WISCONSIN Investment Sales

advertisement

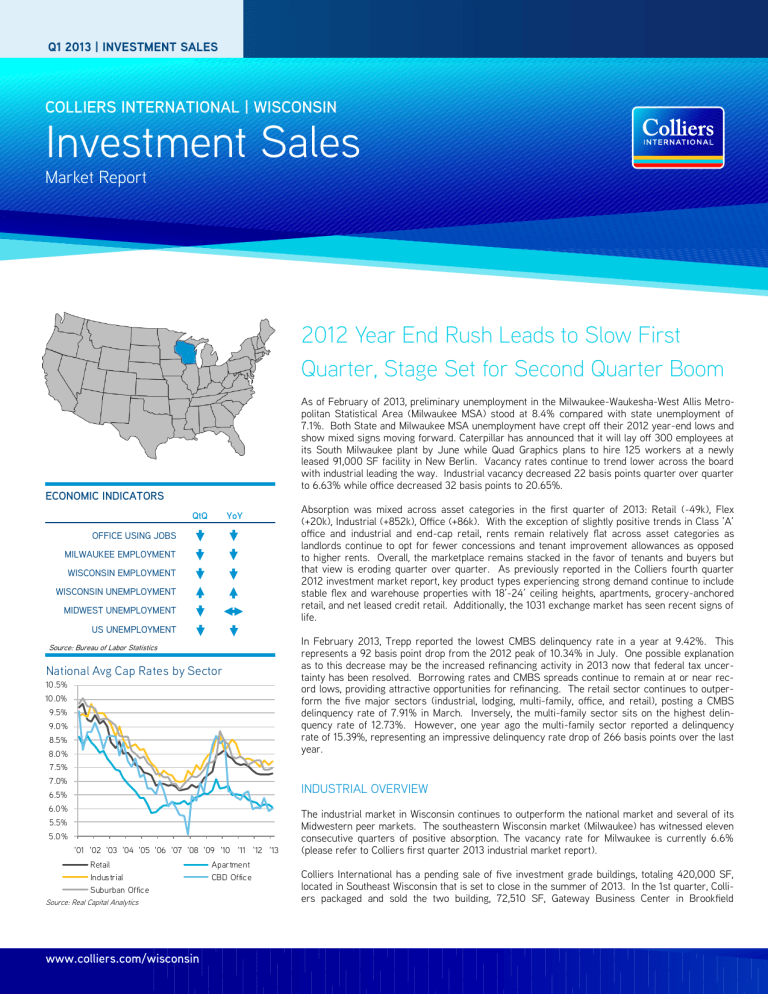

Q1 2013 | INVESTMENT SALES COLLIERS INTERNATIONAL | WISCONSIN Investment Sales Market Report 2012 Year End Rush Leads to Slow First Quarter, Stage Set for Second Quarter Boom As of February of 2013, preliminary unemployment in the Milwaukee-Waukesha-West Allis Metropolitan Statistical Area (Milwaukee MSA) stood at 8.4% compared with state unemployment of 7.1%. Both State and Milwaukee MSA unemployment have crept off their 2012 year-end lows and show mixed signs moving forward. Caterpillar has announced that it will lay off 300 employees at its South Milwaukee plant by June while Quad Graphics plans to hire 125 workers at a newly leased 91,000 SF facility in New Berlin. Vacancy rates continue to trend lower across the board with industrial leading the way. Industrial vacancy decreased 22 basis points quarter over quarter to 6.63% while office decreased 32 basis points to 20.65%. ECONOMIC INDICATORS QtQ YoY OFFICE USING JOBS MILWAUKEE EMPLOYMENT WISCONSIN EMPLOYMENT WISCONSIN UNEMPLOYMENT MIDWEST UNEMPLOYMENT Absorption was mixed across asset categories in the first quarter of 2013: Retail (-49k), Flex (+20k), Industrial (+852k), Office (+86k). With the exception of slightly positive trends in Class ’A’ office and industrial and end-cap retail, rents remain relatively flat across asset categories as landlords continue to opt for fewer concessions and tenant improvement allowances as opposed to higher rents. Overall, the marketplace remains stacked in the favor of tenants and buyers but that view is eroding quarter over quarter. As previously reported in the Colliers fourth quarter 2012 investment market report, key product types experiencing strong demand continue to include stable flex and warehouse properties with 18’-24’ ceiling heights, apartments, grocery-anchored retail, and net leased credit retail. Additionally, the 1031 exchange market has seen recent signs of life. US UNEMPLOYMENT Source: Bureau of Labor Statistics National Avg Cap Rates by Sector 10.5% 10.0% 9.5% 9.0% 8.5% 8.0% In February 2013, Trepp reported the lowest CMBS delinquency rate in a year at 9.42%. This represents a 92 basis point drop from the 2012 peak of 10.34% in July. One possible explanation as to this decrease may be the increased refinancing activity in 2013 now that federal tax uncertainty has been resolved. Borrowing rates and CMBS spreads continue to remain at or near record lows, providing attractive opportunities for refinancing. The retail sector continues to outperform the five major sectors (industrial, lodging, multi-family, office, and retail), posting a CMBS delinquency rate of 7.91% in March. Inversely, the multi-family sector sits on the highest delinquency rate of 12.73%. However, one year ago the multi-family sector reported a delinquency rate of 15.39%, representing an impressive delinquency rate drop of 266 basis points over the last year. 7.5% 7.0% INDUSTRIAL OVERVIEW 6.5% 6.0% 5.5% 5.0% '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 Retail Industrial Suburban Office Source: Real Capital Analytics www.colliers.com/wisconsin Apartment CBD Office The industrial market in Wisconsin continues to outperform the national market and several of its Midwestern peer markets. The southeastern Wisconsin market (Milwaukee) has witnessed eleven consecutive quarters of positive absorption. The vacancy rate for Milwaukee is currently 6.6% (please refer to Colliers first quarter 2013 industrial market report). Colliers International has a pending sale of five investment grade buildings, totaling 420,000 SF, located in Southeast Wisconsin that is set to close in the summer of 2013. In the 1st quarter, Colliers packaged and sold the two building, 72,510 SF, Gateway Business Center in Brookfield RESEARCH & FORECAST REPORT | Q1 2013 | INVESTMENT SALES | WISCONSIN The merchant development business showed signs of life in 2012 and early 2013. Two smaller strip centers were built and sold in infill locations on Milwaukee’s near south side submarket. In January, a 5,828 SF fully-leased Target out lot strip center located at 1403 S. Miller Park Way was sold for $2,170,000 or $372 PSF. This sale equated to an 8.5% cap rate on existing tenant income. In a similar development and sale, a joint venture between Frontline Real Estate and Terraco (both of Chicago, IL) sold a net-leased 8,034 SF strip located at 3640 S. 27th Street to a private investor for $2,060,000 or $256 PSF. This equated to approximately an 8.25% cap rate on a building leased to Mattress Firm, Great Clips, and T-Mobile. Colliers represented the Seller in the sale of the S. 27th Street property. Generally speaking, cap rates for strong retail product in high demand areas have compressed to the 7.5% to 8.5% range. Inland Real Estate Corporation (Oak Brook, IL) and Ramco-Gershenson Properties LP (Farmington Hills, MI) were two REITs that led market acquisition activity in 2012. Their acquisitions included the $21M Mt. Pleasant Shopping Center in Racine (Inland), the Kohls-anchored $15M Shops at Nagawaukee in Delafield (Ramco), and the $10.4M OPUS-developed Shoppes at Fox River in Waukesha (Ramco). Cap rates for the above transactions were generally in the mid 7% range. 3640 S 27th St., newly constructed and net-leased, sold on February 26th at an 8.25% cap rate. Colliers International represented the seller, Frontline Real Estate Partners. P.2 | COLLIERS INTERNATIONAL continued on page 4… $2 00 $40 $100 $20 $0 P rice P SF To tal Sales Vo lume (mil) $60 ** $0 Q1 '07 Q1 '08 Q1 '09 Q1 '10 Q1 '11 Q1 '12 Q1 '13 Average Price PSF Office $6 00 $2 50 $2 00 ** $4 00 $150 $300 $100 $2 00 P rice P SF $500 $50 $100 $0 $Q1 '06 Q1 '07 Q1 '08 Q1 '09 Q1 '10 Q1 '11 Q1 '12 Total Sales Volume - 12 mo. Rolling Q1 '13 Average Price PSF Retail $500 $2 50 $4 00 $2 00 $300 $150 $2 00 $100 ** $100 P rice P SF RETAIL OVERVIEW $300 $50 $0 $Q1 '06 Q1 '07 Q1 '08 Q1 '09 Q1 '10 Q1 '11 Q1 '12 Total Sales Volume - 12 mo. Rolling Average Price PSF Multi-Family $2 50 $150 $2 00 $100 ** $150 $100 $50 ** $50 $0 P rice P er U n it (thou) The office sale market had very few data points in the first quarter of 2013. There was a year end rush in 2012 for investors to acquire office assets under a familiar federal tax policy. That caused a hangover for transactions in the early part of 2013. However, one significant Madison east side (Interstate 94) office property did trade. Wells Real Estate Funds, Inc (Norcross, GA) sold the 101,726 SF, 81% occupied building at 5117 Terrace Drive to a joint venture between Alex Brown Realty (Baltimore, MD) and Fulcrum Asset Advisors (Chicago, IL). The building traded at a 10% cap rate and is anchored by U.S. Cellular (NYSE: USM). They occupy 75% of the building under a shorter term lease (4-5 years). The building, built in 1996, has had a longstanding full floor vacancy. Fulcrum has been very active over the last 24 months, and they have purchased assets in both the Milwaukee and Madison markets. $80 Total Sales Volume - 12 mo. Rolling To tal Sales Vo lume (mil) OFFICE OVERVIEW $4 00 Q1 '06 To tal Sales Vo lume (mil) A few key institutions (Clarion, Liberty, Northwestern Mutual Life, etc.) have recently divested their investment holdings in Wisconsin, therefore creating an attractive opportunity for a new wave of investors. Yields in Wisconsin are 100-300 BPS higher than several peer markets on the coasts. Greenfield/Somerset, Fulcrum Asset Advisors, Sara Investment, and Hendricks Commercial Properties are active groups that are strategically acquiring properties. Industrial To tal Sales Vo lume (mil) The Gateway Business Center sold for $6.1 million on April 24th. At the time of sale the properties were 87% leased. Colliers International represented the seller. (Milwaukee west submarket) for just over $84 PSF at a 9.18% cap rate. This highimage flex property had five technology industry tenants, and it was anchored under a long term lease with network and data solutions provider TW Telecom, Inc (NASDAQ: TWTC). $Q1 '06 Q1 '07 Q1 '08 Q1 '09 Q1 '10 Total Sales Volume - 12 mo. Rolling **Insufficient data Source: Real Capital Analytics Q1 '11 Q1 '12 Q1 '13 Average Price Per Unit RESEARCH AND FORECAST REPORT | Q1 2013 | INVESTMENT SALES | WISCONSIN RECENT INVESTMENT SALE ACTIVITY INDUSTRIAL SALES BUILDING CITY BUYER SELLER Gateway Business Center Brookfield Hendricks Commercial Properties SALE DATE PRICE PRICE PSF ACTUAL CAP Westminster Funds 4/24/2013 $6,100,000 $84.13 9.18% 5612 95th St. Kenosha Venture One Cenveo Inc. 12/20/2012 $5,000,000 $31.19 Not Disclosed W226 N758 Eastmound Dr.^ Waukesha Badger Wire Inc. Sabal Financial Group LP 3/20/2013 $2,500,000 $25.68 10.00% 12/14/2012 $2,061,903 $46.50 8.55% 12/10/2012 $2,000,000 $40.82 11.75% SALE DATE PRICE PRICE PSF ACTUAL CAP 1711 Paramount Court Waukesha Ogden & Company, Inc. First Industrial Realty Trust, Inc. S82W19125 and S82W19151 Apollo Drive Muskego The Carey Group LuAnn Lanke OFFICE SALES BUILDING CITY BUYER SELLER Riverwood Corporate Center II Waukesha Capital Square Realty Advisors Meridian Riverwood II LLC 12/7/2012 $20,800,000 $185.71 8.00% 5117 W Terrace Drive Madison Alex Brown Realty, Inc. Wells Real Estate Funds 3/13/2013 $8,175,000 $80.36 10.00% Squires I and Squires II Brookfield Hakaduli Properties LLC The Palmisano Company 12/21/2012 $4,300,000 $51.27 10.75% Stone Ridge III Pewaukee David Winograd Klements Sausage Co. Inc. 1/7/2013 $3,000,000 $40.00 Not Disclosed 7020 N Port Washington Rd. Glendale David Winograd Scott Revolinski 3/28/2013 $3,000,000 $100.00 Not Disclosed Sky Plaza Office Center Waukesha Wisconsin Hospitality Group Foundations Bank 1/15/2013 $2,100,000 $55.26 Not Disclosed CITY BUYER SELLER SALE DATE PRICE PRICE PSF ACTUAL CAP 12/21/2012 $6,600,000 $112.15 Not Disclosed 2/22/2013 $4,180,000 $184.38 Not Disclosed 1/23/2013 $2,170,000 $372.34 8.53% RETAIL SALES BUILDING Roundy’s Pick n’ Save Saukville Executive Capital Group Barry Geller Mortgage and Investments 1801 Milwaukee Avenue Burlington Campbell Properties LP Malcolm David & Associates 1403 S Miller Parkway Milwaukee Gregory A. Maciel Living Trust Wilson Creek Crossing Milwaukee Private Investor Wisconsin Auto Title Loans, Inc. Frontline Real Estate Partners 2/21/2013 $2,060,000 $256.41 8.25% 5077 S 27th St Greenfield Rockin Ribs LLC Cricdom-iii Madison LLC 2/12/2013 $1,960,000 $494.95 Not Disclosed Milwaukee Ale House Grafton Ryan Mallery Robert Tenges 1/11/2013 $1,625,000 $180.56 8.86% CITY BUYER SELLER SALE DATE PRICE 4454 N Wilson Drive Shorewood David and Kathryn Karademas Daniel W Bruckner 1/4/2013 $16,125,000 $69,410 Not Disclosed Dale Creek Apartments Greendale Ripp Properties Continental Properties Company, Inc. 12/14/2012 $8,500,000 $92,391 Not Disclosed Parkside Commons Milwaukee Capitol Square Investors Steadfast Companies 3/22/2013 $4,700,000 $47,000 Not Disclosed Waterview Senior Housing Sheboygan Meyer M. Appel Horizon Development Group 10/19/2012 $4,200,000 $62,687 7.59% 1303-1309 W Kilbourn Ave Milwaukee Cedar Square Management, LLC UNIVESCO 12/20/2012 $3,150,000 $101,613 7.50% River Heights Apartments West Allis Riverview Real Estate Thomas J Rhoda & Associates 12/12/2012 $2,240,000 $62,222 6.45% SALE DATE PRICE PRICE PSF ACTUAL CAP 11/1/2012 $75,000,000 $199.62 Not Disclosed MULTI-FAMILY SALES BUILDING PRICE PER UNIT ACTUAL CAP MEDICAL AND SPECIAL USE BUILDING CITY BUYER SELLER Newcastle Place* (Cont. Care/Ret. Comm.) Thiensville Westminster Funds Milwaukee Protestant Home for the Aged Seven Oaks Glendale AVIV Seven Oaks Frontage, LLP 10/31/2012 $7,600,000 $138.27 14.40% 1825 N Prospect Avenue (Assisted Living) Milwaukee Dominion Properties Community Care Organization 12/28/2012 $1,300,000 $36.62 Not Disclosed *Includes the value of the business. ^Distressed property purchased via conventional sale Sources: CoStar, Colliers International COLLIERS INTERNATIONAL | P.3 RESEARCH & FORECAST REPORT | Q1 2013 | INVESTMENT SALES | WISCONSIN continued from page 2… MULTI-FAMILY OVERVIEW Demand for multi-family investment property continues to gain strength quarter after quarter. Quality listings have become scarce, thereby driving sales further upstream. The market’s insatiable thirst can be partially supported by a handful of facts. At just 3.1%, Milwaukee boasts the second lowest multifamily vacancy rate in the Midwest according to MPF Analytics. Additionally, rents grew by 80 basis points from the third quarter to the fourth quarter of 2012, a sizable increase for the Milwaukee market. Summarily, record low interest rates and relaxed lending standards are growing the investor pool and heightening the competition. Class ‘A’ properties with 32 or more units are consistently trading at sub 7% cap rates and, according to local underwriters, life companies are underwriting Milwaukee assets at 6% cap rates. Lower quality properties, such as Waterview Senior Housing in Sheboygan, which traded at 7.59%, and 1303-1309 W Kilbourn Avenue (adjacent to Marquette University), which traded at 7.5%, are trading at slightly higher cap rates. Four to eight unit properties are consistently trading above 8% cap rates. 482 offices in 62 countries on 6 continents United States: 147 Canada: 37 Latin America: 19 Asia Pacific: 201 EMEA: 118 2 billion in annual revenue 1.12 billion square feet under management Over 13,500 professionals SPECIAL ASSETS OVERVIEW Milwaukee continues to see a steady flow of special assets to the marketplace. Most notably, partially entitled residential development sites have seen increased activity. Many builder/developers anticipate a shortage of single family lots as bank financing for infra-structure in the last four years has been scarce. Additionally, multi-family parcels that had been entitled are cycling through sufficient writedowns to become valuable as apartment land. Typically, a down-zoning from PUD or condominium is required and pursued under due diligence once the property is under contract. Scarcity of listings has apartment investors frustrated as assets are primarily trading off-market. Colliers recently listed a 64 unit apartment complex, “River Rise”, located in the Riverwest neighborhood. Pricing is set at approximately $32,000 per unit at an 8.5% cap rate. COLLIERS INTERNATIONAL WISCONSIN Corporate Office 1243 N. 10th Street Suite 300 Milwaukee, WI 53205 TEL: 414 276 9500 FAX: 414 276 9501 400 North Richmond Street Appleton, WI 54911 Investment Services | Wisconsin Tom Shepherd, CCIM Partner | Wisconsin Direct +1 414 278 6815 tom.shepherd@colliers.com Joe Eldredge Senior Broker | Wisconsin Direct +1 414 278 6825 joe.eldredge@colliers.com Jennifer Bullock Investment Analyst | Wisconsin Direct +1 414 278 6867 jennifer.bullock@colliers.com Tyler Jauquet Research Analyst | Wisconsin Direct +1 414 278 6811 tyler.jauquet@colliers.com www.colliers.com/wisconsin Brandon Sacia Senior Broker | Wisconsin Direct +1 414 276 9509 brandon.sacia@colliers.com Copyright © 2013 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Accelerating success.