State Update: South Australia – January 2016

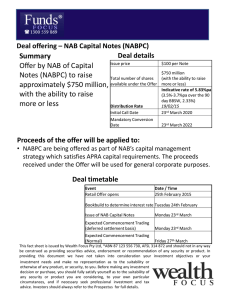

State Update: South Australia – January 2016

NAB Group Economics

more give, less take

Content

In Focus: Population growth and Housing

Services and commodity exports

Semi government bonds and credit outlook

10

11

8

9

12

13

6

7

4

5

2

3

Photo: Greg Rinder, CSIRO

•

•

•

•

•

•

Key points

SA’s economic performance continues to be at the bottom of the pack, challenged by unfavourable demographic factors, weak commodity prices, as well as the long-term structural decline of its manufacturing base. It also lacks the industry mix and job opportunities to draw workers back to the state as the national economy rebalances towards non-mining activity, although the lower AUD is supporting tourism arrivals and expenditure. Below-average population growth, combined with high unemployment, is in turn creating very limited demand and price impetus for residential property. The imminent end to car manufacturing activity in 2017, a challenging outlook for the defence and mining sectors, as well as the upcoming closure of the Port Augusta power stations and Leigh Creek coal mine, also constitute headwinds to the state’s industrial activity. As a result, business conditions remain tepid, with the retail sector the rare bright spot.

We expect the SA economy to grow by 1.7% in 15-16 before rising to 1.8% 16-17, with unemployment rate expected to gradually fall from 7.6% in 15-16 to 7.4% in 16-17.

The Federal Government has announced plans to build $40 billion worth of new surface ships for the navy in South Australia from 2018 onwards. It is also highly likely that at least 8 out of 12 submarines from the navy’s next fleet will be built there although the timing remains uncertain. The scheduled completion of the Royal

Adelaide Hospital late this year suggests that there could still be a public spending gap next year before the commencement of the former project. Meanwhile, the services and construction industries have grown in importance in terms of their contribution to SA’s economic activity and employment since the mid 2000s.

Residential property prices in Adelaide and regional SA have largely flat-lined and are increasingly falling behind the national average. The average regional house price for

2015 looks set to dip below the level seen in the previous year. A gradually rising dwellings to population ratio also suggests limited support for house prices going forward.

Supported by surprisingly resilient wages growth, household consumption is a standout contributor to SA’s recent economic performance, with retail spending and household expenditure growth maintaining strong momentum. Consumers are also seemingly more optimistic, demonstrated by their increased propensity towards discretionary spending. This is despite generally weak labour market conditions as SA continues to experience the highest unemployment rate across the states and territories.

Business conditions continue to be unremarkable in SA, characterised by lower capacity utilisation, weak business investment and an elevated office vacancy rate.

That said, capital expenditure expectations for buildings and structures do suggest an uplift in 2015-16.

In terms of goods exports, the value of SA’s mineral shipments in 2015 were dealt a significant blow by the sharp retreats in commodity prices since late 2014. This was only partially offset by stronger wine exports. Meanwhile, a lower AUD is delivering dividends to the state’s services sectors through higher international student enrolments and overall tourism expenditure, although a more pronounced global slowdown than currently forecast is a downside risk. 2

Contact

Vyanne Lai, Economist

Riki Polygenis, Head of Australian Economics

Skye Masters, Head of Interest Rate Strategy

Chart 1: State GSP Growth Forecasts

12

Annual Growth

10

6

8

4

2

0

NSW VIC

2013-14

QLD

2014-15

SA WA

2015-16 (f)

TAS NT

2016-17 (f)

ACT

Chart 1: State Final Demand and GSP Growth* (y/y%)

% State Final Demand Growth %

12 SA Australia

8

24 8

4

0

-4

-8 8

-12 4

Gross State Product Growth

4

20

0

16

12

8

4

1991 1995 1999 2003 2007

*NAB Estimate Sources: ABS; NAB Economics

2011 2015

0

-4

In Focus: A slowing and ageing SA population poses a challenge to the housing market

•

South Australian population growth has moderated notably since late

2009, largely driven by lower net overseas migration and continuous net outflow of interstate migration. The SA population as a share of the

Australian population has continued its structural decline (Chart 3).

•

More importantly, SA population continues to age relative to the national average (Chart 4).

Chart 3: SA Share of Aus Population and Growth in Migration

Persons

6,000

5,000

Share of Aus population (RHS)

Net overseas migration (LHS)

8.0%

7.8%

4,000

3,000

2,000

1,000

0

7.6%

7.4%

7.2%

7.0%

6.8%

-1,000

-2,000

2001

Net interstate migration (LHS)

2003 2005 2007 2009 2011 2013 2015

6.6%

•

SA manufacturing employment enjoyed a revival in 2013 and 2014, supported largely by a increase in food and beverage manufacturing jobs.

However, the revival proved to be short-lived (Chart 5).

•

Slowing population is one of the main factors weighing on the Adelaide housing market. Combined with more dwellings being constructed in

2015, the dwellings to resident population ratio has resumed an upward trend, which could be a detractor to price growth in the near-term (Chart

6).

Chart 4: Age distribution of South Australian population

16%

14%

South Australia Australia

12%

10%

8%

6%

4%

2%

0%

Chart 5: Manufacturing Employment

'000 Persons

120

110

100

90

80 Manufacturing (% share of total employment, rhs)

70

Total No. of People Employed in

Manufacturing(lhs)

60

1991 1995 1999

Source: ABS, NAB Group Economics

2003 2007 2011 2015

8

%

20

18

16

14

12

10

3

Chart 6: Adelaide House Prices and Dwellings to Population Ratio

$000

800

700

600

500

400

300

RP Data-Rismark hedonic prices; ratio of dwelling to population

Capital City

Dwelling Prices

SA - Dwellings to resident population (rhs)

(lhs)

Ratio

104

103

102

101

100

99

98

200

100

0

2001 2003 2005 2007 2009

Adelaide Dwelling

Prices (lhs)

2011 2013 2015

97

96

95

Consumer and household sector showing momentum despite languishing house price growth

•

Wages growth in SA has been relatively resilient, which has flowed into stronger household consumption (Chart 7).

•

As a result, retail spending growth remains resilient. Meanwhile SA house price growth has also gained traction in recent months, albeit from low levels still (Chart 9).

•

On the back of sustained wages growth, there is evidence that SA consumers have gradually become more optimistic. Based on our survey, consumers are showing increasing inclination to spend on discretionary items such as home improvements, major household items and travel, although they continue to place a strong priority on long-term financial objectives of savings, super and investments; children; medical expenses; as well as paying down debt. (Chart 8).

Chart 7: Average Compensation of Employees and Household

Consumption Growth (y/y%)

14.0%

12.0%

10.0%

8.0%

6.0%

Total Compensation of Employees

Household Consumption

4.0%

2.0%

0.0%

-2.0%

-4.0%

1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015

Chart 9: Retail Turnover and House Price Growth

24.0%

20.0%

16.0%

12.0%

Adelaide House Price

Growth (y/y %) - RHS

Retail Turnover Growth

(y/y%) - LHS

8.0%

4.0%

0.0%

-4.0%

2011 2013 2015

20.0%

16.0%

12.0%

8.0%

4.0%

0.0%

-4.0%

-8.0%

4

Chart 8: NAB Consumer Anxiety Survey - Consumer Spending

Preferences

Changes in Spending Behaviour: SA/NT

(net balance)

Transport

Utilities

Paying off debt

Medical expenses

Entertainment

30

20

10

0

-10

-20

-30

Charitable donations

Eating out

Use of credit

Personal goods

Children

Savings, super, investments

Groceries

Q3'15

Major HH items

Home improvements

Q4'15

Travel

SA business conditions the weakest of all states, offering little impetus to business investment

•

According to the monthly NAB Business Survey, capacity utilisation of businesses in SA has been on a downward trajectory since 2011 to be notably below national average (Chart 10). This trend is consistent with lower business conditions in the state, which had been the weakest across all mainland states since late 2014 (Chart 11).

•

Business investment growth in SA remains subdued, with weaker capex expectations for the next 12 months suggesting little upside impetus for

2016. This is likely to reflect a shrinking manufacturing base and weakness in commodity prices (Chart 12).

•

Services and traditional business sectors alike are plagued by weak business conditions, with the construction industry faring the worst (Chart

13).

Chart 10: NAB Business Survey – Capacity Utilisation

%

86

84

82

80

78

76

74

2001 2003

SA

2005

Total

2007 2009 2011 2013 2015

Chart 12: NAB Survey Capex Expectations & Private Business

Investment Growth

Net balance

60

SA Capex Expectations

(12-month) - LHS

SA Business Investment

Growth (y/y%) -RHS 45

30

15

0

-15

-30

1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015

Source: ABS, NAB Group Economics

%

60

40

20

0

-20

-40

-60

5

Chart 11: Spread in NAB Business Conditions ( net balance , 3-monthmoving average)

40 40

30

20

Spread

South Australia

Total

30

20

10 10

0 0

-10 -10

-20 -20

-30

2007 2008 2009 2010 2011 2012 2013 2014 2015

-30

Chart 13: SA Business Conditions & Confidence by Industry

Net Balance (%). Sep quarter 2015

40

20

0

-20

-40

-60

Conditions Confidence

-80

-100

Commercial property/non-residential investment tracking at low levels, but capex expected to lift

•

Reflecting the soft appetite for business investment, non-residential building approvals have been tracking at low levels, except for

“Retail/Wholesale” which benefits from a surge in consumer activity

(Chart 14).

•

Rising office vacancy rates and low levels of office building approvals signal a substantial amount of spare capacity in the sector (Chart 15).

•

That said, expected capital expenditure (capex) is higher for buildings and structures in 2015-16, while planned spending on machinery and equipment is expected to remain at similar levels to previous years (Chart

16).

Chart 14: Non-residential Building Approvals ($ millions)

70

60

50

40

30

20

10

0

2000

Retail/Wholesale -LHS

Warehouses-LHS

2002 2004 2006

Offices - LHS

Other-RHS

2008 2010 2012

Factories- LHS

2014

Chart 16: SA Capital Expenditure & Expectations

$b

4.5

4.0

Actual & expected based on previous realisation ratio

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

Building & Structures

2012-13 2013-14

Source: ABS, NAB Group Economics

Machinery & Equipment

2014-15 2015-16 (e)

490

420

350

280

210

140

70

0

6

Chart 15: Office Approvals and Vacancy Rates

$m

56

48

40

Office Approvals (lhs)

Office Vacancy Rates (inverse, rhs)

32

24

16

8

0

2005 2007 2009 2011 2013 2015

7

9

11

%

3

5

13

15

17

SA residential property prices expected to ease further

•

The SA residential property sector remains subdued, characterised by low levels of approvals and commencements (Chart 22), as well as modest residential property growth price growth in the last five years. Regional house prices have started to contract since the start of this year (Chart 23).

•

SA residential property price growth by sub-region in Adelaide suggests that eastern Adelaide leads in capital growth for houses while southern

Adelaide dominates in the unit segment (Chart 24).

•

Results from the latest NAB Property Survey reveal expectations by industry participants that SA/NT house prices will continue to contract in the short and medium term (Chart 25) .

Chart 22: SA Residential Approvals & Commencements

4,500

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

1987 1991 1995

Approvals

1999 2003

Commencements

2007 2011 2015

Chart 24: Adelaide - Median Property Price Growth (year to Q3 2015)

Western Adelaide

Southern Adelaide

Northern Adelaide

Eastern Adelaide

0.0

2.0

4.0

House Prices

Unit Prices

6.0

8.0

Source: RP Data, ABS, NAB Group Economics 7

Chart 23: SA Residential Property Price Growth (y/y%)

%

30

25

20

Adelaide Houses

Adelaide Units

Regional Houses

15

10

5

0

-5

-10

2001 2003 2005 2007 2009 2011 2013 2015

Chart 25: NAB Property Survey – House Price Expectations (%)

%

4.0

NAB Property Survey - House Price Expectations (%)

2.0

0.0

-2.0

-4.0

Estimated price growth in relevant survey period...

Australia

Source: ABS, NAB Group Economics

SA/NT

Expectatio ns

SA services and agricultural exports

•

The SA tourism sector have shown signs of picking up since 2013, with accommodation takings turning the corner and bed vacancy rate relatively stable around the 37% mark. A lower AUD is expected to be see a higher level of inbound tourism into SA from international and domestic sources.

•

International student enrolments in SA, an indicator for foreign student numbers, have picked since 2014, but our estimate for 2015 suggests that enrolments will still be below the peak recorded for 2010 (Chart 32).

Education is the largest services export category for SA (Chart 34).

Chart 31: SA Accommodation Takings and Bed Vacancy (4 qtr-rolling average)

$ '000

120,000

%

39

38

100,000

80,000

60,000

40,000

20,000

Total Accomdation Takings ($'000) -

LHS

Total Establishments Bed Vacancy

Rate (%) - RHS

37

36

35

34

33

32

31

30

0 29

1999 2001 2003 2005 2007 2009 2011 2013 2015

Chart 33: Value of South Australian Goods Exports by Industry

$m

5,000

4,500

Agriculture Mining Manufacturing Wholesale

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14

Source: ABS, Australian Education International, NAB Group Economics

Chart 32: International Student Enrolments

Persons

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

2003 2005 2007 2009 2011

Chart 34: Value of SA Services Exports by Sector in 2014

Education

Other travel

Transport

Other buiness services

Business

Telecommunications

Personal, cultural and recreational

Charges for the use of intellectual property

Government goods and services n.i.e.

Insurance and pension

Mantenance and repair

Construction

8

•

Weaker global commodity prices have dented the value of SA agricultural and mining exports in 2013-14, despite relatively robust production volumes (Chart 33). More recent anecdotal data suggests that SA agricultural exports, especially wines, have picked up this year on the back of Australia’s Free Trade Agreements with Japan and Korea and a depreciation in the AUD.

2013 2015 (e)

$m

-100 100 300 500 700 900 1,100 1,300

SA’s labour market continues to underperform other states

•

Labour market conditions in SA have experienced a broad-based deterioration since 2012 and are among the weakest across states (Chart

17).

•

The state has overtaken Tasmania to record the highest unemployment rate among all states and territories since the start of this year. However, a rising SA unemployment rate has been accompanied by a higher participation rate which potentially signifies a turnaround in labour market conditions (Chart 18).

Chart 17: Unemployment Rate by Region

•

In the 12 months to May 2015, most of the jobs created were in services sectors, while the more traditional sectors of manufacturing, wholesale and mining continued to experience job losses (Chart 18).

10

9

8

7

6

5

4

3

2

2001 2003

SA

2005

Greater Adelaide

2007 2009 2011

Rest of SA

2013

Chart 19: SA Unemployment & Participation Rates

14

%

12

10

8

6

4

2

Unemployment rate (trend) (LHS)

Participation rate (trend) (RHS)

0

2001 2003 2005 2007

Source: ABS, NAB Group Economics

2009 2011 2013

2015

2015

63

62

61

60

59

58

57

56

%

65

64

9

Chart 18: Change in employment by industry, last 12 months to

November 2015, SA, '000s

Manufacturing

Mining

Agriculture

Construction

Rental services

Wholesale trade

-6.8

-4.575

-4.025

-2.825

-2.475

-2.075

Education

Other services

Utilities

Arts

Transport

Hospitality

Communications

Retail trade

-1.35

-0.575

0.6

1.125

1.4

2.125

2.25

2.25

Admin services

Finance

Public admin

Business services

Health

2.25

2.725

3.7

4.025

6.225

-8 -7 -6 -5 -4 -3 -2 -1 0 1 2 3 4 5 6 7 8

SA share of Australian population continues its structural decline

•

Since peaking in 2009, SA population growth has slowed notably on the back of lower net overseas migration and a sustained outflow of interstate migrants (Chart 20).

•

SA population growth continues to track significantly below national average levels (Chart 21), which entrenches the sliding trend in its share of the Australian population, currently at around 7.2% from just under 9% in the early 1990s.

Chart 20: SA Population Growth Drivers (000s, over the year)

'000s

25

20

15

10

5

0

-5

-10

2001

Natural increase

Net interstate migration

2003 2005 2007 2009

Net overseas migration

Total population growth

2011 2013 2015

Chart 21: SA Population Growth (y/y%)

%

3.0

2.5

2.0

1.5

1.0

0.5

0.0

2001 2003 2005

SA

2007 2009

AUS

2011 2013 2015

Source: ABS, NAB Group Economics

10

Services sectors are gaining prominence in output and employment shares over manufacturing

•

The top three sectors in SA by output share are health services, manufacturing and finance & insurance services. The former overtook manufacturing as the largest industry by gross value added in 2008-09 and the largest employer in 2006-07 (Chart 26).

•

By employment share, manufacturing (9%) is ranked third behind health and social services (15%) and retail trade (11%).

Chart 26 : Composition of employment & GVA

Other services

Arts

Health

Education

Public admin

Admin services

Business services

Rental services

Finance

Communications

Transport

Hospitality

Retail trade

Wholesale trade

Construction

Utilities

Manufacturing

Mining

Agriculture

Employment

GVA

0% 2% 4% 6% 8% 10% 12% 14% 16%

•

China and the ASEAN bloc are the main trading partners for SA (Chart 27

&28).

•

SA’s top commodity exports include iron ore and concentrates ($1.6bn), wheat ($1.4bn) and alcoholic beverages ($1.2bn). Meanwhile, SA imports mainly refined petroleum ($0.9bn), vehicle parts and accessories ($0.6bn) and goods vehicles ($0.4bn) from other countries (Chart 29 & 30).

Tables 27 & 28: Top SA export destinations and import source countries,2014-15

Value of exports ($m) Value of imports ($m)

2248 1 ASEAN 1909 1 China

2 ASEAN

3 US

4 EU

5 India

6 Japan

7 UK

8 New Zealand

9 HK

2027

1669

1331

762

475

447

424

240

2 China

3 EU

4 US

5 Singapore

6 Japan

7 Korea

8 Germany

1598

1334

815

730

550

484

263

10 HK 240 9 New Zealand 209

11 Taiwan 224 10 UK 193

12 Singapore

13 Germany

129

63

11 Taiwan

12 HK

119

31

Tables 29 & 30: Major SA export and import goods, 2013-14

Major exports, goods, 2013-14

Iron ores & concentrates

Wheat

Copper

Alcoholic beverages

Copper ores & concentrates

A$m

1,596

1,370

1,171

1,154

830

Major imports, goods, 2013-14

Refined petroleum

Passenger motor vehicles

Vehicle parts & accessories

A$m

902

643

420

Goods vehicles

Power generating machinery & parts

282

257

Source: ABS, NAB Group Economics 11

SA General Government debt level expected to pick up in the short term on tax cut measures

•

The SA general government has significantly revised its forecast net debt for 2015-16 downwards by $652m from the 2015-16 Budget estimate of

$4.2b. This primarily reflects higher dividends from MAC to the Highways

Fund due to stronger-than-expected investment returns in 2014-15 (Chart

34). Despite consistent downgrades across the forward estimates period, net debt is still expected to peak in 2016–17 due to the commercial acceptance of the new Royal Adelaide Hospital.

Relative to Budget, total taxation revenues have been revised down in all years, mainly due to revisions to payroll tax, gambling tax and insurance duty. Meanwhile, GST grants have been revised up for the forward estimates period reflecting changes to SA’s expected share of the GST pool. GST is the single largest source of revenue for the state at 32%(Chart 35).

4500

4000

3500

3000

2500

2000

Chart 34: SA Net Operating Balance

$m

7000

6500

6000

5500

5000

Net Debt Level (LHS)

Net Debt as a Share of GSP (RHS)

2015-16 (f) 2016-17 (f) 2017-18 (p) 2018-19 (p)

Note: f= forecast; p= projection

5

4.5

4

3.5

3

2.5

2

7

%

6.5

6

5.5

Chart 35: SA Composition of State Revenue

Sales of

Goods and

Services

14%

Other Grants

24%

Royalty

Income

0%

Other

5%

Taxation

25%

GST

32%

Source: SA Department of Treasury Finance 12

Net debt projections revised lower as is new borrowings

12.0

11.0

•

The improvement in the net debt position in 2015-16 is largely due to the dividend payment from MAC to the Highways Fund. This has been driven by stronger than expected investment returns in 2014-15. Net debt is expected to peak in 2016-17 (due to the commercial acceptance of the new Royal Adelaide Hospital) (Chart 36).

•

Feeding the new budget forecasts into the credit matrix shows only minor changes to the outlook for the states budget performance (Chart 37).

Chart 36: South Australia Non-Financial Public Sector net debt

14.0

13.0

AUDbn

FY15 MYBR

FY16

10.0

9.0

8.0

2014-15 2015-16 2016-17

Chart 38: SAFA borrowing programme

2017-18

Source: South Australian Budget Papers, SAFA, NAB

FY16 MYBR

2018-19

•

SAFA updated its funding program for 2015-16 following the release of the MYBR. Given the dividend payment from the Motor Accident

Commission, client funding has been revised from AUD0.4m to AUD-0.1m, and reducing the overall funding program from AUD4.2bn to AUD3.7bn.

Fiscal year to date SAFA has issued AUD1bn of its revised AUD1.5bn of term funding (or 67%) (Chart 38). The remaining AUD500m of term funding will go across a variety of maturities. The maximum amount of outstanding in each bond line will be capped at AUD2bn. As at the end of

2015 SAFA’s bonds outstanding stood at AUD14.97bn which is AUD0.75bn above levels as at end June 2015 (Chart 39).

13

Chart 37: S&P credit metric: Budget Performance

Chart 39: SAFA term bonds outstanding as at July 2015

Group Economics

Alan Oster

Group Chief Economist

+61 3 8634 2927

Jacqui Brand

Personal Assistant

+61 3 8634 2181

Australian Economics and

Commodities

Riki Polygenis

Head of Australian Economics

+(61 3) 8697 9534

James Glenn

Senior Economist – Australia

+(61 3) 9208 8129

Vyanne Lai

Economist – Australia

+(61 3) 8634 0198

Amy Li

Economist – Australia

+(61 3) 8634 1563

Phin Ziebell

Economist – Agribusiness

+(61 4) 75 940 662

Industry Analysis

Dean Pearson

Head of Industry Analysis

+(61 3) 8634 2331

Robert De Iure

Senior Economist – Industry Analysis

+(61 3) 8634 4611

Brien McDonald

Senior Economist – Industry Analysis

+(61 3) 8634 3837

Karla Bulauan

Economist – Industry Analysis

+(61 3) 86414028

International Economics

Tom Taylor

Head of Economics, International

+61 3 8634 1883

Tony Kelly

Senior Economist – International

+(61 3) 9208 5049

Gerard Burg

Senior Economist – Asia

+(61 3) 8634 2788

John Sharma

Economist – Sovereign Risk

+(61 3) 8634 4514

Global Markets Research

Peter Jolly

Global Head of Research

+61 2 9237 1406

Australia

Economics

Ivan Colhoun

Chief Economist, Markets

+61 2 9237 1836

David de Garis

Senior Economist

+61 3 8641 3045

Tapas Strickland

Economist

+61 2 9237 1980

FX Strategy

Ray Attrill

Global Co-Head of FX Strategy

+61 2 9237 1848

Rodrigo Catril

Currency Strategist

+61 2 9293 7109

Interest Rate Strategy

Skye Masters

Head of Interest Rate Strategy

+61 2 9295 1196

Credit Research

Michael Bush

Head of Credit Research

+61 3 8641 0575

Simon Fletcher

Senior Credit Analyst – FI

+61 29237 1076

Andrew Jones

Credit Analyst

+61 3 8641 0978

Distribution

Barbara Leong

Research Production Manager

+61 2 9237 8151

New Zealand

Stephen Toplis

Head of Research, NZ

+64 4 474 6905

Craig Ebert

Senior Economist

+64 4 474 6799

Doug Steel

Markets Economist

+64 4 474 6923

Kymberly Martin

Senior Market Strategist

+64 4 924 7654

Jason Wong

Currency Strategist

+64 4 924 7652

Yvonne Liew

Publications & Web Administrator

+64 4 474 9771

Asia

Christy Tan

Head of Markets Strategy/Research, Asia,

+ 852 2822 5350

Julian Wee

Senior Markets Strategist, Asia

+65 6632 8055

UK/Europe

Nick Parsons

Head of Research, UK/Europe, and Global Co-Head of FX Strategy

+ 44 207 710 2993

Gavin Friend

Senior Markets Strategist

+44 207 710 2155

Derek Allassani

Research Production Manager

+44 207 710 1532

Important Notice

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances.

NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to hold it. Please click here to view our disclaimer and terms of use.