CAPM and Market Model • If market portfolio is mean

advertisement

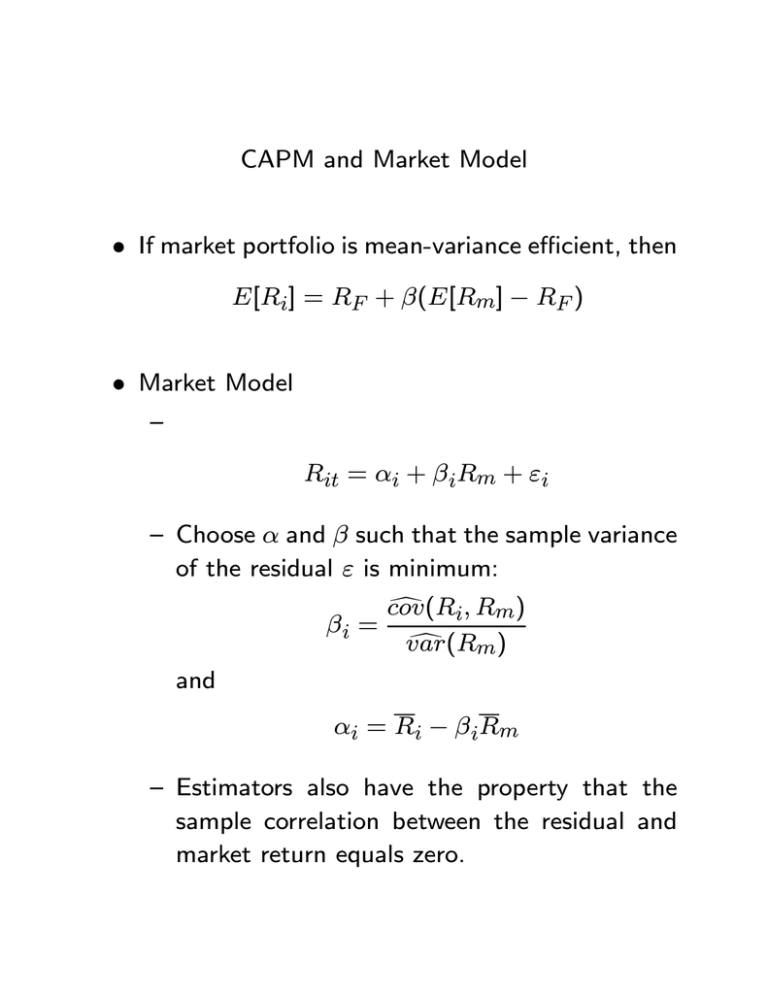

CAPM and Market Model • If market portfolio is mean-variance efficient, then E[Ri] = RF + β(E[Rm] − RF ) • Market Model — Rit = αi + β iRm + εi — Choose α and β such that the sample variance of the residual ε is minimum: and d cov(R i, Rm) βi = d var(R m) αi = Ri − β iRm — Estimators also have the property that the sample correlation between the residual and market return equals zero. — Summary of properties ∗ Unsystematic risk is minimum ∗ Average residual is zero so the average stock and market return fall on regression line ∗ Sample correlation between residual and market return equals zero — Residual across stocks may be correlated, suggesting that additional factors may be required • CAPM and Market Model — Assume market model beta and CAPM beta are the same. — Then the CAPM places restriction on the value of α. — Under market model: E[R] = α + βE[Rm] — Therefore, α = RF (1 − β) — If β > 1, α < 0 — If β < 1, α > 0 • Example — Suppose E[Rm] = 10% and RF = 6%. — Consider four stocks with betas of 0, .5, 1, and 1.5. — If CAPM holds, then alphas are given by 6%, 3%, 0, −3% -4 15 15 10 R 10 E[R] 5 5 -2 0 2 4 6 Rm 8 10 12 0 -5 -5 -10 -10 0.5 1 beta 1.5 2 • — In up market, high beta stocks tend to perform better — For example, suppose Rm = 20% 30 25 20 E[R|Rm=20] 15 10 5 0 0.5 1 beta 1.5 2 • — In down market, low beta stocks tend to perform better — For example, Rm = −5% 10 5 0 0.5 beta 1 1.5 2 -5 E[R|Rm=-5] -10 -15 • — But over up and down markets, high beta stocks have higher average returns • — Flat relationship: alphas given by 10%, 5%, 0%, -5% 15 10 R 5 -5 0 5 Rm 10 15 -5 -10 • — Given that for large portfolios, σ 2p = β 2pσ 2m + + N µ ¶2 X 1 j=1 N X X µ 1 ¶2 j6=k N cov(εj , εk ) var(εi) 2 2 = β pσ m + + N var(εi) µ ¶ 1 2 (N 2 − N)cov(εj , εk ) N var(εi) 1 = β 2pσ 2m + + cov(εj , εk )(1 − ) N N — lim σ 2p = β 2pσ 2m + cov(εj , εk ) N →∞ — a portfolio of low beta stocks will have lower total risk. — For a flat relationship, risk averse investors will choose low-beta risky portfolio and adjust risk by borrowing or lending at risk-free rate. — If expected return on a portfolio is greater than risk-free rate, one can always increase the expected return and beta with leverage. — Suppose β U is beta of unlevered portfolio, then beta of levered portfolio is β L = Xβ U + (1 − X)(0) — Expected return is given by E[RLEV ] = RF + X(E[Rm] − RF ) — So βL E[RLEV ] = RF + (E[Rm] − RF ) βU — If unlevered portfolio is the market, E[RLEV ] = RF + β L(E[Rm] − RF ) — Also, σ LEV βL = X = σm