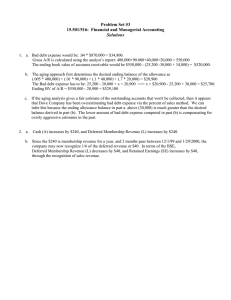

TRI-STATE GENERATION AND TRANSMISSION ASSOCIATION

advertisement