www.pwc.com/ca/retail

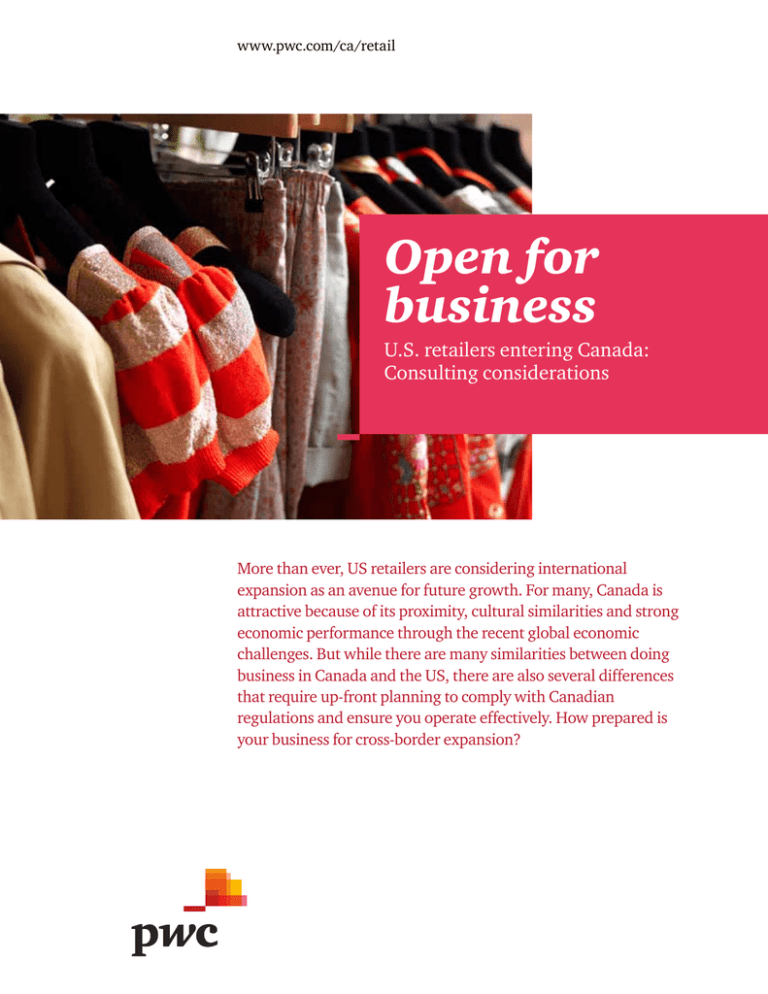

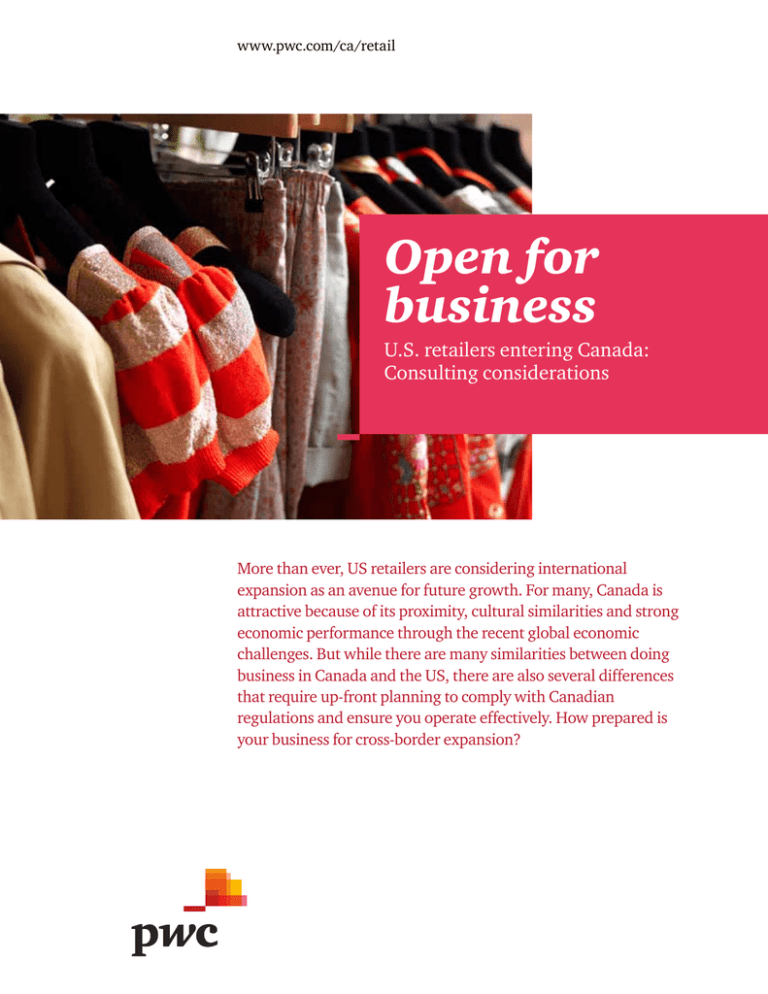

Open for

business

U.S. retailers entering Canada:

Consulting considerations

More than ever, US retailers are considering international

expansion as an avenue for future growth. For many, Canada is

attractive because of its proximity, cultural similarities and strong

economic performance through the recent global economic

challenges. But while there are many similarities between doing

business in Canada and the US, there are also several differences

that require up-front planning to comply with Canadian

regulations and ensure you operate effectively. How prepared is

your business for cross-border expansion?

U.S. retailers entering Canada:

considerations

Becoming a smooth operator

Operations

Merchandise optimization

Technology

To successfully cross the border to the north, you’ll

need to understand the competitive landscape and

the needs of Canadian shoppers and translating those

needs into effective merchandising, marketing and

store operations programs. An important part of this

is the ability to make strategic decisions on what

organizational roles, accountabilities and processes

should reside in Canada versus those that could

remain at the corporate office. Are you confident that

your Canadian operating model will leverage the

uniqueness of the Canadian market? Do you have the

right organizational capabilities required to support

expansion?

Protecting your information assets is important

regardless of what country you operate in. Retailers

in Canada should be in accordance with regulation

and compliance guidelines, such as the Personal

Information Protection and Electronics Document

Act (PIPEDA) and the Payment Card Industry Data

Security Standard (PCI DSS). For instance, if your

business is looking to accept debit cards as a payment

method, you are required to use the Interac network

in Canada.

When it comes to product assortment and allocation,

consider the consumer buying habits of Canadians

in different markets and locations. Also take into

account that there is typically less floor space (square

feet) in Canadian retail locations compared to US

stores. All this boils down to one thing: making sure

you have the right products and the right marketing in

the right stores.

Did you know?

Quebec consumers and language laws

The predominantly French-speaking market of Quebec

makes up a significant portion of Canadian consumers.

There are both subtle and obvious differences in Quebecers’

consumer behaviour, which can impact both the range of

products they will buy and the type of advertising they will

respond to. At the same time, retailers must comply with

the Charter of French Language in Quebec. The language

law places strict restrictions: French is mandatory on

product labelling, commercial documentation (catalogues,

pamphlets, brochures and commercial directors) and

commercial signs (promotional signs, displays, etc.). While

other languages can be present, French text must be at least

equal in size to the other languages.

While you may not need large scale systems

integration for your expansion, consider integrating

Canada-specific business applications and selecting

the right technology vendors with strong Canadian

footprints. Choose vendors that can provide retailspecific services, including multilingual call centres

and payment processors, which will help you navigate

potential language and cultural barriers.

Retail loss prevention

Similar to the US, criminal elements are present

in the Canadian retail market. Comprehensive loss

prevention programs that use a well-crafted mix of

cameras, in-store security devices, control procedures

and data analytics can help to combat those who are

at risk to commit crimes.

One significant difference between Canada and the

US is the existence of personal identification number

(PIN) controlled debit cards. While this is considered

to be more secure, it’s not foolproof, and these cards

have become an increasing target for criminals. Train

your store personnel to inspect and validate that

PIN pads located at the point-of-sale have not been

compromised during the day. When there are doubts,

exercise caution and take such PIN pads out of service

to validate their integrity.

From sea to shining sea

Product flow and supply chain

Taking the risk out of risky

Reporting and risk

Distribution

Customs

Financial Reporting

Unlike the US, the majority of the Canadian

population live in five main cities. This

level of concentration can often provide

distribution challenges for US retailers—

from higher transportation costs to supply

chain inefficiencies. The key to getting it

right is to effectively structure your supply

chain so that it’s scalable to grow with your

business strategy over time.

The duty cost of direct shipment of

inventory purchases to Canada should be

compared to that of replenishment through

US distribution centers. US retailers may

be able to take advantage of Canadian

duty relief programs or US foreign trade

zone programs to reduce or recover duty

on cross-border transactions. Other issues

to consider include customs valuations,

tariff classification and duty rates, tariff

treatment (free trade areas), importer

of record, administrative matters (e.g.

appointing a customs broker, establishing

complaint record keeping processes) and

anti-dumping/countervailing duty.

Retailers can experience a number of

complex financial accounting issues related

to matters such as valuations, pensions and

corporate treasury.

Where your stores are located will help you

determine whether to run your distribution

network out of the US or set-up distribution

centres within Canada, and if you should use

a third party distribution centre. In the case

of sourcing from low-cost countries, such

as China and India, it may be more cost and

time effective to import directly to Canada

rather than through a US distribution

centre. Having a Canadian-specific sourcing

and supply chain strategy, which looks at

origin/inbound flow, provincial warehouse

real estate, market coverage of third party

logistics providers and transportation,

can help you focus on optimizing your

distribution network from both a cost and

service perspective.

Did you know?

Liquor and tobacco

Canadian law prohibits tobacco from being sold in places

that provide healthcare and pharmacies and vending

machines. The ability for retailers to sell liquor varies

between provinces. In some provinces you can only

purchase liquor through government and licensed private

stores; in others, grocery and convenience stores are able

to sell liquor.

Before entering Canada, understand the

different reporting and financial standards

in both countries, including SarbanesOxley (SOX) and the Canadian equivalent

for public companies (CSOX). At the same

time, while IFRS is not mandatory for public

companies in the US, all Canadian public

companies are required to implement IFRS

in January 2011. US retailers should also

consider how they plan to develop their

non-financial performance reporting.

Risk and Regulatory

As with any business, it’s important to have

sound internal audit and risk management

functions that deliver more strategic value at

a lower cost of operation. As you bring your

business north, consider the implications

on your controls functions. Many retailers

establish their internal audit and monitoring

activities in centres of excellence while

others set them up in one centralized office,

depending on the needs and geographical

dispersion of the business. This may also

change based on whether or not you operate

through branches or subsidiaries in Canada.

Controls testing, including SOX testing of

internal controls financial reporting and

CSOX, is another key consideration. Finally,

with two official languages in Canada

(English and French), how equipped are

you to operate effectively in both languages

and comply with French language laws in

Quebec?

The bricks and mortar

of doing business

People

Real Estate

Who to call

Employers in Canada must comply with

payroll withholding, remittance and

reporting requirements relating to the

following four main areas, as well as to

personal income tax withholding from

employment income:

Not uncommon in any retail market,

location is key. But since Canada is a vast

geographic country with few main retail

cities, the availability of good retail space

in these cities is limited. Indeed, with 2-3%

vacancies, shopping centres in Canada are

essentially full. It’s important to have a solid

understanding of the value that each of your

retail locations can produce.

Greater Toronto Area

Christopher Kong

National Retail & Consumer Leader

416 869 8739

christopher.p.kong@ca.pwc.com

Similar to in the US, the rent on a leased

space is calculated based on the square

footage of the space in addition to a

percentage of sales.

Tax

Ryan Thulien

416 869 2342

ryan.d.thulien@ca.pwc.com

When it comes to real property tax:

Deals

Carla Eisnor

416 815 5015

carla.eisnor@ca.pwc.com

• Canada Pension Plan (CPP) – mandatory

equal contributions by employers and

employee

• Employment Insurance (EI) – mandatory

employer and employee premiums based

on insurable earnings to a maximum

• Employer health and post-secondary

education premiums for certain provinces

at varying rates applied to total payroll

• Provincial workers’ compensation

premiums, which vary by industry and

experience rating

Environmental concerns

Canada offers a number of environmental

programs and government incentives to

help retailers embrace sustainability and go

green. Environmental levies include:

• Certain provinces and municipalities

impose a transfer tax on the transfer of

real property (land and buildings), which

varies by province.

• Leases could be subject to land transfer

taxes on long-term leases, which varies by

province, for example leases in excess of

50 years in Ontario

• Blue box and recycling programs

(available in several provinces)

• E-waste/hazardous waste

• Tire stewardship

• Plastic bags – in several cities across the

country, retailers are mandated to charge

consumers for plastic bags

Environmental incentives are available

at both the federal and provincial levels,

including for energy conservation and

efficiency. Many of these opportunities are

provided through government agencies,

but some are offered through utility, power

and other companies, often funded through

government agencies.

How we can help

PwC’s Retail and Consumer professionals

can help you successfully expand your

US retail business to Canada. We use our

business, strategy and technology skills and

experience so you can better understand and

navigate the Canadian landscape and market

your business accordingly. Our range of

experience gives us a strong understanding

of the issues retail and consumer companies

face across the entire supply chain, from

manufacturing and distribution to final

consumer purchase.

Call one of our consultants to discuss your

unique needs.

Ross Sinclair

416 228 4000

ross.sinclair@ca.pwc.com

Supply Chain

Lino Casalino

416 815 5263

lino.casalino@ca.pwc.com

Risk & Internal Audit

Dorothy Sanford

416 869 2353

dorothy.a.sanford@ca.pwc.com

Private Company Services

Mauro Fratarcangeli

416 218 1433

mauro.fratarcangeli@ca.pwc.com

Corporate Finance

Keith Mosley

416 941 8307

keith.mosley@ca.pwc.coom

Quebec Region

Alain Michaud

514 205 5327

alain.michaud@ca.pwc.com

B.C. Region

Calle Johnson

604 806 7774

calle.johnson@ca.pwc.com

Retail Consulting Services

Antony Karabus

416 373 4225

antony.karabus@ca.pwc.com

www.pwc.com/ca/retail

© 2011 PricewaterhouseCoopers LLP. All rights reserved. In this document, “PwC” refers to PricewaterhouseCoopers LLP, an Ontario limited liability partnership, which is a member firm

of PricewaterhouseCoopers International Limited, each member firm of which is a separate legal entity. 0807-02 0411