E-mail: kbabu74@yahoo.com No. 16, 2nd Floor, Apple villa, Service Tax Office Complex, Lalbagh Road, Bangalore – 560027 22483869 — 93425–00855 97313-00855 CA. Ravindranath S. N. Treasurer E-mail: fcasnravi@yahoo.com Partner Narayana Setty RVM & Co., Chartered Accountants, #227 IST FLR, 4TH Main Road (opp to SBM) ChamarajpetBangalore - 560080 26611090 22420924 26670924 26676112 96325-03279 CA. Nithin M. Chairman, SICASA nithin@nnr.co.in; No.163, Second Floor Rajeshwari Complex Above Karnataka Bank LTD. R V RoadBangalore 560004 41204315 — 94484-023569 9456-82356 CA. Govinda Bhat N. Member gbhatn@gmail.com CFO and Company Secretary Mistral Solutions Pvt LTD 60 Addarsh Regent, 100 Feet Ring Road Domlur EXTNBangalore 560071 30912600 — 97312-67777 CA. Shivakumar H. Member shivakumar.h@icai.org No. 11 Resham MahaL Complex Cubbonpet Main Road Bangalore 560022 22218628 — 98440-38807 CA. Prasad S. R. Member prasad.spc@gmail.com No.2A I Floor Nanjappa Road Shanthi nagar Bangalore 560027 41248838 — 98455-42486 22240020 22210309 26597142 93412–19091 CA. Raghu K. M – 12, Unity Building, J C Road, Ex-OfficioCentral Council Bangalore – 560002 E-maill: kraghu9999@gmail.com April 2010 Office CA. Madhukar N. Hiregange Ex-OfficioCentral Council madhukar@hiregange.com No 1010 I Floor (Above Corporation Bank) 26536404 26th Main 4th “T” Block Jayanagar 26536405 Bangalore 560041 CA. Srinivas C. S. Ex-OfficioRegional Council E-mail: ssb@yukthi.co.in No. 27 Between 2nd & 3rd Cross, Pampamahakavi Road Shankarapuram Bangalore 560004 43464700 43464749 22427349 98450–63387 CA. Suresh P. R. Ex-OfficioRegional Council suresh@chandranandraman.com No. 137, 5th Main, 2nd Block, 3rd Stage, Basaveshwaranagar, Bangalore – 79 23225000 23228795 22929350 — 98450–58988 CA. Viswanath K. Ex-OfficioRegional Council E-mail: kprao@vsnl.com ‘POORNIMA’, 25, State Bank Road Bangalore – 560001 25587385 25586814 25594661 25595551 25595295 99455–25595 4 98453-44353 TAX UPDATES FEBRUARY 2010 Chythanya K.K., B.Com, FCA, LL.B, Advocate VAT, CST, ENTRY TAX, PROFESSIONAL TAX furnished to the satisfaction of the Tribunal. PARTS DIGESTED: a) 2009-10 (14) KCTJ – Vol-14 No.11 b) 2010 (68) KLJ Part 2 c) 28 VST – Part 1 & 2 [2010] 28 VST 64 (Ker) HC I.F.B. Industries Ltd. v. State of Kerala The Hon’ble High Court of Kerala in the instant case observed that for the purpose of Kerala General Sales Tax Rules, 1963, r. 9 (a) (discount allowable in the computation of taxable turnover) the condition precedent was that the price charged on the goods should be less discount (therefore in the nature of a trade discount – given in the bills). It held that incentives given by way of credit notes at end of year were not deductible under the aforesaid Rule.The aforesaid decision misses the point that discount need not be given on transaction to transaction basis but could be given as a volume discount at the end of a definite period. Reference/Description 2010 (68) Kar. L.J. 113 (HC) (DB) Shekar Bhojanna v. State of Karnataka In the instant case the assessee was a distributor of motor cycles, despatching motor cycles from his depot on lorries for delivery on sale to dealers spread out in the State at their door-steps. The assessee was collecting transportation charge on account of the said delivery from the dealers by showing it separately in the sale bill. The assessee however, was not paying tax on the freight amount on the contention that the freight was a postsale expense and so did not form part of price of the motor cycles, whose sale was ex-depot. The Hon’ble High Court of Karnataka held that, where the assessee had failed to refute the concurrent finding arrived at by both the tax authorities as well as the Tribunal that the freight paid was presale expense forming part of sale price, that the freight paid by him was on behalf of dealers in terms of a separate agreement with them and that the sale concluded at his depot and that the transport was arranged at the risk and cost of the dealers, the assessee was liable to pay tax inclusive of the freight amount, including the same as a part of his taxable turnover.Therefore, it is important for the assessee to prove on fact that the freight is a post sale expense and such proof should be [2010] 28 VST 82 (Ker) HC K. Sadikali v. Commercial Tax Officer (VAT), V Circle, Kozhikode and others In the instant case the petitioner was a dealer in timber and had purchased timber logs from the Forest Department of the State Government. In the matter of claiming refund of input tax credit, the Hon’ble High Court of Kerala observed that the dealer having produced bills from Forest Department showing payment of input tax along with the copies of separate demand drafts through which the tax amount had been remitted the onus of burden of proof vested on the dealer was discharged. The Court held that the dealer could not be asked to produce further evidence in form of tax remittance certificate from the Department. The Assessing Officer was required to conduct “such enquiry as it considered necessary” and that it was the duty of the officer to cross verify. Welcome relief! To check the department’s ever growing inclination to conveniently shun its responsibility by passing the buck (even otherwise a lot of duties of the taxmen have been conveniently passed on to the taxpayers much to their chargin!) INCOME TAX PARTS DIGESTED: a) 320 ITR – Part 5 to 7 b) 321 ITR – Part 1 c) 186 Taxman – Part 1 to 3 d) 187 Taxman – Part 1 to 3 e) 1 ITR(Trib) – Part 4 to 8 f) 126 TTJ – Part 7 g) 29 CAPJ - February (2nd), 2010 h) 41-B BCAJ – Part 5 i) 58 TCA – Part 8 Reference/Description [2010] 320 ITR 526 (Bom) East India Hotels Ltd. & another v. CBDT & another In the instant case the Hon’ble High Court of Bombay observed that the services rendered by a hotel to its customers are not covered under section 194C of the Income-tax Act (IT Act, TDS on contractors). The Court further went on to hold that Circular no. 681 dated March 8, 1994 issued by the CBDT was illegal and liable to be quashed in as much as it applied to payments made by customers to the hotel for availing certain facilities or amenities. By insertion of Explanation III to section 194C the scope of expansion to the term work was limited only such services where the work culminated in a product.Therefore, no tax is required to be deducted at source in respect of 5 April 2010 TAX UPDATES JANUARY 2010 Bangalore Branch of SIRC of the Institute of Chartered Accountants of India payment to be made to a hotel except in case of rent paid for booking the room on a regular basis. [2010] 320 ITR 542 (Delhi) HC CIT v. Smt. Rani Shankar Mishra The Hon’ble Delhi High Court in the instant case held that the amount received by way of compensation for denial of job on the basis of gender discrimination was not in the nature of ‘profit in lieu of salary under section 17(3(iii) of the IT Act, but in fact was a capital receipt. The Court observed that the amount referred to in the aforesaid section was in connection with the employment with the person from whom it was received. Subclause (A) of the said section referred to a period prior to an assessee joining employment, whereas sub-clause (B) referred to a period after the cessation of an assessee’s employment. When in the instant case there in fact did not exist any employer-employee relationship as aforesaid, the period after and prior have no meaning. [2010] 320 ITR 561 (SC) CIT v. (1) Kelvinator of India Ltd. (2) Eicher Ltd. The Hon’ble Supreme Court in the context of section 147 of the IT Act (post its amendment in 1989) and the insertion of the term ‘reason to believe’ in the said section, observed that post 1st April 1989 the power to reopen was much wider. However one needs to give a schematic interpretation to the words “reason to believe”, failing which, section 147 would only give arbitrary powers to the AO to reopen assessments on the basis of a “mere change of opinion”, which however could not per se be the reason for reopening. Further it was observed that there existed a conceptual difference between power to review and power to reassess. The AO has April 2010 6 no power to review but has power to reassess. However the reassessment had to be based on fulfilment of certain pre-conditions and if the concept of ‘change of opinion’ were removed, then in the garb of reopening the assessment, review would take place. The concept of ‘change of opinion’ was an in-built test to check abuse of power by the AO. After the aforesaid amendment the AO could reopen provided there was ‘tangible material’ to come to the conclusion that there was escapement of income from assessment. Reasons must have a live link with the formation of the belief.The aforesaid decision is a welcome decision which has read “no change of opinion” in “reason to belief” so as to protect the interest of the assessee from the review action of the assessing officer. [2010] 321 ITR 49 (Karn)C I T (International Taxation) & another v. Illinois Institute of Technology (India) P. Ltd. The Hon’ble High Court of Karnataka held that there was no liability to deduct tax at source u/s. 195 of the IT Act in a case where the payee was not earning any profit or income in India by conducting any trade or business. In the instant case the assessee had entered into an agreement with a foreign company in order to impart distance education in certain faculties. The assessee remitted the entire fees collected to the foreign company and the foreign company was not earning any profit out of such receipts.The above decision has as soothing effect after the controversial Samsung case. [2010] 321 ITR 132 (Ker) N. J. Jose & Co. (P.) Ltd. v. Assistant CIT & another In the matter of computing the book profits u/s. 115J of the IT Act, the Hon’ble High Court of Kerala observed that, as long as long-term capital gains are a part of the profit included in the profit and loss account prepared in accordance with Parts II and II of Schedule VI to the Companies Act, the said gains could not be excluded unless provided under the Explanation to section 115J(1A). In the absence of any provision for exclusion of capital gains in the computation of book profit under the aforesaid section, the assessee was not entitled to the said exclusion and that section 54E had no applicability in the computation of the book profit u/s. 115J. [2010] 321 ITR 147 (Delhi) CIT v. Woodward Governor India Ltd. The Hon’ble High Court of Delhi held that the provision for warranty expenses arrived at on the basis of working of average rate of warranty expenses is rational and scientific and therefore allowable to the sales made during the year. However it was held that the assessee is not entitled to claim warranty expenses on provision basis in respect of prior period sales wherein warranty expenses had already been allowed on actual basis. [2010] 321 ITR 165 (Raj) CIT v. Lake Palace Hotels & Motels Ltd. In the instant case the assessee leased out a property for a period of 72 years under a lease deed stipulating annual rent and also stipulating a sum of Rs. 2.5 crores as deposit. The said deposit as per the deed was to fetch interest @ 9% p.a. The AO contended that the market rate of interest was between 18-24% and therefore computed that difference between 9 and 18% to be the capital gains. The Hon’ble High Court of Rajasthan held that unlike the Wealth-tax Act there was no provision u/s. 45 and 48 of the IT Act to bring deemed profits or gain to be taxable as a capital gain. [2010] 186 Taxman 187 (AAR-New Delhi) Dana Corporation, In re The AAR in the instant case held that if by the application of the provisions of section 45 r.w.s. 48 of the IT Act, there does not arise any income, then section 92 (computation of income having regard to the arm’s length price) does not come to the aid of revenue, even though the transaction is an international transaction. [2010] 186 Taxman 208 (Delhi) HC CIT, Delhi-VI v. Teehdrive (India) (P.) Ltd. In the instant case the assessee registered with STPI was an exporter of computer software. For the assessment year under consideration the assessee filed its return claiming deduction u/s. 10B of the IT Act, which was rejected by the AO on the ground that the assessee was not having its own infrastructure and was using old plant/machinery of another concern to develop its software. The claim of the assessee was upheld by the CIT(A) on the ground that as per the conditions u/s. 10B it was not mandatory for the assessee to use its own infrastructure and so long as the software was developed by the assessee’s own personnel/employees the said software belonged to the assessee and the condition u/s. 10B were satisfied. The Hon’ble High Court of Delhi further held that in the instant case it was not a case of manufacture of any article but development and creation of intellectual property, namely, software programme. The essential and main inputs for such developments were that of the personnel belonging to the assessee, their intellect and creation of the aforesaid property. Therefore, use of computers would not be of much significance. [2010] 186 Taxman 233 (Kar.) HC CIT, Bangalore v. Brindavan Beverages Ltd. The Hon’ble High Court of Karnataka held that the provisions of section 234B and section 234C of the IT Act are attracted even in a situation where the deemed income and liability to tax thereon is calculated in terms of the provision u/s. 115JA.In the above case, it was held that the profit directly taken to capital reserve in the case of profit on slump sale could be added by the Assessing officer while computing book profit.The aforesaid decision in so far as it relates to computation of book profit requires a review as the same runs contrary to the decision of the Supreme Court in Apollo Tyres 255 ITR 273 SC. [2010] 187 Taxman (SLP) 15 (SC) CIT, Delhi v. Delhi Public School The Supreme Court has dismissed the special leave petition filed by the Department against the judgment in the case of CIT (TDS) v. Delhi Public School [2009] 318 ITR 234 (Delhi) HC wherein the Delhi High Court with reference to valuation of perquisites under Rule 3(5) of the Income Tax Rules, had held that, the valuation of free educational facilities to children of staff is to be made with reference to cost of such education in similar institutions in or near the same locality and not with reference to the cost of education for other students in the same school. [2010] 187 Taxman (BN-i) Part 2 (P&H) HC CIT v. Satinder Pal Singh The Hon’ble High Court of Punjab & Haryana in the context of determining the exclusion of agricultural land from the definition of capital asset as under section 2(14)(iii) of the IT Act held that, the distance of 2Kms. from the municipal limits of city of Khanna had to be taken in terms of approach by road and not as per straight line distance on a horizontal plane. The Court contended that if the principle of measurement of distance was considered straight line distance on a horizontal plane or as per crow’s flight then it would have no relationship with the statutory requirement of keeping in view the extent of urbanization! [2010] 187 Taxman (BN-v) Part 2 (Kar.) HC Asstt. CIT v. Dr. K. Satish Shetty The Hon’ble High Court of Karnataka in the context of section 44AB (and to ascertain monetary limit for the purpose of mandatory tax audit) held that nowhere in the aforesaid section is there a stipulation that in case an assessee is carrying on many businesses then to calculate the turnover limit, the turnover of all the businesses need to be clubbed. [2010] 187 Taxman 136 (Ker.) HC Girnar Industries v. CIT, Central Cochin The Hon’ble High Court of Kerala in the context of exemption u/ s. 10A of the IT Act and the interpretation of the meaning of the term manufacture for the purpose observed that, since the purpose of exemption under section 10A – FTZ (read with section 10AA) was to give effect to the EXIM Policy of the Government (assessment year 200405), the definition of ‘manufacture’ as contained in the aforesaid Policy was applicable for the purpose of section 10A. Since ‘manufacture’ as defined under the Policy had a wide and liberal meaning covering tea blending as well, the blending and packing of tea qualified for exemption u/s. 10A. The Court further held that the amendment to section 10AA, whereby definition of ‘manufacture’ as per section 2(r) of the Special Economic Zones Act, 2005 was inserted with effect from 10-2-2006 was only clarificatory and the same applied to section 10A as well. 7 April 2010 Bangalore Branch of SIRC of the Institute of Chartered Accountants of India [2010] 1 ITR (Trib) 807(Delhi) Growth Avenue Securities P. Ltd. v. Deputy CIT In the matter of computing the book profits as per section 115JB of the IT Act, the Delhi Tribunal observed that, only the items specifically referred to in the aforesaid section could be deducted from the profit and loss account as prepared in accordance with Parts II and II of Schedule VI to the Companies Act. The exemption under section 54EC in respect of capital gains is an includible item while calculating the profits as aforesaid and therefore there is no possibility of deducting on account of any other item by the Assessing Officer other than those which has been explicitly provided for in the section. Similar to the judgement of the Kerala High Court in the case of Jose & Co. (supra). the methods were for the purpose of determining the income from transfer of long-term capital asset. (2009) 126 TTJ (Mumbai) 892 Keshav S. Phansalkar v. ITO The Mumbai Tribunal in the instant case held that the capital loss worked out by the assessee with indexation could be set off against long-term capital gains computed without indexation. It observed that the option of the assessee to work out the gain arising on transfer of long-term capital asset with or without indexation was distinct from allowing the set off of loss arising under one particular method of computation against gain arising on account of following another method of computation. Both (2010) 41-B BCAJ 27: (2009) 34 SOT 152 (Delhi) Addl.CIT v. Narendra Mohan Uniyal The Delhi Tribunal in the context of section 54F of the IT Act (exemption from capital gains tax in case of investment in residential house) observed that there was no rider u/s. 54F that no deduction would be allowed in respect of investment of capital gains made on acquisition of land appurtenant to the building or on the investment on land on which a building is being constructed thereon, it is not necessary that such construction should be on the entire plot of land. Announcement CPE course on COMPUTER ACCOUNTING AND AUDITING TECHNIQUES (CAAT) Bangalore branch is conducting the CAAT course in the month of April/May 2010 as per the directions of The Committee on Information Technology, ICAI New Delhi. Interested members may send their name, membership number and contact details with telephone number and e-mail ID to registrations@bangalore-icai.org. The details of the event and the course fees will be communicated seperately to registered members Course co-ordinator : CA H SHIVAKUMAR e-mail : shivakumar.h@icai.org CA. Prasanna Kumar D has been elected as Professional Director for Sree Thyagaraja Co-Operative Bank Ltd April 2010 8 Announcement CONGRATULATIONS Members are requested to kindly send their views and suggestion on Exposure drafts – Accounting Standards 10 & Accounting Standards 16 by April 15, 2010 to bangalore@icai.org. Drafts can be viewed at AS-10: http://www.icai.org/resource_file/ 18399as10_ias16.pdf and AS-16: http://www.icai.org/resource_file/ 18400as11_ias21.pdf RECENT JUDICIAL PRONOUNCEMENTS IN INDIRECT TAXES transport. Prima facie realisation of demand to be stayed. Section 35F of the Central Excise Act, 1944 is as applicable to Service tax vide Section 83 of the Finance Act, 1994. N.R. Badrinath, Grad C.W.A., F.C.A., Madhur Harlalka, B. Com., F.C.A. [Korea Plant Service & Engineering Co. Ltd. vs. Commr. of C. Ex., Jaipur 2010 (17) S.T.R. 466 (Tri. – Del.)] SERVICE TAX Development Corporation by the appellant. Prima facie service provided primarily for industrial purpose and covered under relevant service. Tribunal decisions held that Service tax not liable on laying of pipes distinguishable as they relate to water supply projects in the nature of civic amenity provided in public interest. Pre-deposit of Rs. 50 lakhs directed. Pre-deposit of penalty and balance Service tax waived. Section 65(25b) of the Finance Act, 1994 read with Section 35F of the Central Excise Act, 1944 is as applicable to Service tax vide Section 83 of Finance Act, 1994. Filing of refund claim z The dispute in the present case relates to refund of service tax under Notification No. 41/2007S.T. on input services used in export of goods. The refund claim was filed with the 60 days time limit with the Deputy Commissioner of Service tax instead of appropriate authority under the Central Excise. The impugned order extending benefit on the ground that re-filing of claim beyond time limit not relevant. It was held that the claim filed before the wrong authority within limitation cannot be held as filed beyond limitation when both authorities are working under the same Department. The Revenue’s appeal is accordingly rejected. [Ms. Archana Wadhwa, Member (J) C.C.E., Ahmedabad vs. Gujarat Tea Processors and Packers Ltd. 2010 (17) S.T.R. 489 (Tri. – Ahmd.)] Stay / Dispensation of pre-deposit z The appellant was engaged in the activity of lowering, laying, jointing and testing GRP pipes (which were manufactured by them) at the customer’s site during the material period. Demand was raised on service provided by appellant to Gujarat Industrial [Graphite India Ltd. vs. Commissioner of C. Ex., Nasik 2010 (17) S.T.R. 459 (Tri. – Mumbai)] z Service tax paid on GTA service and coal handling charges paid. The appellants provide operation, repair and maintenance contract for power project of a company for power generation for its captive consumption. The term ‘maintenance’ is not to be read in isolation of purport of contract, appellant operating plant also. Power cannot be generated without coal and reaching of coal to the plant is essential. Coal handling and delivery connected with power generation as also Valuation z The case pertains to abatement under Notification No. 1/2006S.T. Cenvat credit availed simultaneously with exemption / abatement during the month when condition on non-availment of credit introduced. The credit is reversed with interest. The impugned order in favour of the assessee relying on precedents that reversal of credit amounts to non-availment, sustainable. Sections 67 and 93 of the Finance Act, 1994 as applicable. [Ms. Archana Wadhwa, Member (J) C.C.E., Vadodara vs. Ram Krishna Travels Pvt. Ltd.2010 (17) S.T.R. 487 (Tri. – Ahmd.)] Penalty z The appellant, in this case, failed to pay the service tax on due date and did not file Service tax – 3 return on time. The service tax was collected but the appellant was not aware of the head under which the tax had to be deposited. Service tax was paid after confirmation from the Department and interest also paid when pointed out. Service tax not deposited by the assessee due to bona fide belief. The impugned order upholding penalty under Section 76 of the 9 April 2010 TAX UPDATES - INDIRECT TAXES Bangalore Branch of SIRC of the Institute of Chartered Accountants of India Finance Act, 1994 set aside. [Deccan Mechanical & Chemical Indus. Pvt. Ltd. vs. Commissioner of C. Ex., Pune 2010 (17) S.T.R. 484 (Tri. – Mumbai)] Further, the petitioner is not entitled to Service tax from respondent based on oral evidence as such evidence, prima facie, is not acceptable under Section 91 of the Indian Evidence Act, 1872. Invocation of discretionary jurisdiction by the High Court is to be based on the facts and circumstances of the case. The High Court is empowered to entertain writ petition if it is shown that there is something which goes to the root of jurisdiction or a case of palpable injustice. Clarification z The case pertains to the appealability of letter from Department. The impugned order rejects the appeal as not maintainable against letter. Letter from Deputy Commissioner was in response to appellant’s letter clarifying service tax liability. The letter is not in the form of order or appealable order. If the appellants were aggrieved, they could have approached the Deputy Commissioner for issuance of an appealable order. Accordingly, the appeal filed by the appellant is rejected. [JMC Project India Ltd. vs. Commissioner of Service Tax, Ahmedabad 2010 (17) S.T.R. 486 (Tri. – Ahmd.)] Writ Jurisdiction z April 2010 The liability of payment of Service tax was not stipulated in the agreement between parties. Letter or demand from respondent admitting Service tax liability not produced. The letter relied upon by the petitioner seeking confirmation of reimbursement of Service tax not accepted by the respondent. Petitioner not entitled for amount claimed towards Service tax, thereby, interest does not arise. The impugned case involves substantial questions of fact. Writ Jurisdiction not invocable. The petitioner is entitled to civil remedies, if available, under Article 226 of the Constitution of India. 10 Sections 111 and 112 of the Customs Act, 1962 is as applicable and the appeal was disposed off. [Ishwarlal Soni vs. Commissioner of Customs, Jamnagar 2010 (250) E.L.T. 429 (Tri. – Ahmd.)] CENTRAL EXCISE Limitation z [Brahmaputra Infrastructure Ltd. vs. Delhi Development Authority 2010 (17) S.T.R. 452 (Del.)] CUSTOMS Confiscation z Gold detained by Police as smuggled and was handed over to the Customs. Statements recorded over a period of three months and subsequent retraction while replying to show cause notice and not sent through post, only an afterthought. The affidavits of persons concerned contradictory and rejection thereof sustainable. The impugned gold of 16 to 18 carat purity while gold ornaments in India of more than 20 carats. There were discrepancies on the purity of gold in the purchase bills produced and gold seized. Evidences were rightly rejected in the impugned order. The source for gold not produced. Cited decisions considered in impugned order as per remand directions. It was held that the confiscation was sustainable. Heavy penalty not imposable as gold absolutely confiscated and penalty reduced. The appellants are an Export Oriented Unit (EOU), engaged in the manufacture and export of P or P medicaments. They procured various goods for use in the EOU through import and from the local market. Goods were procured duty free on the undertaking of their use in terms of the respective notifications, that is, notification no. 53/97-Cus., dated 3-6-97 for imported goods and notification no. 1/95-C.E., dated 4-1-95 for indigenous goods. It was held that inadmissible exemption recoverable in terms of bond, without being restricted by limitation prescribed in Customs Act, 1962 and Central Excise Act, 1944. Section 28 of the Customs Act read with Section 11A of the Central Excise Act, 1944 is as applicable. [Dr. Reddy’s Laboratories Ltd. vs. Commr. of C. Ex., Hyderabad 2010 (250) E.L.T. 369 (Tri. – Bang.)] Manufacture z Does breaking of stone constitute ‘manufacture’? Limestone purchased in lumps and broken into small pieces. The process does not amounts to manufacture as per the Tribunal’s decision in 1991 (54) E.L.T. 414 (Tribunal) upheld by Supreme Court decision [1997 (96) E.L.T. A160 (S.C.)]. The demand was set aside and the appeal allowed. Section 2(f) and 11A of the Central Excise Act, 1944 is as applicable. import and exempt. Section 2(ab), 5(2) of the Central Sales tax Act, 1956 read with Section 2(11), (13), 47, 68 of the Customs Act, 1962. [Alagappa Cements (P) Ltd. vs. Commissioner of Central Excise, Trichy 2010 (250) E.L.T. 427 (Tri. – Chennai)] [State of Tamil Nadu vs. Rajan Universal Export (MFRS) Pvt. Ltd. 2010 (28) VST 279 (Mad)] Sales Tax z Sale was in the course of import. Goods were warehoused and not cleared on payment of Customs Duty. Transfer of documents of title in favour of buyer prior to clearance of goods. Warehouse included in the definition of ‘customs station’. Sale was considered as sale in the course of z The case pertains to inter-state sale or consignment sale. The Dealer produced form F declaration, stock register, pattials, copies of agreement with agents and delivery notes. The form F was rejected without cogent reason and on the presumption of direct sales to ultimate buyer in other State not justified. [Lakshmi Trading Co. vs. Joint Commissioner (Commercial The Dealer in this case, produced records to show that goods were sent to agents in other States and commission paid. The Declaration in form F was not doubted. Agents paying local tax in other State. Goods neither manufactured to specifications of, nor meant for, particular customer and that same amount mentioned in sale invoice paid to dealer by agents or that there was no specific clause in agreement that unsold goods liable to be sent back to dealer. No grounds to hold the transactions as inter-state sales. The petition was dismissed. [State of Tamil Nadu vs. Kumaran Mills Limited and Another 2010 (28) VST 262 (Mad)] REQUIRED CHARTERED ACCOUNTANTS /INTER CA We require CAs / PE II candidates who have completed their Articleship and having 2 to 3 years of work experience. Interested candidates may send their detailed resumes /profiles to : bkr@ramadhyani.com jayanti@ramadhyani.com B.K.Ramadhyani & Co., 4B, Chitrapur Bhavan, 8th Main, 15th Cross, Malleswaram, Bangalore -560 055 Telephone No.080-2346 4700 (6 lines)Fax No.080-2334 8964 Advt. 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 Senior professionals (CA) primarily in 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 audit practice (10 years post 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 qualification experience) required by a 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 Chartered Accountants firm in 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 Bangalore. Matching compensation 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 package will be ensured for the right 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 candidate with prospect of partnership 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 in near future based on ability and 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 performance. 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 E-mail : mark@mabacas.net 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 OR 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 malay@mabacas.net 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 12345678901234567890123456789012123456789012 z Advt. VALUE ADDED TAX Inter-State Sale Taxes), Chepauk, Chennai 2010 (28) VST 259 (Mad)] 11 April 2010 Bangalore Branch of SIRC of the Institute of Chartered Accountants of India BUDGET PROPOSALS IN SERVICE TAX – PART I CA Rajesh Kumar T R, B Com, LL.B, FCA, DISA, CA Chandra Shekar B D, B Com. LL.B, FCA, DISA Budget day is the day everybody viz., a business man, layman, salaried class or anyone for that matter is waiting to know what sort of changes are going to take place, which are going to affect them. It is said that this Budget belongs to ‘Aam Aadmi’. It belongs to the farmer, the agriculturist, the entrepreneur and the investor. Even we, Chartered Accountants, are also interested in the budget proposals, so that we can advise our clients about the changes in the budget and how the financial planning is to be done, be it direct or indirect taxes. centre or institute by whatever name called where training or coaching is imparted for consideration, whether are not they are registered as trust, society etc., and carrying on its activity with or without profit motive. In this issue we shall discuss the service tax proposals and changes without discussing the new category of services & changes in refund provisions, which would be discussed in the next issue. 2. Residential Complex and Industrial Construction Services 1. Commercial coaching and training – An Explanation is being added to overcome a spate of litigation on date where the assessee/s had taken the contention that only institutes which are run on a profit motive are only taxable, which was also upheld by number of decisions of Tribunal [Great Lakes Institute of Management Ltd. v. Commissioner — 2008 (10) S.T.R. 202 (Tri); ICFAI vs C.C. & C.E., 2009 (14) STR 220 (Tri)]. This explanation clarifies the term ‘commercial training or coaching centre’ would also include any April 2010 12 Therefore this will have lot of implication on various institutions other than those who are providing pre-school coaching or who are issuing any certificate or diploma or degree or any educational qualification recognised by law for the time being in force. This is one of the area the department has created an utter chaos both for themselves as well as the assessees. Contradicting Circulars and notifications were issued in this regard time and again putting assesses into jeopardy. This is a draconian provision for the builders; they are harassed by the department officials and also by the customers/prospective customers. Construction service was introduced from 10-09-2004 and from 01-06-2007 Work contract service was introduced. Circular No. 108/02/2009 dated 28.01.2009 clarified that service provided by a builder to a customer is not liable to tax. Now the newly inserted explanation states that construction of complex which is intended for sale, wholly or partly, by a builder or any person authorized by the builder before, during or after construction shall be deemed to be a service provided by the builder to the buyer. This is a deeming provision. However, even though there is a deeming provision that if the builder had not received any amount prior to obtaining appropriate completion certificate by the competent authorities then such transactions would not be within the purview of the service tax. This amendment seems to be prospective in nature as there is no mention about the effective date hence it cannot be said to be retrospective unless there is specific mention about the same. This amendment could lead to a number of doubts arising in our minds. Few of them are as undera. Even after this amendment, whether the clarification given by circular No. 108/02/2009 that the apartments/residential units built for personal use is excluded from the scope of residential complex as it is for personal use by buyer holds waters or not needs to be examined. b. There is no corresponding amendment under Works Contract service. Does that mean if there is construction agreement where sales tax is being paid; the transaction is not in the nature of builder and buyer model? c. How would the taxability get determined for the projects under progress? SERVICE TAX – SERIES – PART VII d. Constitutional validity of the concept of ‘deeming fiction’? 3. Renting of Immovable property service – a. Renting of vacant land – The definition of renting of immovable property had certain inclusions and exclusions. One of such exclusion was vacant land. In the transactions like long term leases on vacant land by Public sector undertakings, industrial corporations, etc under explicit understanding that lessee would construct factory or commercial building on that land. In such cases the ownership is not transferred to the lessee and thus it is a service provided by the lessor to the lessee. Since the earlier definition had excluded the vacant land, the same was said to be non-taxable service. In the Finance Bill 2010, there is a proposal to add to the inclusion list specifically such cases that is to say it would cover vacant land given on lease or license for construction of building or temporary structure at a later stage to be used for furtherance of business or commerce. b. Renting – amendment definition – This is the hot topic of discussion at any forum on indirect taxes. Because of the decision of the Honourable Delhi High Court in the case of Home Solutions Retail India Ltd & others [2009 (14) STR 433 (Del)] clarified the taxable service under this category covers only services in relation to renting and renting per-se. Though there was a mention that it is not a service, as there is no value addition per-se, the decision was rendered that it is not covered within the scope of taxable service definition. This had given scope for a spate of litigations and relying on the said decision the tenants stopped paying service tax to the landlords. In the Finance Bill 2010, there is a proposal giving a retrospect effect from 01.06.2007 whereby it specifically covers ‘renting’ along with services in relation to renting. This is added along with validating provision allowing the department to recover the past dues to the Government in this regard viz., service tax, interest and penalties. In the opinion of the paper writers the Delhi High Court in the Home Solutions case had not considered few other vital points, presently pending before Supreme Court. Therefore it has to be seen how the Supreme Court would give finality to this amendment. How should we as Chartered Accountants advise our clients who are tenants and landlords after the enactment of Finance Act, 2010, till the verdict is given by the Supreme Court? In the opinion of the paper writers there are 3 optionsa. If the tenant is ready to pay the service tax then the landlord collects the same and remits it to the department. However, it could be paid under protest. b. Irrespective of the fact whether tenant pays the service tax or not, the landlord can pay the taxes under protest to avoid interest and penalty. c. Await the decision of the Supreme Court and face the consequence. Each of the options may be chosen depending on the level of risk acceptable by the landlords/ tenants. c. Air Passenger Transport – Exemption is provided on Statutory taxes charged by any Government (including foreign governments, where a passenger disembarks) on air passenger would be excluded from taxable value for the purpose of levy of service tax under Air Passenger Transport Service – Notification No 15/2010-ST d. Erection, commissioning or installationExemption is given if a service is provided in relation to the following • Mechanized Food Grain Handling Systems, etc. • Equipment for settingup or substantial expansion of cold storage and • Machinery for initial setting up or substantial expansion of units for processing of agricultural, apiary, horticulture, diary, poultry, aquatic, marine or meat products. – Notification No 12/2010-ST e. Packaged or Canned Software Information Technology software packed intended for single use is being exempt from the whole of service tax if the following conditions are fulfilled viz., • License/document which gives right to use should be packed along with software. • Manufacturer, duplicator or person holding the copyrights/ importer should have discharged duties of excise/customs on the amount received from the buyer. 13 April 2010 Bangalore Branch of SIRC of the Institute of Chartered Accountants of India • No exemption is claimed on the value attributable to right to use software is claimed under Central Excise or Customs. Basically, if we examine the conditions it appears that either excise duty or customs duty is to be paid on packaged software, to avail this exemption. [Notifications – 2/2010 & 172010-ST] f. Transportation of Goods by Rail – Exempts specified goods like defence/military equipments, railway equipments/materials, food grains etc., transported by rail. Notification No - 08/2010-ST. g. Vocational Training Vocational Training Services were exempted and definition for the same was given as training or coaching to enable the trainee to seek employment or undertake self-employment, directly after such training or coaching. It is amended w.e.f. 27.02.2010 to confine the exemption only to institutes and industrial training Centres affiliated to the National Council of Vocational Training (NCVT) and offering courses in the designated trades covered under Schedule I of The Apprentice Act, 1961. The List figuring under Schedule I of the Act covers engineering as well as non-engineering skills/trade – Notification No - 3/2010-ST. h. Group Personal Accident Scheme Exemption from Service tax, presently available to Group Personal Accident Scheme provided by Government of Rajasthan to its employees, under April 2010 14 General Insurance Service is being withdrawn -Notification No. 5/2010-ST. i. Sponsorship Service The definition of sponsorship specifically excluded the services in relation to sports. The exclusion relating to sponsorship pertaining to sports is being removed. This could be because of big stakes involved in the recent IPL matches. j. Transportation of Goods by Road – Exemption for transportation of fruits, vegetables, eggs or milk under GTA Services is extended to include even ‘food grains and pulses’ – Notification No. 04/ 2010-ST. k. Information Technology Software Service The taxability of Information Technology Software services was confined only to cases where such software was used for furtherance of trade or commerce and was not covering such services which were not so used. In the Finance Bill, it is proposed to remove such distinction and tax all the information technology software service irrespective of its usage. l. Services provided in an airport or port There was confusion amongst the assessees whether the services rendered at the port or airport should be classified under specific category or general category. The definition of port/airport used the words ‘any person authorized by port/airport’ but there was no specific procedure to authorize a service provider to undertake a particular activity. The assessee/s contention was that the airport authority had not specifically authorized anybody for rendering the services at the port/airport and pretext of which the assessees were claiming tax exemption. In the Finance Bill 2010, it is proposed to cover all the services provided within the port by any person under the category of port service. Further it is also explained that if the entire services are provided within the port, the same has to be classified as port/airport services without getting into classification principles set out in Section 65A. m. Transportation of passengers by air service The taxation under this category was confined only to international flights and economy class was excluded. But in the Finance Bill 2010, there is proposal to cover domestic flights as well as economy class within the tax net. n. Auction by Government New explanation has been inserted which wants to give clarity on the phrase ‘auction by the Government’ in the Auctioneers service which was introduced earlier. The service excluded ‘auction by the Government.’ This has created some confusion because there were transactions which included property that belonged to the Government auctioned by private people or property of private people auctioned by the Government. Now the proposal states that ‘Auction by the Government’ means Government property being auctioned by any person acting as an auctioneer. Sl No Particulars Existing Category New Category 1 Mandap keeper service Performance outside India 2 Chartered Accountant, Cost Accountant & Company Secretary Performance outside India Immovable property situated outside India Recipient outside india o. Export of Service Rules, 2005 i. One of the mandatory conditions which had lead to lot of litigation has been deleted but with a prospective date (27-02-2010) viz., ‘such service provided from India and used outside India.’ This is a welcome move and will avoid a lot of litigation in the future to come. (Notification 6/2010-ST) ii. Other amendments were with regard to the shift in the manner of determination of export of services for certain categories which are given below (Notification 16/2010-ST) OBITUARY Name CA. PUTTARAMAIAH V G M.No. : 222115 Required Article Clerks CA firm with 6 Partners require brilliant, sincere and committed Article clerks for our firm. Required Audit / Tax Assistants CA Firm with 6 Partners requires Accounts/Audit/Tax Assistants. Candidate should be CA / CA Intermediate qualified, brilliant, sincere, committed and should be willing to commit for atleast one year. Offering an attractive remuneration commensurate with experience and exposure in audits and direct taxes. Interested students / candidates may please send their detailed resumes / bio-data to: N S V M & Associates Chartered Accountants # 63/1, I Floor, Above Canara Bank, Railway parallel Road, Kumara Park West, Bangalore – 560 020. Ph: 41506054 / 55 / 56 Advt. Email: anp@nsvmandassociates.com / dnsreehari63@yahoo.com 15 April 2010 Bangalore Branch of SIRC of the Institute of Chartered Accountants of India I NVESTMENT B ANKING C OURSE Austal Group www.austalgroup.net/education L IVE C LASSROOM T RAINING C OMPREHENSIVE F INANCIAL M ODELING AND V ALUATION A NALYSIS C OURSE Class Format All 8 sessions are tailored for personalized instruction using the case study approach. Each student follows the banker teaching the class and builds the financial models along with him. Each session is 4 hours long of in-class live training. The training model is structured to allow students to also independently pursue investigations and searches on their own. Course Materials INTRODUCTION AND FINANCIAL STATEMENT ANALYSIS COMPREHENSIVE VALUATION ANALYSIS INTEGRATED CASH FLOW MODELING COMPLETE LBO MODELING MERGER (ACQUISITION) MODELING INVESTMENT BANKING PROCESS AND BEST PRACTICES, INTERVIEW SKILLS AND RESUME REVISION Course Offerings in Bangalore Courses are conducted during the week and on weekends to accommodate working professionals and those attending full time programs. Please refer to our website for the most recent updated schedule. Please email us at info@austalgroup.net or sign up on our website at www.austalgroup.net/education. Please visit our website to view all our offerings. SICASA Bangalore Branch of SIRC of ICAI Organising at Branch Premises SPECIAL REVISION FOR MAY 2010 EXAMINATION FOR FINAL STUDENTS Date 10.04.10 Subject Faculty Time Indirect Direct Taxes CA. T.R RAJESH KUMAR 08.30AM TO 01.00PM CA. K.K. CHYTHANYA 08.30AM TO 01.00PM Discussion on Amendments & Case Laws Applicable to MAY 2010 21.04.10 Direct Taxes Discussion on Amendments & Case Laws Applicable to MAY 2010 Delegate Fee: Rs. 50/- (for both programmes) SPECIAL REVISION FOR MAY 2010 EXAMINATION FOR PEII / PCC/ IPCC STUDENTS Date Subject Faculty Time 11.04.10 Direct Taxes CA. Naveen Khariwal 10.00am to 05.00pm Delegate Fee: Rs. 75/- (Lunch arranged at 1.00 pm) April 2010 CA. Shambhu Sharma H CA. Babu. K CA. Nithin M Chairman Secretary Chairman, SICASA 16 Advt. For More Information Congratulations from Managing Committee RANK HOLDERS - NOVEMBER 2009 EXAMINATION Sl. No 1 2 3 4 5 6 Reg No. SRO0250193 SRO0228537 SRO0253082 SRO0232673 SRO0252407 SRO0243840 Roll. No 19520 20394 19577 20396 19633 20500 Sl. No 1 2 3 4 5 Reg No. SRO0249254 SRO0251869 SRO0224094 SRO0268164 SRO0242837 Roll. No 27950 28075 27979 28310 28031 Sl. No 1 2 3 4 Reg No. SRO0205719 SRO0215868 SRO0139202 SRO0215688 Roll. No 12264 11970 13032 12022 PCC Name SHASHANK VISWANATHAN SUSHEEN M BOHRA YASHASWINI M PRIYANKA J POOJA B MEHTA VENKATRAMAN R BHAT IPCC Name ASHIKA HARIKRISHNAN HARISH KUMAR J SRINIDHI E S SUMANA M RAO SALVA RAHUL DEVCHAN BHAI FINAL (OLD) Name SHRUTHI B N AJITH K G NIKHIL BHARAT DEORA RAMA RAJU N Marks Obtained 410 401 395 394 392 385 Rank 21 29 35 36 38 45 Marks Obtained 465 447 441 439 436 Rank 23 38 44 46 49 Marks Obtained 518 505 504 476 Rank 10 19 20 46 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 Venue 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 Jnana Jyothi Convention Center, 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 Central College Campus 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 Bangalore 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 Date 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 Saturday 12th & 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 Sunday 13th June 2010 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 CPE:12Hrs. 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 Kindly block your dates 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456 123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567 Announcement Karnataka State Level CA Conference 17 April 2010 Bangalore Branch of SIRC of the Institute of Chartered Accountants of India Workshop on Legal & Financial Safeguards for Challenging Times on Saturday, 17th April, 2010 at Branch Premises Time: 09.00 am to 01.00 pm Fee: Rs. 250 CPE: 4 hrs Time Topic 09.00 am to 01.00 pm (Tea Break : 11.00 am) Restricted to 250 delegates Speaker Customer Contract evaluation Practical suggestions Mr. Karthik S A, Founder, Quasar Legal ECGC Insurance Policy A tool to protect the export receivables Mr. Ramesh Bhat, AGM, ECGC, Bangalore Director and Officers (D&O) Policy and Mr. Ashwin Sunder, Errors and Omissions (E&O) Policy Manager, Marsh India Insurance Brokers Workshop on KVAT & CST Fee: Rs. 250 CPE: 4 hrs Time Topic 09.30 am to 01.30 pm (Tea Break : 11.30 am) Fee: Rs. 500 CPE: 6hrs Speaker Recent Notifications under KVAT & CST Mr. M. A. Maniyar, Co-Ordinator - Commercial Taxes RIL Karnataka VAT & CST Amendments CA. Sanjay M Dhariwal Practical Issues KVAT & CST CA. S. Venkataramani S Workshop on Service Tax - Recent Changes Time on Saturday, 1st May 2010 at Branch Premises Time : 10.00 am to 05.30 pm Topic Speaker Recent changes in the IT Sector CA Naveen Rajpurohit 11:30 am to 12:30 pm Recent changes in Construction Industry CA Deepak Kumar Jain B 2:15 pm to 3.30 pm 3:45 pm to 5:00 pm 5.00 pm to 5.30 pm CA Badrinath NR Panel Discussion Recent changes in the CA Madhur Harlalka Cenvat Credit & Classification Recent changes in Health Care Sector CA. Anand N Mr. Gururaj BN Advocate Panel Discussion Tea Break: 11.00am; Lunch : 01.15pm; Tea Break: 3.30pm. For Registration contact Ms. Roopashree. Tel: 3056-3500/513, blrregistration@icai.org , bangalore@icai.org 18 Restricted to 250 delegates Session Moderator 10:00 am to 11:15 am 12.45 pm to 01.15 pm April 2010 Restricted to 250 delegates on Saturday, 24th April, 2010 at Branch Premises Time: 09.30 am to 01.30 pm Visit: www.icai-bangalore.org Bangalore Branch of SIRC of the Institute of Chartered Accountants of India April 2010 20