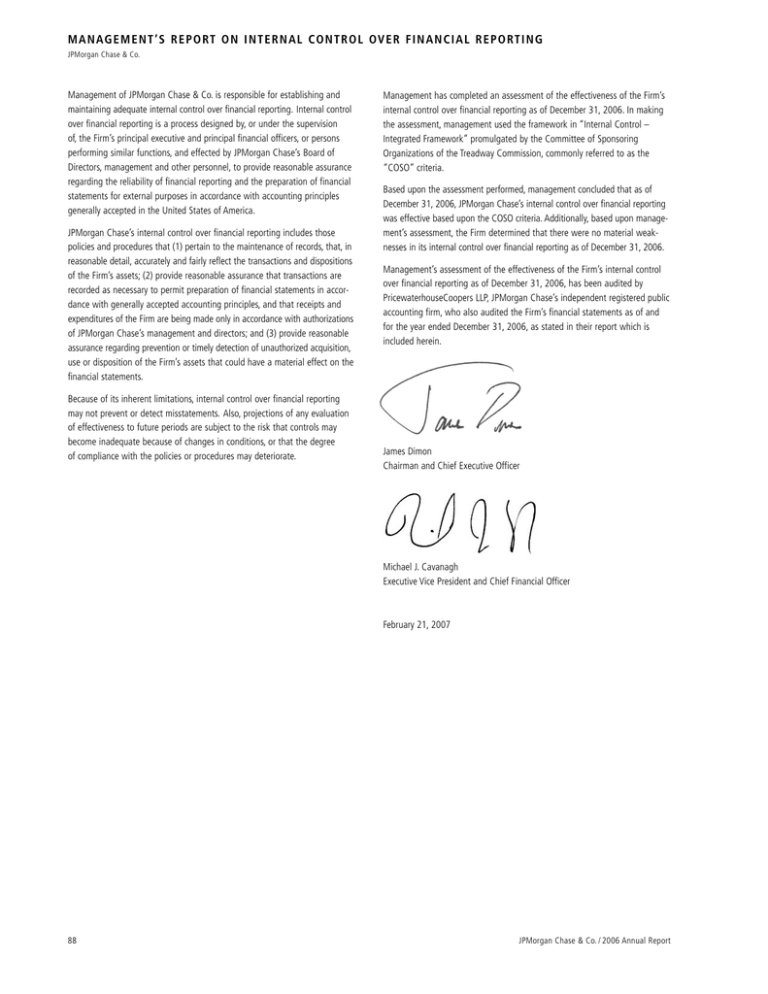

MANAGEMENT`S REPORT ON INTERNAL CONTROL OVER

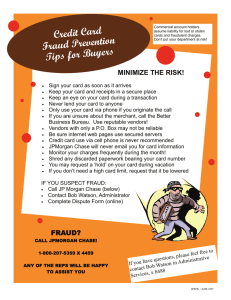

advertisement