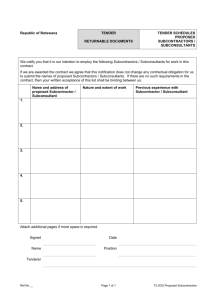

SubContracting in the South African Construction Industry

advertisement