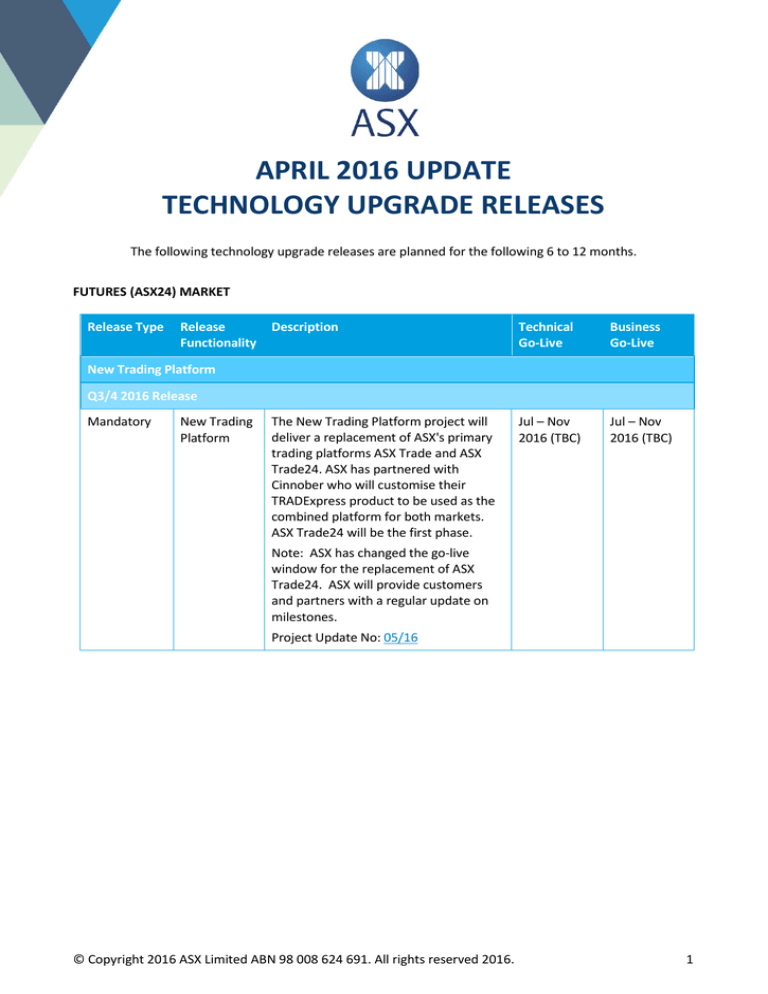

APRIL 2016 UPDATE

TECHNOLOGY UPGRADE RELEASES

The following technology upgrade releases are planned for the following 6 to 12 months.

FUTURES (ASX24) MARKET

Release Type

Release

Functionality

Description

Technical

Go-Live

Business

Go-Live

The New Trading Platform project will

deliver a replacement of ASX's primary

trading platforms ASX Trade and ASX

Trade24. ASX has partnered with

Cinnober who will customise their

TRADExpress product to be used as the

combined platform for both markets.

ASX Trade24 will be the first phase.

Jul – Nov

2016 (TBC)

Jul – Nov

2016 (TBC)

New Trading Platform

Q3/4 2016 Release

Mandatory

New Trading

Platform

Note: ASX has changed the go-live

window for the replacement of ASX

Trade24. ASX will provide customers

and partners with a regular update on

milestones.

Project Update No: 05/16

© Copyright 2016 ASX Limited ABN 98 008 624 691. All rights reserved 2016.

1

EQUITIES (ASX) MARKET

Release Type

Release

Functionality

Description

Technical

Go-Live

Business

Go-Live

This release of the New Trading Platform

will deliver the ASX Trade equities

platform replacement as an extension to

the existing ASX Trade24 replacement

offering a combined platform for both

the ASX and ASX 24 markets.

No sooner

than Feb

2017

No sooner

than Feb

2017

Description

Technical

Go-Live

Business

Go-Live

The enhancement release includes:

21 May 2016

23 May 2016

New Trading Platform

Q1 2016 Release

Mandatory

New Trading

Platform

Note: ASX has changed the go-live

window for ASX Trade. ASX will provide

customers and partners with a regular

update on milestones.

Project Update No: 05/16

CLEARING AND SETTLEMENT SERVICES

Release Type

Release

Functionality

CHESS

Q2 2016 Release

Enhancement mFund

Settlement

Service

(CHESS 9)

New CHESS message to allow

distribution preferences to be

updated through Sponsoring

Participant.

New CHESS messages for annual tax

statements

A change to the structure of the

current CHESS distribution

statement message.

Notice reference number: 0085.16.01

After consultation with mFund Issuers

and PISPs, it has been determined not to

proceed with the Regular Payment Plan

(RPP) feature under CHESS Release 9.

© Copyright 2016 ASX Limited ABN 98 008 624 691. All rights reserved 2016.

2

Q4 2016 Release

Informational

ISIN

Restructure

Proposed changes to the methodology

for allocating ISIN’s issued by ASX over

listed Equities and other products,

through its role as a National Numbering

Agency

Q4 2016

Q4 2016

(TBC)

(TBC)

Changes to Austraclear to support the

full depository and settlement services

for fixed income securities denominated

in Chinese Renminbi (RMB)

30 Jul 2016

1 Aug 2016

The existing ASX Collateral Management

offering for fixed income securities in

Austraclear will be extended to include a

Tri-Party Securities Lending Service

(securities as principal vs securities as

collateral).

Nov 2016

Nov 2016

Sep 2016

Sep 2016

Q4 2016

Q4 2016

Austraclear

Q3 2016 Release

Enhancement ASX

Austraclear –

Multi

Currency

Settlement

(RMB)

Q4 2016 Release

Enhancement ASX

Collateral

Further enhancements to mobilise

equities will be considered in

conjunction with the initiative to replace

CHESS.

OTC Calypso

Q3 2016 Release

Enhancement OTC Interest

Rate

Derivatives

Clearing

This release will deliver the following:

Extend A$ product coverage,

including Asset Swaps, BBSW vs

AONIA Basis Swaps and longer

BBSW 3m maturities

Support MarkitWire Trade Division

Q4 2016 Release

Enhancement OTC Interest

Rate

Derivatives

Clearing

This release will deliver enhanced

compression capabilities, Multilateral

Compression and extended trading

hours

© Copyright 2016 ASX Limited ABN 98 008 624 691. All rights reserved 2016.

3

Derivatives Clearing System (DCS)

Q3 2016 Release

Enhancement Weekly &

Serials

This release will deliver enhancements

to increase the available expiries on

existing ASX ETO products by listing:

1 Oct 2016

4 Oct 2016

Description

Technical

Go-Live

Business

Go-Live

This release will replace the existing

Participants section of ASX Online and

introduce new functionality for ALC

Customers.

21 May 2016

23 May 2016

Weekly XJO and top 10-15 single

stock options for near month, and

Serial month XJO’s for first 6 months

(from 3 months)

This provides the opportunity for

additional liquidity and will capture

existing OTC ETO volumes that currently

trade on more frequent expiry terms.

DIGITAL SERVICES

Release Type

Release

Functionality

ASXOnline

Q2 2016 Release

Enhancement ASXOnline

Participants

and ALC

Notice reference number: 0307.16.03

© Copyright 2016 ASX Limited ABN 98 008 624 691. All rights reserved 2016.

4

ASX Mandatory Release Periods

ASX mandatory releases require all users and vendors to amend their applications that directly connect to the relevant

ASX service. ASX may require accreditation of each application either in entirety or to capture the scope of the

mandatory change.

ASX generally plans to implement no more than two Mandatory Releases [per service] per calendar year. These releases

will typically be around 6 months apart and may be scheduled to coincide with regulatory changes mandated by ASIC.

ASX may also need to schedule a Mandatory Release in the case of a critical production fault.

ASX may also implement one or more Enhancement Releases during the year. An Enhancement Release will not be

scheduled within four weeks of a Mandatory Release.

Release Terminology

Enhancement Release – Enhancement releases are incremental updates without the need for users to upgrade all

applications at the same time. This release is voluntary and enables users to prioritise business objectives and allocate

resources as required.

Mandatory Release – Mandatory releases are required to be implemented by all users and vendors to upgrade all

applications. A mandatory release may comprise any change, including improvements and corrections to the messaging

structure, logic (API in some instances) or content associated with the relevant system.

Informational – This is not a release, but more of an item to be noted. This functionality may potentially have an impact

as it is a change to existing business processes.

Technical Go-Live – Technical Go-Live is the date the release is installed into production. Functionality may be disabled

until Business Go-Live.

Business Go-Live – Business Go-Live is the date when the functionality is enabled in production.

Associated Releases

ASX has an ongoing commitment to conduct disaster recovery testing across all ASX platforms. Refer to the ASX Business

Continuity Management Testing Schedule on the Participants Welcome page on ASXOnline for more information.

COMMUNICATION

Detailed documentation on the scope, technical specifications and projected timeframes for individual Mandatory and

Enhancement releases will be provided by ASX no later than 90 days prior to the implementation date (unless required

to do otherwise by a regulator or regulatory obligation, or to resolve a critical production issue). ASX will confirm the

Go-Live date of each release by ASX Notice, generally at least two weeks prior to implementation (unless otherwise

agreed with stakeholders).

The trademarks listed below are trademarks of ASX. Where a mark is indicated as registered it is registered in Australia

and may also be registered in other countries. Nothing contained in this document should be construed as being any

licence or right to use of any trade mark contained within the document.

ASX®, CHESS®, Austraclear®, ASX Trade24®, LEPO®, ASX Trade®

© Copyright 2016 ASX Limited ABN 98 008 624 691. All rights reserved 2016.

5