Water Damage Risk and Canadian Property Insurance Pricing

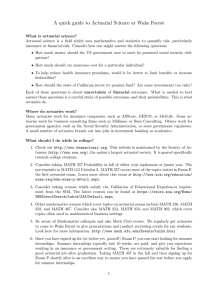

advertisement