VDC Research Group

Power Conversion and

Control Practice

An Executive Brief

THE 20.1 KVA AND OVER UPS MARKET:

From VDC’s 2008 Power Protection Market Intelligence Service

Volumes 4 – 6

Prepared by:

Brian Greenberg, Senior Analyst

Power Conversion and Control Practice

VDC Research Group

October 2008

All rights reserved

An Executive Brief, THE 20.1 KVA AND OVER UPS MARKET

1

The need to store and process large amounts of data in new and more complex ways shows no sign of

abating. Data centers will drive UPS revenue growth of leading vendors such as APC, Eaton and

Emerson Network Power over the next five years.

As the need to store more data and provide more computing power increases, participants throughout the

enterprise data center commercial value chain continue to evaluate methods and alternatives to slow

down the associated increases in electricity consumption and operating costs. More efficient equipment,

the availability of design/monitoring and control software, and alternative energy storage technologies are

all being researched, developed and deployed.

Advancements in these areas will also present a new set of growth opportunities both for established and

emerging participants.

MARKET OVERVIEW

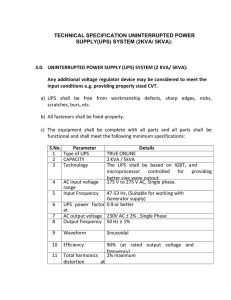

VDC estimates worldwide shipments of 20.1 kVA and over UPSs totaled $US 2.8 billion in 2007. Total

shipments are forecast to grow with an average compounded annual growth rate (CAGR) of 11.9%,

reaching $US 4.9 billion in 2012 (Exhibit 1).

Exhibit 1

20.1 kVA and Over UPS 2007 Estimated and 2012 Forecasted Shipments Segmented by Region

(Dollars in Millions)

6,000

5,000

1,538.6

4,000

3,000

1,442.2

822.1

2,000

853.0

1,000

1,906.8

1,112.6

0

2007

2012

Asia-Pacific

EMEA (Europe, Middle East, Africa)

Americas

© 2008 VDC Research Group, Inc.

An Executive Brief, THE 20.1 KVA AND OVER UPS MARKET

2

Some of the applications and market segments driving demand and growth for IT hardware, including

UPS solutions, include:

•

Mid-sized to large data centers

•

Unified communications

•

Real-time inventory and supply chain management

•

Electronic medical records

•

Online entertainment

VENDOR MARKET SHARE

The leading vendors accounted for more than 50% of the market (Exhibit 2). They also continue to

expand their footprints through new product and service introductions and new partnerships.

Exhibit 2

Top 5 Worldwide Vendors of 20.1 kVA and Over UPSs

(Ranked in Descending Order)

Emerson Network Power

American Power Conversion

Eaton Corporation

Mitsubishi

Piller

Looking toward the potential of Asia, Emerson expanded it channel network in Asia and Eaton acquired

Phoenixtec. APC’s acquisition by Schneider Electric and subsequent merger with MGE enabled

Schneider to become a significant presence in all regions. In 2007 APC and Schneider Electric also

announced a partnership with IBM in their Energy Efficiency Initiative.

Beyond batteries, Emerson also offers Pentadyne flywheels as alternatives to their battery-based UPS.

Pentadyne and Active Power, another emerging participant in the UPS market, have both seen continued

market acceptance of their flywheel technologies. VDC expects the use of flywheels in backup power

applications to see significant gains in the coming years as IT and facility managers look to reduce or

eliminate the costs associated with lead-acid battery monitoring and maintenance.

© 2008 VDC Research Group, Inc.

An Executive Brief, THE 20.1 KVA AND OVER UPS MARKET

3

CHANNELS

Direct and indirect sales channels were used almost equally. Their market position(s) can be described

primarily in two ways:

1. Vendors of UPSs in this market tend to rely on their direct sales channels for their larger projects

(Exhibit 3).

2. Virtually all other business is routed through channels based on market preferences for aggregated

sourcing or value-added services

Exhibit 3

Worldwide 20.1 and kVA UPS 2007 Estimated Shipments Segmented by Distribution Channels

(Percent of Dollars)

2007 Total: $US 2.8 Billion

Other

1.4%

OEM/Pvt.

Label

3.5%

Distributor

15.5%

Direct

43.6%

Reseller

36.0%

Many organizations recognize that achieving long-term success is not possible without strong business

partner relationships. Manufacturers in this market maintain relationships with various networks of

resellers and distributors. The more established relationships allow manufacturers to:

•

Deliver solutions to high-volume customers across a wide geographic area in a

timely fashion.

•

Provide pre-sales, technical and overall account service to medium and large

system customers.

•

Access key decision makers, buyers, account managers and program managers of highvalue and high-volume accounts.

© 2008 VDC Research Group, Inc.

An Executive Brief, THE 20.1 KVA AND OVER UPS MARKET

4

After-purchase support presents a major opportunity for vendors. While purchasers of larger UPS

systems expect a high level of reliability for their systems, they also expect to have access to a customer

service organization that can respond to requests around the clock and offer on-site assistance when

necessary.

BEING GREEN

The environment has become an increasingly important factor when making decisions about many

technology-related activities and purchases, from the greenness of products to the carbon footprint of

organizations and their facilities. UPS manufacturers are making a major push toward green power as

their customers demand greener, smaller and more efficient solutions. As power consumption and energy

prices rise, end users are taking a closer look at their existing power consumption, including

uninterruptible power supplies. For UPS manufacturers, this can create opportunities for upgrades to

more efficient models and the resulting unit shipments.

It will become essential to develop solutions that are highly efficient and help lower the total cost of

ownership (TCO) for the end user. In order to address these challenges, many UPS manufacturers are

developing technologies that increase energy efficiency and reduce UPS lifecycle costs. These

developments include investigation of alternative energy storage technologies such as flywheels and fuel

cells, as well monitoring and control software.

As IT managers struggle with increasing data-handling demands and energy expenses, many companies

will continue to look for new ways to curtail costs and meet the various industry and governmental

efficiency requirements. Successful UPS manufacturers will be able to support these efforts by

participating in government and industry programs and by providing power protection solutions that not

only consume less electricity themselves but also help customers reduce their overall electricity usage.

Critical power backup is no longer about a battery pack and power electronics. It requires a system and

holistic view to offer the best and most cost-effective solution on a customer-by-customer basis.

© 2008 VDC Research Group, Inc.

An Executive Brief, THE 20.1 KVA AND OVER UPS MARKET

5

ABOUT THE STUDY

This executive brief is based on the most comprehensive market research report available on the worldwide

markets for uninterruptible power supplies 20.1 kVA and over. These reports are packed with nearly 100

exhibits, deep market segmentations, and an extensive discussion of the most important issues affecting

the industry. As part of our 13th edition of our 2008 Power Protection Program (which includes six volumes

on the UPS market and three volumes on the surge suppressor market), VDC covers the 20.1 kVA and

over market across three volumes:

•

Volume 4: Americas (North, Central and South America) 20.1 kVA and over UPS market;

•

Volume 5: EMEA (Europe, Middle East, Africa) 20.1 kVA and over UPS market; and

•

Volume 6: APAC (Asia-Pacific) 20.1 kVA and over UPS market.

ABOUT VDC RESEARCH GROUP

VDC Research Group, Inc. (VDC) is a technology market research and strategy consulting firm that

advises clients in a number of industrial, embedded, component, retail automation, RFID, AIDC,

datacom/telecom, and defense markets. Using rigorous primary research and analysis techniques, the

firm helps its clients identify, plan for, and capitalize on current and emerging market opportunities. We

strive to deliver exceptional value to our clients by leveraging the considerable technical, operational,

educational and professional experience of our research and consulting staff. During our nearly four

decades of ongoing operation, we have had the pleasure of serving most of the world’s leading

technology companies, many high-profile start-ups, and numerous blue-chip early and later stage

investors. Our products and services consist of research reports, annual research programs, and custom

research and consulting services. Founded in 1971, the firm is located in the Boston area. Please visit our

Web site at www.vdcresearch.com to learn more.

For further information about VDC’s 2008 Power Protection Market Intelligence Program, contact:

Brian Greenberg, Analyst, Power Conversion and Control Practice, +1.508.653.9000 ext. 146,

bgreenberg@vdcresearch.com

For pricing/purchasing information, contact:

Tim Shea, Account Executive, +1.508.653.9000 ext. 119, tims@vdcresearch.com

Join the VDC mailing list to receive future updates at: http://www.vdcresearch.com/OptIn.asp

VDC RESEARCH GROUP

679 Worcester Road | Suite 2 | Natick, MA 01760

T: +1.508.653.9000 | F: +1.508.653.9836

E: info@vdcresearch.com | W: www.vdcresearch.com