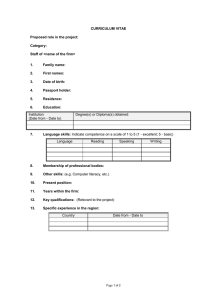

guidelines for the engagement of consultants and other

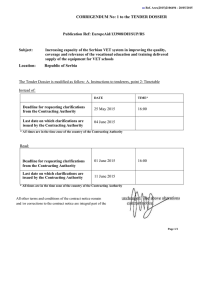

advertisement