Training Needs and Training Capacity of the Water Industry in

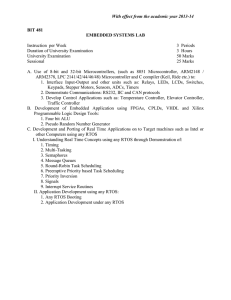

advertisement